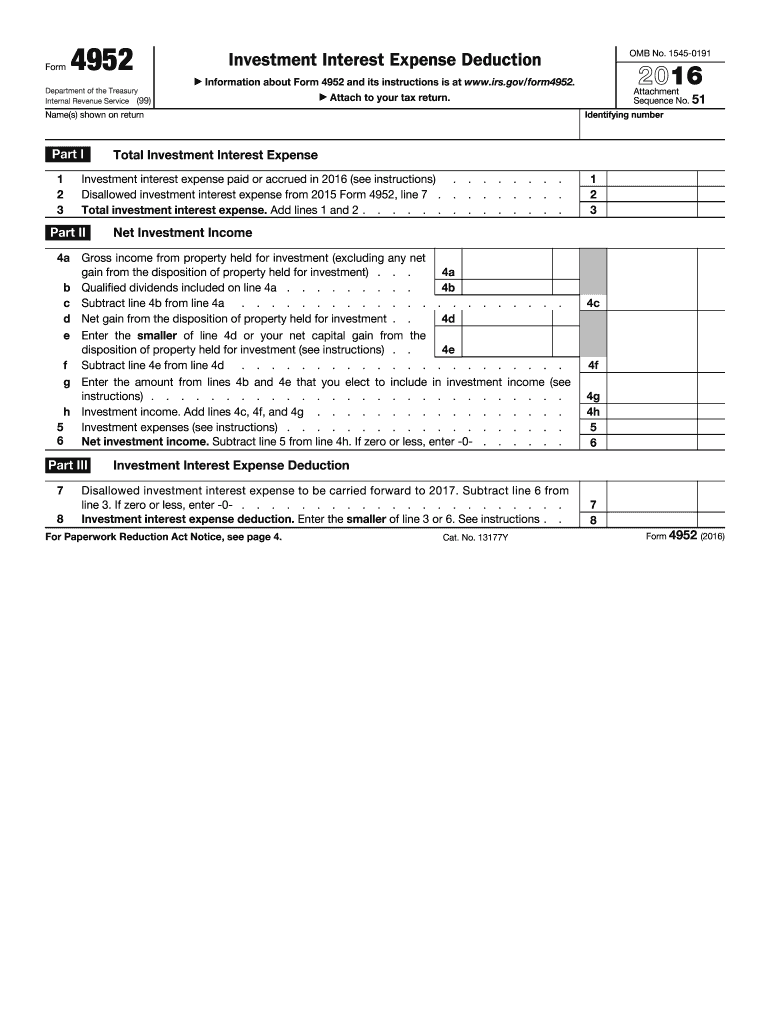

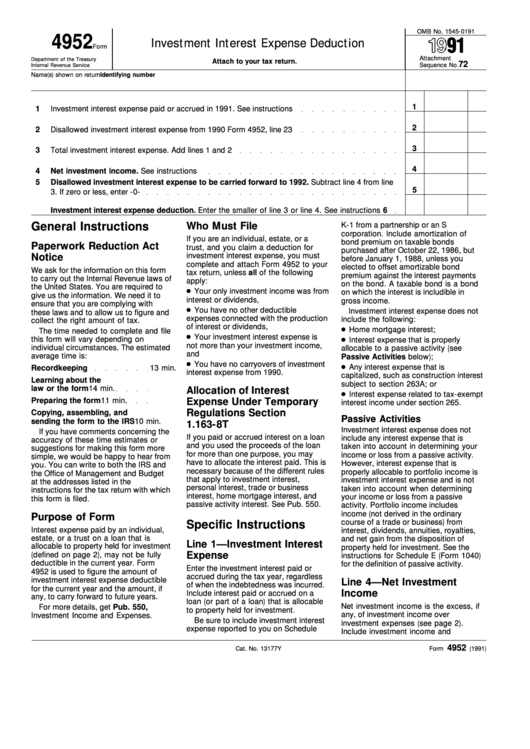

Irs Tax Form 4952

Irs Tax Form 4952 - This article will walk you through irs form 4952 so you can better understand: How you can identify investment interest expense. You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry.

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. You don’t have to file form 4952 if all of the following apply. This article will walk you through irs form 4952 so you can better understand: How you can identify investment interest expense. • your investment income from interest and ordinary dividends minus any.

How you can identify investment interest expense. • your investment income from interest and ordinary dividends minus any. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. This article will walk you through irs form 4952 so you can better understand: You don’t have to file form 4952 if all of the following apply.

Form 4952 Fillable Printable Forms Free Online

How you can identify investment interest expense. This article will walk you through irs form 4952 so you can better understand: • your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. You don’t have.

Irs Form W4V Printable IRS Form 4952 Download Fillable PDF or Fill

Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. • your investment income from interest and ordinary dividends minus any. How you can identify investment interest expense. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. You don’t.

How Far Back Can The IRS Audit? Polston Tax

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. This article will walk you through irs form 4952 so you can better understand: • your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and.

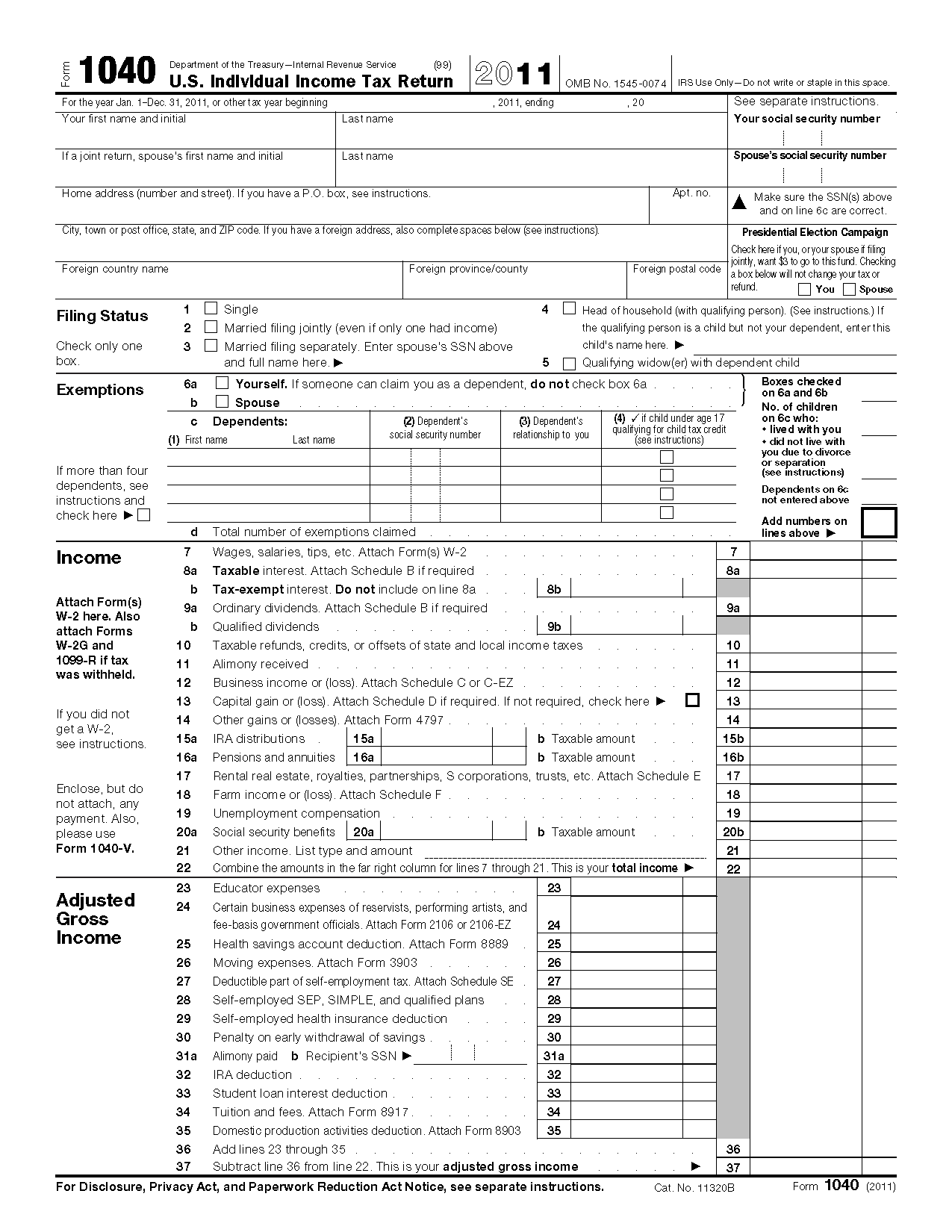

Printable Federal Tax Form 1040 Printable Forms Free Online

Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. This article will walk you through irs form 4952 so you can better understand: You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

• your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. This article will walk you through irs form 4952 so you can better understand: Learn how to use form 4952 to calculate your investment.

IRS Form 6251 walkthrough (Alternative Minimum Tax For Individuals

• your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. This article will walk you through irs form 4952 so you can better understand: Learn how to use form 4952 to calculate your investment.

IRS Form 4952 Instructions Investment Interest Deduction

You don’t have to file form 4952 if all of the following apply. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. • your investment income from interest and.

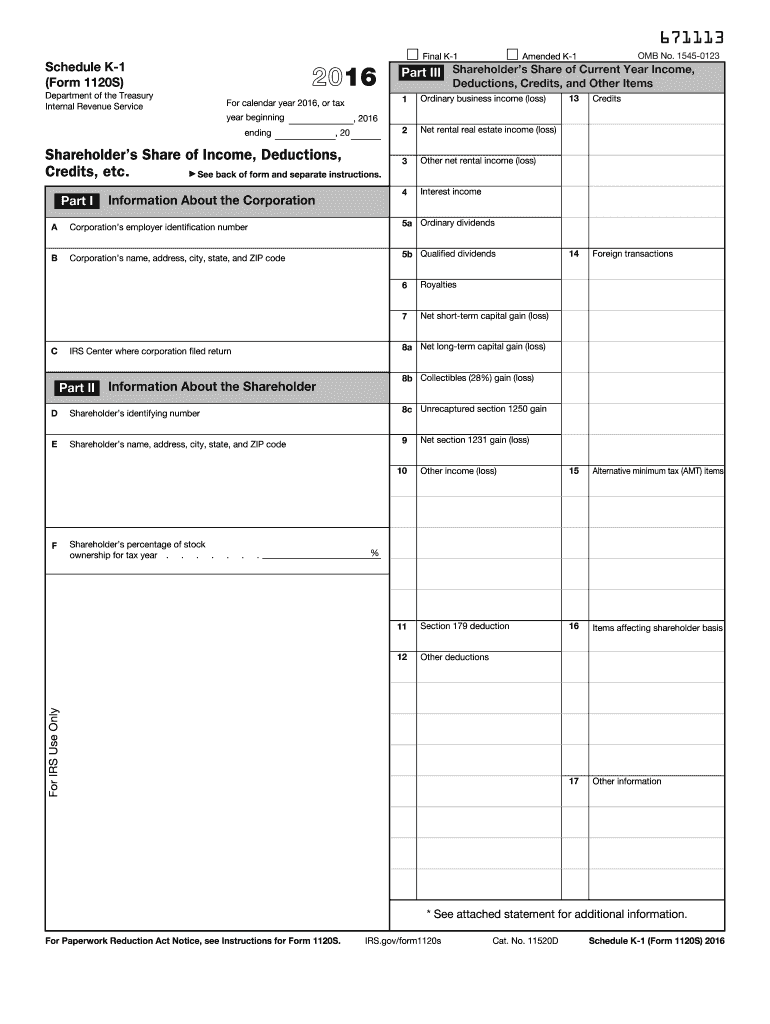

IRS 1120S Schedule K1 2016 Fill out Tax Template Online US Legal

This article will walk you through irs form 4952 so you can better understand: • your investment income from interest and ordinary dividends minus any. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. How you can identify investment interest expense. You don’t have.

Irs tax forms Artofit

Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. • your investment income from interest and ordinary dividends minus any. How you can identify investment interest expense. You don’t have to file form 4952 if all of the following apply. Form 4952 is used to determine the amount of investment interest expense you can.

Form 4952 Investment Interest Expense Deduction printable pdf download

How you can identify investment interest expense. You don’t have to file form 4952 if all of the following apply. • your investment income from interest and ordinary dividends minus any. Learn how to use form 4952 to calculate your investment interest expense deduction and carryover. This article will walk you through irs form 4952 so you can better understand:

Learn How To Use Form 4952 To Calculate Your Investment Interest Expense Deduction And Carryover.

You don’t have to file form 4952 if all of the following apply. Form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry. How you can identify investment interest expense. This article will walk you through irs form 4952 so you can better understand: