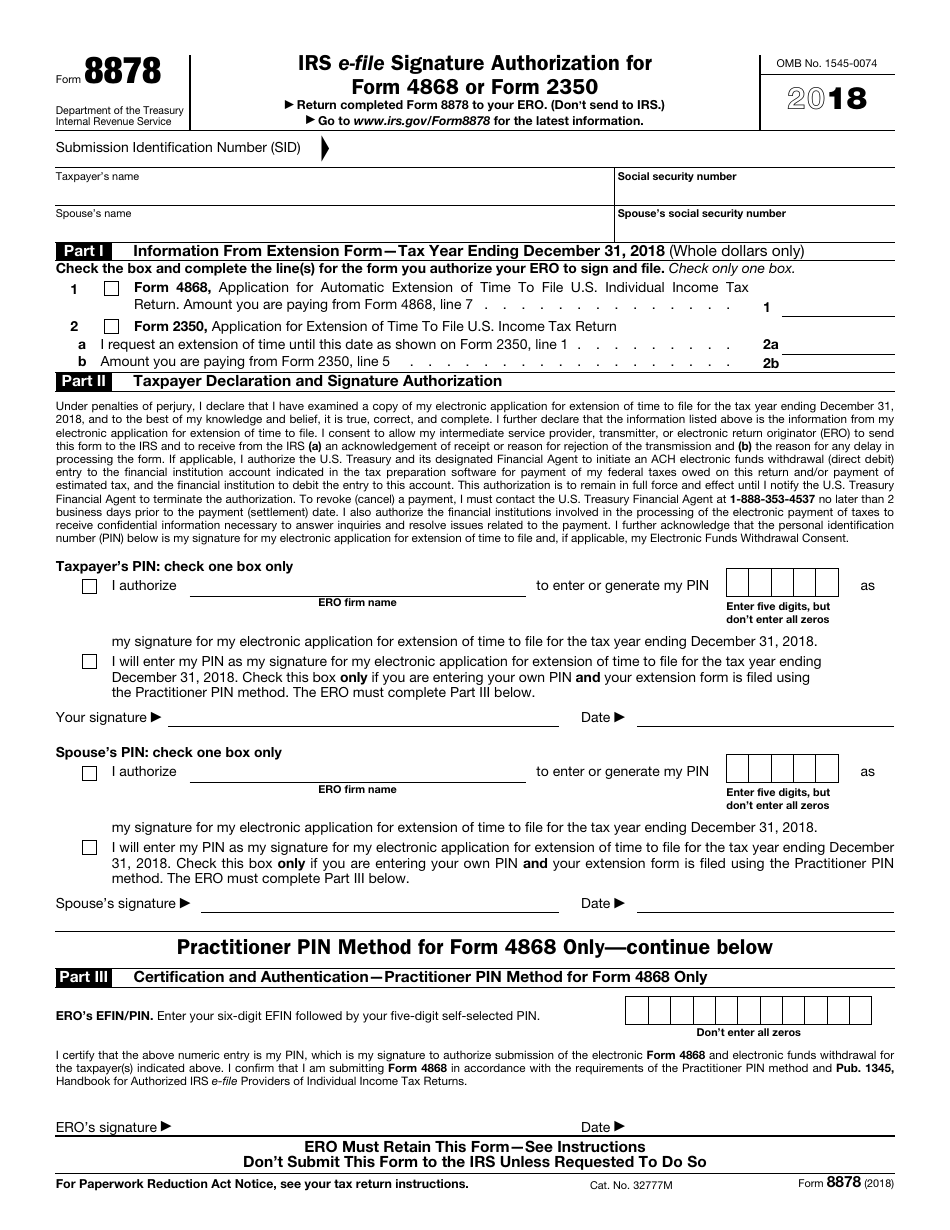

Irs Form 8878

Irs Form 8878 - Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Individual income tax return electronically. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification.

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Individual income tax return electronically.

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Individual income tax return electronically. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification.

Form 8878 IRS efile Signature Authorization for Form 4868 or Form

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Individual income tax return electronically.

Irs Form 8857 Printable

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Individual income tax return electronically.

IRS Form 8878 Download Fillable PDF or Fill Online IRS EFile Signature

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Individual income tax return electronically. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification.

Form 8878 IRS efile Signature Authorization for Form 4868 or Form

Individual income tax return electronically. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s.

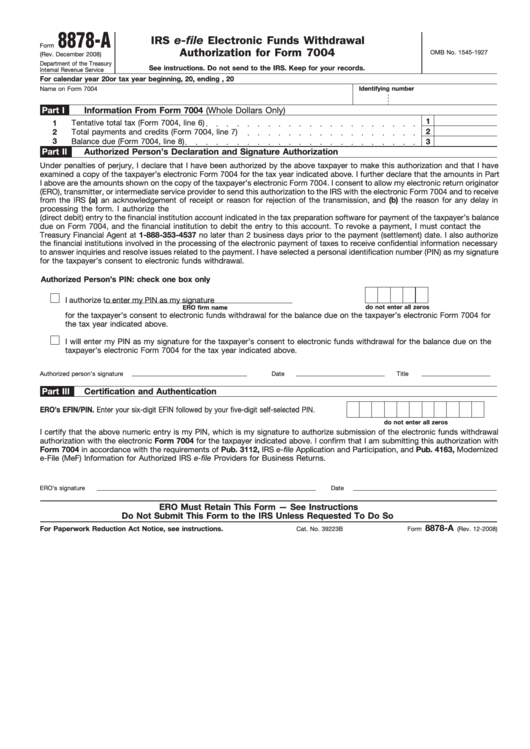

Fillable Form 8878A Irs EFile Electronic Funds Withdrawal

Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Individual income tax return electronically. Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s.

Fillable Online Form 8878 IRS efile Signature Authorization for Form

Individual income tax return electronically. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s.

IRS Form 8878 Instructions eFile Authorization for Tax Extensions

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Individual income tax return electronically.

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Individual income tax return electronically. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification.

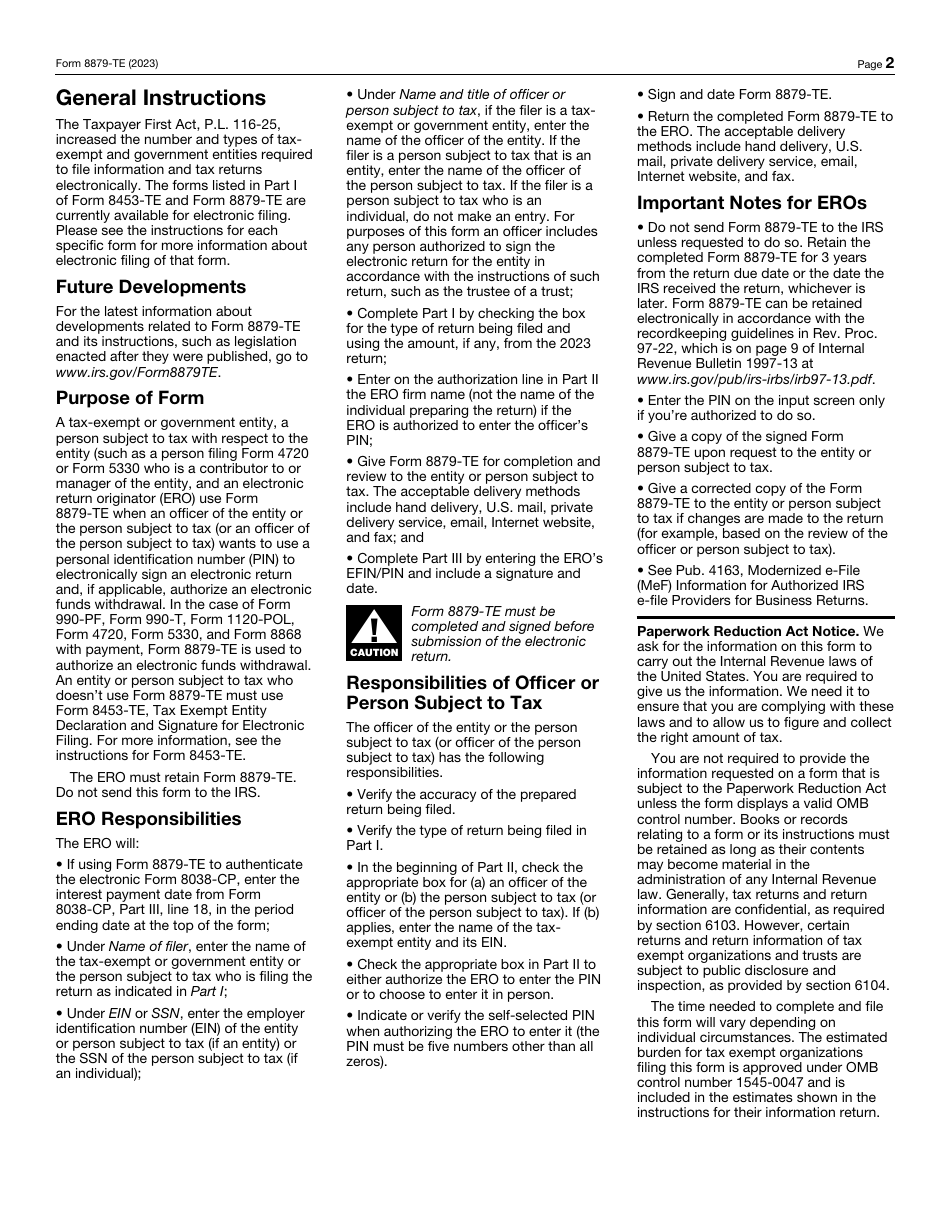

IRS Form 8879TE Download Fillable PDF or Fill Online IRS EFile

Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Individual income tax return electronically. Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s.

Fillable Online www.irs.govformspubsaboutform8878About Form 8878

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification. Individual income tax return electronically.

Form 8878 Allows The Taxpayer To Authorizes The Electronic Return Originator (Ero) To Enter Or Generate Their Personal Identification.

Form 8878 is used when filing form 4868 or form 2350 for extension of time to file u.s. Individual income tax return electronically.