Irs Form 8865 Instructions

Irs Form 8865 Instructions - Learn how to file form 8865, return of u.s. Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers, and changes in. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Instructions for schedule b (form 941), report of tax liability for semiweekly schedule depositors : Persons with respect to certain foreign partnerships, for tax year 2023. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary.

Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers, and changes in. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Instructions for schedule b (form 941), report of tax liability for semiweekly schedule depositors : Learn how to file form 8865, return of u.s. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Persons with respect to certain foreign partnerships, for tax year 2023.

Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers, and changes in. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Persons with respect to certain foreign partnerships, for tax year 2023. Instructions for schedule b (form 941), report of tax liability for semiweekly schedule depositors : Learn how to file form 8865, return of u.s.

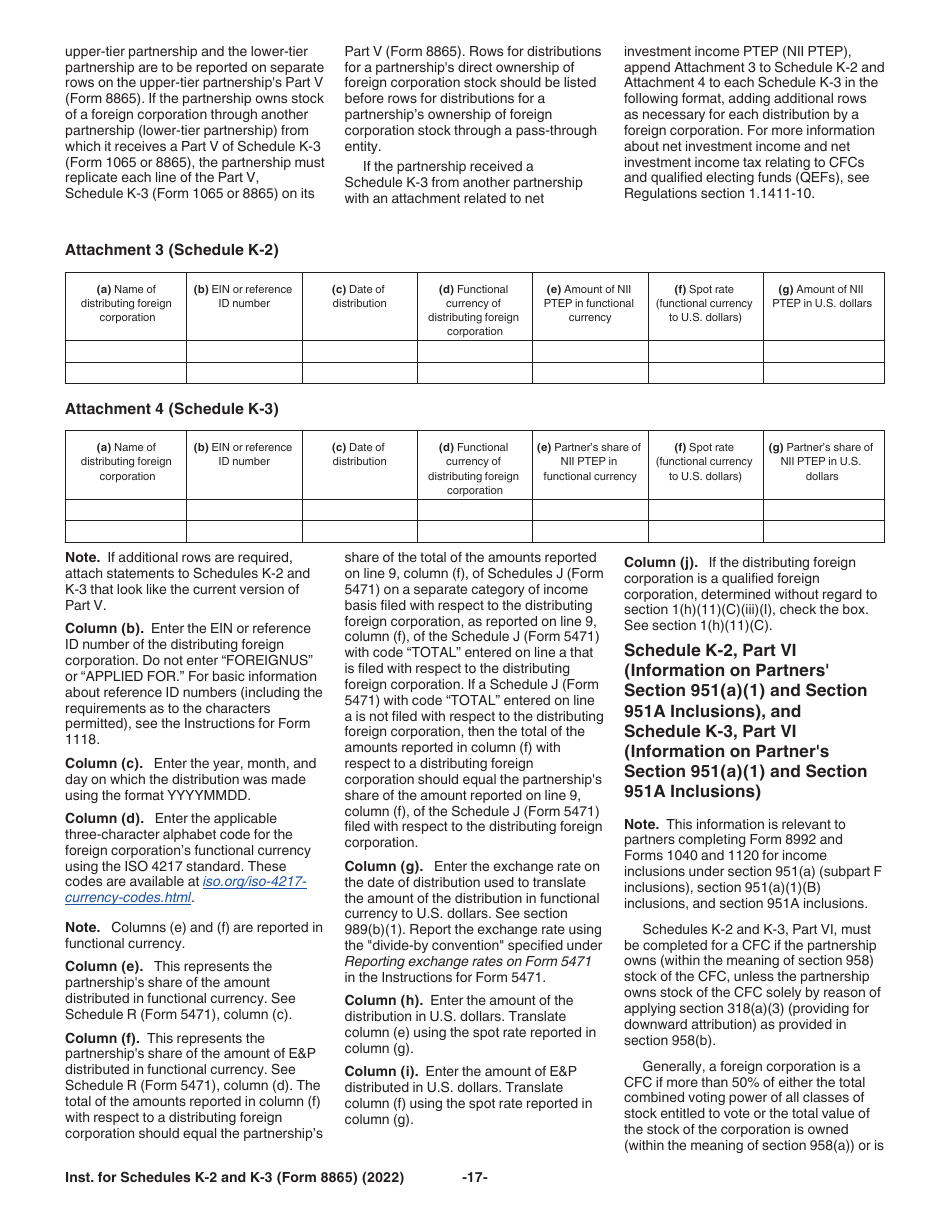

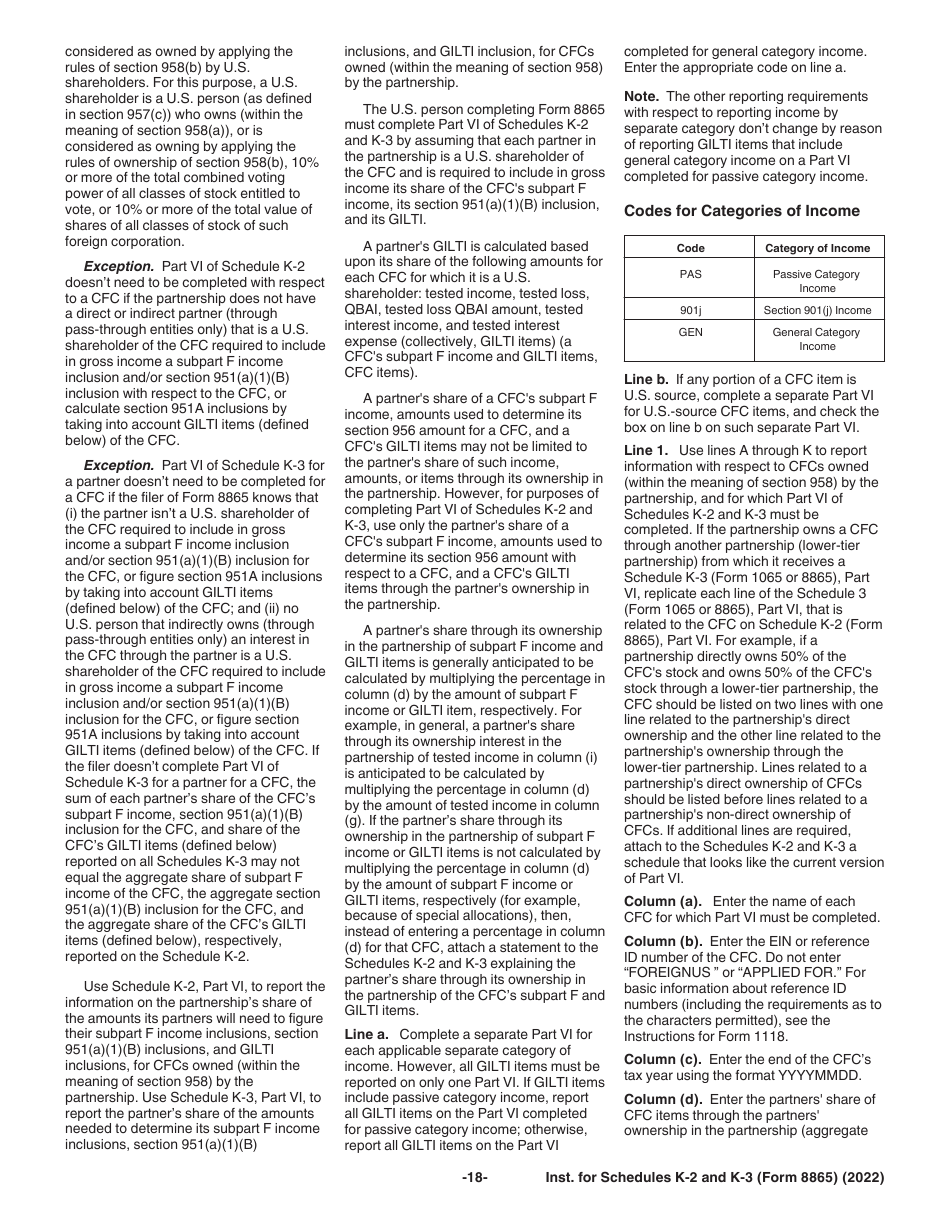

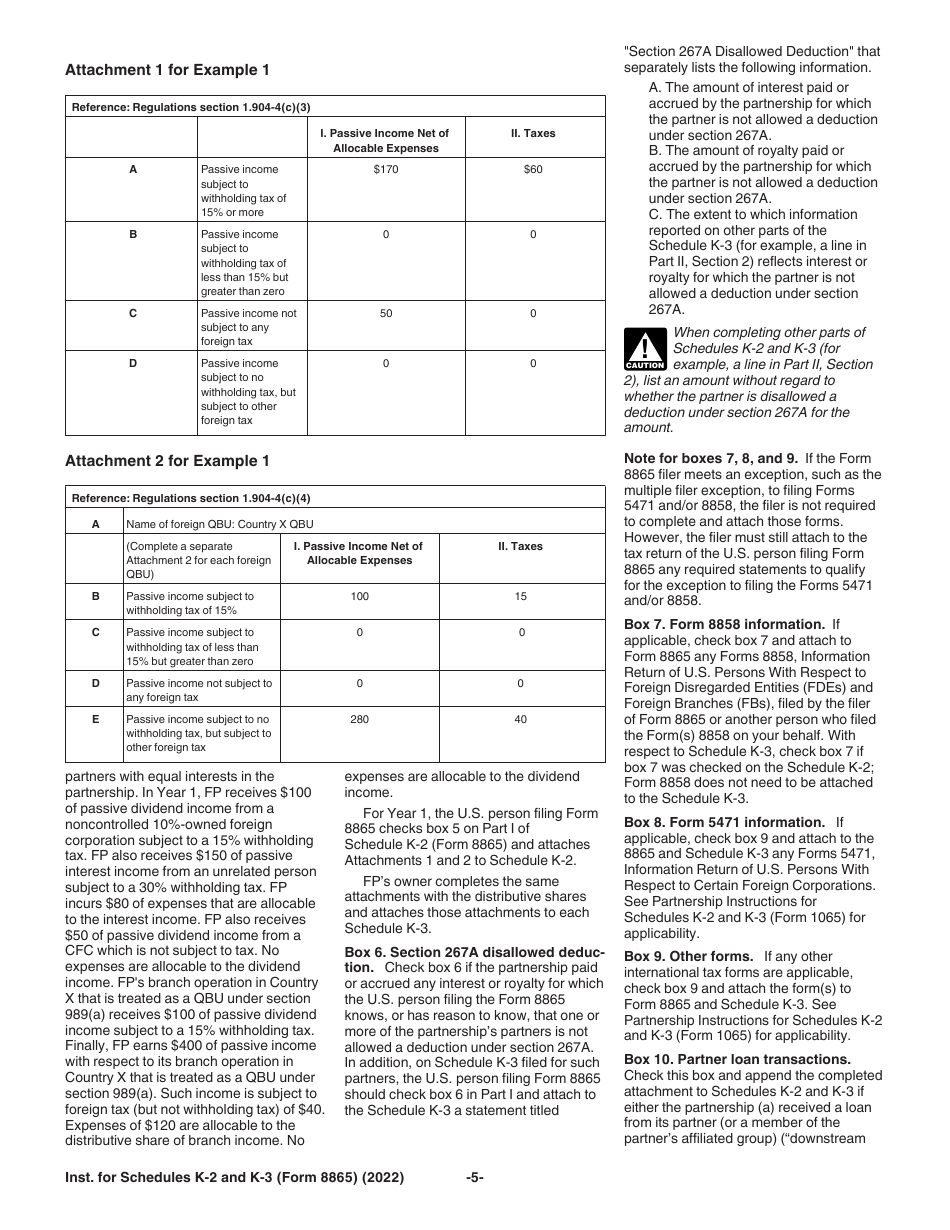

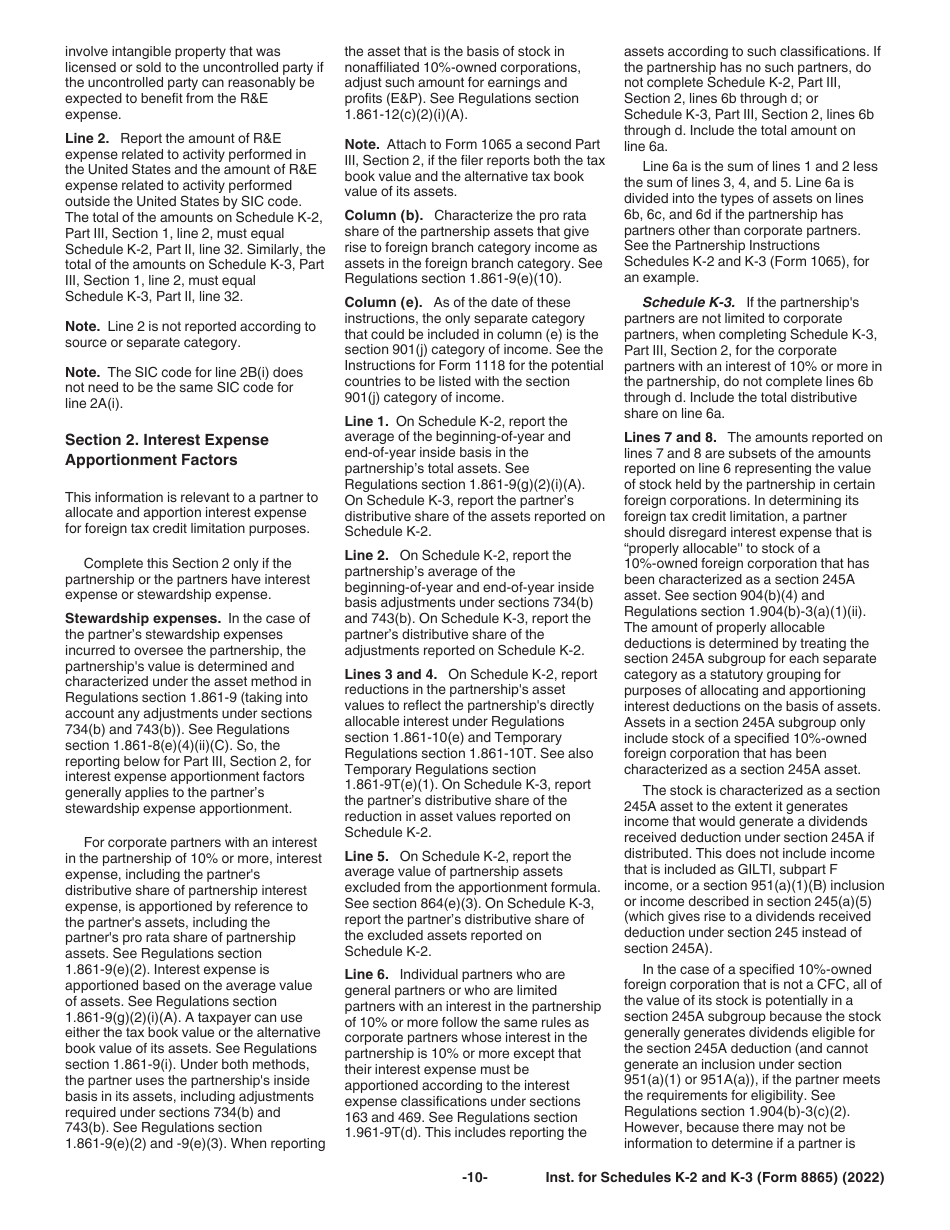

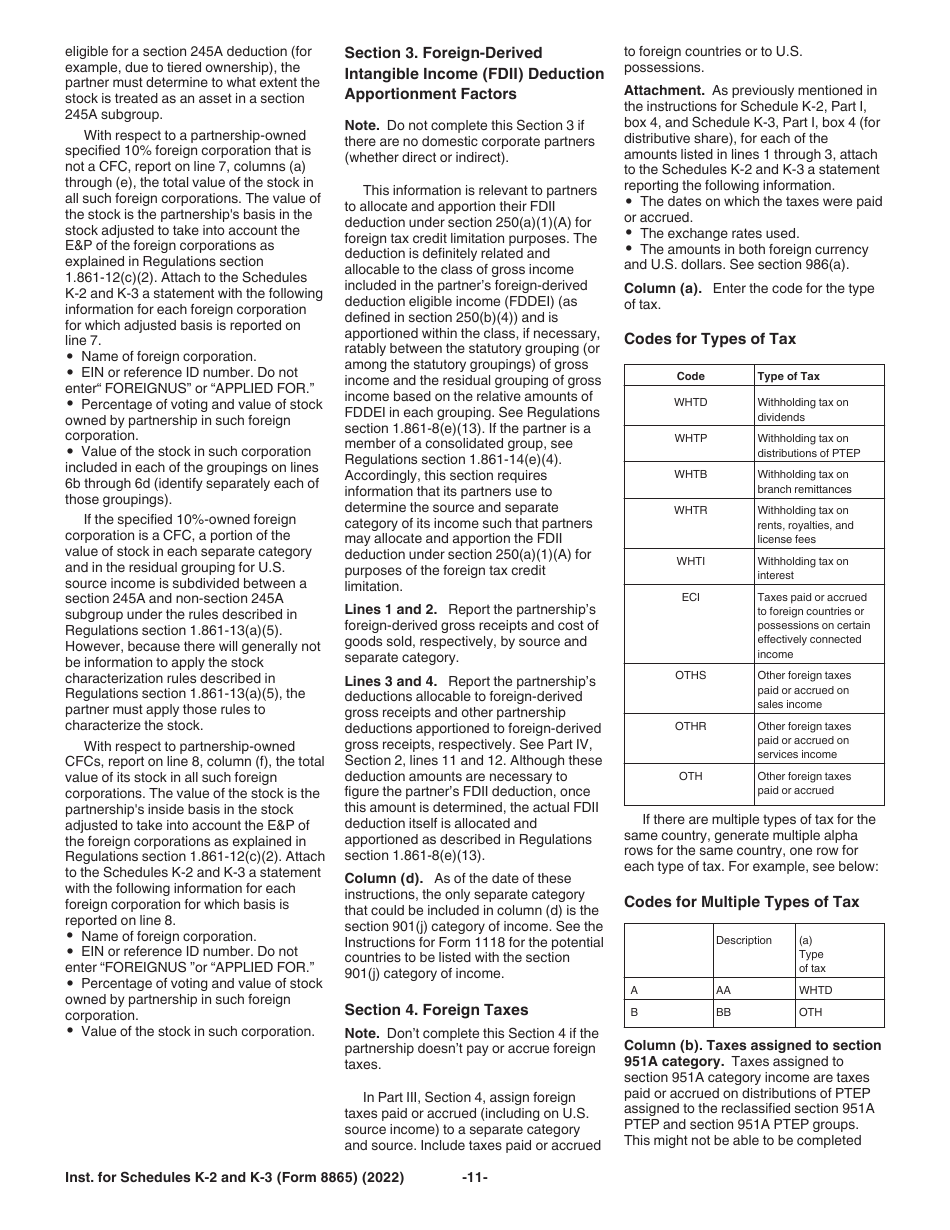

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Persons with respect to certain foreign partnerships, for tax year 2023. Learn how to file form 8865,.

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Learn how to file form 8865, return of u.s. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Instructions for schedule b (form 941), report of.

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Persons with respect to certain foreign partnerships, for tax year 2023. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers, and changes in. In this article, we’ll break down everything you need.

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Instructions for schedule b (form 941), report of tax liability for semiweekly schedule depositors : Persons with respect to certain foreign partnerships, for tax year 2023. Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers, and changes in. Learn how to file form 8865, return of u.s. In this article, we’ll break.

IRS Form 8858 Instructions Information Return for FDEs & FBs

In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Learn how to file form 8865, return of u.s. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Learn how to file form 8865, which is.

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Learn how to file form 8865, return of u.s. Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers, and changes in. Instructions for schedule b (form 941), report of tax liability for.

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Learn how to file form 8865, return of u.s. Persons with respect to certain foreign partnerships, for tax year 2023. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers,.

5 Things You Should Know About IRS Form 8865 Greenback Expat Tax Services

In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Persons with respect to certain foreign partnerships, for tax year 2023. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories. Instructions for schedule b (form 941),.

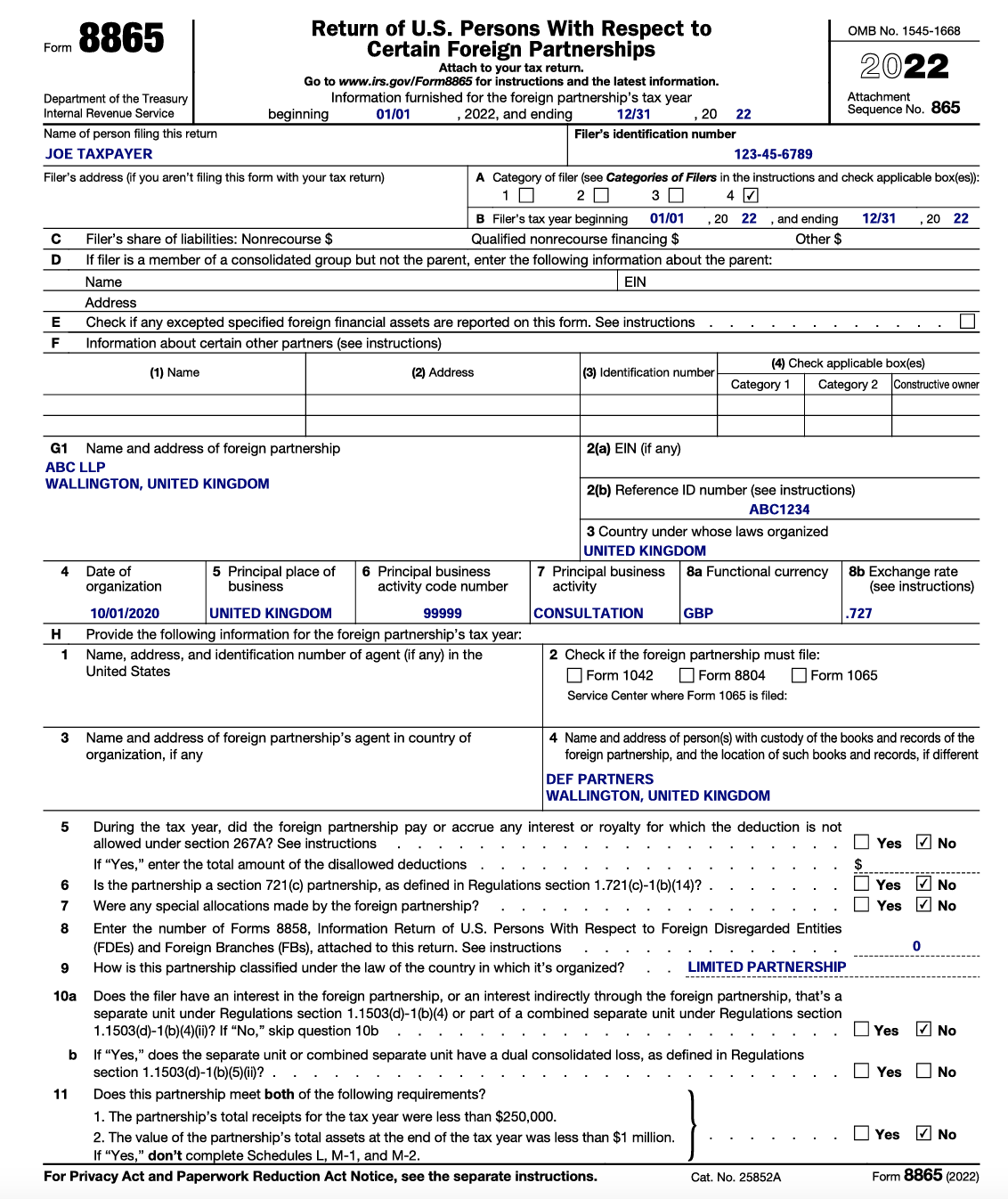

IRS Form 8865 Returns WRT Certain Foreign Partnerships

Persons with respect to certain foreign partnerships, for tax year 2023. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Instructions for schedule b (form 941), report of tax liability for semiweekly schedule depositors : Person with interest in a partnership formed in a foreign country.

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Persons with respect to certain foreign partnerships, for tax year 2023. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Learn how to file form 8865, return of u.s. Person with interest in a partnership formed in a foreign country and qualifying under one or more.

Persons With Respect To Certain Foreign Partnerships, For Tax Year 2023.

Learn how to file form 8865, return of u.s. In this article, we’ll break down everything you need to know about irs form 8865, its purpose, who must file it, the necessary. Learn how to file form 8865, which is used to report information about certain foreign partnerships, transfers, and changes in. Person with interest in a partnership formed in a foreign country and qualifying under one or more of the categories.