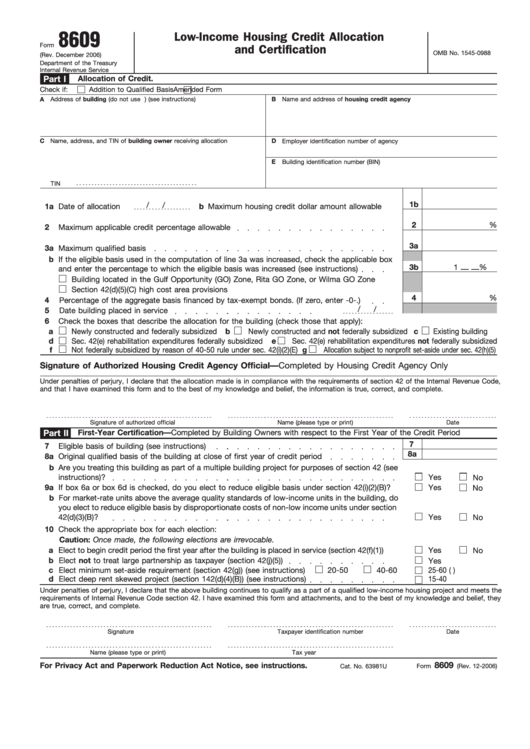

Irs Form 8609

Irs Form 8609 - Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. In this article, we will be examining. Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible to claim. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. A separate form 8609 must be issued for each.

Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible to claim. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. A separate form 8609 must be issued for each. In this article, we will be examining. Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance.

Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. A separate form 8609 must be issued for each. In this article, we will be examining. Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible to claim.

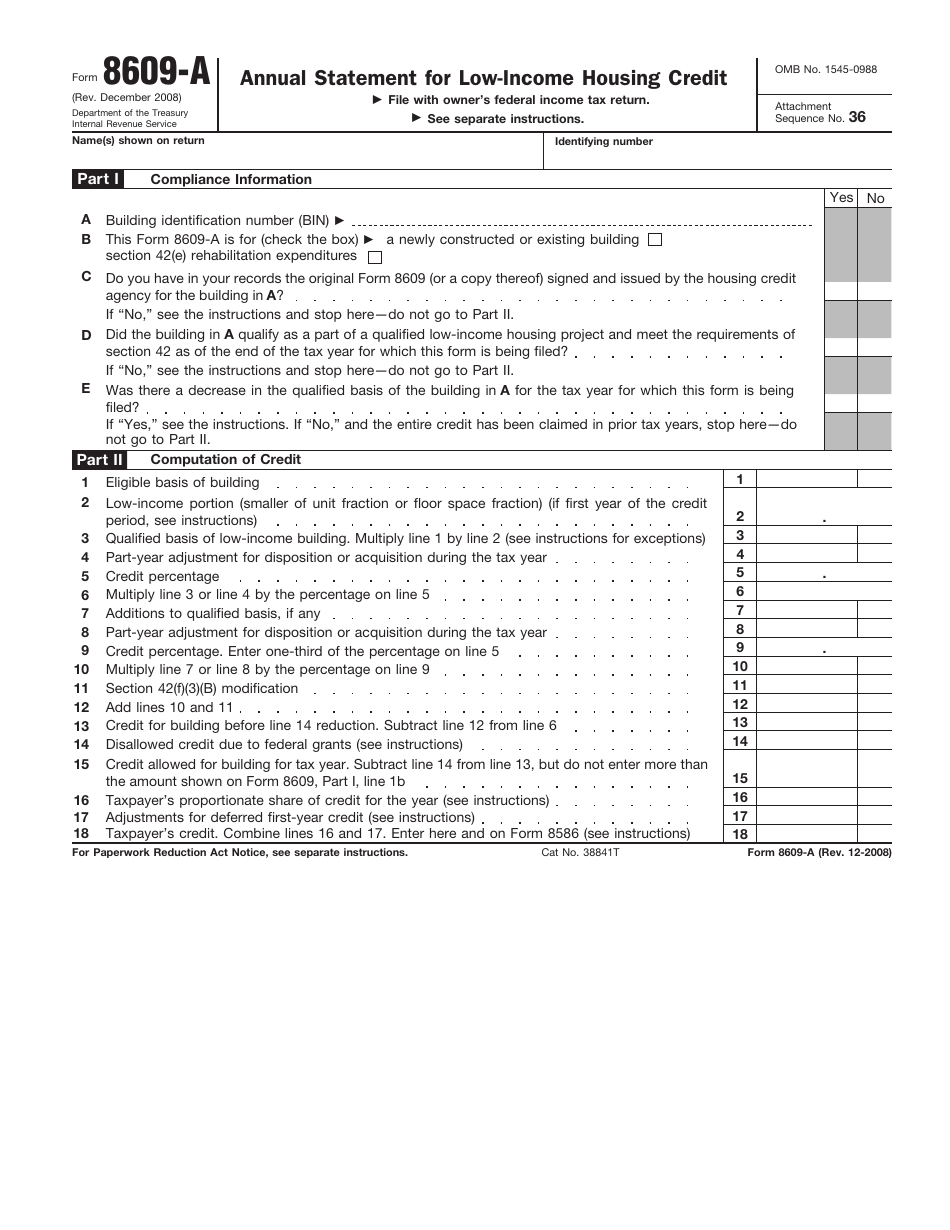

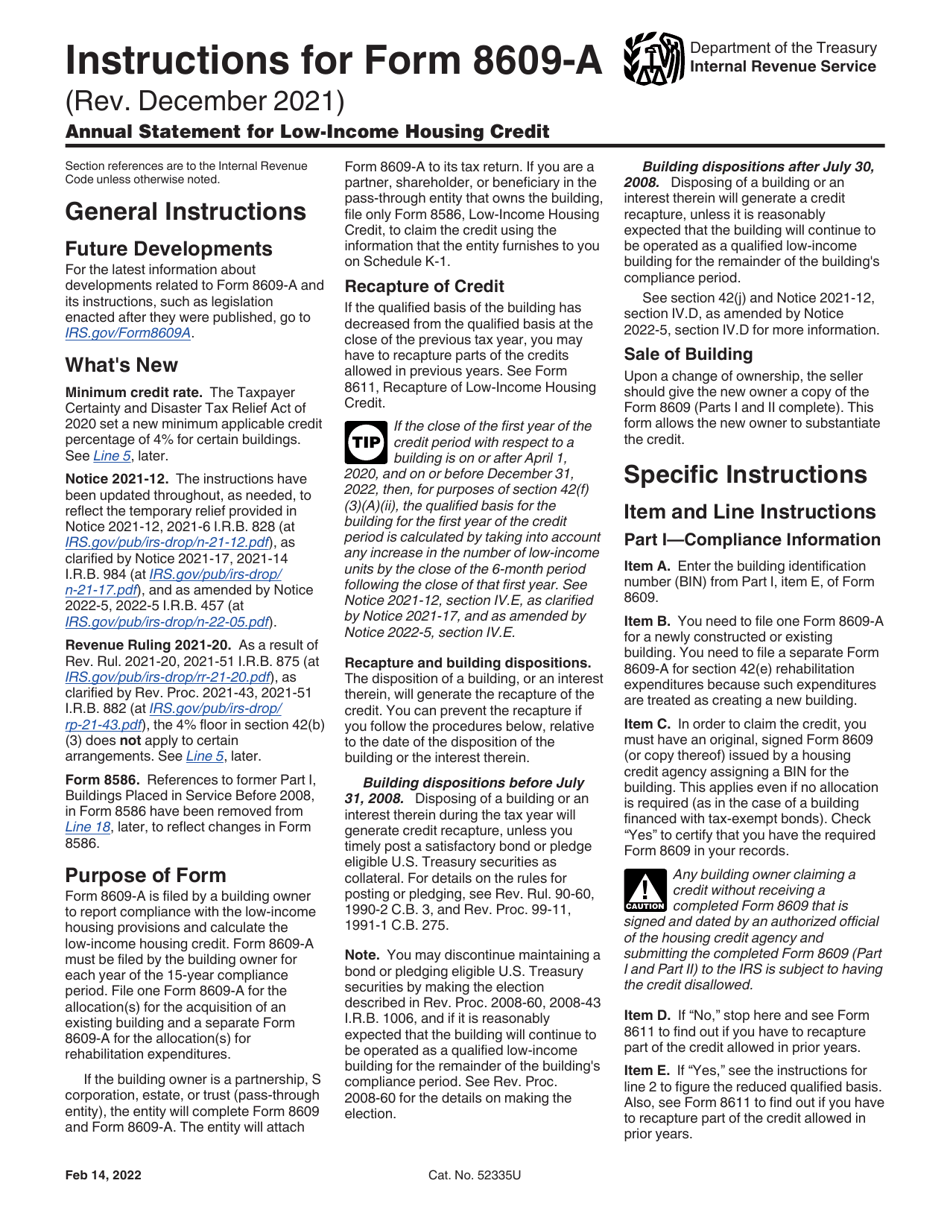

Download Instructions for IRS Form 8609A Annual Statement for Low

Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. A separate form 8609 must be issued for each. In this article, we will be examining. Form 8609 is the irs document that credit allocating agencies give to.

IRS Form 8609A Fill Out, Sign Online and Download Fillable PDF

Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. In this article, we will be examining. Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. Form 8609 can be used to obtain a housing credit allocation from the housing.

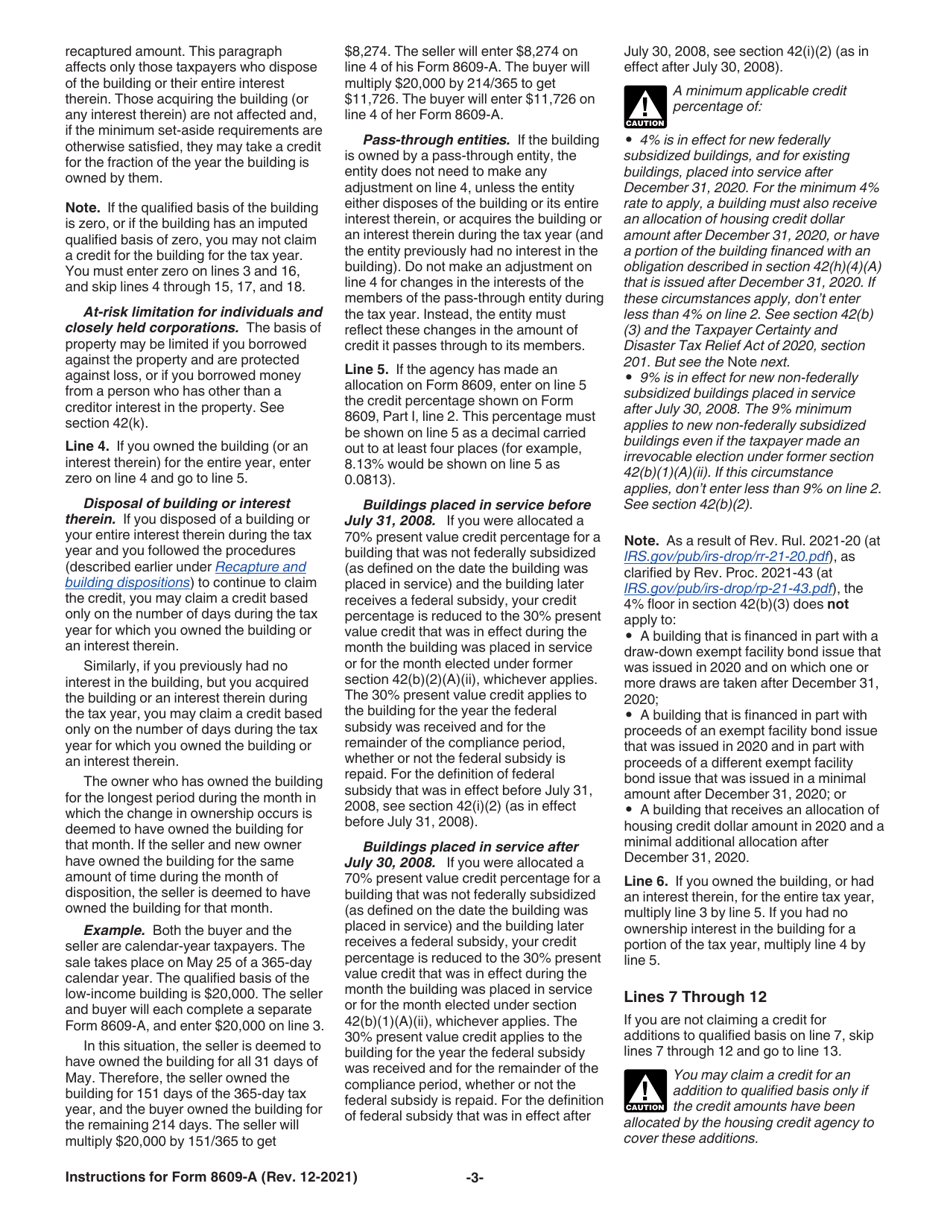

Download Instructions for IRS Form 8609A Annual Statement for Low

Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. A separate form 8609 must be issued for each. Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. Regardless of your experience level, the 8609 has valuable information that will.

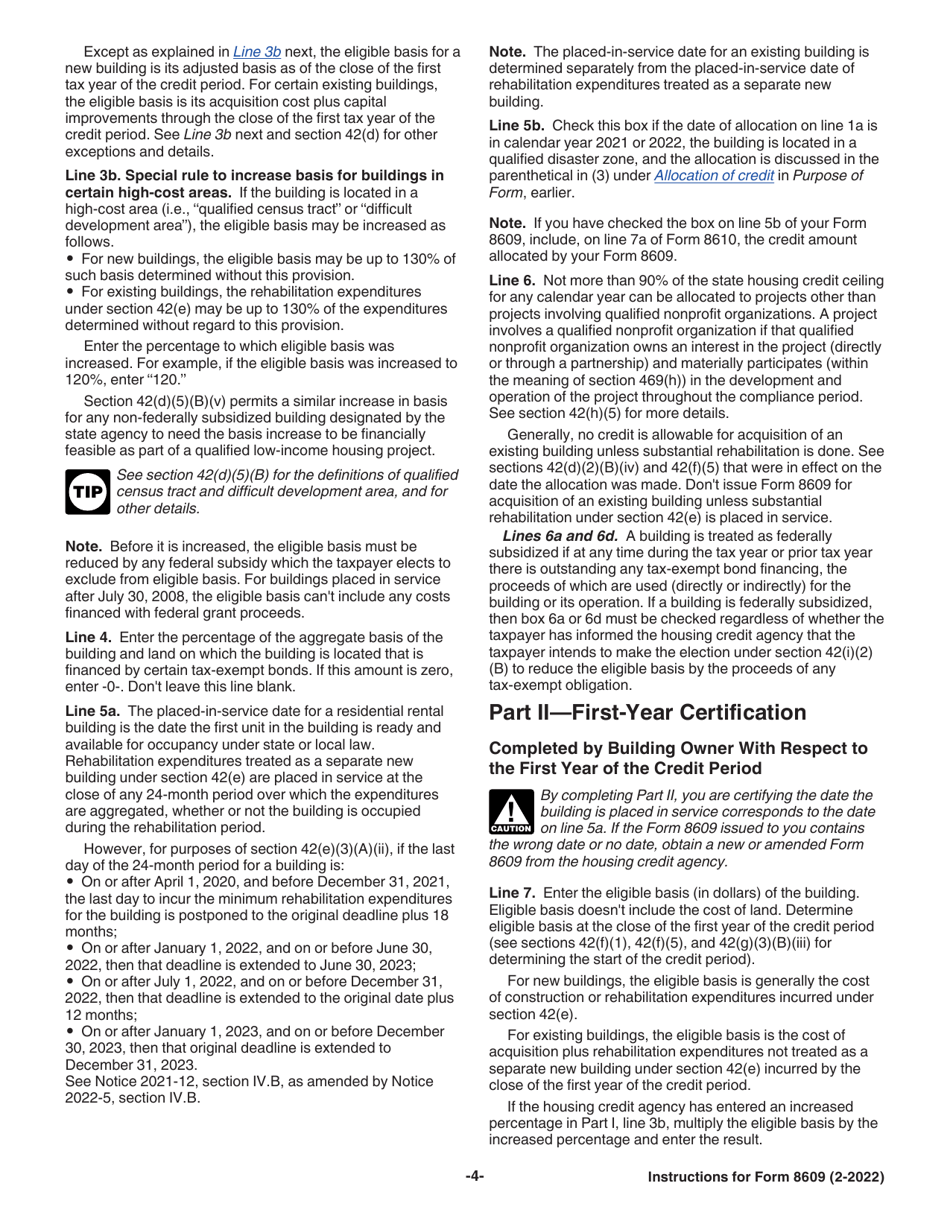

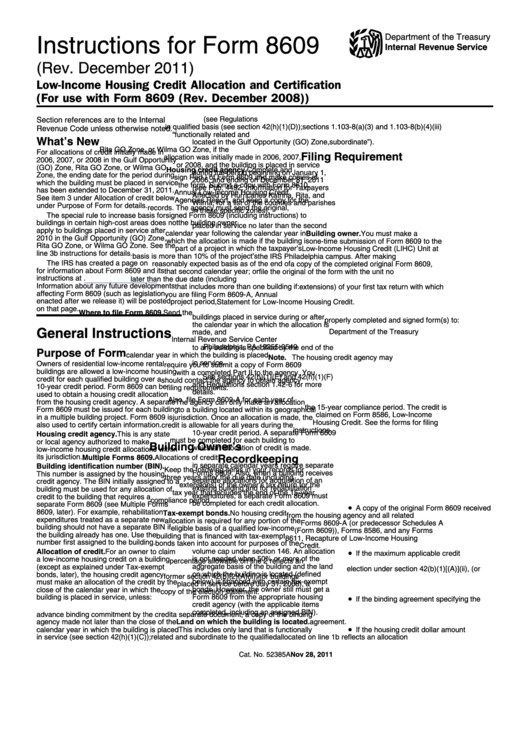

Download Instructions for IRS Form 8609 Housing Credit

Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 can be used.

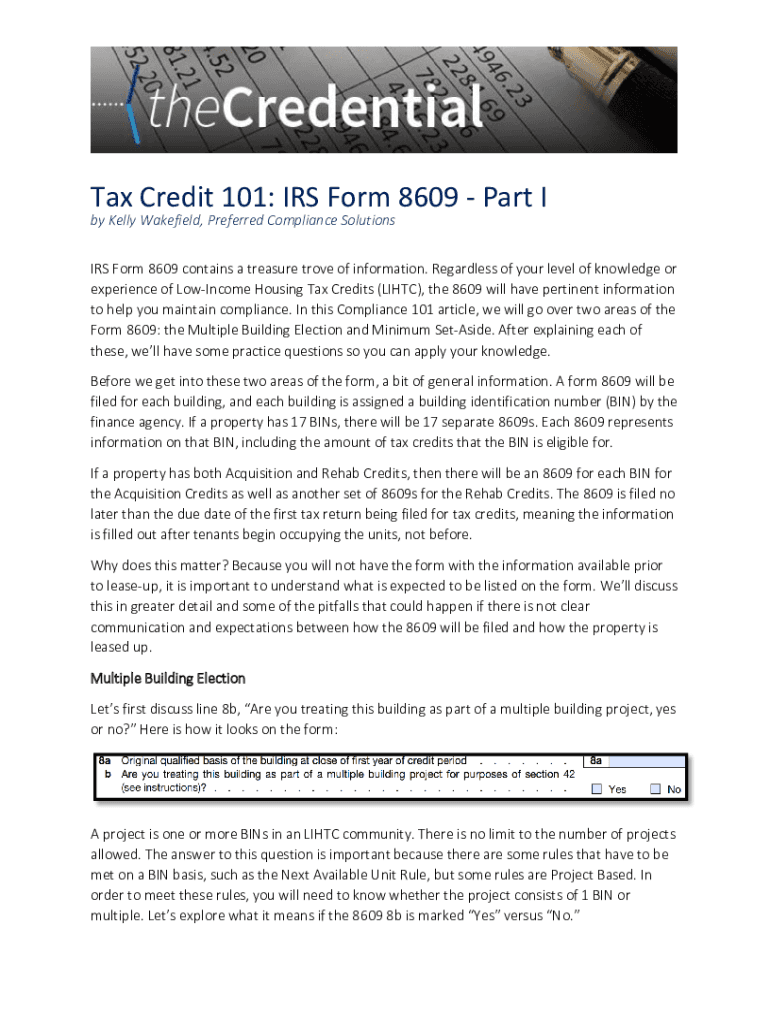

Fillable Online Tax Credit 101 IRS Form 8609 Part I Fax Email Print

Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible to claim. Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. In this article, we will be examining. Form 8609 can be used to obtain a housing credit allocation from the housing.

IRS Form 2848 What Internal Revenue Service Form 2848 Is & How to

Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible to claim. Regardless of your experience level,.

Form 8609 Housing Credit Allocation and Certification

Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible.

Fillable Form 8609 Housing Credit Allocation And

Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible to claim. Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. Form 8609 can be used.

Download Instructions for IRS Form 8609A Annual Statement for Low

Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. Form 8609 is the irs document that credit allocating agencies give to property owners as evidence that the owner is eligible to claim. A separate form 8609 must be issued for each. Form 8609 can be used to obtain a housing credit allocation from.

Instructions For Form 8609 Housing Credit Allocation And

Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance. In this article, we will be examining. Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. A separate form 8609 must be issued for each. Form 8609 can be used.

Form 8609 Is The Irs Document That Credit Allocating Agencies Give To Property Owners As Evidence That The Owner Is Eligible To Claim.

Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. Form 8609 is the irs document that credit allocating agencies give to property owners, evidence that the owner is eligible to claim low. Form 8609 can be used to obtain a housing credit allocation from the housing credit agency. A separate form 8609 must be issued for each.

In This Article, We Will Be Examining.

Regardless of your experience level, the 8609 has valuable information that will help you ensure compliance.