Irs Form 8332 Instructions

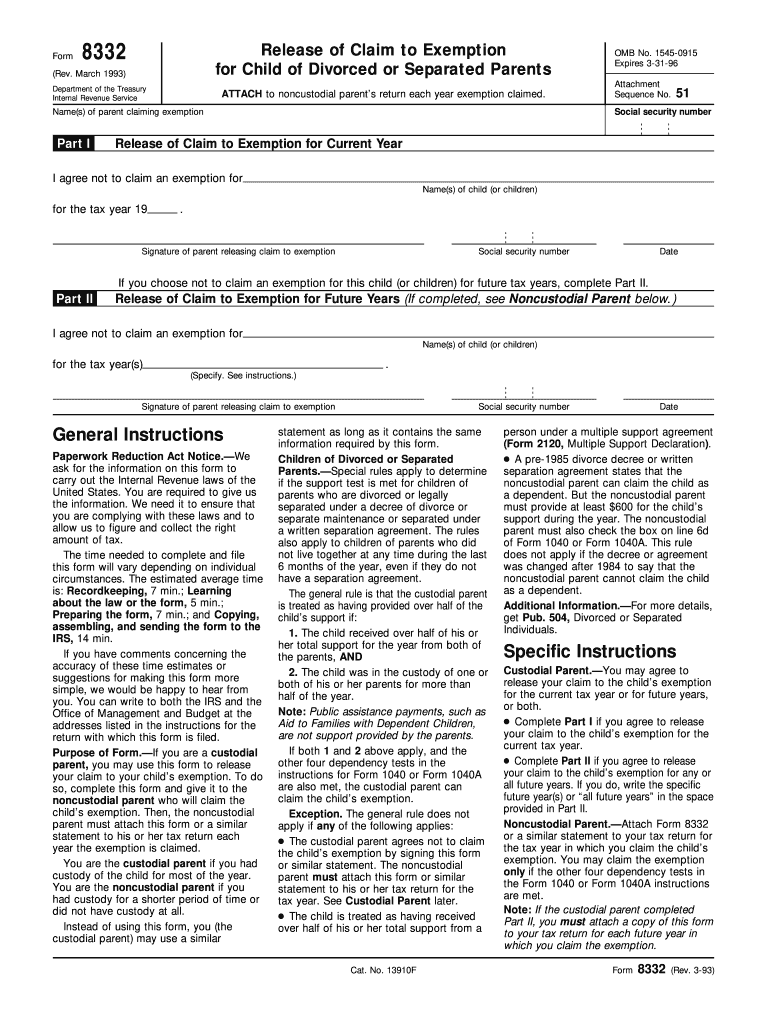

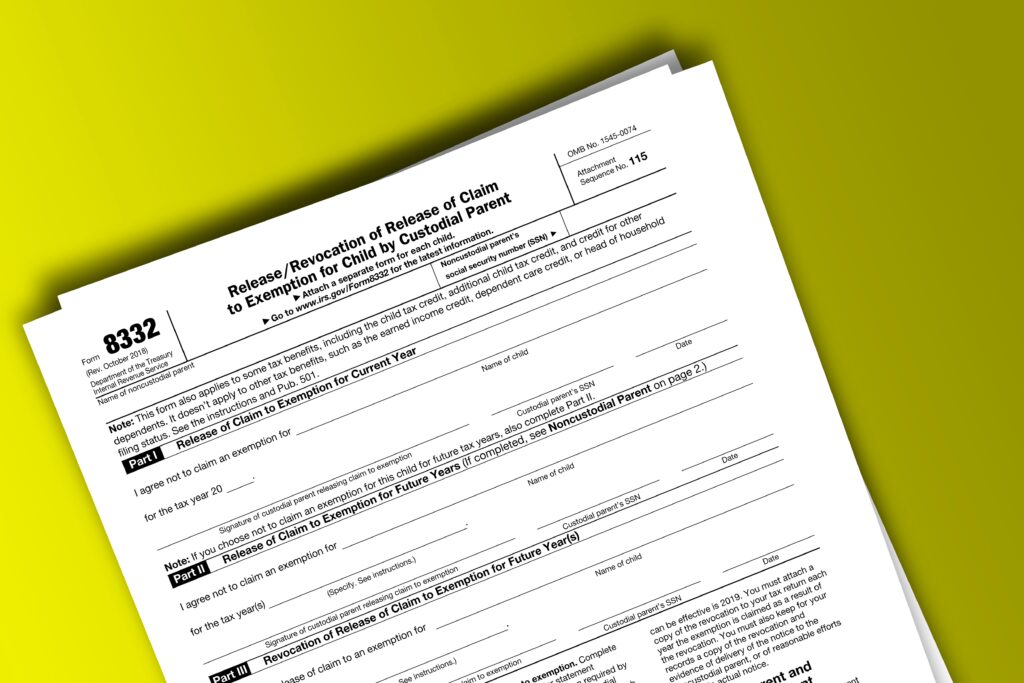

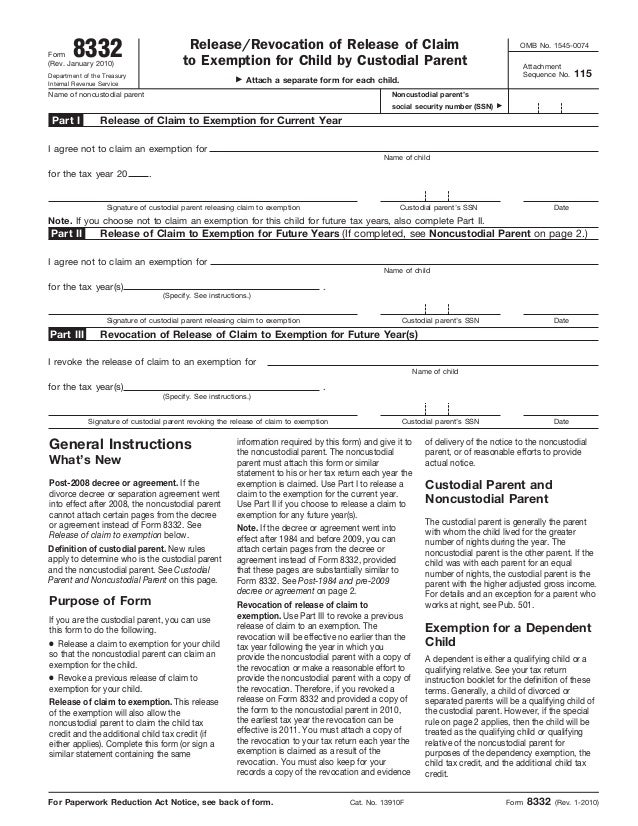

Irs Form 8332 Instructions - Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. Electronically, you must file form 8332 with form 8453, u.s. This revocation takes effect in the tax year following the year the. See form 8453 and its instructions for more details. The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. According to the irs, a separate form 8332 is filed for each child. Release of claim to exemption for current. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. There are three parts to form 8832: The change may go in either direction:

The change may go in either direction: The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. Release of claim to exemption for current. How do i complete irs form 8332? Electronically, you must file form 8332 with form 8453, u.s. According to the irs, a separate form 8332 is filed for each child. This revocation takes effect in the tax year following the year the. See form 8453 and its instructions for more details.

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. How do i complete irs form 8332? Electronically, you must file form 8332 with form 8453, u.s. This revocation takes effect in the tax year following the year the. The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. The change may go in either direction: According to the irs, a separate form 8332 is filed for each child. There are three parts to form 8832: When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. Release of claim to exemption for current.

A brief guide on filing IRS Form 8332 for release of dependency exemption

When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. How do i complete irs form 8332? Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. This revocation takes effect in the tax year following.

Tax Forms In Depth Tutorials, Walkthroughs, and Guides

This revocation takes effect in the tax year following the year the. There are three parts to form 8832: See form 8453 and its instructions for more details. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. How do i complete irs form 8332?

IRS Form 8332 Instructions Release of Child Exemption

Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. Release of claim to exemption for current. How do i complete irs form 8332? The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. According to the.

IRS 8332 1993 Fill out Tax Template Online US Legal Forms

When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. According to the irs, a separate form 8332 is filed for each child. This revocation takes effect in the tax year following the year the. How do i complete irs form 8332? See form 8453 and its instructions for more.

IRS Form 8332 Explained Claiming Dependents and Benefits

According to the irs, a separate form 8332 is filed for each child. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. The change may go in either direction: Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related.

Irs Form 8832 Fillable Form Printable Forms Free Online

See form 8453 and its instructions for more details. This revocation takes effect in the tax year following the year the. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on. There are three parts to form 8832: Electronically, you must file form 8332 with form.

Form 8332 Fillable Printable Forms Free Online

When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. This revocation takes effect in the tax year following the year the. There are three parts to form 8832: The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. The change.

Irs Gov Printable Forms

How do i complete irs form 8332? Release of claim to exemption for current. There are three parts to form 8832: When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. The change may go in either direction:

IRS Form 8332 Instructions A Guide for Custodial Parents

According to the irs, a separate form 8332 is filed for each child. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption. This revocation takes effect in the tax year following the year the. Information about form 8332, release/revocation of release of claim to exemption for child by custodial.

There Are Three Parts To Form 8832:

Release of claim to exemption for current. This revocation takes effect in the tax year following the year the. Electronically, you must file form 8332 with form 8453, u.s. See form 8453 and its instructions for more details.

Information About Form 8332, Release/Revocation Of Release Of Claim To Exemption For Child By Custodial Parent, Including Recent Updates, Related Forms, And Instructions On.

According to the irs, a separate form 8332 is filed for each child. The change may go in either direction: The custodial parent can revoke a previous release of the exemption claim by completing part three of form 8332. When a custodial parent files their taxes, they may use form 8332 to change which parent claims the tax exemption.