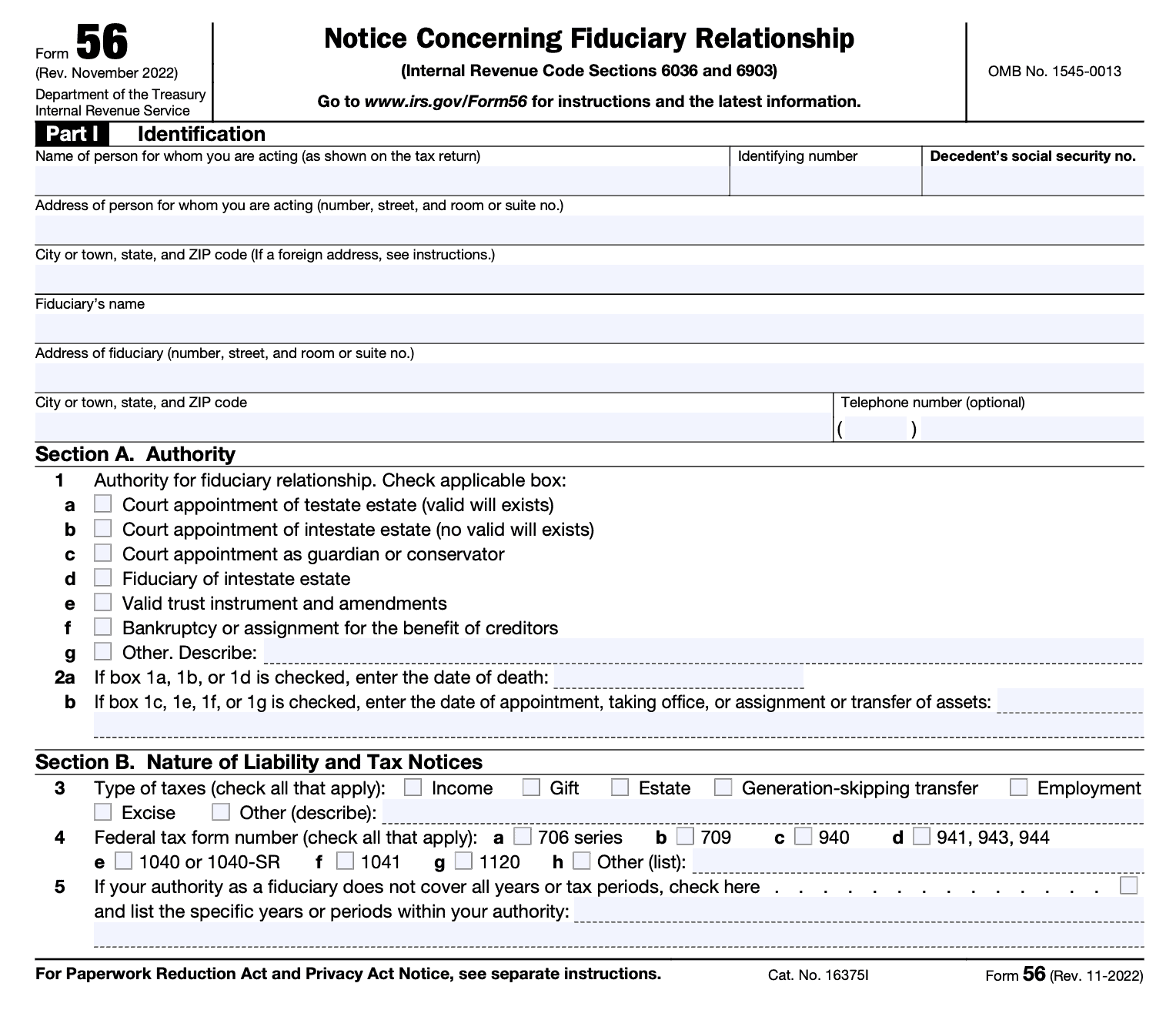

Irs Form 56F

Irs Form 56F - Irs form 56 is required when a fiduciary relationship is established or terminated. Irs form 56 is a pivotal document in tax and financial regulations. Learn how the form works and when advisors must submit it. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Learn how the form works and when advisors must submit it. Irs form 56 is required when a fiduciary relationship is established or terminated. Irs form 56 is a pivotal document in tax and financial regulations.

Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Irs form 56 is required when a fiduciary relationship is established or terminated. Learn how the form works and when advisors must submit it. Irs form 56 is a pivotal document in tax and financial regulations. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift).

IRS Form 56 Notice of Fiduciary Relationship YouTube

Irs form 56 is a pivotal document in tax and financial regulations. Irs form 56 is required when a fiduciary relationship is established or terminated. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Irs form 56 is required when a fiduciary relationship is established or terminated. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Learn how the form works and when advisors must submit it. Irs form 56 is a pivotal document in tax and financial regulations. Use this form to notify the irs of a.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Irs form 56 is a pivotal document in tax and financial regulations. Learn how the form works and when advisors must submit it. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution.

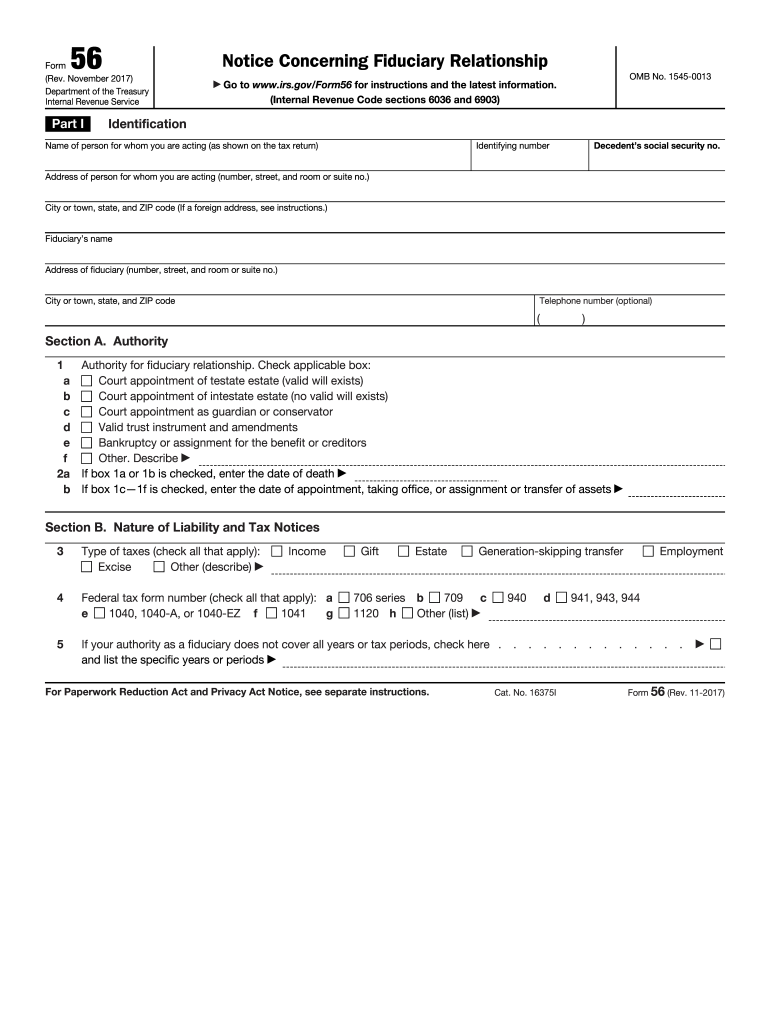

2017 Form IRS 56 Fill Online, Printable, Fillable, Blank pdfFiller

Irs form 56 is a pivotal document in tax and financial regulations. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Learn how the form works and when advisors must submit it. Irs form 56 is required when a fiduciary relationship is established or terminated. Use this form to notify the irs of a.

20222024 Form IRS 56F Fill Online, Printable, Fillable, Blank pdfFiller

Irs form 56 is a pivotal document in tax and financial regulations. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Irs form 56 is required when a fiduciary relationship is established or terminated. Officially titled, “notice concerning fiduciary relationship,”.

Cplr 2105 certification Fill out & sign online DocHub

Irs form 56 is required when a fiduciary relationship is established or terminated. Learn how the form works and when advisors must submit it. Irs form 56 is a pivotal document in tax and financial regulations. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Use this form to notify the irs of a.

Form 56 IRS Template PDF

Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Learn how the form works and when advisors must submit it. Irs form 56 is required when a fiduciary relationship is established or terminated. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial.

IRS Form 56F Instructions Fiduciary of a Financial Institution

Irs form 56 is a pivotal document in tax and financial regulations. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Irs form 56 is.

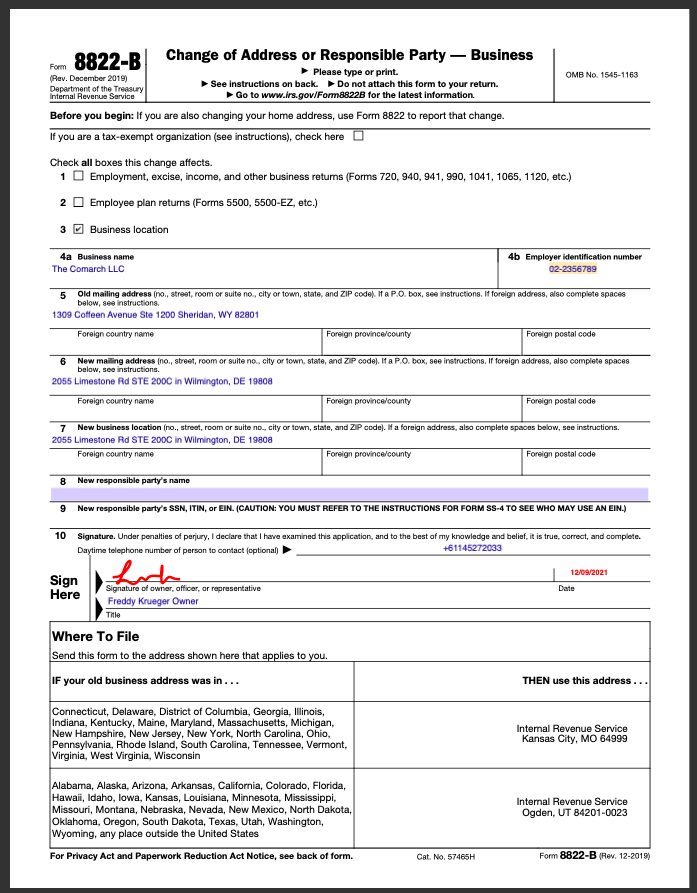

Printable 8822 B Form Printable Forms Free Online

Irs form 56 is required when a fiduciary relationship is established or terminated. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a financial institution (such as a bank or a thrift). Learn how the.

form 56 Internal Revenue Service Fiduciary

Irs form 56 is a pivotal document in tax and financial regulations. Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Irs form 56 is required when a fiduciary relationship is established or terminated. Use this form to notify the irs of a fiduciary relationship only if that relationship is with respect to a.

Use This Form To Notify The Irs Of A Fiduciary Relationship Only If That Relationship Is With Respect To A Financial Institution (Such As A Bank Or A Thrift).

Officially titled, “notice concerning fiduciary relationship,” the form is often overlooked but it wields significant. Learn how the form works and when advisors must submit it. Irs form 56 is required when a fiduciary relationship is established or terminated. Irs form 56 is a pivotal document in tax and financial regulations.