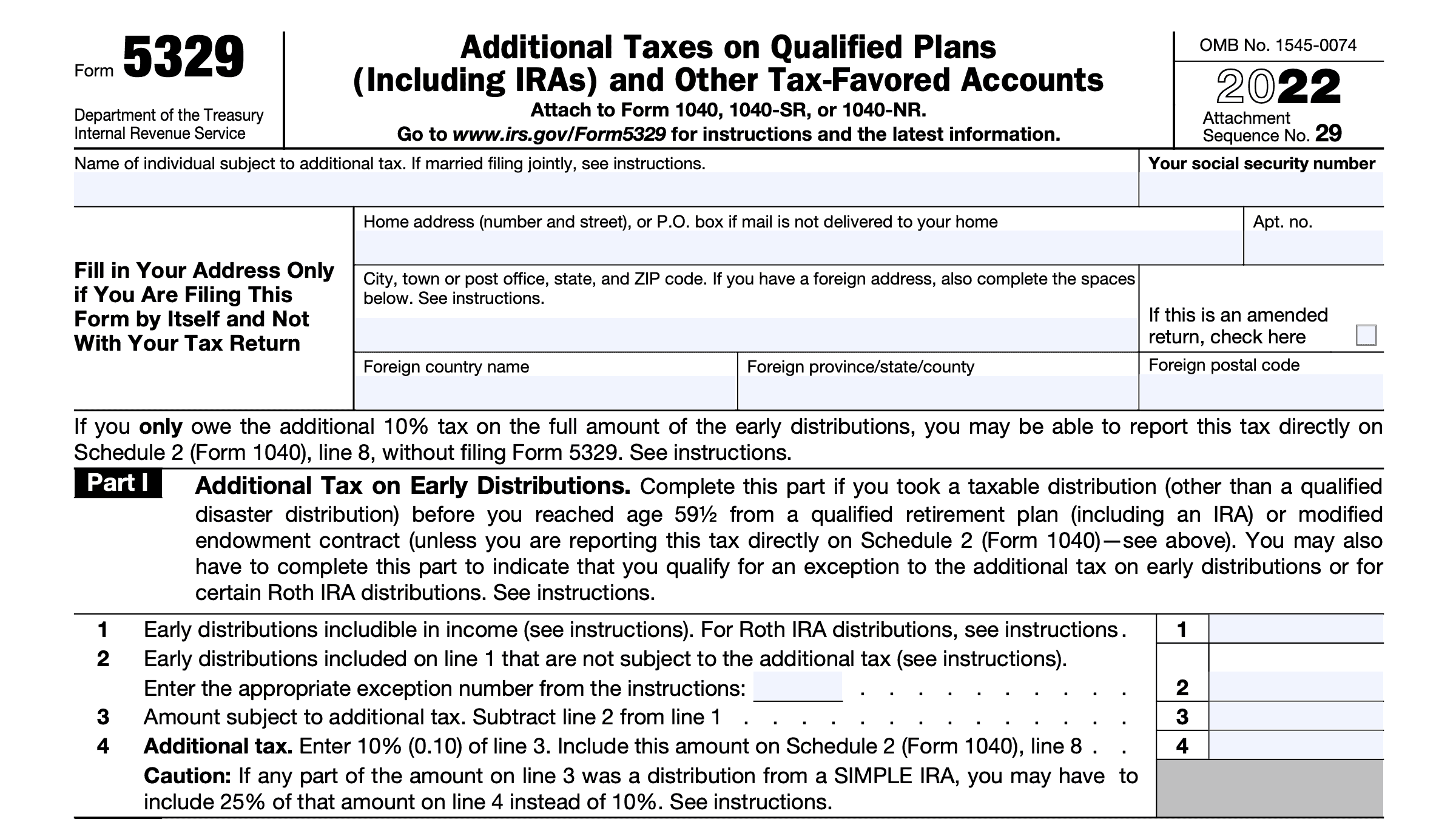

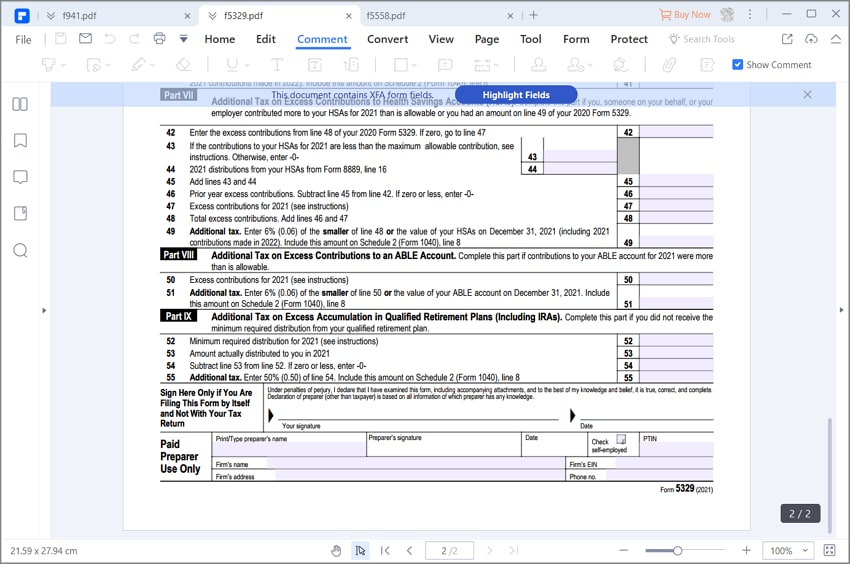

Irs Form 5329 Instructions

Irs Form 5329 Instructions - This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. They received an early distribution from a roth ira,.

This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. They received an early distribution from a roth ira,.

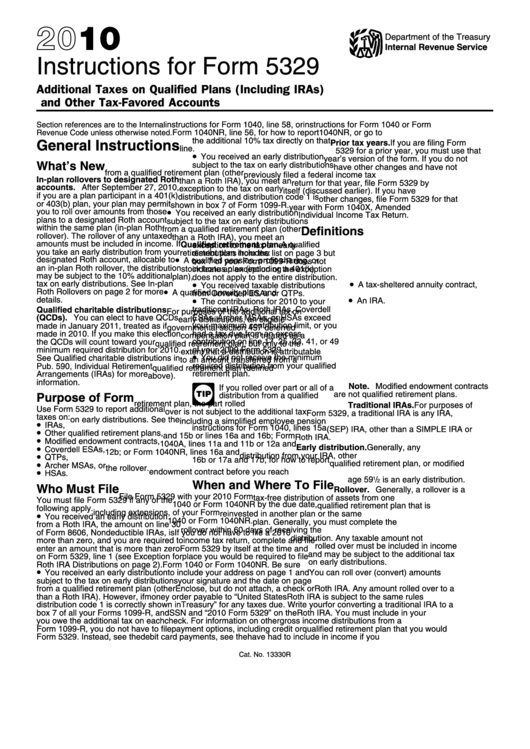

Instructions For Form 5329 2010 printable pdf download

They received an early distribution from a roth ira,. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

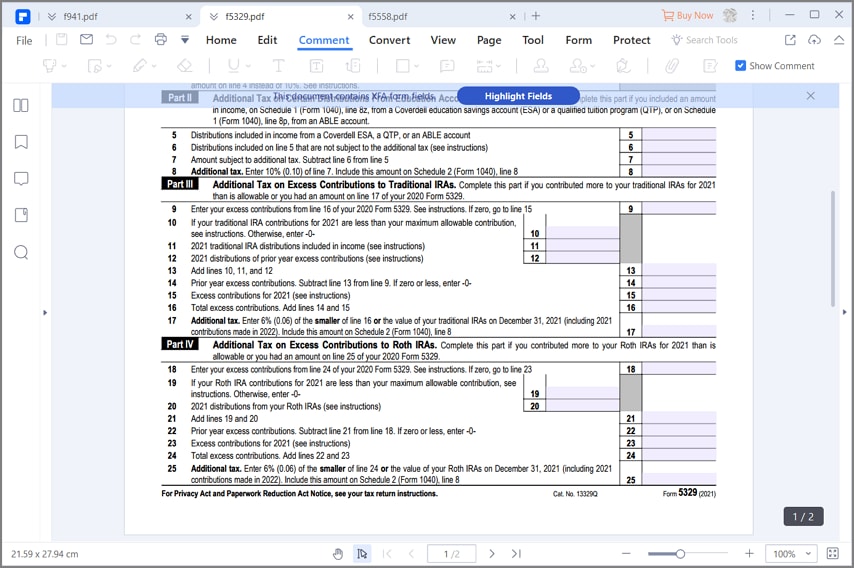

How to Fill in IRS Form 5329

This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. They received an early distribution from a roth ira,.

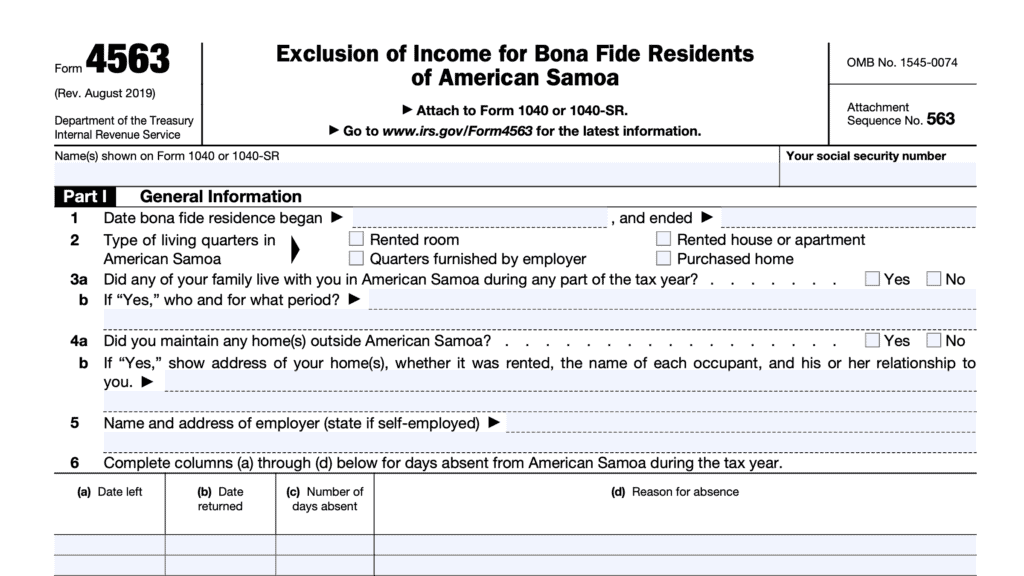

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. They received an early distribution from a roth ira,.

IRS Form 5329 Instructions How To File Retirement Plan Tax Form IRS

They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in.

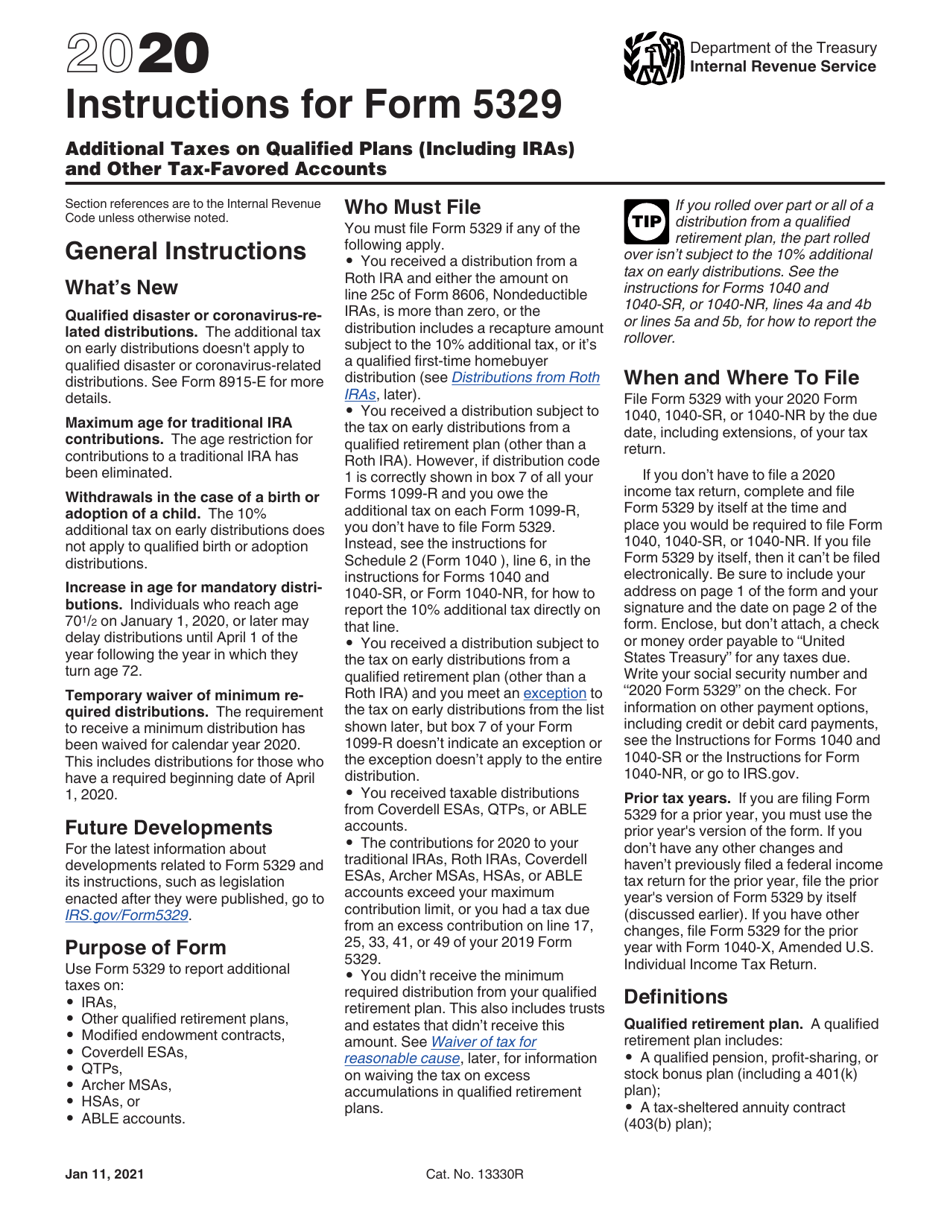

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

IRS Form 5329 Instructions A Guide to Additional Taxes

They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in.

Irs Gov Printable Forms

They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in.

Irs Form 5329 Fillable Printable Forms Free Online

They received an early distribution from a roth ira,. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply.

Comment remplir le formulaire 5329 de l'IRS

They received an early distribution from a roth ira,. File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in.

IRS Form 2210 Instructions Underpayment of Estimated Tax

File requirements for form 5329 a taxpayer must file form 5329 if any of the following apply. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in. They received an early distribution from a roth ira,.

File Requirements For Form 5329 A Taxpayer Must File Form 5329 If Any Of The Following Apply.

They received an early distribution from a roth ira,. This table explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in.