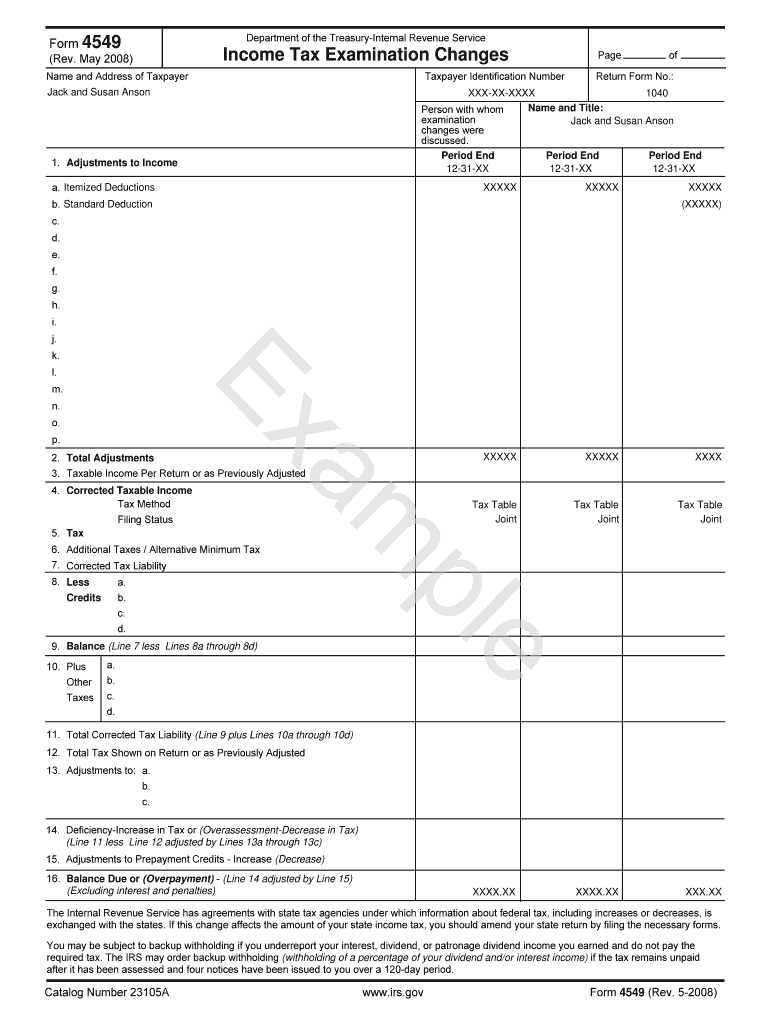

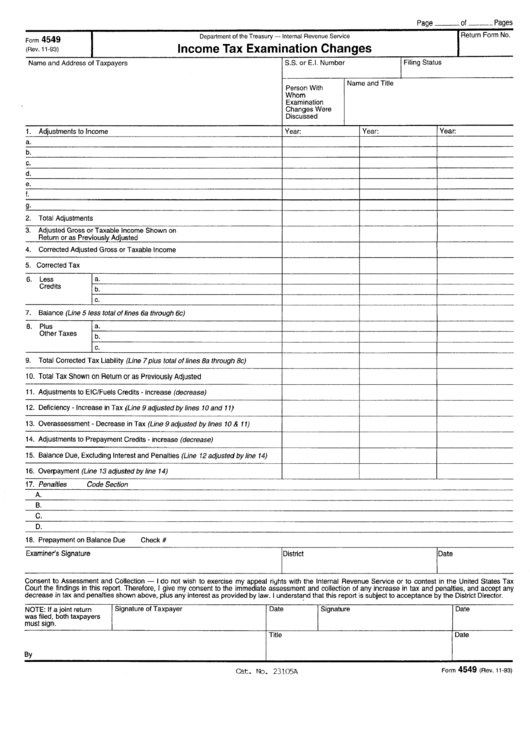

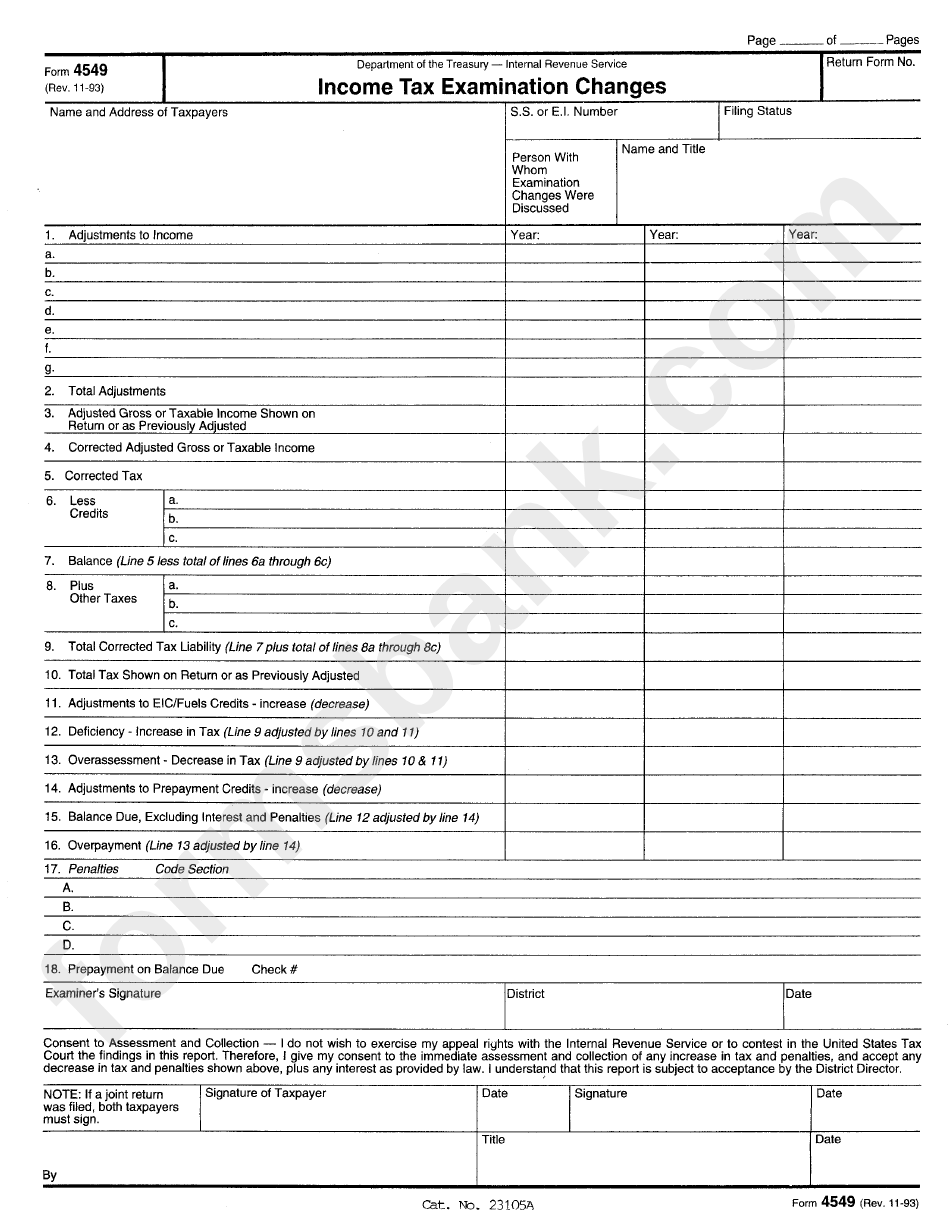

Irs Form 4549 Instructions

Irs Form 4549 Instructions - The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Access irs forms, instructions and publications in electronic and print media. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Letter 4306, reply to closed correspondence examination mail, or form. Once you sign the form, you will then be liable for the taxes and penalties due. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter.

Access irs forms, instructions and publications in electronic and print media. Letter 4306, reply to closed correspondence examination mail, or form. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Once you sign the form, you will then be liable for the taxes and penalties due.

Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Once you sign the form, you will then be liable for the taxes and penalties due. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Access irs forms, instructions and publications in electronic and print media. Letter 4306, reply to closed correspondence examination mail, or form.

Form 4549 IRS Audit Reconsideration The Full Guide Silver Tax Group

Letter 4306, reply to closed correspondence examination mail, or form. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Access irs forms, instructions and publications in electronic and print media. Once you.

Formulario 4549 del IRS. Auditorías ¡No se de por vencido! TaxHelpLaw

Once you sign the form, you will then be liable for the taxes and penalties due. Letter 4306, reply to closed correspondence examination mail, or form. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. The internal revenue service has agreements with state tax agencies under which information about.

Formulario 4549 del IRS. Auditorías ¡No se de por vencido! TaxHelpLaw

Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with.

Irs form 4549 Fill out & sign online DocHub

The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Letter 4306, reply to closed correspondence examination mail, or form. Prepare examination report form 4549,.

Form 4549 Tax Examination Changes Department Of The Treasury

Letter 4306, reply to closed correspondence examination mail, or form. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. The internal revenue service has agreements with state tax agencies under which information.

The IRS Form 4549 (Guidelines) Expat US Tax

Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Access irs forms, instructions and publications in electronic and print media. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Once you sign the form, you will then be liable for the.

Form 4549 Tax Examination Changes Department Of The Treasury

Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Once you sign the form, you will then be liable for the taxes and penalties due. Access irs forms, instructions and publications in electronic and print media. The internal revenue service has agreements with state tax agencies under which information.

The IRS Form 5471 Category Filer Rules San Francisco Tax Lawyers

Letter 4306, reply to closed correspondence examination mail, or form. Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. The internal revenue service has agreements with state tax agencies under which information.

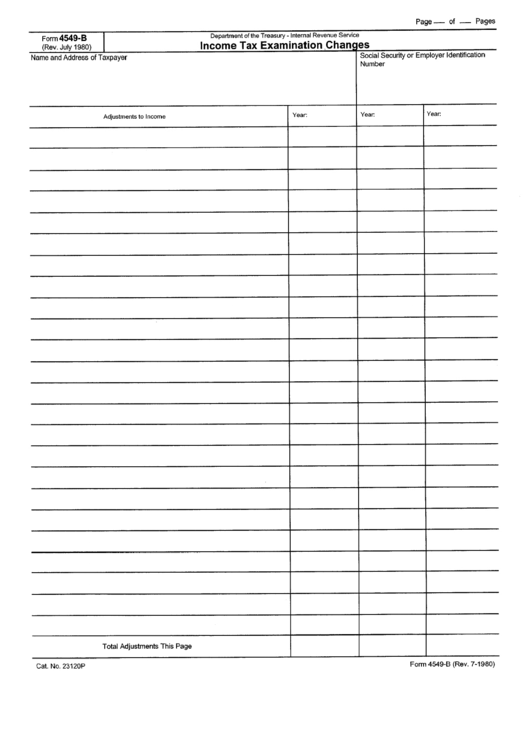

Form 4549B Tax Examitation Changes printable pdf download

Letter 4306, reply to closed correspondence examination mail, or form. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Access irs forms, instructions and publications in electronic and print media. Once you sign the form, you will then be liable for the taxes and.

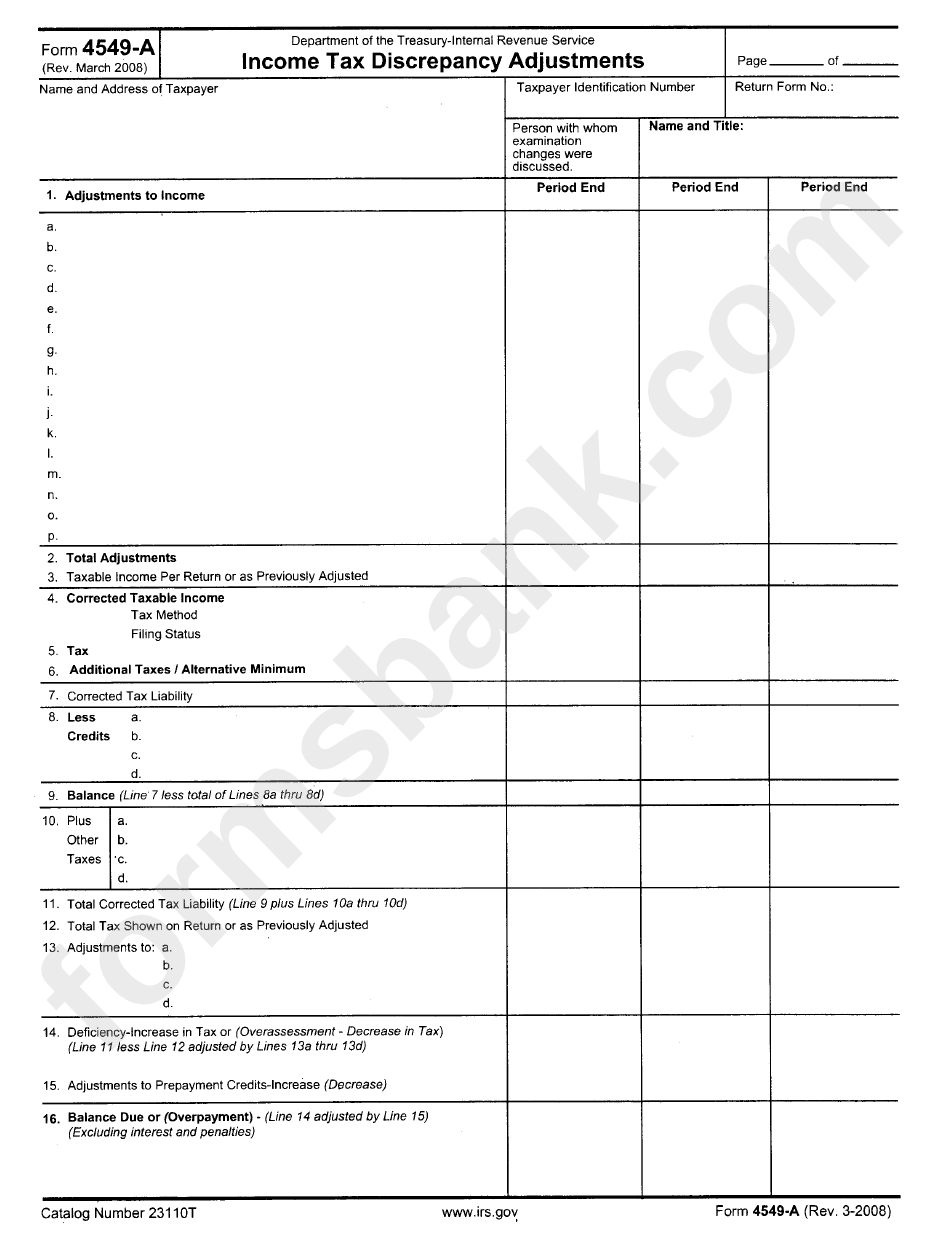

Form 4549A Tax Discrepancy Adjustments printable pdf download

Once you sign the form, you will then be liable for the taxes and penalties due. The internal revenue service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. Letter 4306, reply to closed correspondence examination mail, or form. Access irs forms, instructions and publications in electronic and.

Access Irs Forms, Instructions And Publications In Electronic And Print Media.

Check out the form 4549 instructions on your form to find out what to do if you receive form 4549. Prepare examination report form 4549, report of income tax examination changes, and enclose with a cover letter. Once you sign the form, you will then be liable for the taxes and penalties due. Letter 4306, reply to closed correspondence examination mail, or form.