Irs Form 3552

Irs Form 3552 - 1) cp14h which bills you for not having health insurance & 2) notice cp14i, which bills you for excess ira. There are also 2 new notices: Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt.

Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… 1) cp14h which bills you for not having health insurance & 2) notice cp14i, which bills you for excess ira. There are also 2 new notices: If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt.

There are also 2 new notices: If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. 1) cp14h which bills you for not having health insurance & 2) notice cp14i, which bills you for excess ira. The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt. Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the…

Irs Form 8857 Printable

The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt. Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… There are also 2 new notices: 1).

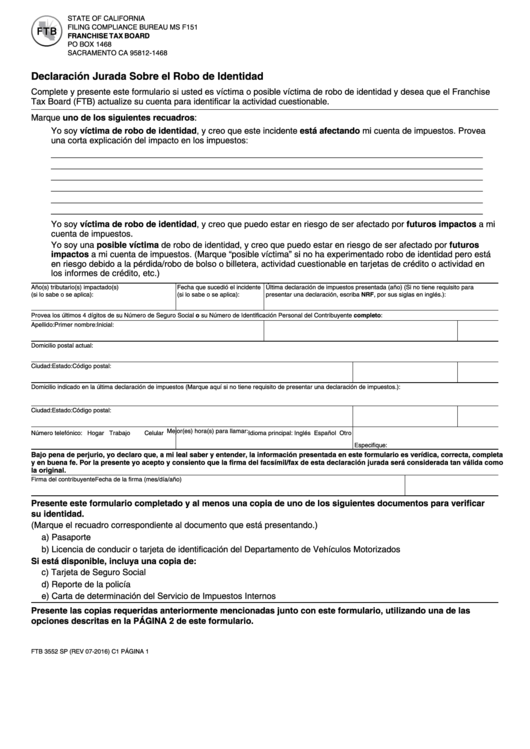

Fillable Form Ftb 3552 Declaracion Jurada Sobre El Robo De Identidad

If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. There are also 2 new notices: Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on.

3.12.21 Credit and Account Transfers Internal Revenue Service

If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… The irs must wait 60.

IRS Form 8832 Instructions to Fill Out and File On Time 1800Accountant

The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt. Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… If the campus discovers a math error.

3.17.244 Manual Assessments Internal Revenue Service

The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt. 1) cp14h which bills you for not having health insurance & 2) notice cp14i, which bills you for excess ira. If the campus discovers a math error on a return submitted for prompt assessment which results in an increase.

3.17.244 Manual Assessments Internal Revenue Service

Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… There are also 2 new notices: If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they.

Irs Forms And Worksheets For Homeowners FasterCapital Worksheets

If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… There are also 2 new.

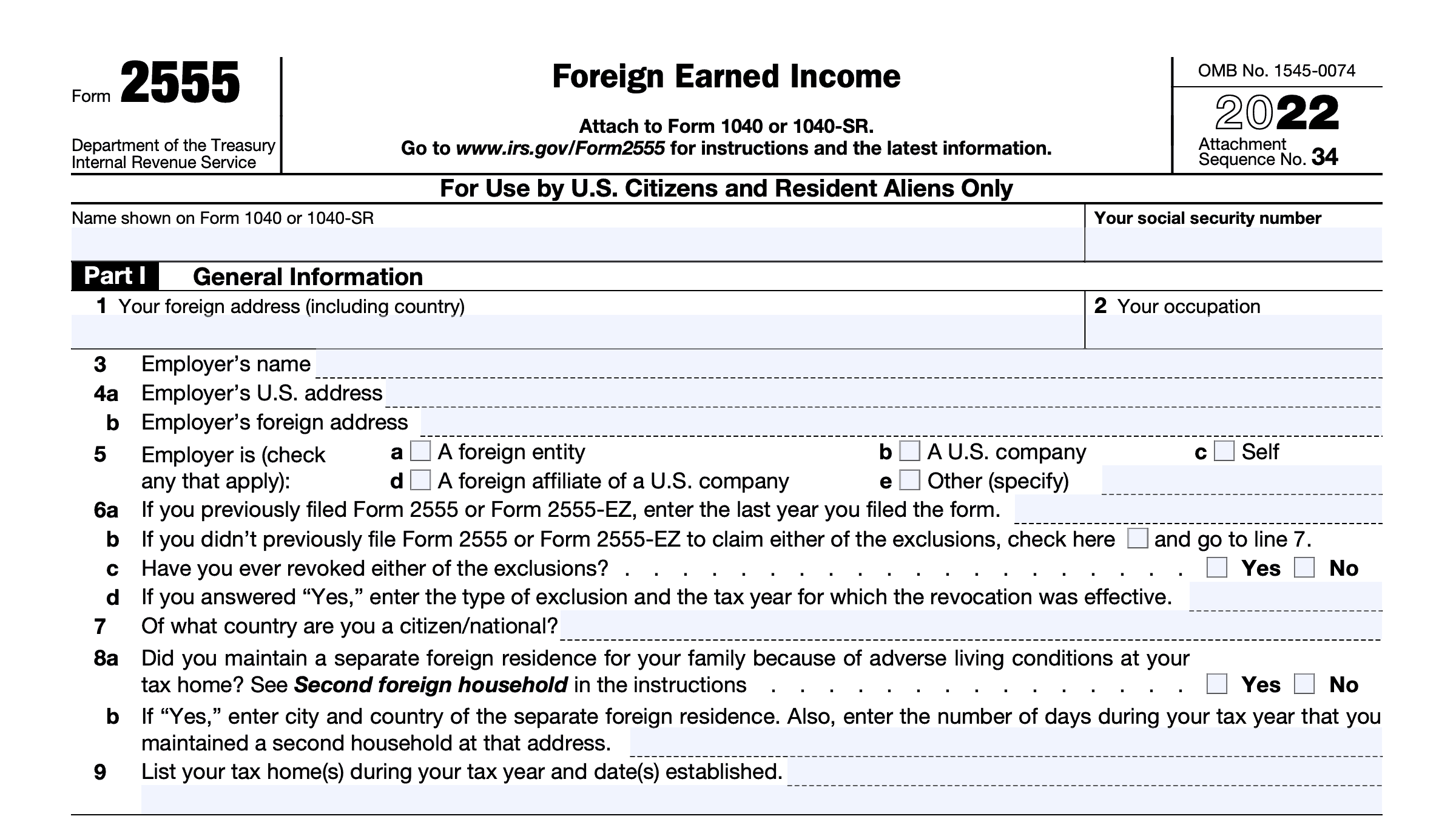

IRS Form 2555 Instructions

If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt. Got a letter from the irs, confirming my refund i got this year, in april i.

IRS Form 3922 walkthrough ARCHIVED COPY READ COMMENTS ONLY YouTube

Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… There are also 2 new notices: The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt. 1).

IRS Form 2848 What Internal Revenue Service Form 2848 Is & How to

If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will. The irs must wait 60 days after issuance of letter 1153 before issuing notice and demand for payment (form 3552, prompt. Got a letter from the irs, confirming my refund i got this year, in april i.

The Irs Must Wait 60 Days After Issuance Of Letter 1153 Before Issuing Notice And Demand For Payment (Form 3552, Prompt.

Got a letter from the irs, confirming my refund i got this year, in april i filed for 2014 taxes that i never mailed (that i was due a refund) on the… There are also 2 new notices: 1) cp14h which bills you for not having health insurance & 2) notice cp14i, which bills you for excess ira. If the campus discovers a math error on a return submitted for prompt assessment which results in an increase of tax, they will.