Irs Form 2159

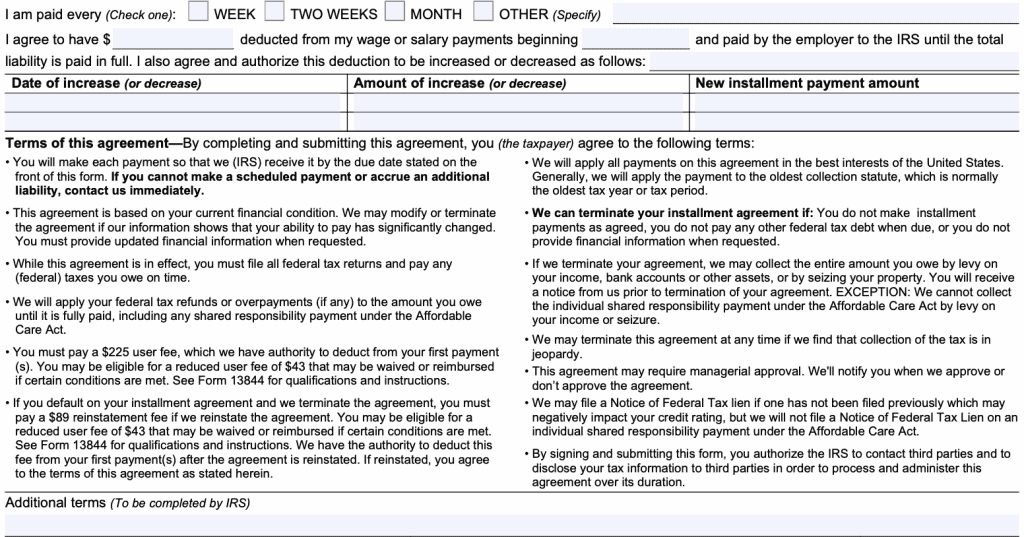

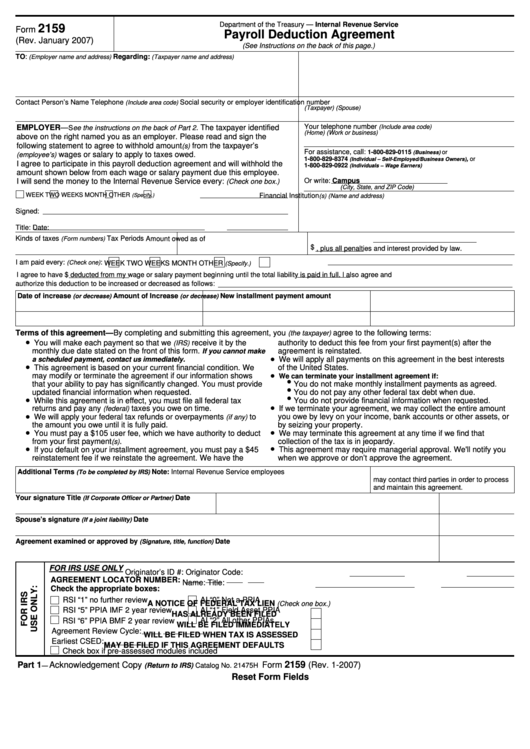

Irs Form 2159 - There are some potential traps. What is irs form 2159? Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction. • we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. Irs form 2159, payroll deduction agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows taxpayers to make monthly payments on their federal tax debt by.

Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction. What is irs form 2159? • we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. Irs form 2159, payroll deduction agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows taxpayers to make monthly payments on their federal tax debt by. There are some potential traps.

What is irs form 2159? Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. Irs form 2159, payroll deduction agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows taxpayers to make monthly payments on their federal tax debt by. There are some potential traps. • we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction.

Fillable Online Irs form 2159 instructions. Irs form 2159 instructions

• we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. What is irs form 2159? Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their.

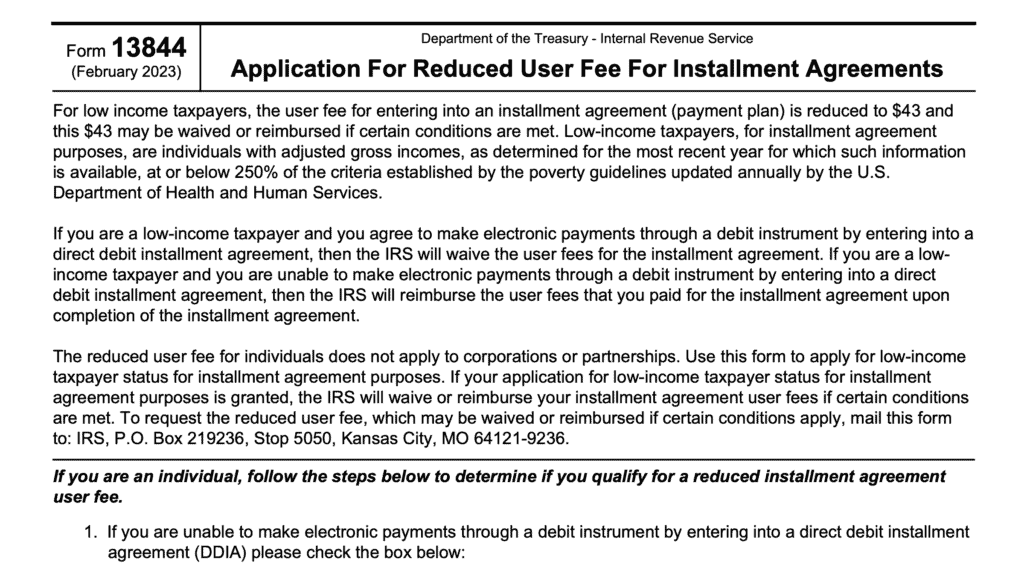

IRS Form 9465 Instructions Your Installment Agreement Request

• we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction. Irs form 2159, payroll deduction agreement, is the.

IRS Form 2159 A Guide to Your Payroll Deduction Agreement

What is irs form 2159? Irs form 2159, payroll deduction agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows taxpayers to make monthly payments on their federal tax debt by. To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction..

IRS Form 2159 Instructions

There are some potential traps. What is irs form 2159? • we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. Irs form 2159, payroll deduction agreement, is a tax document to set up an installment agreement, a form.

Printable Irs Form 2159 Printable Forms Free Online

What is irs form 2159? To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction. Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. There are some potential traps. • we will apply.

Printable Irs Form 2159 Printable Forms Free Online

What is irs form 2159? To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction. • we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. There are some.

Irs Form 2159 ≡ Fill Out Printable PDF Forms Online

What is irs form 2159? Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. • we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the.

Irs Form 2159 ≡ Fill Out Printable PDF Forms Online

Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. What is irs form 2159? There are some potential traps. Irs form 2159, payroll deduction agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows.

Printable Irs Form 2159 Printable Forms Free Online

Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. Irs form 2159, payroll deduction agreement, is a tax document to set up an installment agreement, a form of tax debt relief that allows taxpayers to make monthly payments on their federal tax debt.

IRS Form 2159 walkthrough (Setting Up a Payroll Deduction Agreement

• we will apply your federal tax refunds or overpayments (if any) to the amount you owe until it is fully paid, including any shared responsibility payment under the affordable care act. Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. Irs form.

Irs Form 2159, Payroll Deduction Agreement, Is A Tax Document To Set Up An Installment Agreement, A Form Of Tax Debt Relief That Allows Taxpayers To Make Monthly Payments On Their Federal Tax Debt By.

What is irs form 2159? To provide instructions on completing irs form 2159 to initiate a payment installment agreement with the irs through payroll deduction. There are some potential traps. Irs form 2159, payroll deduction agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability.