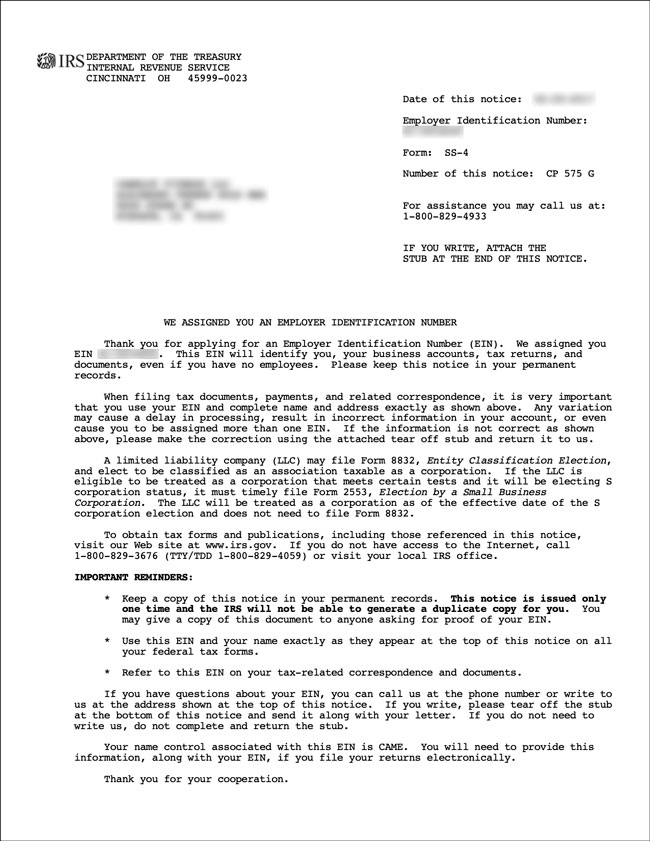

Irs Form 147C Online

Irs Form 147C Online - Only an owner or a power of attorney (poa) can request a 147c letter. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. If you would like a poa to request your ein verification letter (147c), both. Learn how to obtain a copy of your federal ein letter from the irs. Discover the process, key details, and alternatives for quick.

Learn how to obtain a copy of your federal ein letter from the irs. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Discover the process, key details, and alternatives for quick. Only an owner or a power of attorney (poa) can request a 147c letter. If you would like a poa to request your ein verification letter (147c), both.

Learn how to obtain a copy of your federal ein letter from the irs. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Discover the process, key details, and alternatives for quick. If you would like a poa to request your ein verification letter (147c), both. Only an owner or a power of attorney (poa) can request a 147c letter.

147C Letter Printable 147C Form

Discover the process, key details, and alternatives for quick. Only an owner or a power of attorney (poa) can request a 147c letter. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. If you would like a poa to request your ein verification letter.

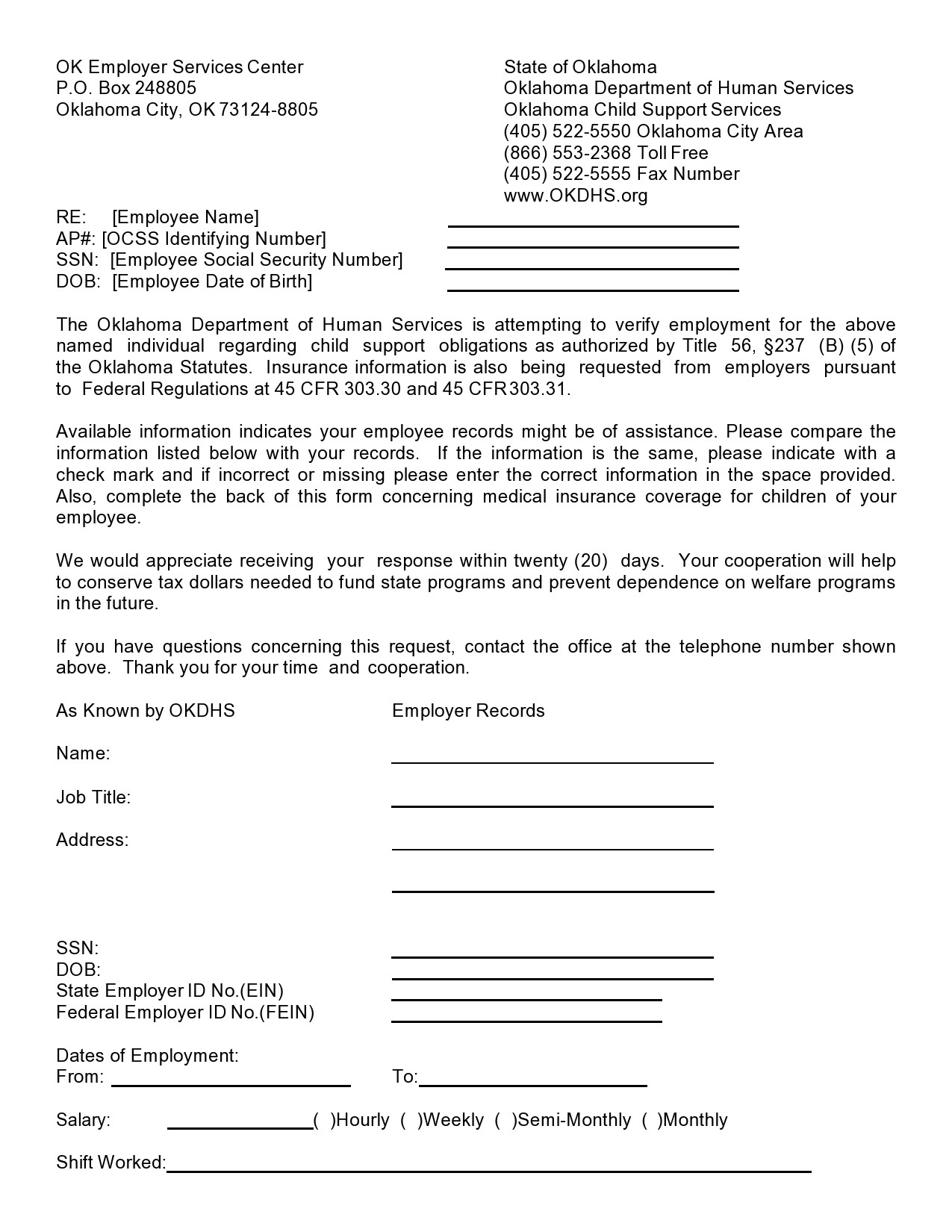

Irs Form 147c Printable Printable Forms Free Online

Only an owner or a power of attorney (poa) can request a 147c letter. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. If you would like a poa to request your ein verification letter (147c), both. Discover the process, key details, and alternatives.

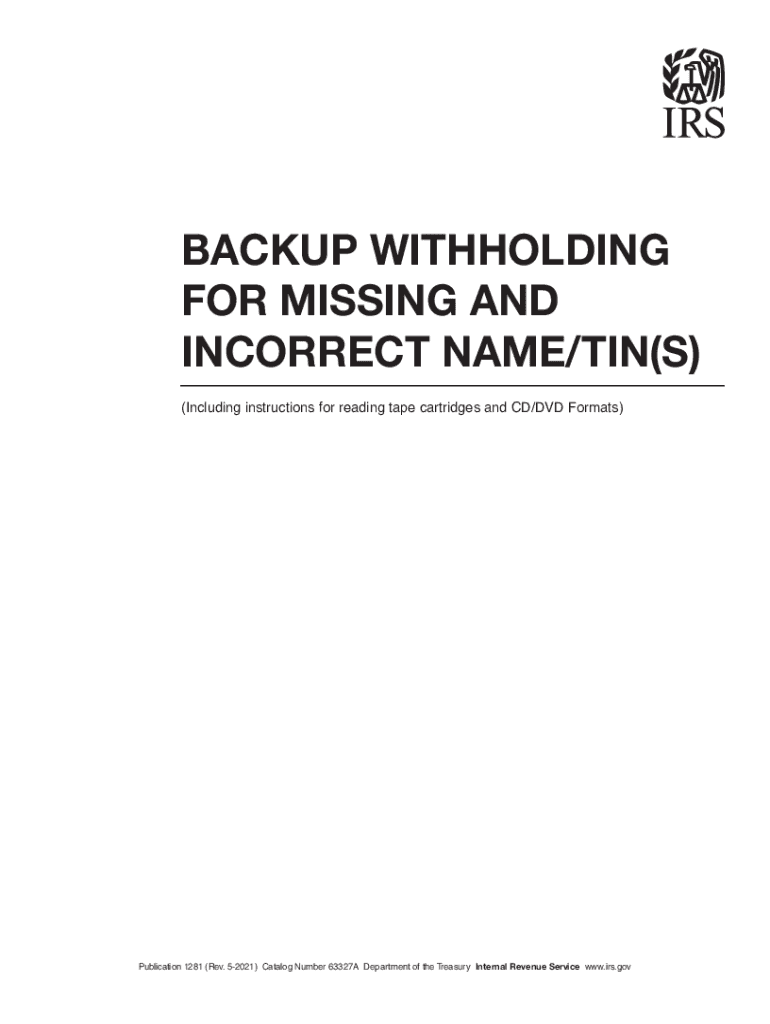

Irs Letter 147C Thankyou Letter

Discover the process, key details, and alternatives for quick. Learn how to obtain a copy of your federal ein letter from the irs. Only an owner or a power of attorney (poa) can request a 147c letter. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or.

Irs Form 147C Printable

Discover the process, key details, and alternatives for quick. If you would like a poa to request your ein verification letter (147c), both. Only an owner or a power of attorney (poa) can request a 147c letter. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or.

Ein Verification Letter 147c

Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Only an owner or a power of attorney (poa) can request a 147c letter. Learn how to obtain a copy of your federal ein letter from the irs. If you would like a poa to.

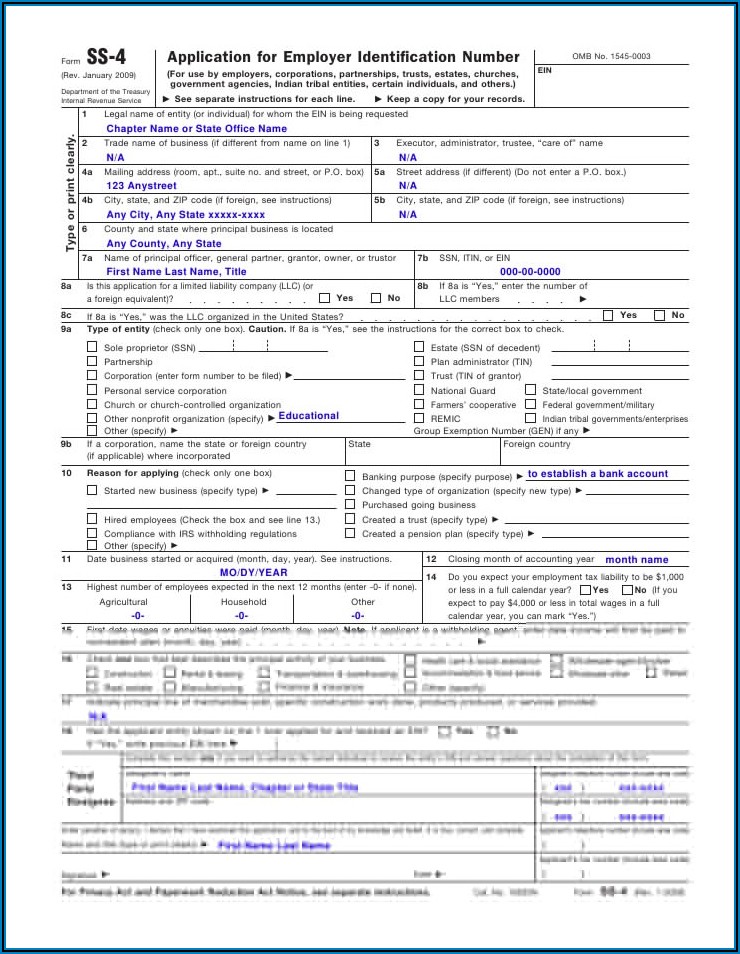

Irs form 147c pdf Fill out & sign online DocHub

If you would like a poa to request your ein verification letter (147c), both. Learn how to obtain a copy of your federal ein letter from the irs. Discover the process, key details, and alternatives for quick. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or.

147C Letter Printable 147C Form

Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Learn how to obtain a copy of your federal ein letter from the irs. If you would like a poa to request your ein verification letter (147c), both. Only an owner or a power of.

Cancel Ein Sample Letter

If you would like a poa to request your ein verification letter (147c), both. Only an owner or a power of attorney (poa) can request a 147c letter. Learn how to obtain a copy of your federal ein letter from the irs. Find a previously filed tax return for your existing entity (if you have filed a return) for which.

Irs Form 147C Printable

Only an owner or a power of attorney (poa) can request a 147c letter. Discover the process, key details, and alternatives for quick. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. If you would like a poa to request your ein verification letter.

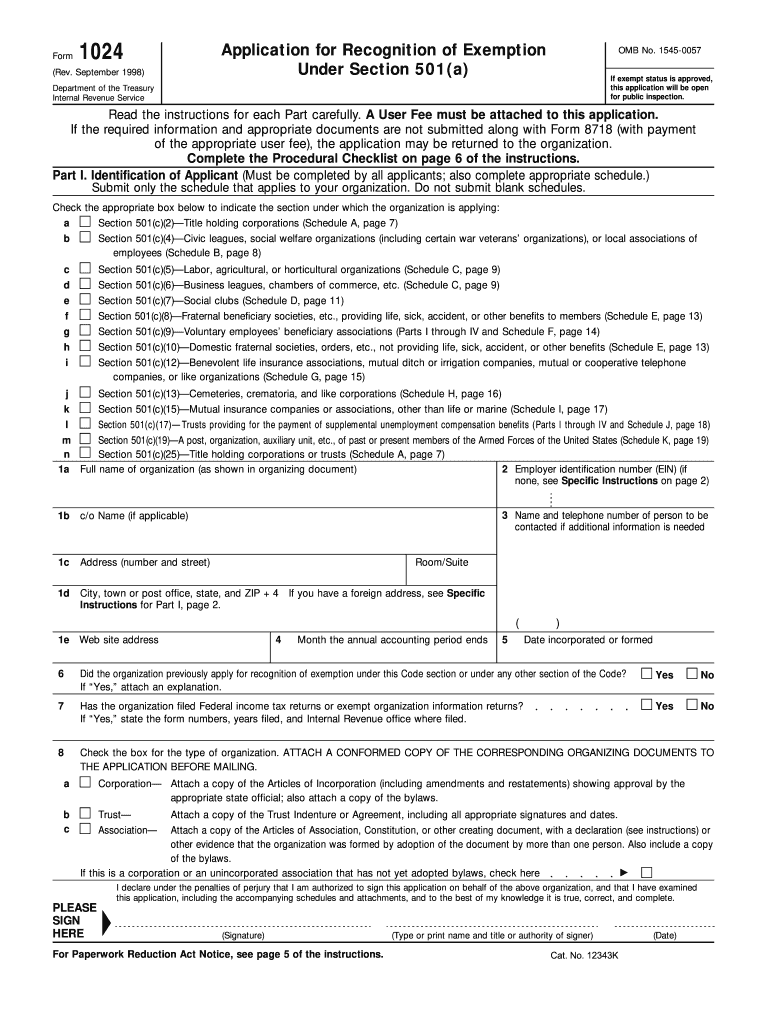

Ir's Form 1024 Fill Out and Sign Printable PDF Template airSlate

If you would like a poa to request your ein verification letter (147c), both. Learn how to obtain a copy of your federal ein letter from the irs. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Discover the process, key details, and alternatives.

If You Would Like A Poa To Request Your Ein Verification Letter (147C), Both.

Learn how to obtain a copy of your federal ein letter from the irs. Only an owner or a power of attorney (poa) can request a 147c letter. Discover the process, key details, and alternatives for quick. Find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein.