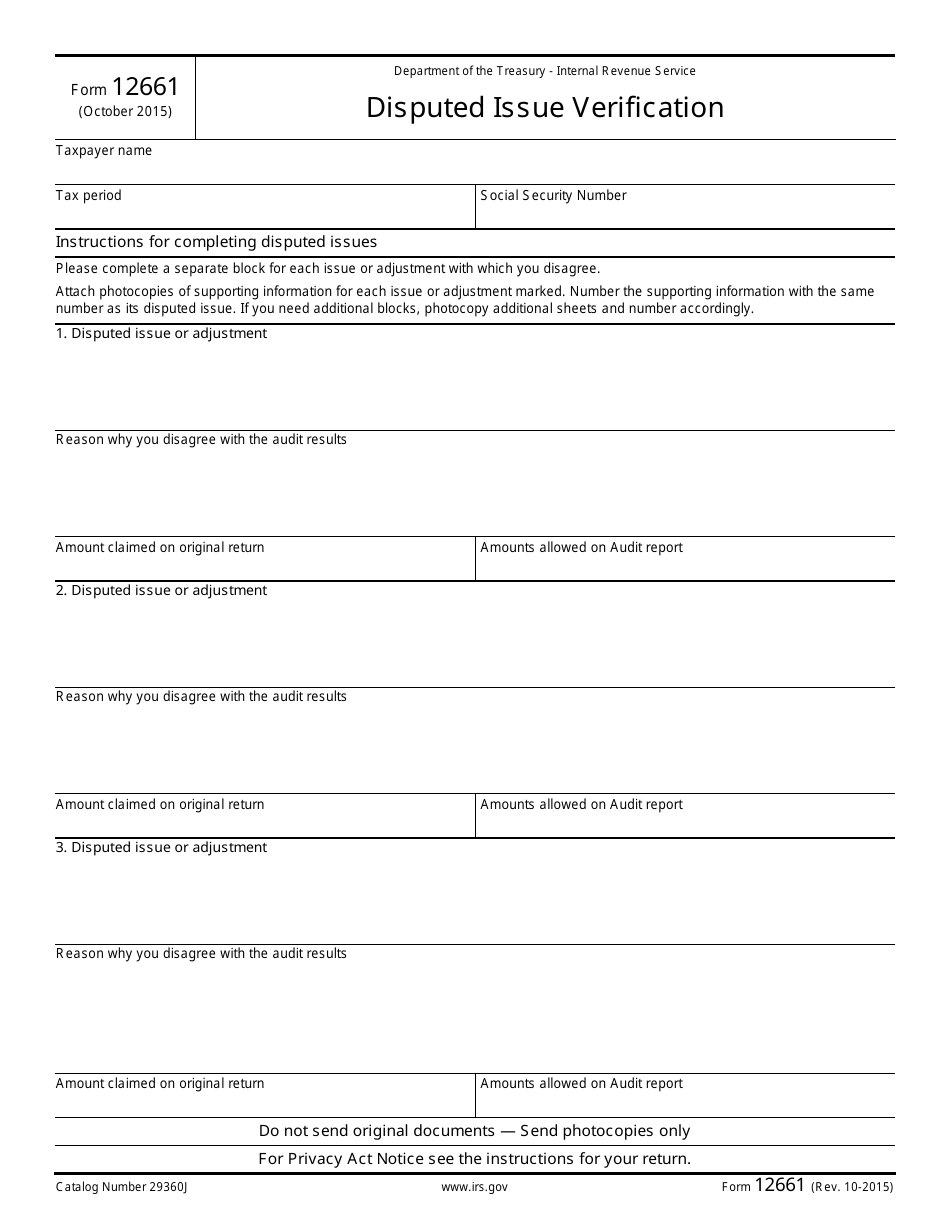

Irs Audit Reconsideration Form 12661

Irs Audit Reconsideration Form 12661 - Refer to publication 3598 for more. Only complete this form if you have a closed audit and have additional information to consider. Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661.

Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Only complete this form if you have a closed audit and have additional information to consider. Refer to publication 3598 for more.

Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Only complete this form if you have a closed audit and have additional information to consider. Refer to publication 3598 for more.

IRS Audit Letter 3219C Sample 1

Only complete this form if you have a closed audit and have additional information to consider. Refer to publication 3598 for more. Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661.

IRS Form 12661 Fill Out, Sign Online and Download Fillable PDF

Refer to publication 3598 for more. Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Only complete this form if you have a closed audit and have additional information to consider.

IRS Audit Letter 3219C Sample 1

Refer to publication 3598 for more. Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Only complete this form if you have a closed audit and have additional information to consider.

Irs audit reconsideration form 12661 Fill online, Printable, Fillable

Only complete this form if you have a closed audit and have additional information to consider. Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Refer to publication 3598 for more.

IRS Audit Reconsideration Guide My Broken Coin

Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Refer to publication 3598 for more. Only complete this form if you have a closed audit and have additional information to consider.

IRS Form 12661 & The IRS Audit Reconsideration Process

Only complete this form if you have a closed audit and have additional information to consider. Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Refer to publication 3598 for more.

How to Request an IRS Audit Reconsideration Paladini Law

Refer to publication 3598 for more. Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Only complete this form if you have a closed audit and have additional information to consider.

What is an IRS Audit Reconsideration? ExIRS Agent Explains shorts

Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Refer to publication 3598 for more. Only complete this form if you have a closed audit and have additional information to consider.

IRS Audit Letter 3219C Sample 1

Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Only complete this form if you have a closed audit and have additional information to consider. Refer to publication 3598 for more.

Only Complete This Form If You Have A Closed Audit And Have Additional Information To Consider.

Advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. Refer to publication 3598 for more.