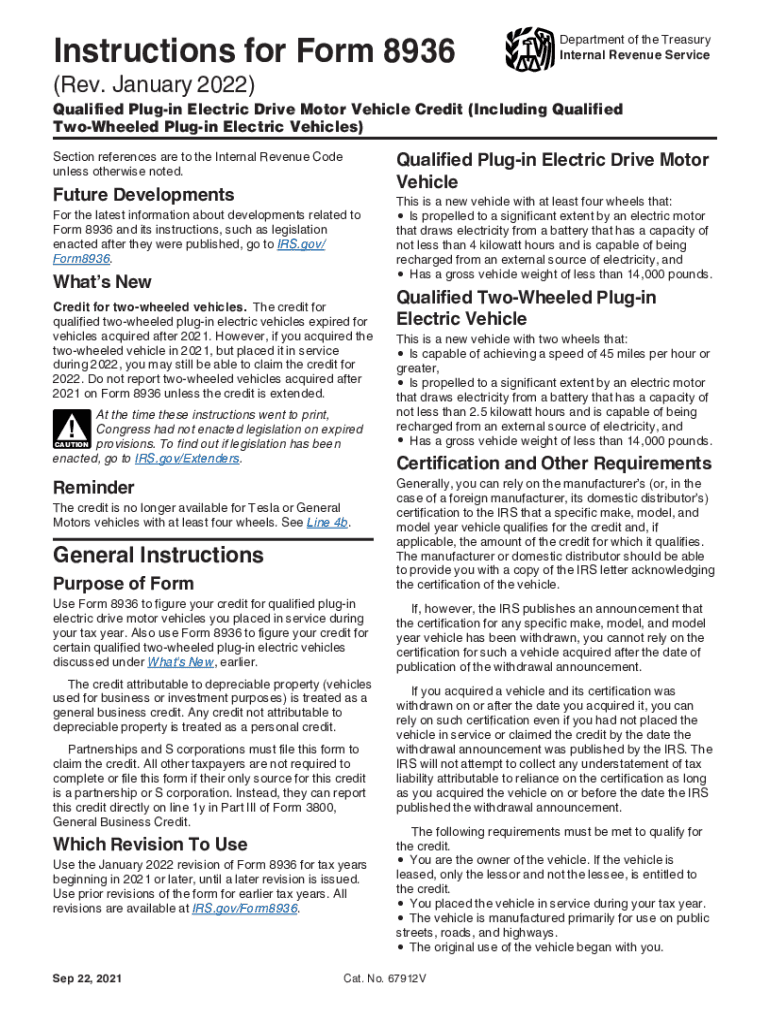

Instructions For Form 8936

Instructions For Form 8936 - Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Download Instructions for IRS Form 8936 Qualified PlugIn Electric

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

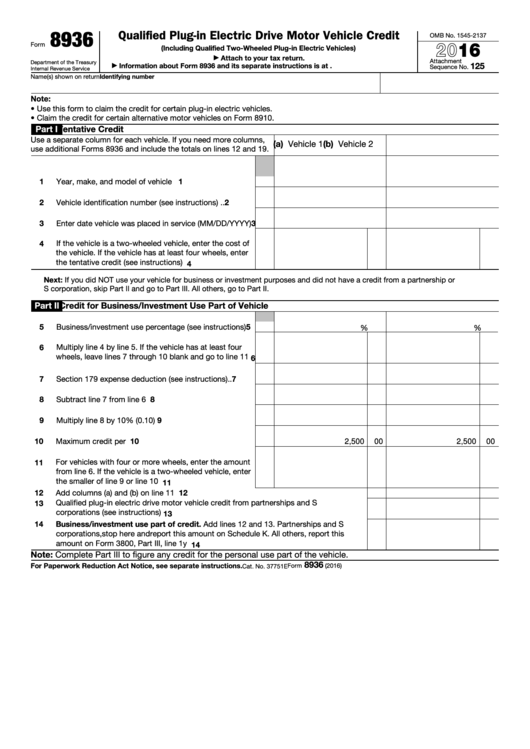

Fillable Form 8936 Qualified PlugIn Electric Drive Motor Vehicle

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Form 8936

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Download Instructions for IRS Form 8936 Clean Vehicle Credits PDF, 2023

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Form 8936 Instructions 2023 Printable Forms Free Online

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

Fillable Online Instructions for Form 8936 (Rev. January 2022

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

Form 8936 Edit, Fill, Sign Online Handypdf

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

Fillable Online 8936 Instructions for Form 8936. Instructions for Form

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

IRS Form 8936 Instructions Qualifying Electric Vehicle Tax Credits

This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936. Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

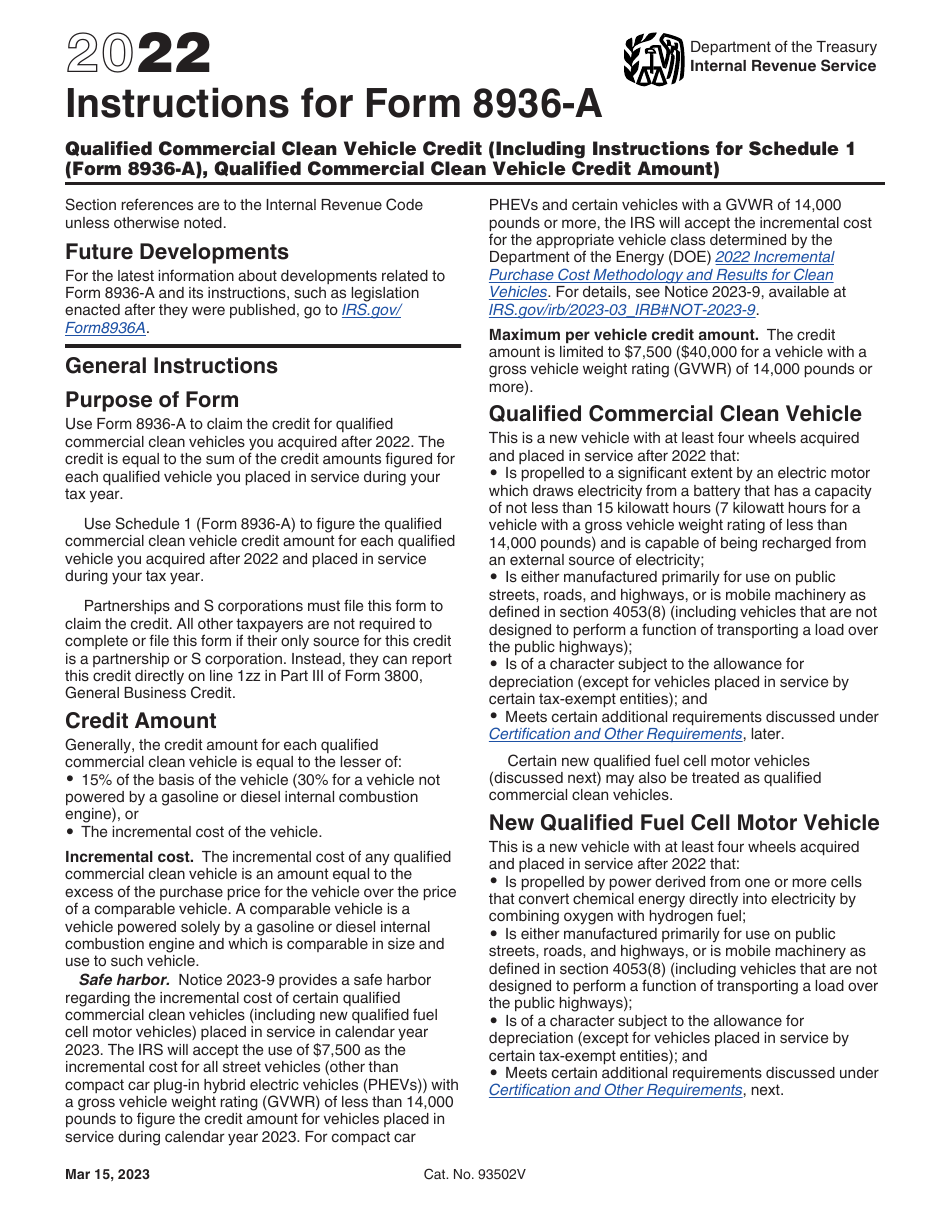

Download Instructions for IRS Form 8936A Schedule 1 PDF, 2022

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed. This article explains how to claim the maximum credit amount for business/investment use of an electric vehicle on form 8936.

This Article Explains How To Claim The Maximum Credit Amount For Business/Investment Use Of An Electric Vehicle On Form 8936.

Use parts i and v of schedule a (form 8936) to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed.

:max_bytes(150000):strip_icc()/IRSForm8936-e08cdbaf8ff74a2eab7cd0c1e19b93ef.png)