Instacart Stripe 1099

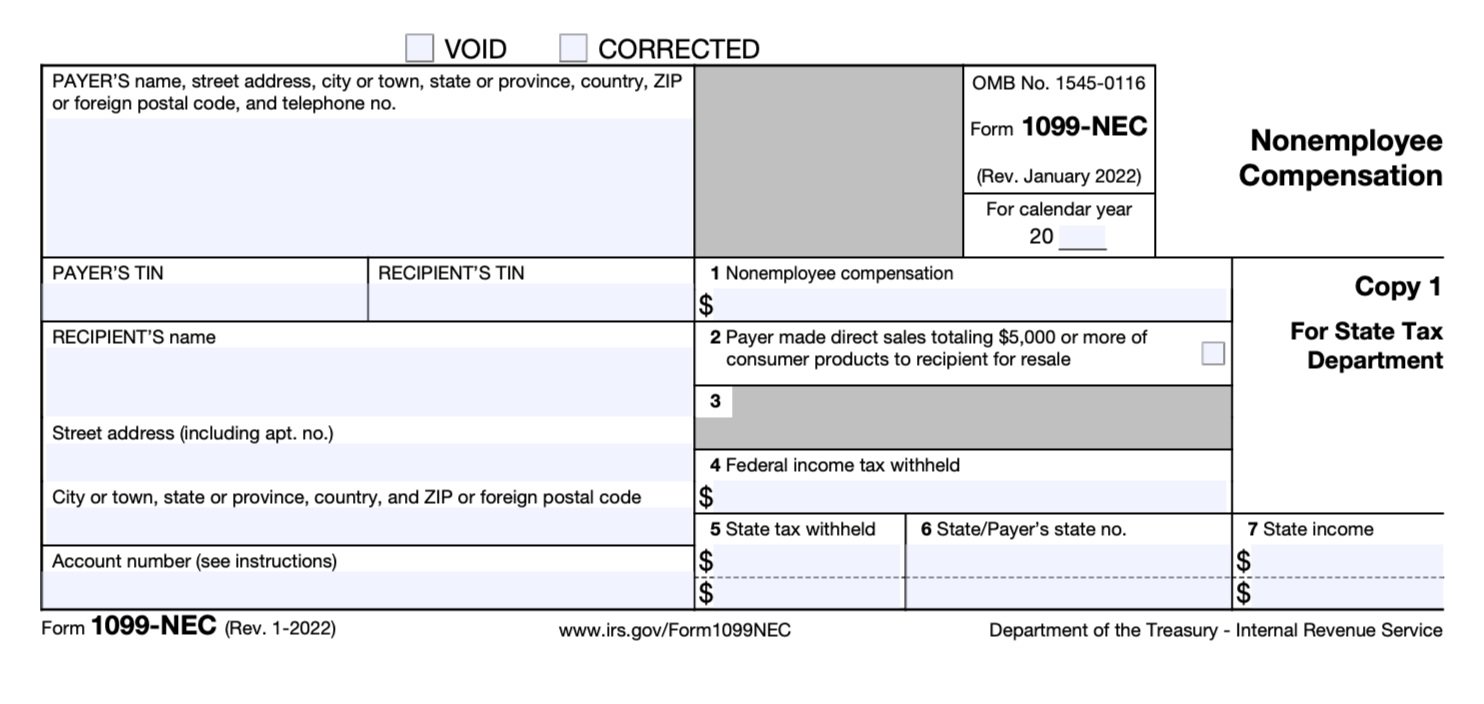

Instacart Stripe 1099 - You’ll need to reach out to instacart to access your 2023 1099 tax form; Stripe partners with online platforms like doordash, instacart, and shipt to. If you earned less than $600 from instacart last year, you won‘t receive a 1099 but are still responsible for reporting and paying taxes on. Check the link to the instacart shopper site to learn more. Looking for information about your 1099 tax form from your platform? If you worked with instacart in 2021 or 2022, there is a different process of obtaining form 1099. We’ve put together some faqs. Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities.

Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities. If you worked with instacart in 2021 or 2022, there is a different process of obtaining form 1099. You’ll need to reach out to instacart to access your 2023 1099 tax form; Looking for information about your 1099 tax form from your platform? Stripe partners with online platforms like doordash, instacart, and shipt to. If you earned less than $600 from instacart last year, you won‘t receive a 1099 but are still responsible for reporting and paying taxes on. We’ve put together some faqs. Check the link to the instacart shopper site to learn more.

Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities. If you worked with instacart in 2021 or 2022, there is a different process of obtaining form 1099. We’ve put together some faqs. Looking for information about your 1099 tax form from your platform? If you earned less than $600 from instacart last year, you won‘t receive a 1099 but are still responsible for reporting and paying taxes on. Stripe partners with online platforms like doordash, instacart, and shipt to. Check the link to the instacart shopper site to learn more. You’ll need to reach out to instacart to access your 2023 1099 tax form;

Sprouts Launches New Retail Media Network Powered by Instacart's Carrot

We’ve put together some faqs. Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities. You’ll need to reach out to instacart to access your 2023 1099 tax form; Looking for information about your 1099 tax form from your platform? Check the link to the instacart shopper site to learn more.

Instacart Shopper Leaves Receipt in Bag, Reveals 77 Difference

Check the link to the instacart shopper site to learn more. Stripe partners with online platforms like doordash, instacart, and shipt to. Looking for information about your 1099 tax form from your platform? If you worked with instacart in 2021 or 2022, there is a different process of obtaining form 1099. We’ve put together some faqs.

HUGE IPOs Stripe, Rivian, Instacart YouTube

Check the link to the instacart shopper site to learn more. Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities. Looking for information about your 1099 tax form from your platform? You’ll need to reach out to instacart to access your 2023 1099 tax form; We’ve put together some faqs.

Where is my 1099 tax form? Stripe Help & Support

Looking for information about your 1099 tax form from your platform? We’ve put together some faqs. Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities. You’ll need to reach out to instacart to access your 2023 1099 tax form; If you earned less than $600 from instacart last year, you won‘t receive.

What Is a 1099NEC? — Stride Blog

If you worked with instacart in 2021 or 2022, there is a different process of obtaining form 1099. We’ve put together some faqs. Stripe partners with online platforms like doordash, instacart, and shipt to. You’ll need to reach out to instacart to access your 2023 1099 tax form; Instacart previously partnered with stripe to file 1099 tax forms that summarize.

Understanding Your Instacart 1099 in 2021 Tax guide, Understanding

If you earned less than $600 from instacart last year, you won‘t receive a 1099 but are still responsible for reporting and paying taxes on. You’ll need to reach out to instacart to access your 2023 1099 tax form; Stripe partners with online platforms like doordash, instacart, and shipt to. Instacart previously partnered with stripe to file 1099 tax forms.

Is being a 1099 worth it? Leia aqui What is the downside of 1099

If you earned less than $600 from instacart last year, you won‘t receive a 1099 but are still responsible for reporting and paying taxes on. Looking for information about your 1099 tax form from your platform? You’ll need to reach out to instacart to access your 2023 1099 tax form; Stripe partners with online platforms like doordash, instacart, and shipt.

Does Instacart Hire Felons? The Ultimate Guide to the Policy & Hiring

You’ll need to reach out to instacart to access your 2023 1099 tax form; Looking for information about your 1099 tax form from your platform? Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities. Check the link to the instacart shopper site to learn more. If you worked with instacart in 2021.

Instacart Referral Code (JOY6CB078) Earn 40 OFF Bonus And 10

Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities. We’ve put together some faqs. You’ll need to reach out to instacart to access your 2023 1099 tax form; Check the link to the instacart shopper site to learn more. If you earned less than $600 from instacart last year, you won‘t receive.

Guide to 1099 tax forms for Instacart Shopper Stripe Help & Support

You’ll need to reach out to instacart to access your 2023 1099 tax form; Looking for information about your 1099 tax form from your platform? If you earned less than $600 from instacart last year, you won‘t receive a 1099 but are still responsible for reporting and paying taxes on. If you worked with instacart in 2021 or 2022, there.

If You Earned Less Than $600 From Instacart Last Year, You Won‘t Receive A 1099 But Are Still Responsible For Reporting And Paying Taxes On.

Looking for information about your 1099 tax form from your platform? If you worked with instacart in 2021 or 2022, there is a different process of obtaining form 1099. Stripe partners with online platforms like doordash, instacart, and shipt to. Check the link to the instacart shopper site to learn more.

We’ve Put Together Some Faqs.

You’ll need to reach out to instacart to access your 2023 1099 tax form; Instacart previously partnered with stripe to file 1099 tax forms that summarize your earnings or sales activities.