Instacart 1099 Or W2

Instacart 1099 Or W2 - It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. It shows your annual wages and.

W2 vs. 1099 What's the Difference? PeopleReady

It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

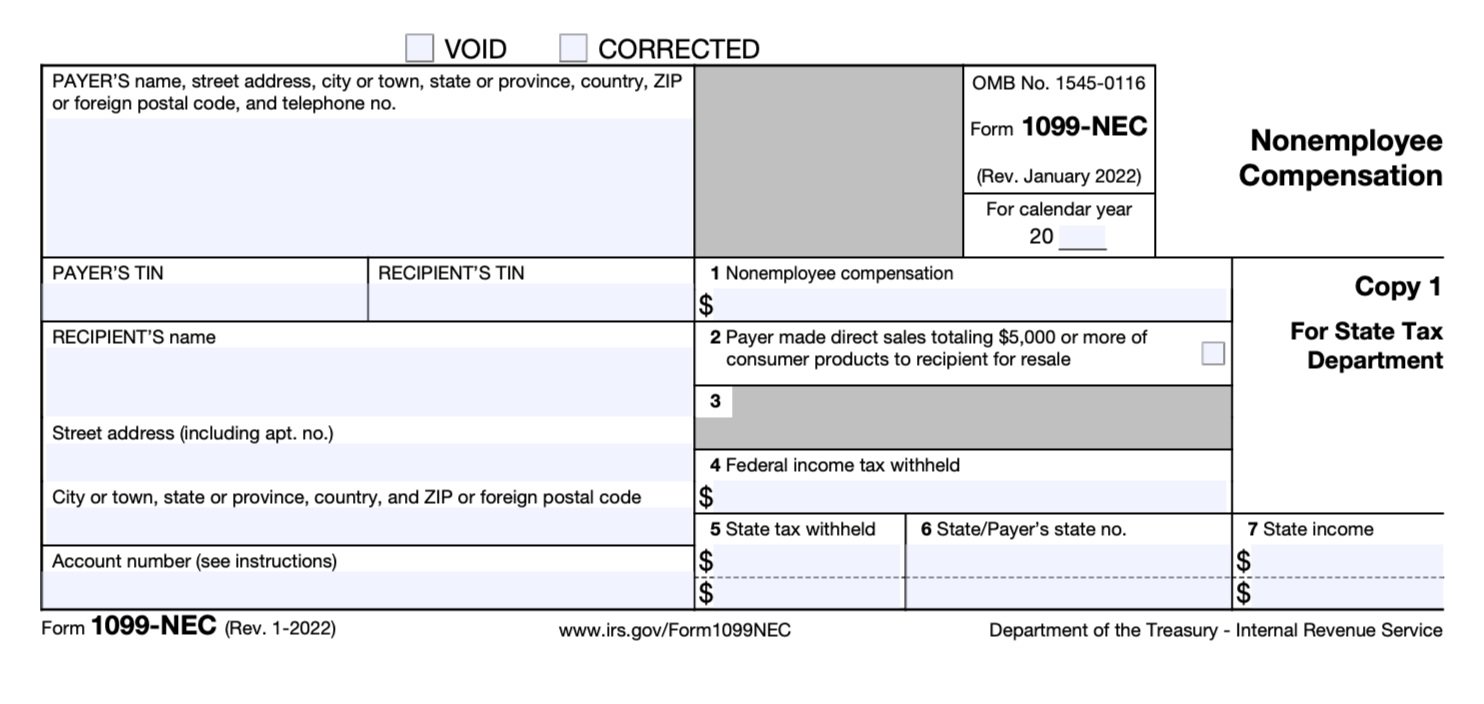

What Is a 1099NEC? — Stride Blog

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. It shows your annual wages and.

1099 Instacart Taxes File Taxes On Your Instacart

It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

How To Get 1099 From Instacart YouTube

It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

Understanding Your Instacart 1099 in 2021 Tax guide, Understanding

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. It shows your annual wages and.

Instacart Company Retailers

It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

Instacart 1099 Form 2024 Lanae Doralynne

It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

Instacart Restructures, Laying Off 7 of Workforce

It shows your annual wages and. Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

When Do You Get a 1099 Tax Form and Why Does It Matter?

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs. It shows your annual wages and.

It Shows Your Annual Wages And.

Instacart will deduct social security, medicare, and a few other taxes from your paycheck and remit that to the irs.

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)