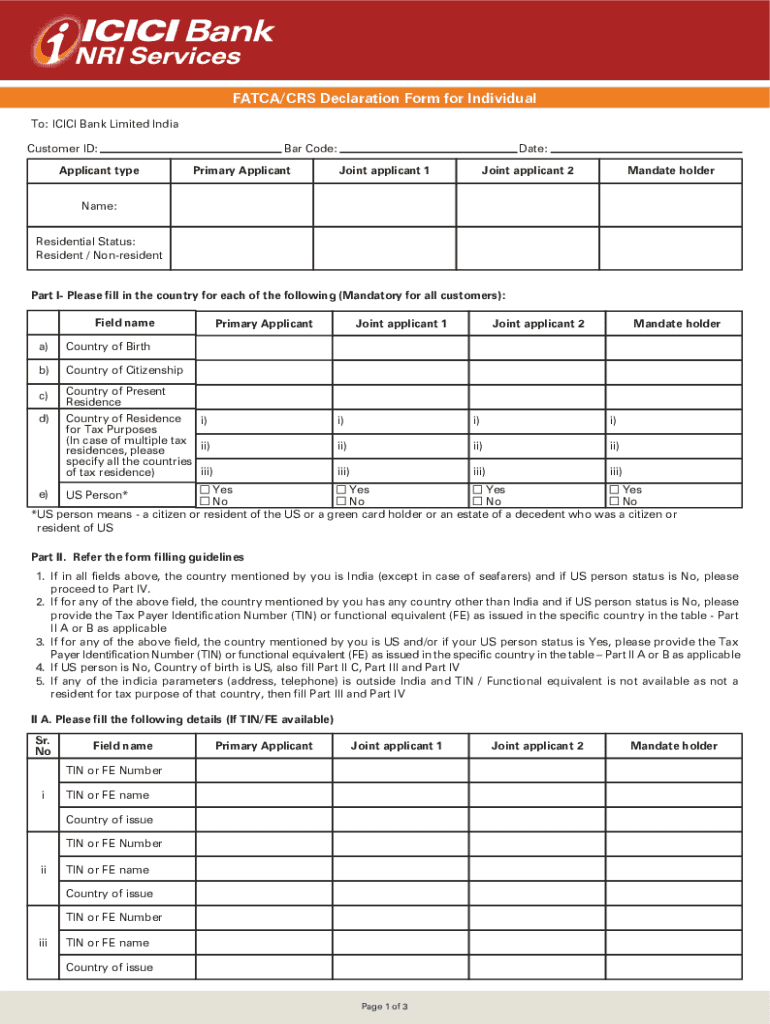

Icici Fatca Crs Declaration Form

Icici Fatca Crs Declaration Form - (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly.

(other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly.

Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental.

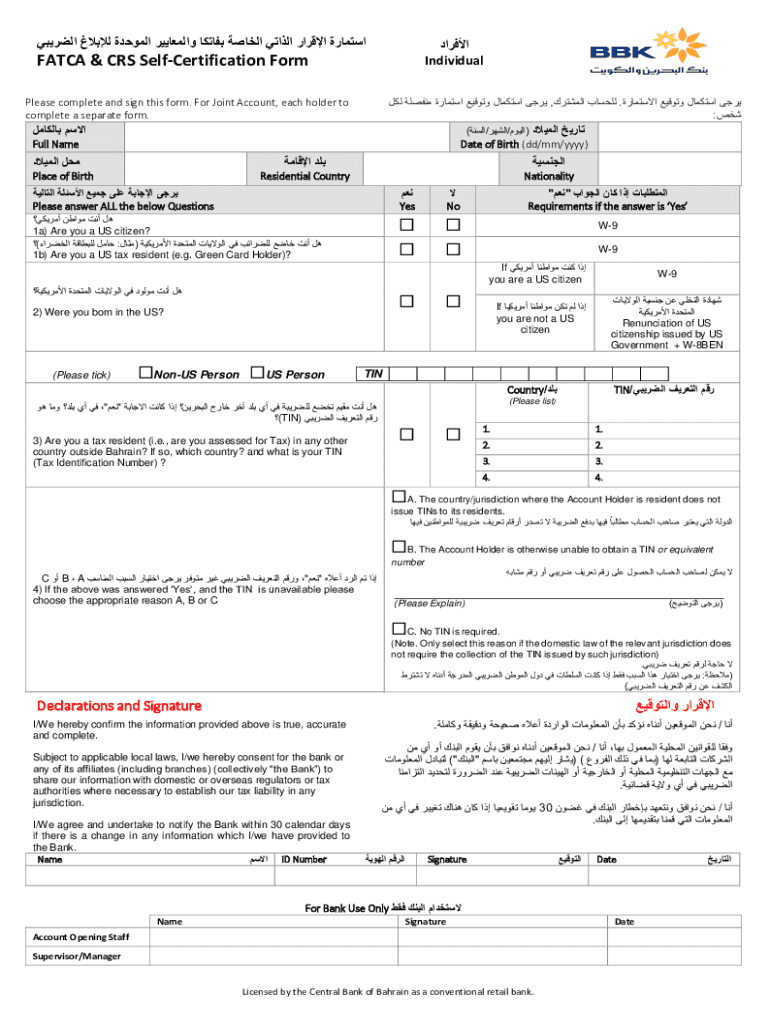

Fillable Online FATCA & CRS SelfCertification Form Fax Email Print

Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. (other than.

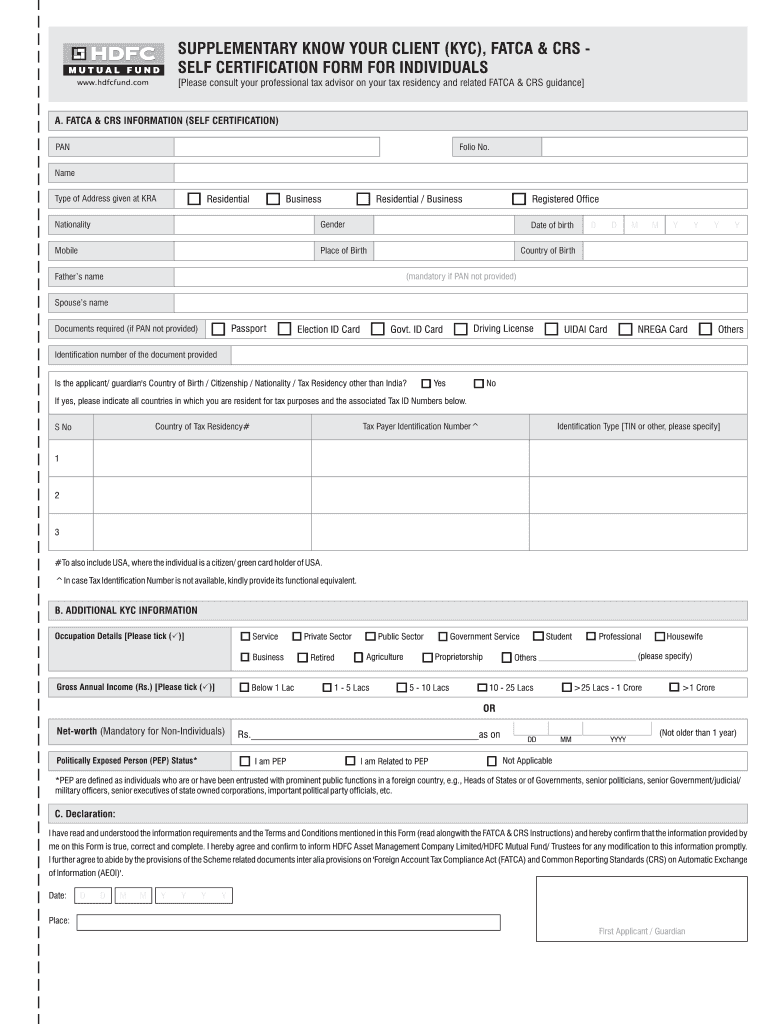

FATCACRS Declaration & Supplementary KYC Information Declaration Form

Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. Under.

FatcaCRS Declaration Form (Individual) FT FATCACRS Declaration Form

(other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. Under.

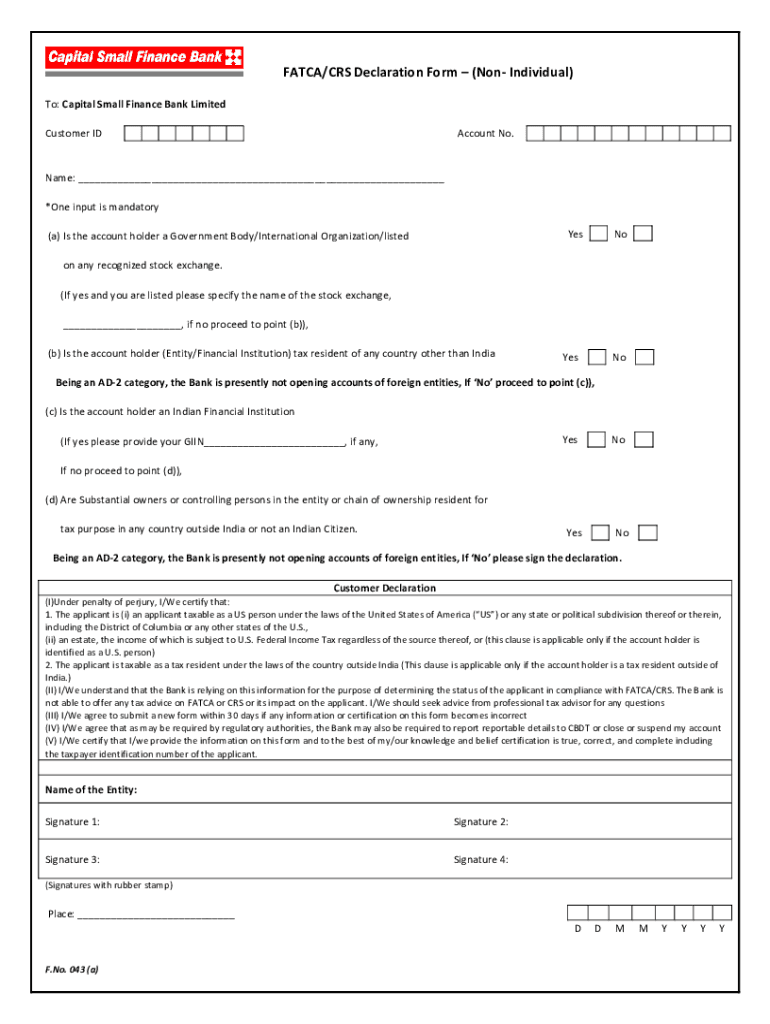

Fillable Online capitalbank co FATCA/CRS Declaration Form Capital

(other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Fatca requires banks in kingdom of.

Fatca full form Fill out & sign online DocHub

Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. (other than.

ICICI Bank SelfCertification Form for FATCA and CRS PDF Securities

Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Fatca requires banks in kingdom of.

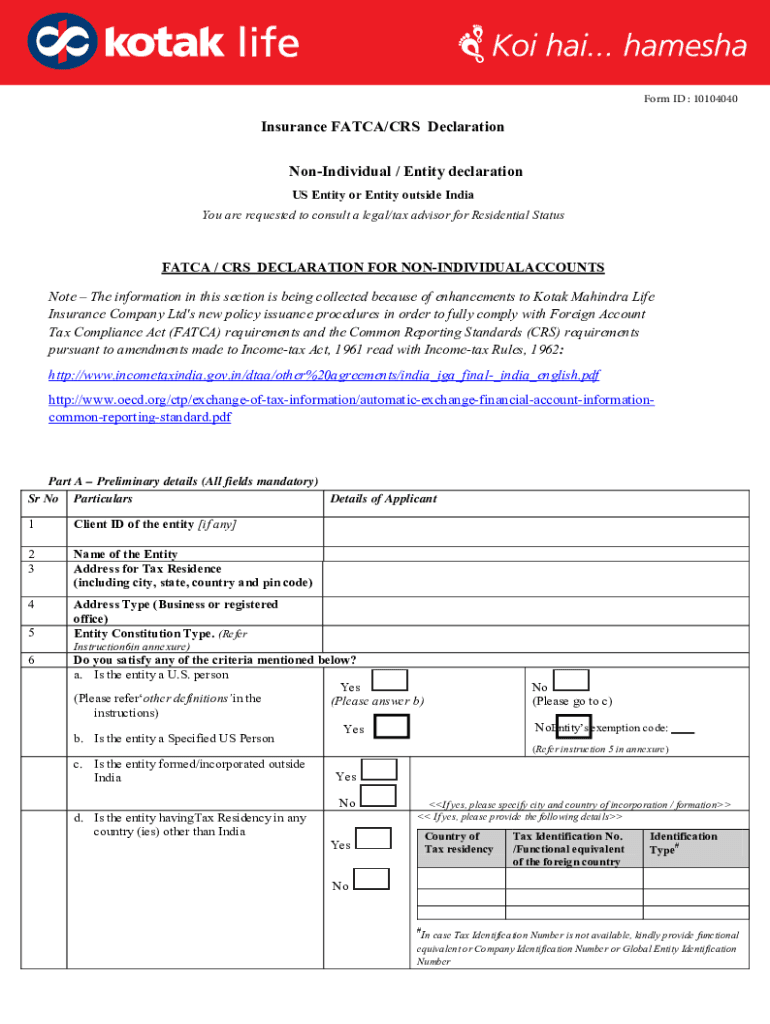

Declaration Form Fatca Fill Online, Printable, Fillable, Blank

Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. (other than.

FATCACRS Declaration & Supplementary KYC Information Declaration Form

Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Under.

Fillable Online Fatca Crs Declaration Form For Non Individual Fax Email

Submit the completely filled and signed fatca/crs declaration (click here) through your registered email id to nri@icicibank.com. Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Under.

Fillable Online India ICICI Bank FATCA/CRS Declaration Form

Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s. (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental..

Submit The Completely Filled And Signed Fatca/Crs Declaration (Click Here) Through Your Registered Email Id To Nri@Icicibank.com.

Fatca requires banks in kingdom of bahrain to report and provide information of their account holders who are us persons, and hence, kindly. (other than u.s.) requiring reporting under fatca/crs or any other laws, my account details, as required under inter governmental. Under common reporting standards (crs), reportable person means tax residents of a reportable foreign jurisdiction other than u.s.