How To Record A Vendor Refund In Quickbooks

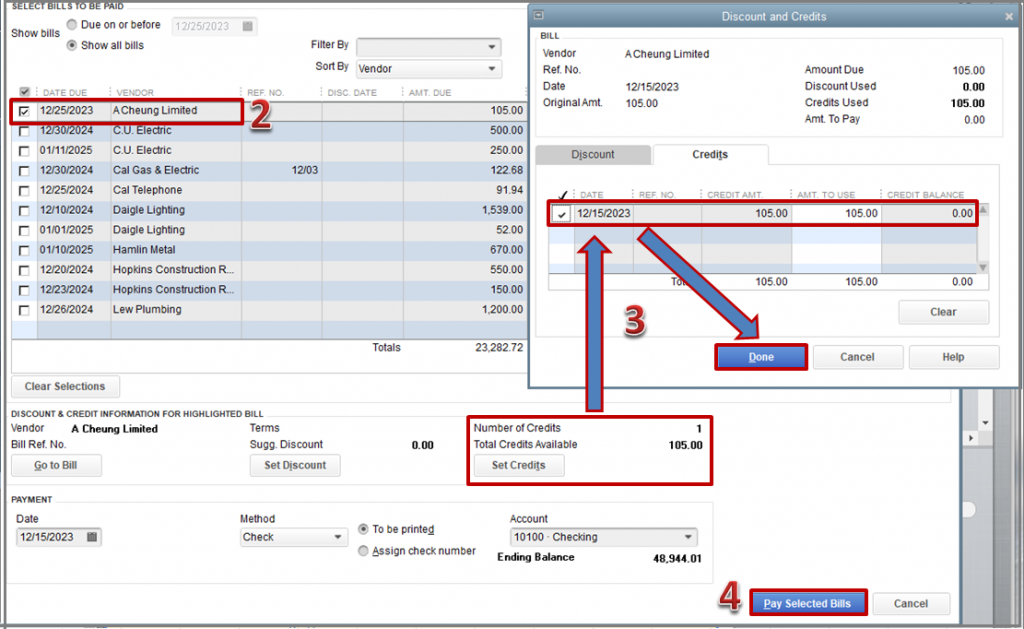

How To Record A Vendor Refund In Quickbooks - Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the. Enter vendor credits to record: Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. You'll have to enter the vendor refund using a bank. When you were given the credit. Click create (+) > vendor credit. Learn how to record a refund or credit from a vendor in quickbooks online. Just got a refund for a business expense? The first thing we need to do is link the vendor refund check to a vendor credit. Choose the vendor who is giving you the credit.

Enter vendor credits to record: You'll have to enter the vendor refund using a bank. Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the. Click create (+) > vendor credit. Just got a refund for a business expense? Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. Learn how to record a refund or credit from a vendor in quickbooks online. The first thing we need to do is link the vendor refund check to a vendor credit. Choose the vendor who is giving you the credit. When you were given the credit.

The first thing we need to do is link the vendor refund check to a vendor credit. Choose the vendor who is giving you the credit. Learn how to record a refund or credit from a vendor in quickbooks online. When you were given the credit. Enter vendor credits to record: Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. You'll have to enter the vendor refund using a bank. Just got a refund for a business expense? Click create (+) > vendor credit. Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the.

Record Quickbooks Vendor Refund 1 Select the Received fr… Flickr

Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the. When you were given the credit. You'll have to enter the vendor refund using a bank. Just got a refund for a.

How To Record A Refund In Quickbooks

Enter vendor credits to record: When you were given the credit. Choose the vendor who is giving you the credit. Click create (+) > vendor credit. You'll have to enter the vendor refund using a bank.

Record QuickBooks Vendor Refund Complete StepbyStep Guide

When you were given the credit. Enter vendor credits to record: Click create (+) > vendor credit. You'll have to enter the vendor refund using a bank. Just got a refund for a business expense?

Record Vendor Refund in Quickbooks Desktop YouTube

Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. The first thing we need to do is link the vendor refund check to a vendor credit. When you were given the credit. Enter vendor credits to record: Learn how to record a refund or credit from a vendor in quickbooks online.

How to Record a Vendor Refund in Quickbooks Online YouTube

Click create (+) > vendor credit. Enter vendor credits to record: The first thing we need to do is link the vendor refund check to a vendor credit. When you were given the credit. Just got a refund for a business expense?

Record a Refund from a Vendor in QuickBooks Online Accounting Guide

Enter vendor credits to record: When you were given the credit. Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the. Learn how to record a refund or credit from a vendor in quickbooks online. Click create (+) > vendor credit.

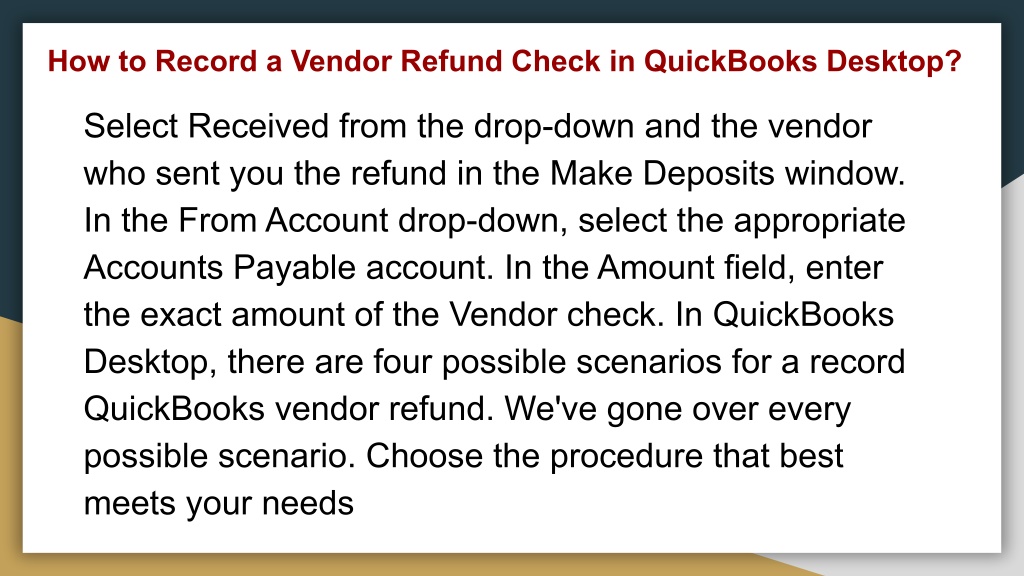

PPT Record a Quickbooks vendor refund PowerPoint Presentation, free

Click create (+) > vendor credit. Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. You'll have to enter the vendor refund using a bank. Choose the vendor who is giving you the credit. The first thing we need to do is link the vendor refund check to a vendor credit.

PPT Record a Quickbooks vendor refund PowerPoint Presentation, free

Click create (+) > vendor credit. Enter vendor credits to record: Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the. Choose the vendor who is giving you the credit.

PPT HOW TO RECORD A VENDOR REFUND IN QUICKBOOKS PowerPoint

Choose the vendor who is giving you the credit. When you were given the credit. You'll have to enter the vendor refund using a bank. Click create (+) > vendor credit. Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the.

How to record refund from vendor

Enter vendor credits to record: Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. Just got a refund for a business expense? Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the. Click create (+) > vendor credit.

You'll Have To Enter The Vendor Refund Using A Bank.

Just got a refund for a business expense? Learn how to record a refund or credit from a vendor in quickbooks online. Recording a vendor refund in quickbooks online involves documenting the return of funds from a supplier or service provider and updating the. The first thing we need to do is link the vendor refund check to a vendor credit.

Choose The Vendor Who Is Giving You The Credit.

Enter vendor credits to record: Learn how to record refunds you received from a vendor in different scenarios using quickbooks desktop. Click create (+) > vendor credit. When you were given the credit.