How To Adjust Payroll Liabilities In Quickbooks Desktop

How To Adjust Payroll Liabilities In Quickbooks Desktop - This video shows you how to adjust payroll liabilities in quickbooks 2024. This video is from our complete quickbooks desktop. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Steps to delete or remove scheduled payroll liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Click payroll center under the employees tab in quickbooks desktop. Head to employees, then payroll taxes and liabilities.

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Click payroll center under the employees tab in quickbooks desktop. Steps to delete or remove scheduled payroll liabilities. This video shows you how to adjust payroll liabilities in quickbooks 2024. This video is from our complete quickbooks desktop.

Steps to delete or remove scheduled payroll liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Click payroll center under the employees tab in quickbooks desktop. Head to employees, then payroll taxes and liabilities. This video is from our complete quickbooks desktop. This video shows you how to adjust payroll liabilities in quickbooks 2024. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and.

How to Adjust Payroll Liabilities in QuickBooks Desktop

Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. This video shows you how to adjust payroll liabilities in quickbooks 2024. Click payroll center under the employees tab in quickbooks desktop. This video is from our complete quickbooks desktop.

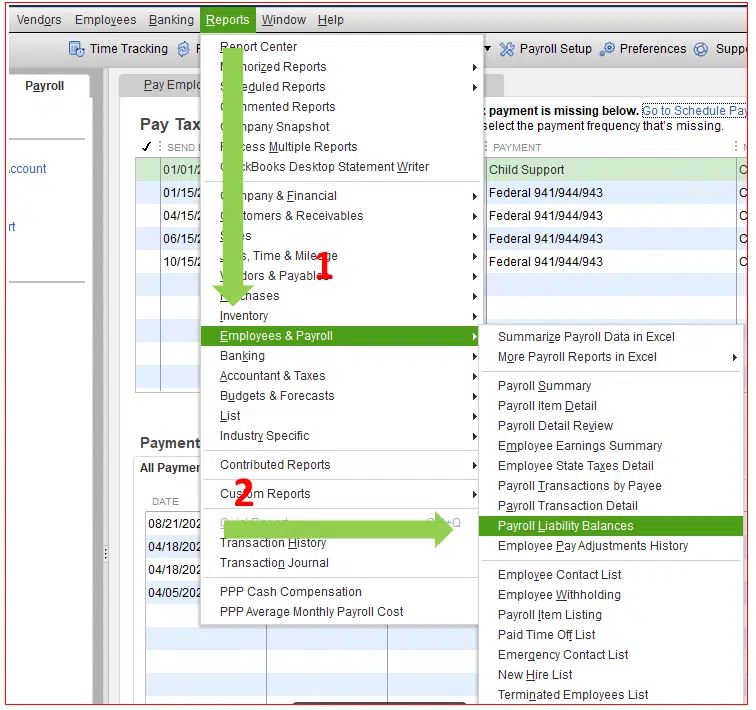

Adjust Payroll Liabilities in QuickBooks How Does it Help? by Account

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. This video is from our complete quickbooks desktop. Head to employees, then payroll taxes and liabilities. Click payroll center under the employees tab in quickbooks desktop. Choose adjust payroll liabilities and pick the last paycheck date of.

PPT Adjust payroll liabilities in QuickBooks PowerPoint Presentation

Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities. This video shows you how to adjust payroll liabilities in quickbooks 2024. Click payroll center under the employees tab in quickbooks desktop. This video is from our complete quickbooks desktop.

How To Adjust Payroll Liabilities In Quickbooks Online

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. This video shows you how to adjust payroll liabilities in quickbooks 2024. Head to employees, then payroll taxes and liabilities. Click payroll center under the employees tab in quickbooks desktop. Choose adjust payroll liabilities and pick the last paycheck date of.

Zero Out Payroll Liabilities in QuickBooks (2 DIY Steps )

This video shows you how to adjust payroll liabilities in quickbooks 2024. This video is from our complete quickbooks desktop. Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Click payroll center under the employees tab in quickbooks desktop.

Learn how to Adjust Payroll Liabilities in Intuit QuickBooks Desktop

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Click payroll center under the employees tab in quickbooks desktop. Steps to delete or remove scheduled payroll liabilities. Head to employees, then payroll taxes and liabilities. This video shows you how to adjust payroll liabilities in quickbooks 2024.

How to pay payroll taxes and liabilities in QuickBooks Desktop Payroll

Click payroll center under the employees tab in quickbooks desktop. Choose adjust payroll liabilities and pick the last paycheck date of. Steps to delete or remove scheduled payroll liabilities. Head to employees, then payroll taxes and liabilities. This video shows you how to adjust payroll liabilities in quickbooks 2024.

How to Adjust Payroll Liabilities in QuickBooks [Explained]

Choose adjust payroll liabilities and pick the last paycheck date of. This video shows you how to adjust payroll liabilities in quickbooks 2024. This video is from our complete quickbooks desktop. Head to employees, then payroll taxes and liabilities. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and.

Solved Payroll liabilities

Click payroll center under the employees tab in quickbooks desktop. This video is from our complete quickbooks desktop. Steps to delete or remove scheduled payroll liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities.

Quickbooks desktop payroll liabilities locatormusli

Head to employees, then payroll taxes and liabilities. Click payroll center under the employees tab in quickbooks desktop. Choose adjust payroll liabilities and pick the last paycheck date of. This video shows you how to adjust payroll liabilities in quickbooks 2024. Steps to delete or remove scheduled payroll liabilities.

This Video Is From Our Complete Quickbooks Desktop.

Click payroll center under the employees tab in quickbooks desktop. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Steps to delete or remove scheduled payroll liabilities. This video shows you how to adjust payroll liabilities in quickbooks 2024.

Head To Employees, Then Payroll Taxes And Liabilities.

Choose adjust payroll liabilities and pick the last paycheck date of.

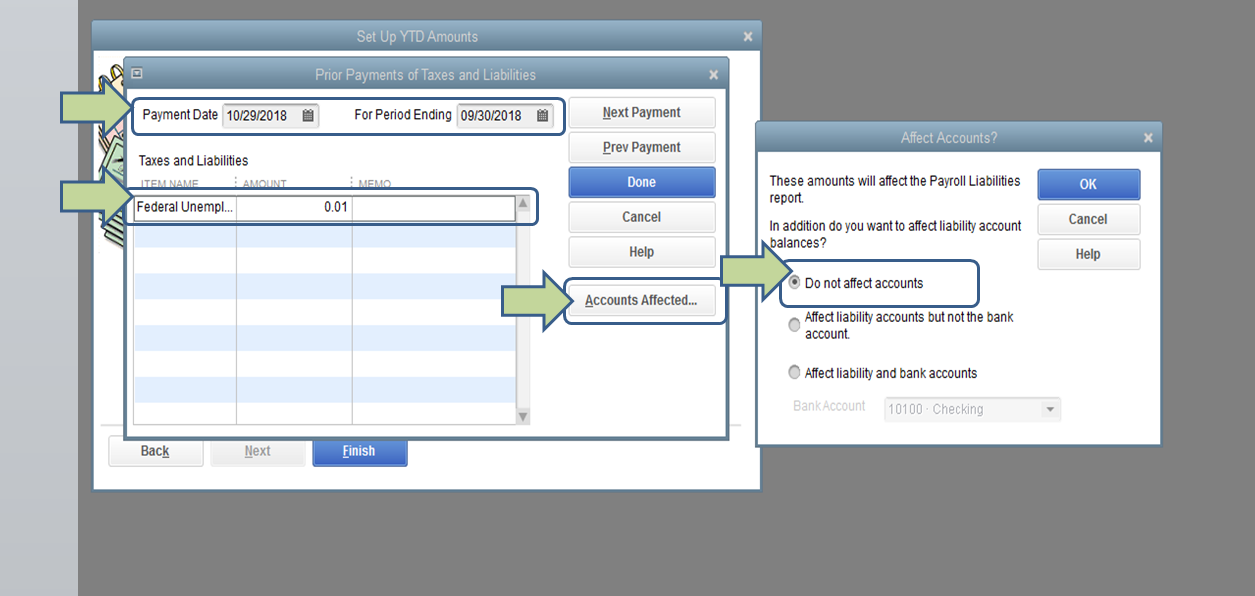

![How to Adjust Payroll Liabilities in QuickBooks [Explained]](https://blog.accountinghelpline.com/wp-content/uploads/2018/12/QuickBooks-Liability-Adjustment.png)