How Long Should You Keep Bankruptcy Discharge Papers

How Long Should You Keep Bankruptcy Discharge Papers - That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key papers to retain include: Far more important is the list of creditors that were included in the. • your bankruptcy petition • court.

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. • your bankruptcy petition • court. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Far more important is the list of creditors that were included in the. Key papers to retain include:

Far more important is the list of creditors that were included in the. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. • your bankruptcy petition • court. Key papers to retain include:

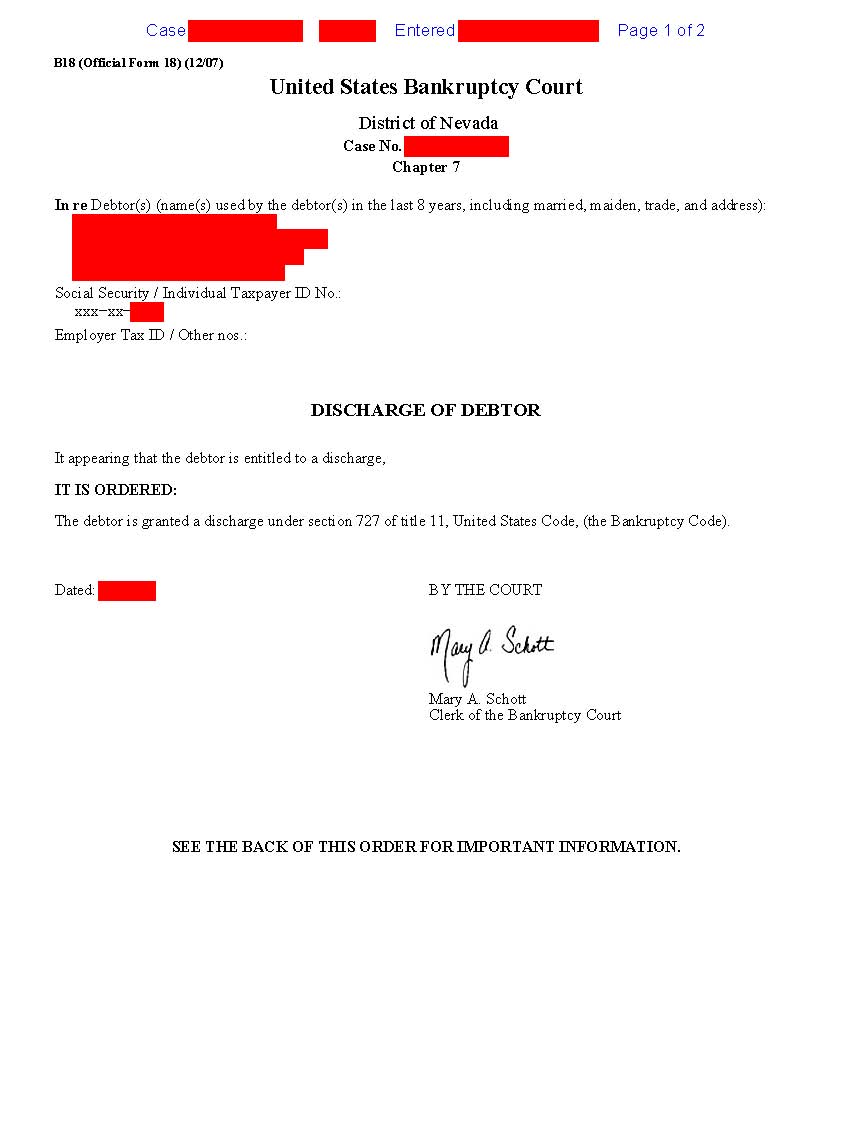

What do my bankruptcy discharge papers look like? Las Vegas

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Far more important is the list of creditors that were included in the. • your bankruptcy petition • court. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Key.

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys ARM Lawyers

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. • your bankruptcy petition • court. Far more important is the list of creditors that were included in the. Key papers to retain include: That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept.

How to Get Copy of Bankruptcy Discharge Papers Debt Game Over

Far more important is the list of creditors that were included in the. • your bankruptcy petition • court. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Key.

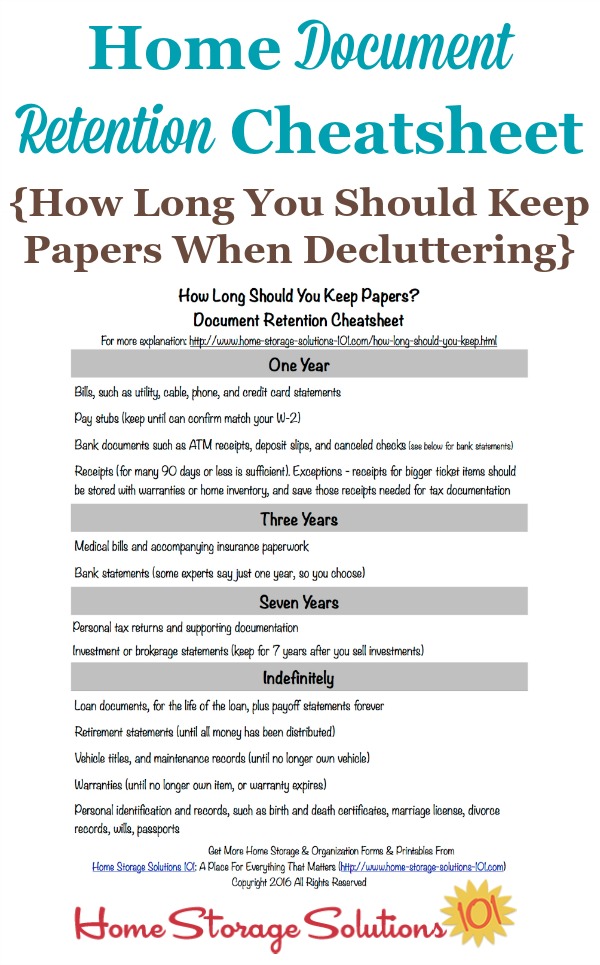

How Long Should You Keep Papers? Home Document Retention Schedule {Plus

• your bankruptcy petition • court. Key papers to retain include: It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Far more important is the list of creditors that.

Why You Should Keep Your Bankruptcy Discharge Papers Bankruptcy Ontario

• your bankruptcy petition • court. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key papers to retain include: Far more important is the list of creditors that.

How long it take to get my bankruptcy discharge paper?

That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Far more important is the list of creditors that were included in the. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key papers to retain include: • your.

Bankruptcy Discharge For Fha Loan US Legal Forms

That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Far more important is the list of creditors that were included in the. Key papers to retain include: • your.

Discharge Las Vegas Bankruptcy Attorney Luh & Associates

• your bankruptcy petition • court. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Far more important is the list of creditors that were included in the. Key papers to retain include: It’s wise to keep your bankruptcy discharge papers indefinitely for.

How long do bankruptcy cases last?

It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key papers to retain include: Far more important is the list of creditors that were included in the. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. • your.

How Long Should You Keep Papers? Home Document Retention Schedule {Plus

Far more important is the list of creditors that were included in the. • your bankruptcy petition • court. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. Key.

• Your Bankruptcy Petition • Court.

Far more important is the list of creditors that were included in the. It’s wise to keep your bankruptcy discharge papers indefinitely for the reasons mentioned above. That being said, the library of virginia requires that the lists of taxes written off (including those discharged in bankruptcy) be kept for 3 years or. Key papers to retain include: