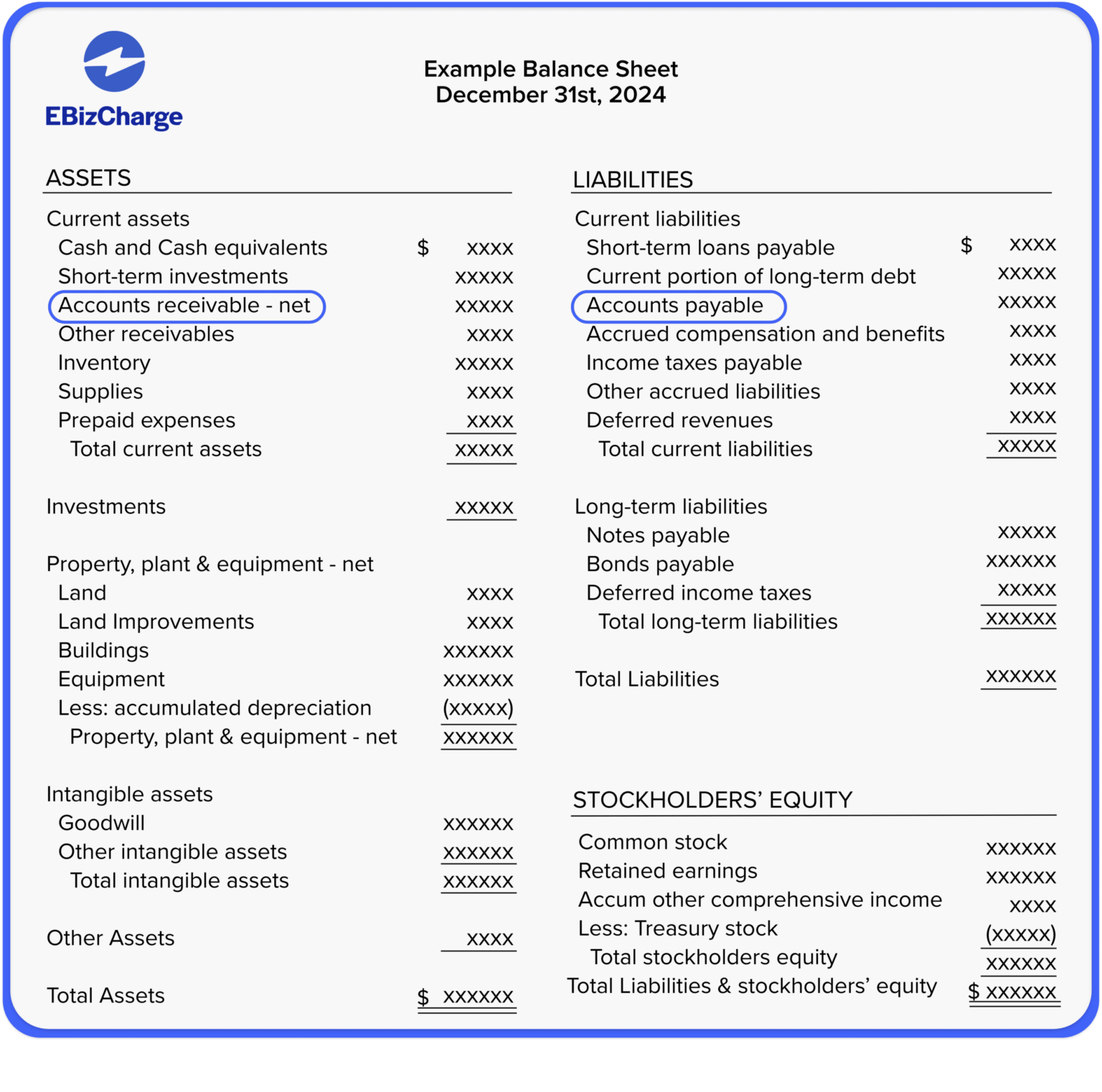

How Is Accounts Receivable Reported On The Balance Sheet

How Is Accounts Receivable Reported On The Balance Sheet - Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. This categorization aligns perfectly with the. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accounts receivable are explicitly classified as current assets on the balance sheet.

Accounts receivable are explicitly classified as current assets on the balance sheet. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. This categorization aligns perfectly with the.

Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. This categorization aligns perfectly with the. Accounts receivable are explicitly classified as current assets on the balance sheet.

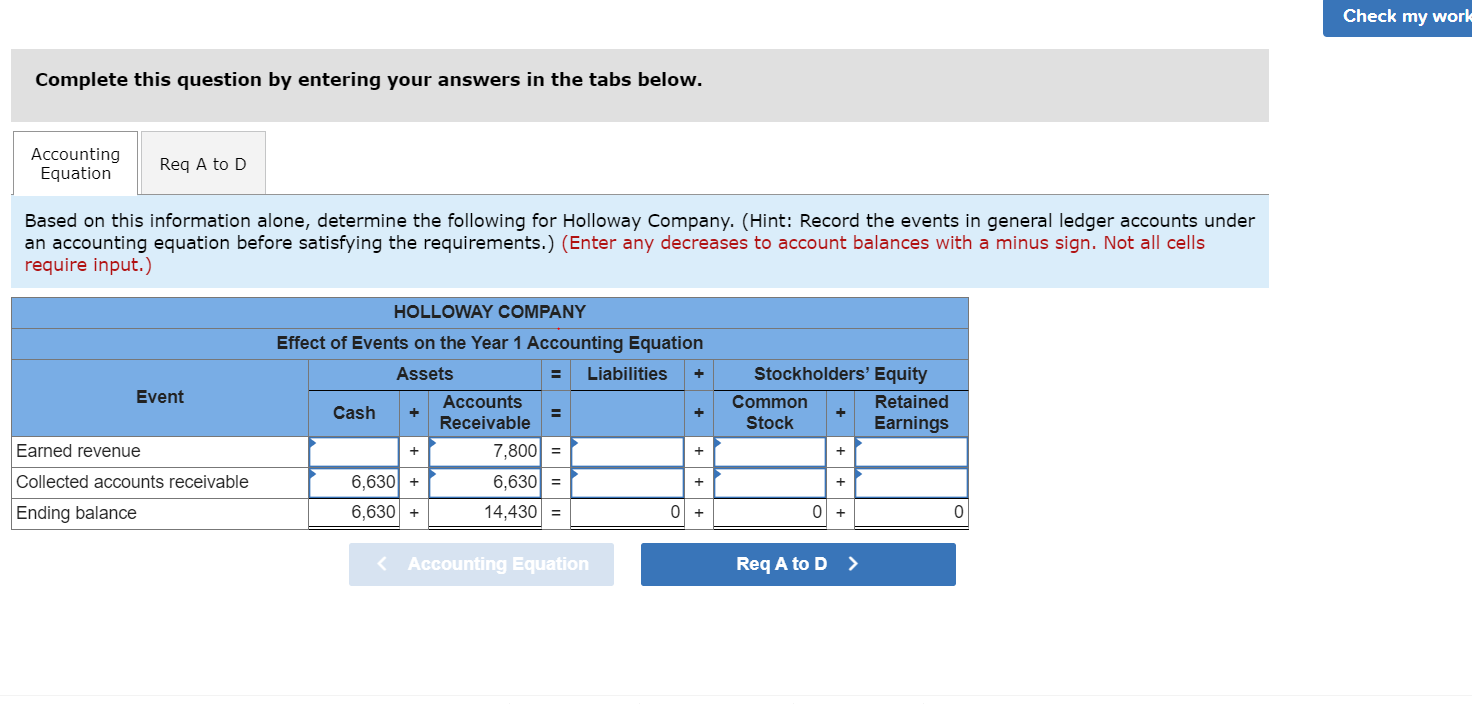

Solved Exercise 21A (Algo) Effect of collecting accounts

Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. Accounts receivable are explicitly classified as current assets on the balance sheet. This categorization aligns perfectly with the.

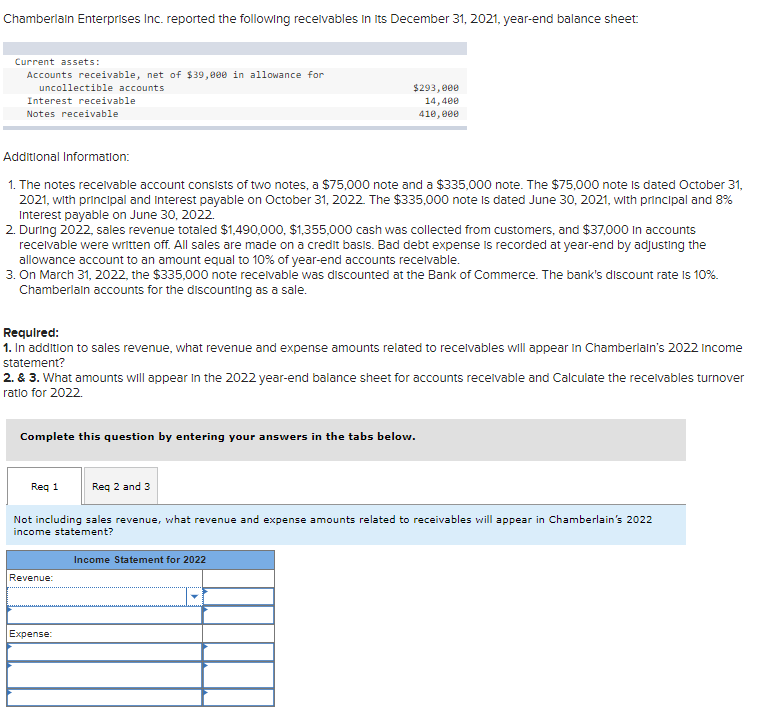

Solved Chamberlain Enterprises Inc. reported the following

Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accounts receivable are explicitly classified as current assets on the balance sheet. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. This categorization aligns perfectly with the.

GAAP Generally Accepted Accounting Principles

Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accounts receivable are explicitly classified as current assets on the balance sheet. This categorization aligns perfectly with the.

At December 31, 2021, Marigold Co. reported the following information

Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. This categorization aligns perfectly with the. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accounts receivable are explicitly classified as current assets on the balance sheet.

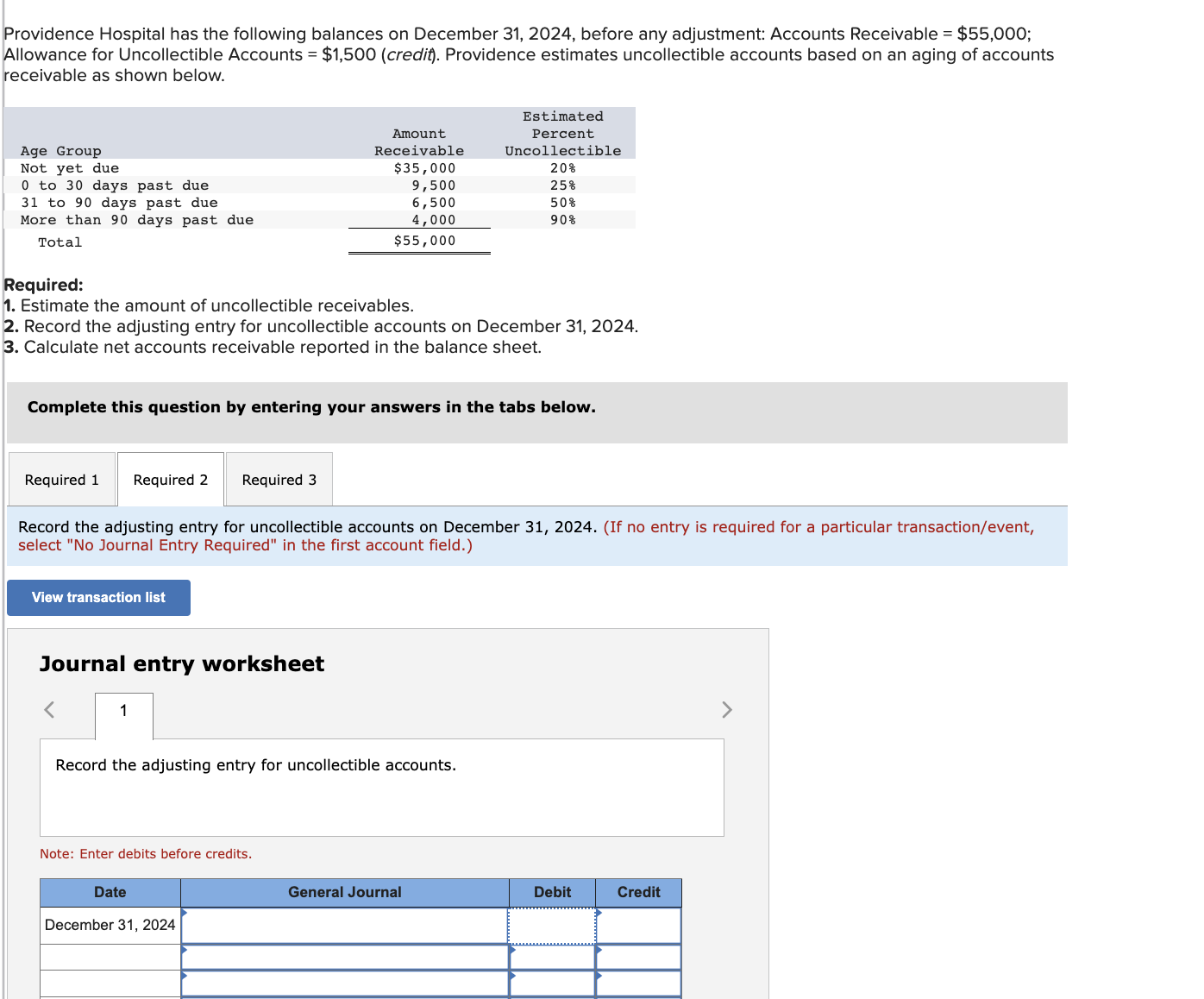

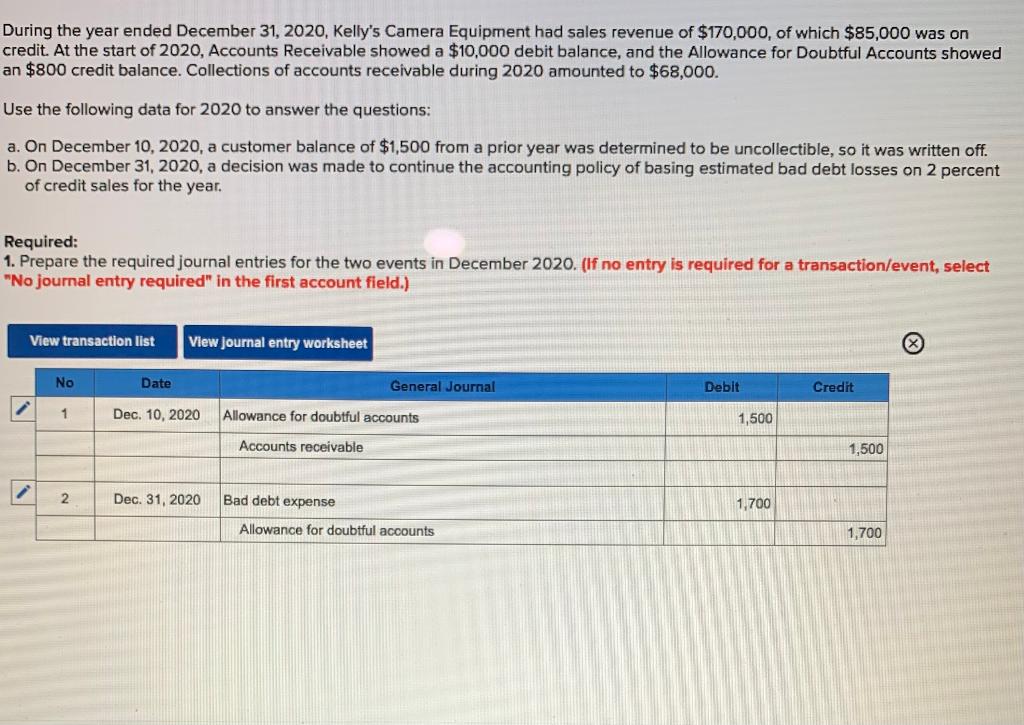

Solved please do the journal entry and Calculate the net

This categorization aligns perfectly with the. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accounts receivable are explicitly classified as current assets on the balance sheet. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services.

Solved 2. Show how the amounts related to Accounts

Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. This categorization aligns perfectly with the. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accounts receivable are explicitly classified as current assets on the balance sheet.

Accounts Receivable (AR) What They Are and How to Interpret Pareto Labs

Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. This categorization aligns perfectly with the. Accounts receivable are explicitly classified as current assets on the balance sheet. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services.

How to Find Accounts Receivable on Balance Sheet

Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. This categorization aligns perfectly with the. Accounts receivable are explicitly classified as current assets on the balance sheet.

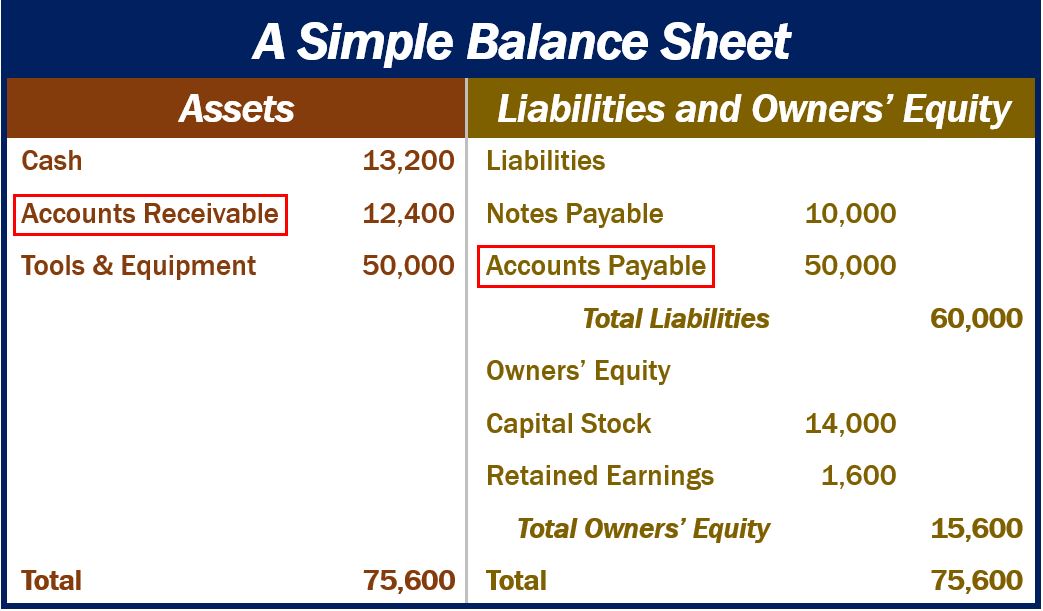

What are Accounts Receivable and Accounts Payable?

Accounts receivable are explicitly classified as current assets on the balance sheet. This categorization aligns perfectly with the. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid.

year end accounts receivable Nicolasa Turley

Accounts receivable are explicitly classified as current assets on the balance sheet. This categorization aligns perfectly with the. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services.

Accountants Disclose Receivables When The Reporting Company Has The Right To Receive Cash, Some Other Asset, Or Services.

This categorization aligns perfectly with the. Accounts receivable are explicitly classified as current assets on the balance sheet. Accounts receivable (ar) represents money that is due to a company by its customers for goods or services supplied but still unpaid.