How Do You Categorize A Refund In Quickbooks

How Do You Categorize A Refund In Quickbooks - To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. When you refund a customer's overpayment or credit, record it using a check or expense. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. Go to the add funds to this deposit section.

Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. When you refund a customer's overpayment or credit, record it using a check or expense. Go to the add funds to this deposit section. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system.

Go to the add funds to this deposit section. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. When you refund a customer's overpayment or credit, record it using a check or expense. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system.

How To Categorize Expenses in QuickBooks (FAQs Guide) LiveFlow

Go to the add funds to this deposit section. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. When you refund a customer's overpayment or credit, record it using a check.

How do you categorize transactions? Leia aqui What are the 4 types of

When you refund a customer's overpayment or credit, record it using a check or expense. Go to the add funds to this deposit section. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. To categorize.

How do I categorize a refund made to a client? Keeping in mind that it

By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. Go to the add funds to this deposit section. When you refund a customer's overpayment or credit, record it using a check or expense. To categorize.

How to Categorize Credit Card Payments in QuickBooks? MWJ Consultancy

Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. Go to the add funds to this deposit section. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. When you refund a customer's overpayment or credit, record it using a check or expense. To categorize.

How To Categorize a Tax Refund In QuickBooks

Go to the add funds to this deposit section. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. When you refund a customer's overpayment or credit, record it using a check.

How to Categorise Transactions in QuickBooks Online Introduction to

By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. Go to the add funds to this deposit section. When you refund a customer's overpayment or credit, record it using a check.

Quickbooks A follow along guide on how to use it TechStory

Go to the add funds to this deposit section. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. When you refund a customer's overpayment or credit, record it using a check or expense. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. To categorize.

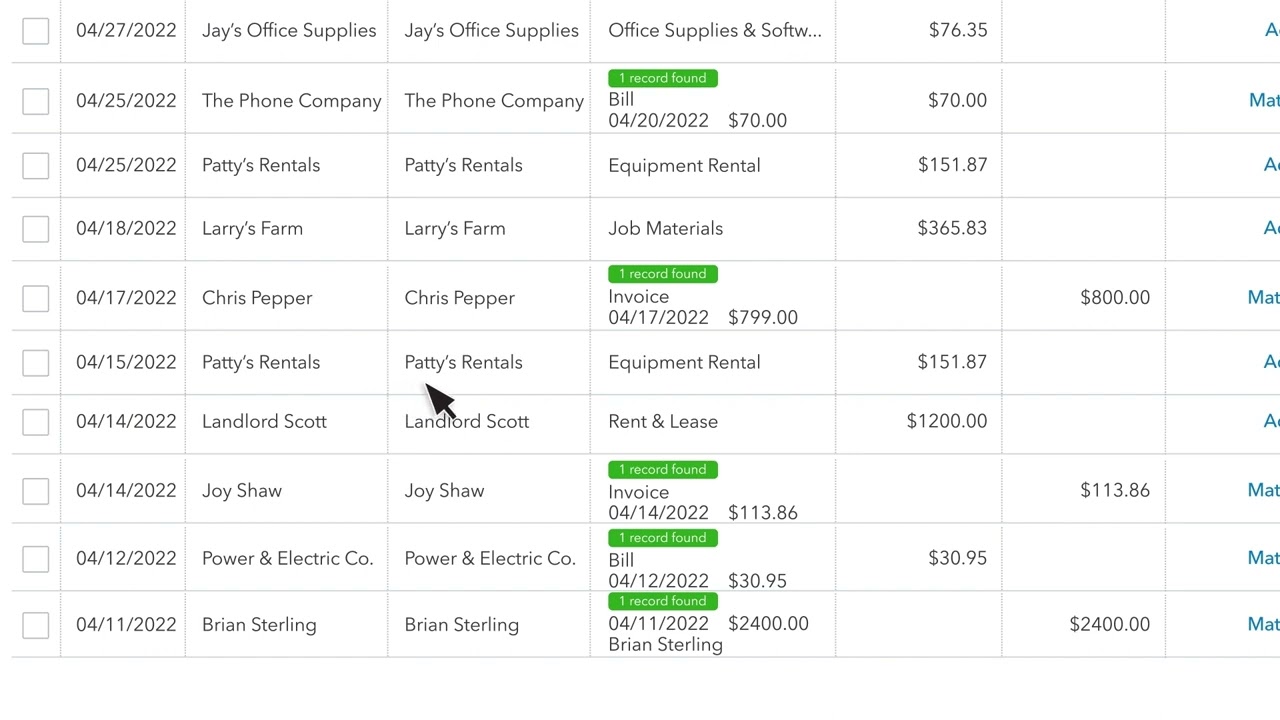

How to categorize transactions in QuickBooks Online (Business View

By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. When you refund a customer's overpayment.

How to Record and Categorize Refunds in QuickBooks Desktop

When you refund a customer's overpayment or credit, record it using a check or expense. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. Go to the add funds to this deposit section. To categorize.

How To Categorize A Refund In Quickbooks

When you refund a customer's overpayment or credit, record it using a check or expense. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. By setting up a separate refund account, categorizing refunds as sales receipts or credit memos, and distinguishing between. Categorizing tax refunds in quickbooks involves specific.

By Setting Up A Separate Refund Account, Categorizing Refunds As Sales Receipts Or Credit Memos, And Distinguishing Between.

Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. Go to the add funds to this deposit section. When you refund a customer's overpayment or credit, record it using a check or expense.