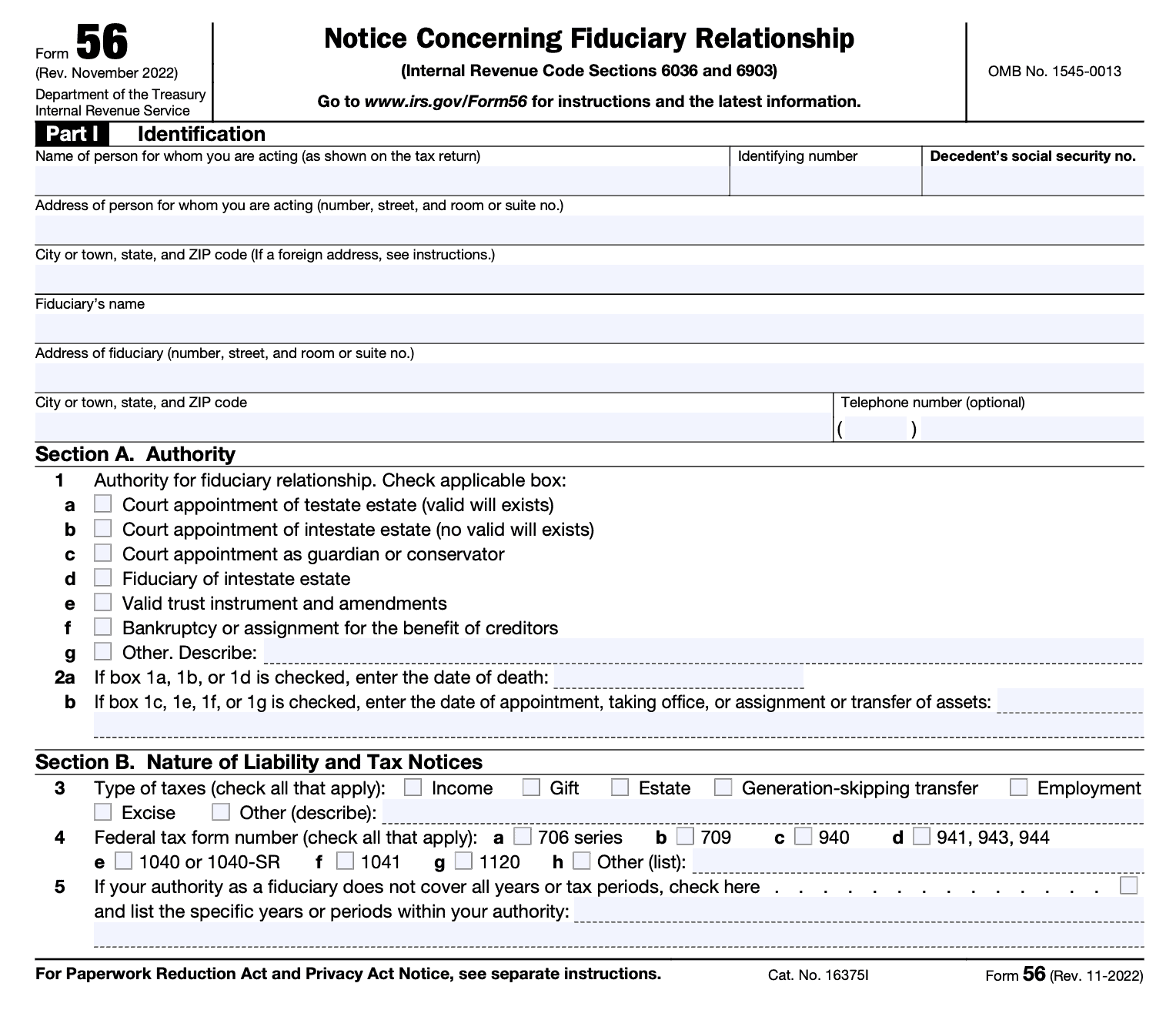

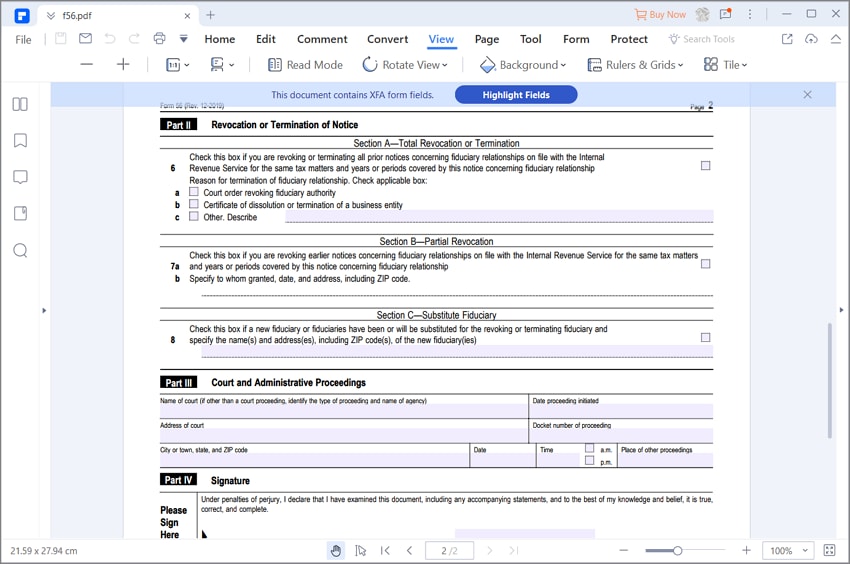

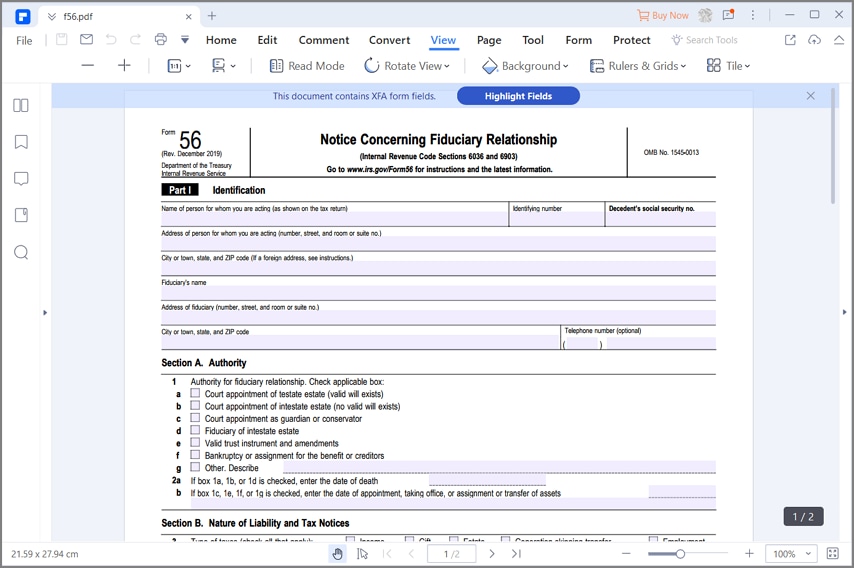

How Do I Submit Form 56 To The Irs

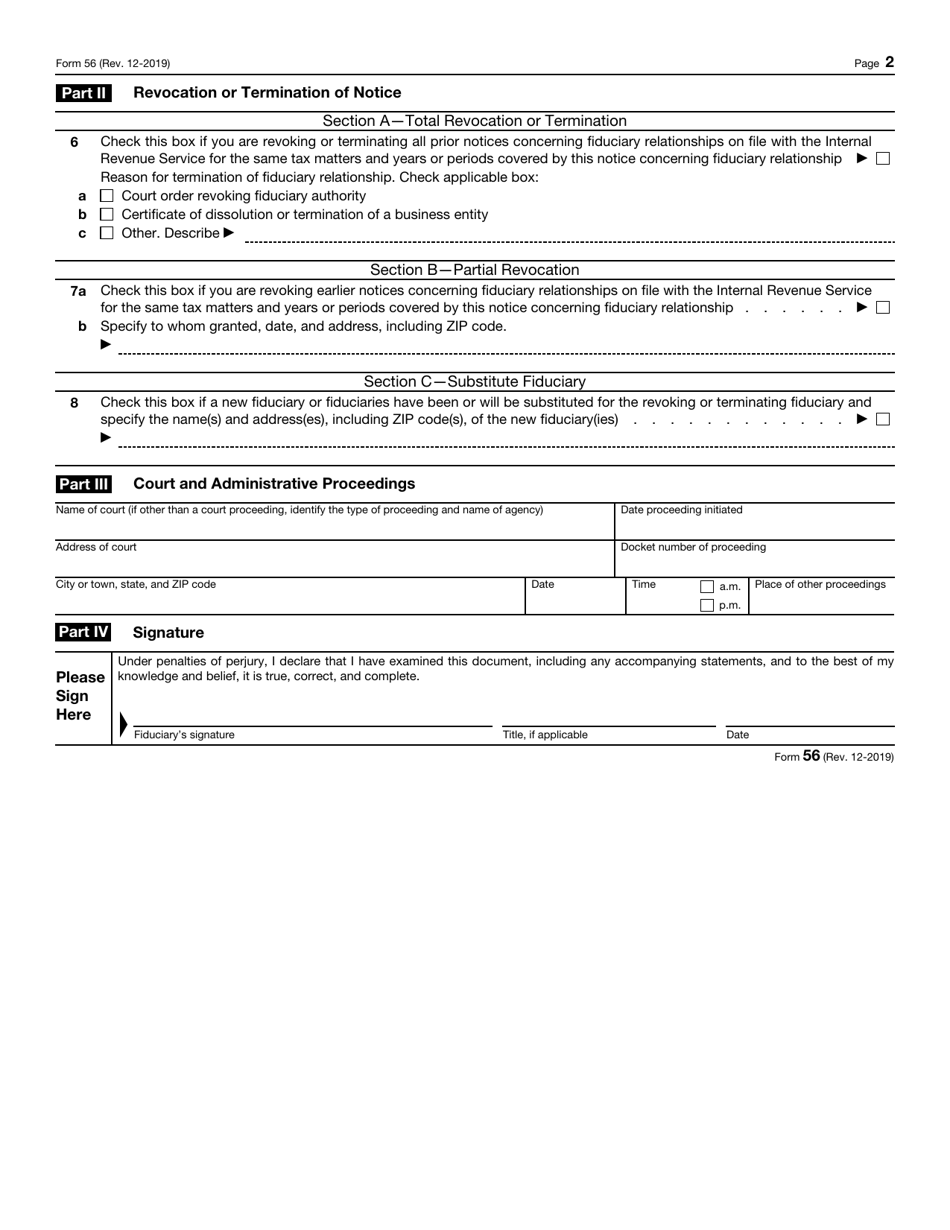

How Do I Submit Form 56 To The Irs - Filling out irs form 56 involves a few straightforward steps: Include the name and taxpayer. Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Enter your name, address, and taxpayer identification number (tin). Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax.

Enter your name, address, and taxpayer identification number (tin). Filling out irs form 56 involves a few straightforward steps: file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax. Include the name and taxpayer. Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the.

Enter your name, address, and taxpayer identification number (tin). Include the name and taxpayer. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax. Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Filling out irs form 56 involves a few straightforward steps:

All About IRS Form 56 Tax Resolution Services

Enter your name, address, and taxpayer identification number (tin). file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax. Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Filling out irs form 56 involves a few.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Include the name and taxpayer. Filling out irs form 56 involves a few straightforward steps: Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. file.

IRS Form 56 You can Fill it with the Best Form Filler

Include the name and taxpayer. Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Filling out irs form 56 involves a few straightforward steps: Enter.

Irs Form 56 instructions Fill online, Printable, Fillable Blank

Enter your name, address, and taxpayer identification number (tin). Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Include the name and taxpayer. Filling out.

2021 Form IRS 56F Fill Online, Printable, Fillable, Blank pdfFiller

Include the name and taxpayer. Enter your name, address, and taxpayer identification number (tin). Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax. Use.

Form 56 Fillable Pd Printable Forms Free Online

Filling out irs form 56 involves a few straightforward steps: Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Include the name and taxpayer. Enter your name, address, and taxpayer identification number (tin). Form 56 is used to notify the irs of the creation or termination of a.

Download Instructions for IRS Form 56 Notice Concerning Fiduciary

file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax. Enter your name, address, and taxpayer identification number (tin). Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Include the name and taxpayer. Filling out irs.

IRS Form 56 Fill Out, Sign Online and Download Fillable PDF

Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Filling out irs form 56 involves a few straightforward steps: Enter your name, address, and taxpayer identification number (tin). file form 56 with the internal revenue service center where the person for whom you are acting is required to.

Form 56 Edit, Fill, Sign Online Handypdf

Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. file form 56 with the internal revenue service center where the person for whom you are acting is required to file tax. Enter your name, address, and taxpayer identification number (tin). Use form 56 to notify the.

2007 Form IRS 56 Fill Online, Printable, Fillable, Blank pdfFiller

Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Filling out irs form 56 involves a few straightforward steps: Include the name and taxpayer. Enter your name, address, and taxpayer identification number (tin). Use form 56 to notify the irs of the creation/termination of a fiduciary.

File Form 56 With The Internal Revenue Service Center Where The Person For Whom You Are Acting Is Required To File Tax.

Use form 56 to notify the irs of the creation/termination of a fiduciary relationship under section 6903 and give notice of. Enter your name, address, and taxpayer identification number (tin). Form 56 is used to notify the irs of the creation or termination of a fiduciary relationship under section 6903 and provide the. Include the name and taxpayer.