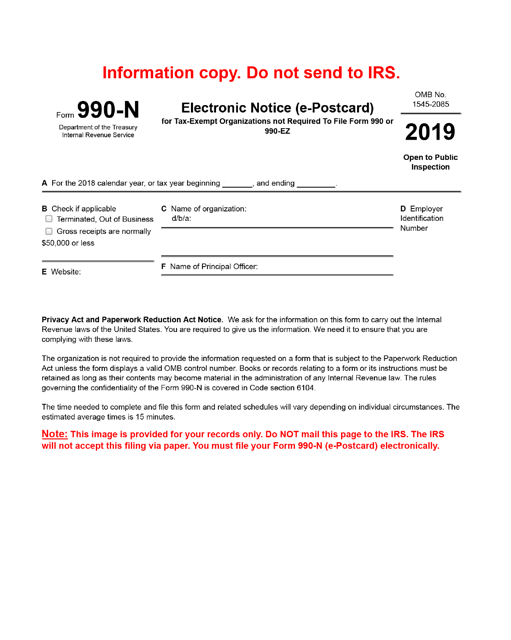

How Do I File Form 990 N

How Do I File Form 990 N - Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

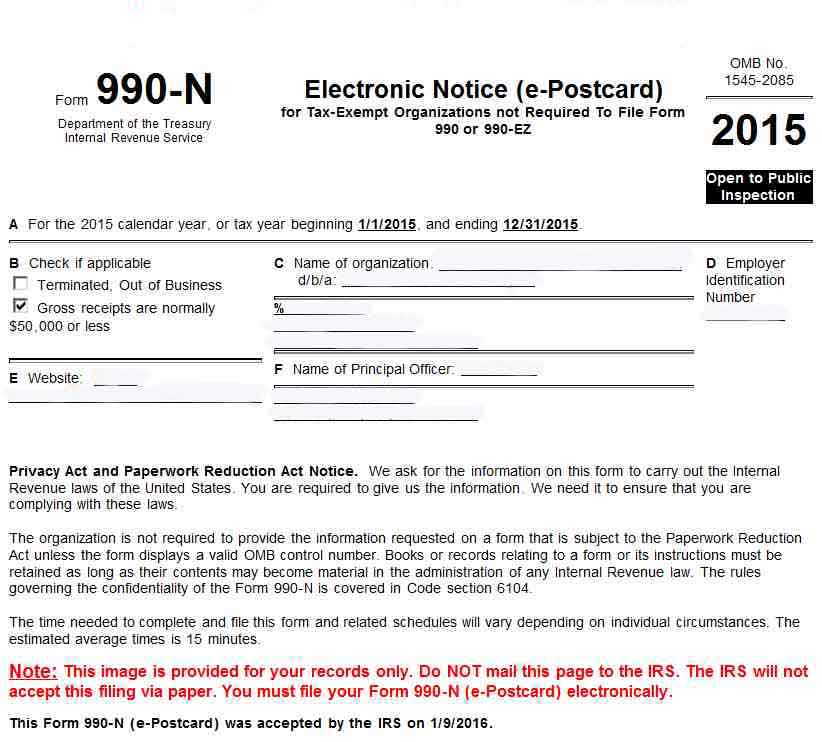

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

Demystifying IRS Form 990N What Nonprofits Should Know Instrumentl

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

Instructions to file your Form 990PF A Complete Guide

For the filing link and. Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

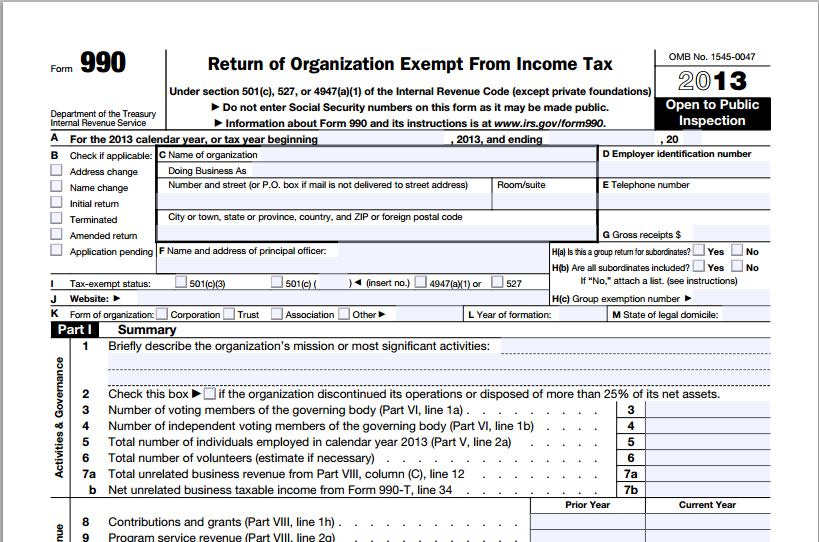

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

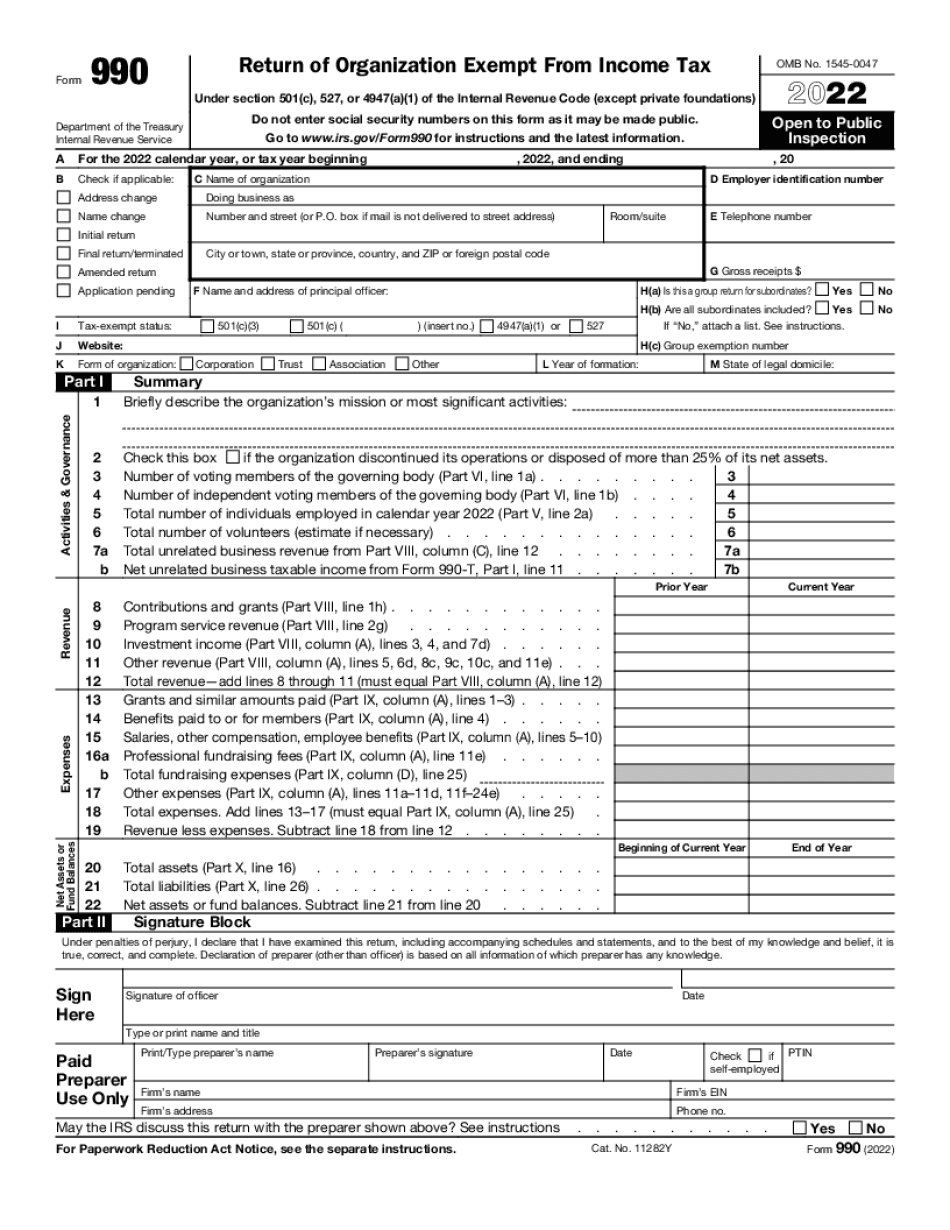

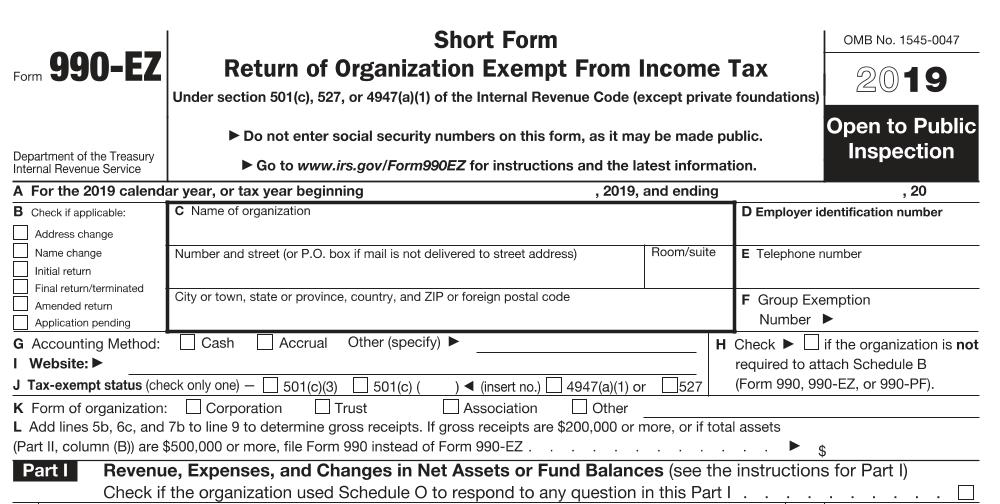

2022 Form 990 Ez Fillable Fillable Form 2024

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

Printable 990 N Form Printable Form 2024

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

990N vs. 990EZ What is the difference?

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

What You Need to Know About Filing Form 990 Davis Law Group

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

For the filing link and. Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Small Public Charities With Annual Gross Receipts Of Normally $50,000 Or Less Must File The Electronic Form 990 N.

For the filing link and.