How Do I Change Tax Rate In Quickbooks

How Do I Change Tax Rate In Quickbooks - You can edit a sales tax rate if you need to make changes to it. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. You can only edit component rates. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. The updated sales tax rate. To edit a combined rate,.

You can edit a sales tax rate if you need to make changes to it. The updated sales tax rate. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. You can only edit component rates. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. To edit a combined rate,.

This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. The updated sales tax rate. You can only edit component rates. You can edit a sales tax rate if you need to make changes to it. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. To edit a combined rate,.

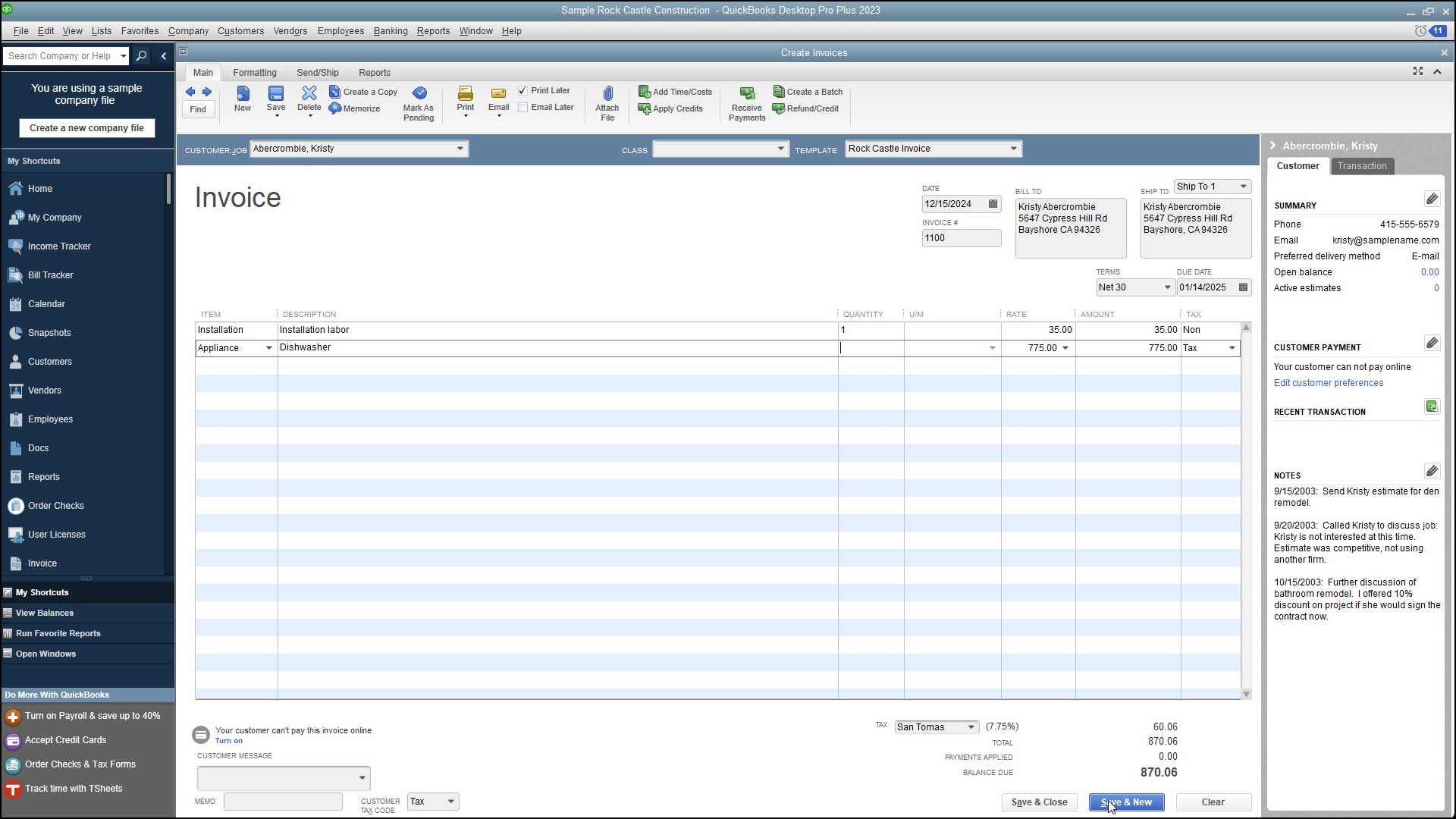

How to Setup Sales Tax in Quickbooks YouTube

The updated sales tax rate. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. You can edit a sales tax rate if you need to make changes to it. To edit a combined rate,. When you edit a sales tax rate, all existing transactions that use the old.

A StepbyStep Guide to Paying Bills with QuickBooks Online

This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. You can only edit component rates. To edit a combined rate,. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. The updated sales tax rate.

How To Change Sales Tax Rate In Quickbooks

This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. To edit a combined rate,. The updated sales tax rate. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. You can edit a sales tax rate if you need.

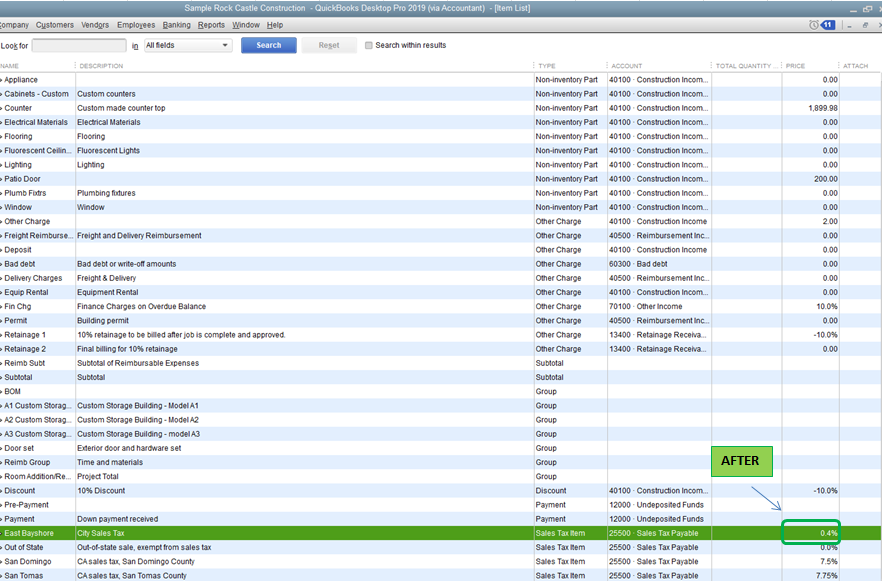

How to Change Tax Rates in Quickbooks Every state changes … Flickr

The updated sales tax rate. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. To edit a combined rate,. You can edit a sales tax rate if you need to make changes to it. You can only edit component rates.

How To Change Payroll Tax Rate In Quickbooks Desktop

When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. You can only edit component rates. You can edit a sales tax rate if you need to make changes to it. The updated sales tax rate. This process can be performed within quickbooks online by accessing the tax settings and selecting.

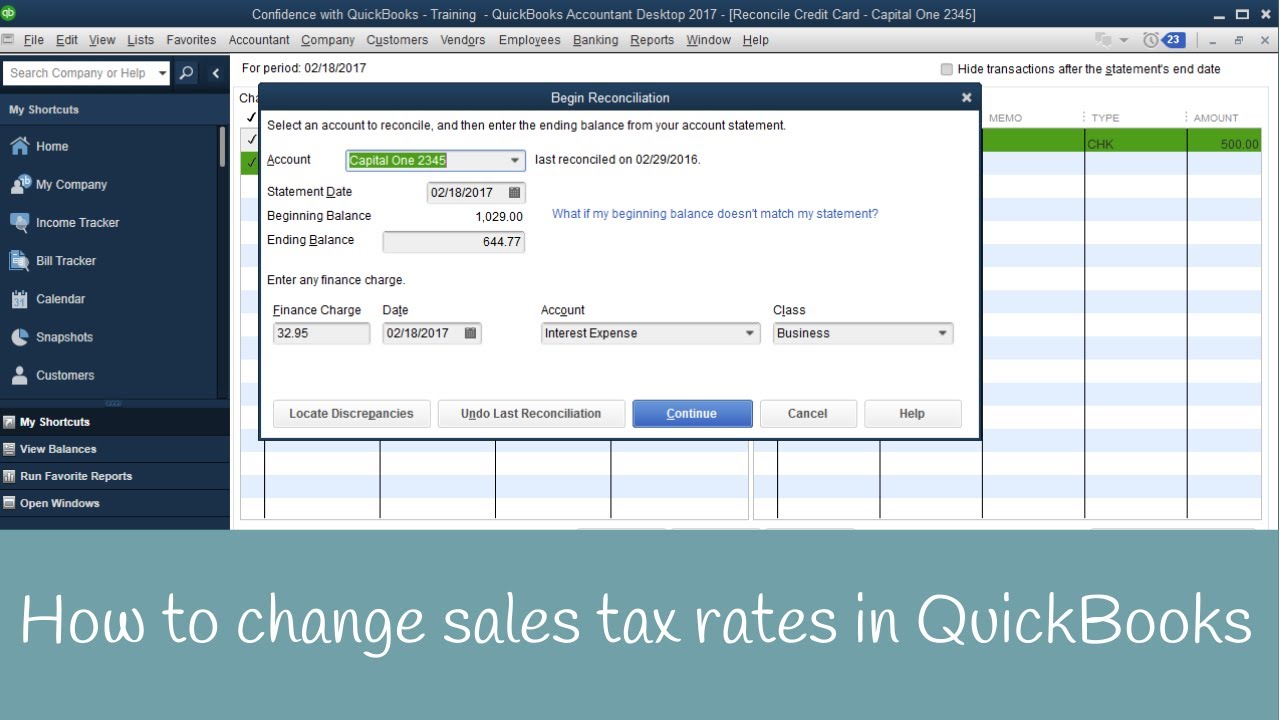

How to update or change sales tax rates in QuickBooks YouTube

To edit a combined rate,. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. You can only edit component rates. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. You can edit a sales tax rate if you.

How To Change Sales Tax Rate In Quickbooks

The updated sales tax rate. To edit a combined rate,. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. You can edit a sales tax rate if you need.

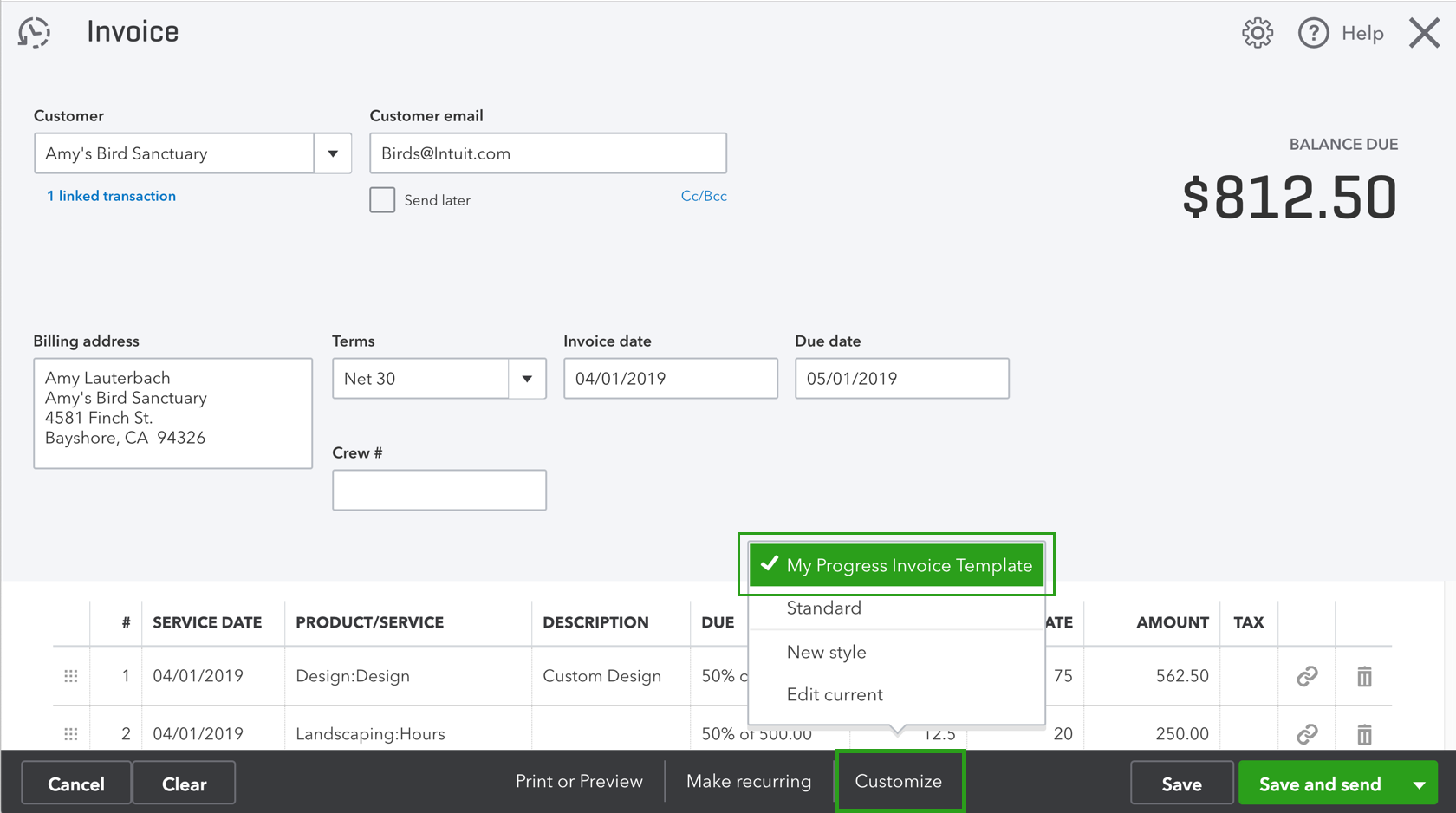

How To Change Invoice Template In Quickbooks Desktop

You can edit a sales tax rate if you need to make changes to it. To edit a combined rate,. You can only edit component rates. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. The updated sales tax rate.

How To Change Payroll Tax Rate In Quickbooks Desktop

The updated sales tax rate. You can only edit component rates. To edit a combined rate,. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same.

Solved Change the sales tax rate for all customers

When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. The updated sales tax rate. You can only edit component rates. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. You can edit a sales tax rate if you.

You Can Only Edit Component Rates.

To edit a combined rate,. This process can be performed within quickbooks online by accessing the tax settings and selecting the specific tax rate to modify. When you edit a sales tax rate, all existing transactions that use the old tax rate remain the same. You can edit a sales tax rate if you need to make changes to it.