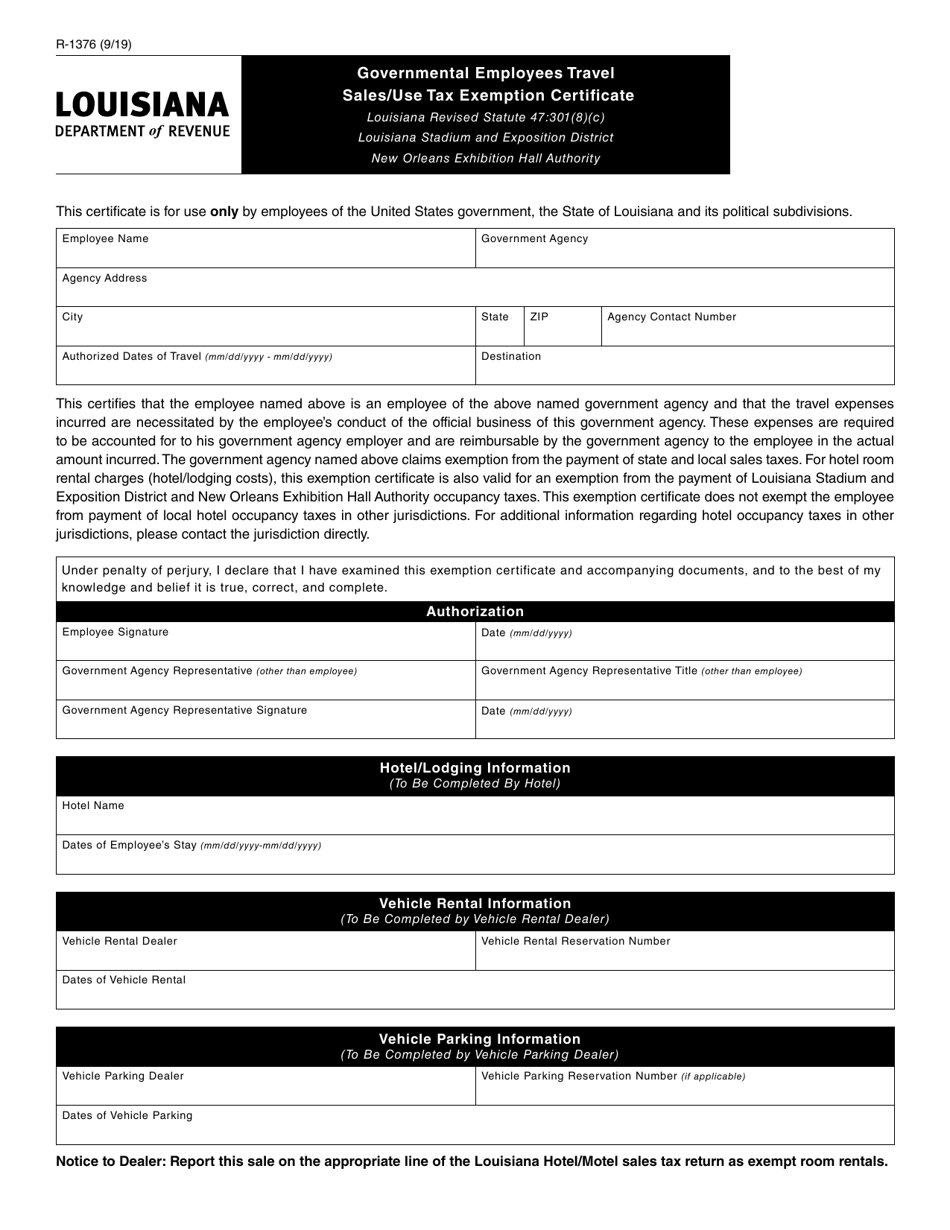

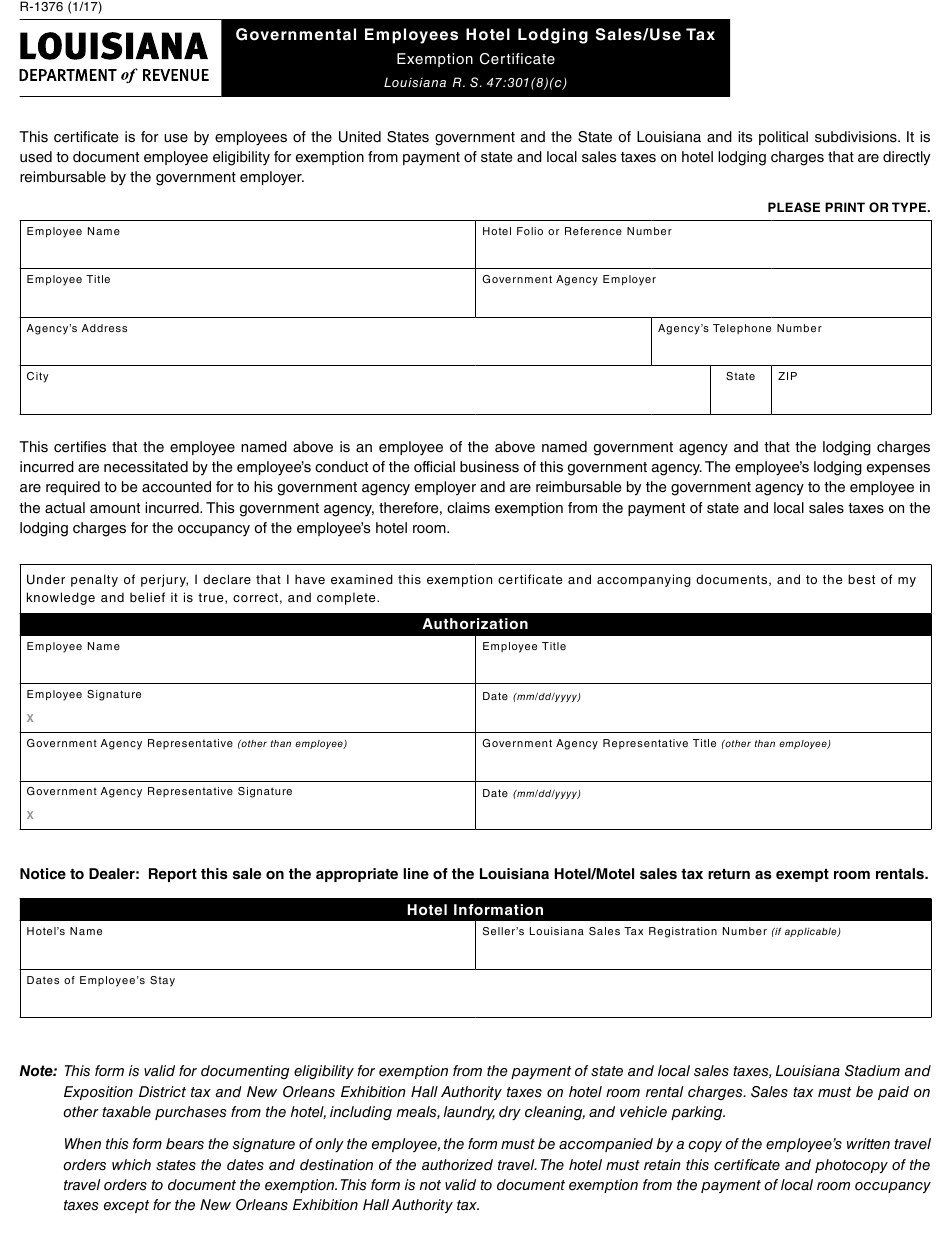

Hotel Tax Exempt Form Louisiana

Hotel Tax Exempt Form Louisiana - This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. It is used to document employee eligibility for exemption. It is used to document employee eligibility for exemption from payment of state and local sales taxes on hotel lodging charges that are directly reimbursable by the government employer.

It is used to document employee eligibility for exemption. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption from payment of state and local sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition.

This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. It is used to document employee eligibility for exemption from payment of state and local sales taxes on hotel lodging charges that are directly reimbursable by the government employer.

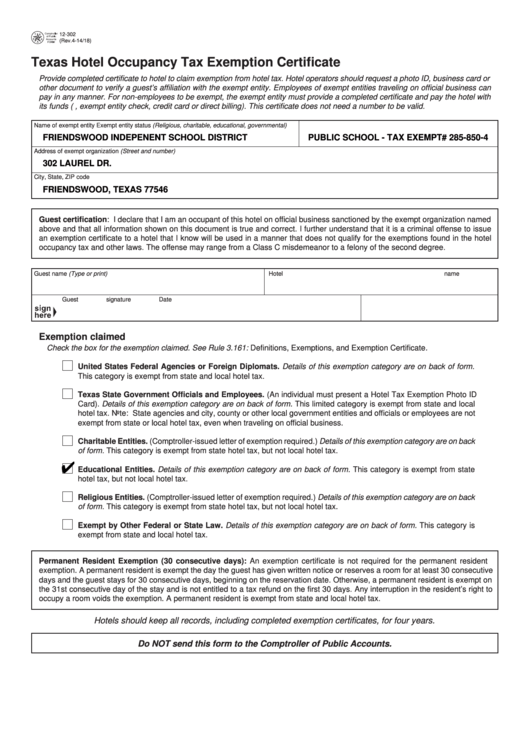

Form R1376 Download Fillable PDF or Fill Online Governmental Employees

It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption. It is used.

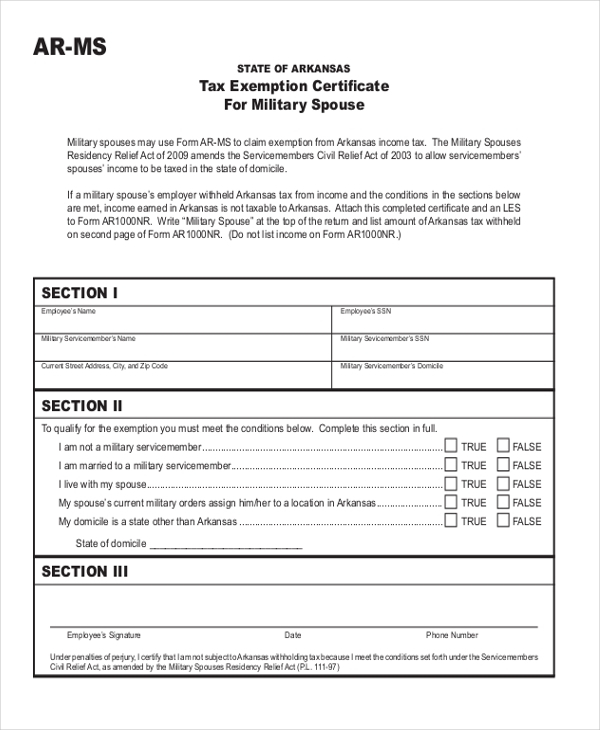

Us Army Tax Exempt Form

For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption from payment.

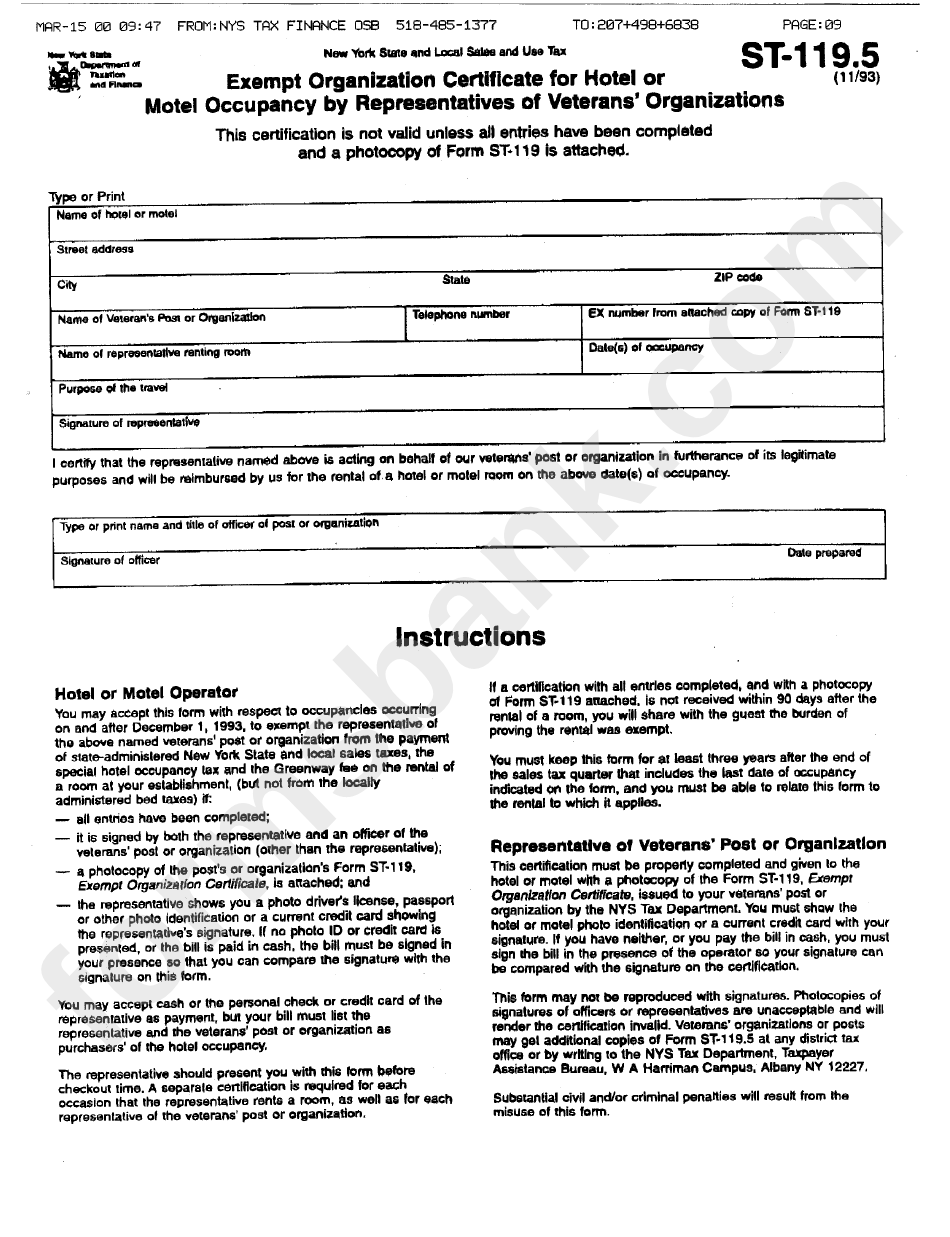

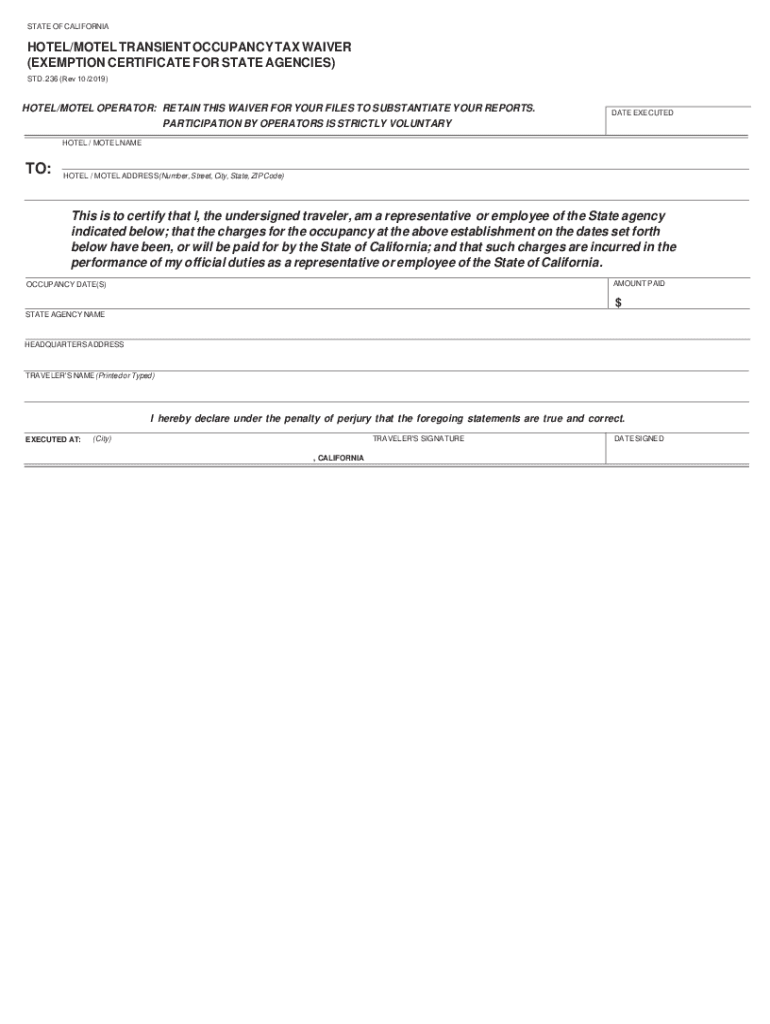

California Hotel Occupancy Tax Exemption Certificate

It is used to document employee eligibility for exemption. It is used to document employee eligibility for exemption from payment of state sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. For hotel room.

California Hotel Tax Exempt Form Pdf

For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. It is used to document employee eligibility for exemption from payment of state and local sales taxes on hotel lodging charges that are directly reimbursable by the government employer. It is used.

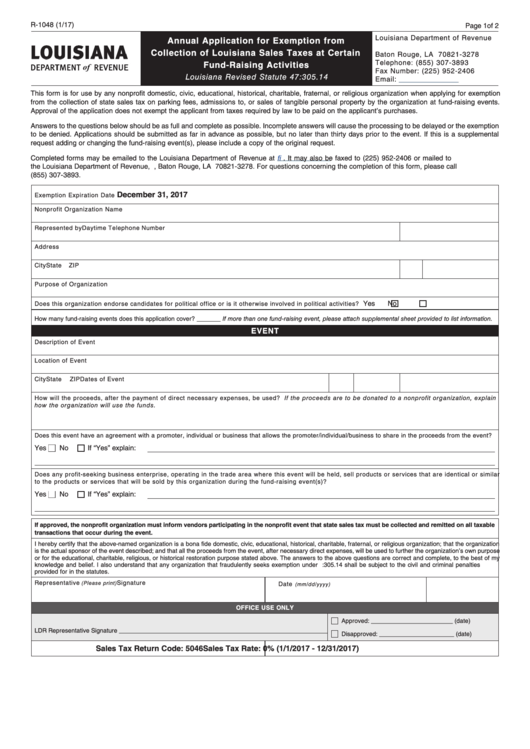

Louisiana Sales Tax Exemption Application Form

This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. It is used to document employee eligibility for exemption from.

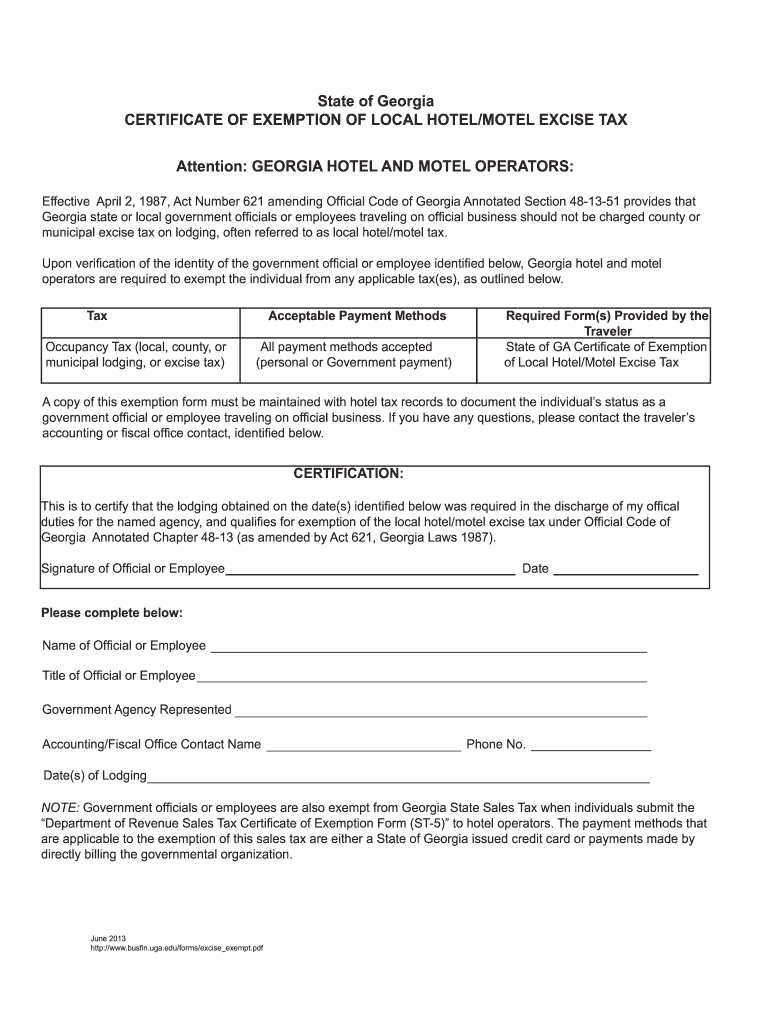

State Of Certificate Of Exemption Of Local Hotel Motel Excise

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. It is used.

State Of Utah Tax Exempt Form Form example download

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. It is used to document employee eligibility for exemption from.

Lodging tax exemption form government travelers pdf Fill out & sign

For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. This certificate is.

Louisiana Hotel Tax Exempt Form 2023

For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. It is used.

Louisiana hotel tax exempt form Fill out & sign online DocHub

It is used to document employee eligibility for exemption. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions. This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. It.

It Is Used To Document Employee Eligibility For Exemption From Payment Of State Sales Taxes On Hotel Lodging Charges That Are Directly Reimbursable By The Government Employer.

This form is valid for documenting eligibility for exemption from the payment of state and local sales taxes, louisiana stadium and exposition district tax and new orleans exhibition hall. For hotel room rental charges (hotel/lodging costs), this form is also valid for an exemption from the payment of louisiana stadium and exposition district and new orleans exhibition. It is used to document employee eligibility for exemption from payment of state and local sales taxes on hotel lodging charges that are directly reimbursable by the government employer. This certificate is for use by employees of the united states government and the state of louisiana and its political subdivisions.