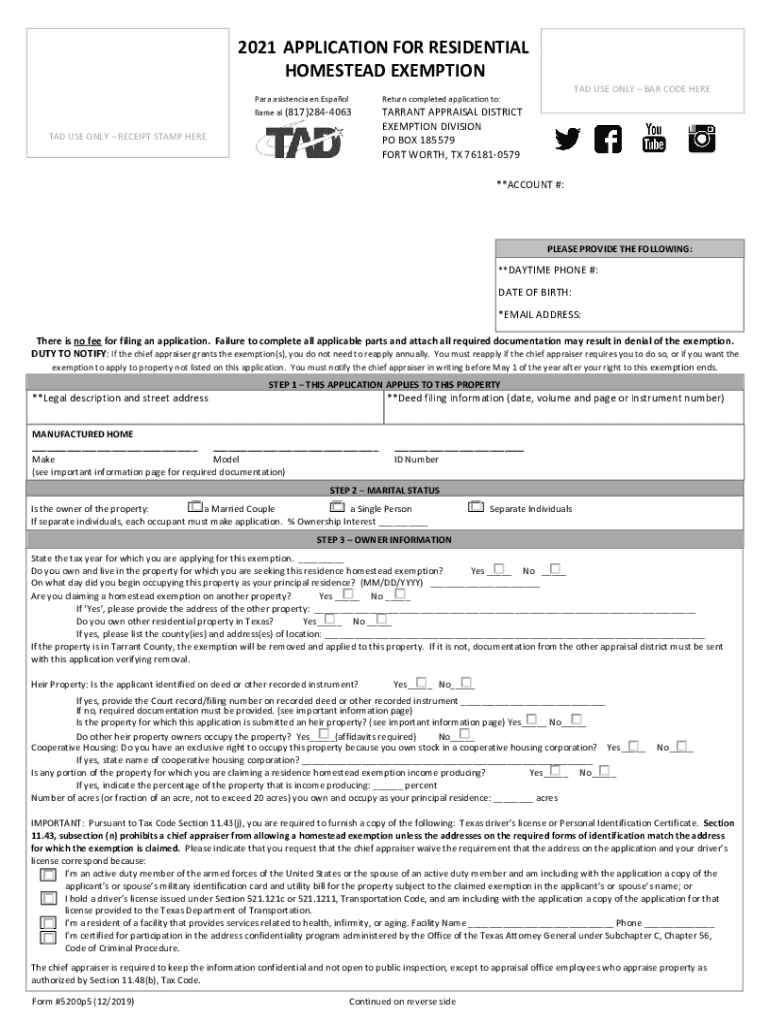

Homestead Exemption Form Tarrant County

Homestead Exemption Form Tarrant County - There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131.

There is no fee for filing an application. View list of entities we. Failure to complete all applicable parts and attach all required documentation may result in denial of. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131.

View list of entities we. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach all required documentation may result in denial of. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. There is no fee for filing an application.

Tarrant county homestead exemption form Fill out & sign online DocHub

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. Failure to complete all applicable parts and attach all required documentation may result in denial of. There is no fee for.

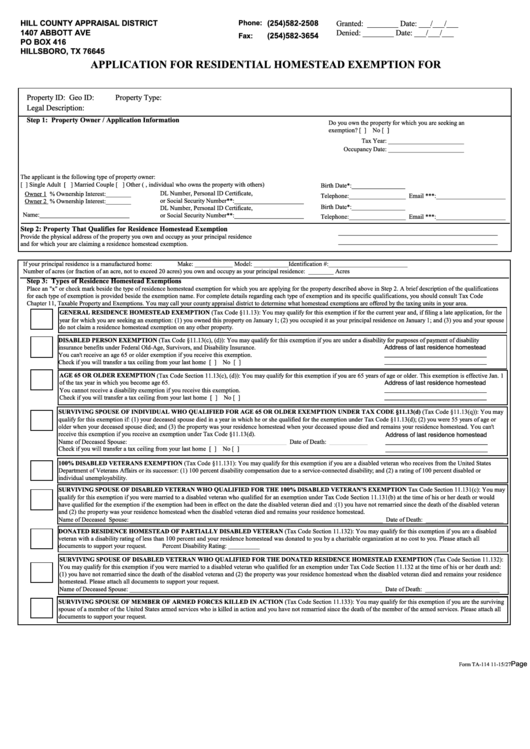

Harris County Homestead Exemption Form

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. Failure to complete all applicable parts and attach all required documentation may result in denial of. There is no fee for.

How a Homestead Exemption Can Save You Taxes Orchard

A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we..

How to File for a Homestead Exemption in Tarrant County TX Step by

A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we..

Tarrant County Homestead Exemption Deadline 2024 Lotta Rhiamon

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. Failure to complete all applicable parts and attach all required documentation may result.

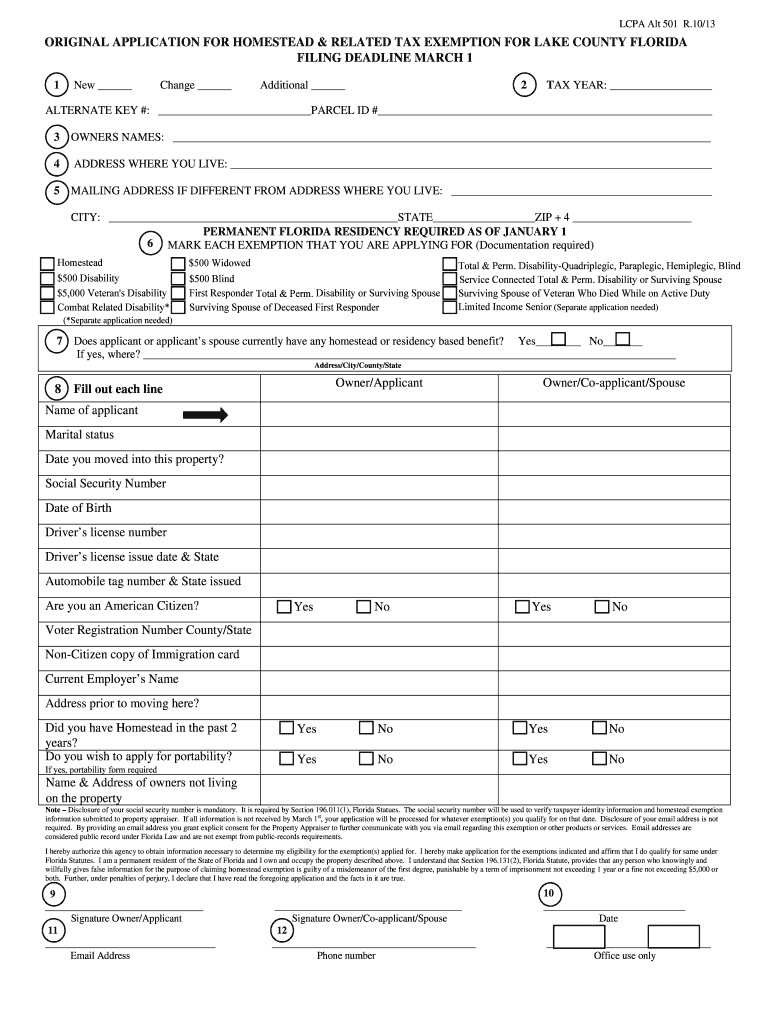

Riverside County Homestead Exemption Form

View list of entities we. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. There is no fee for filing an application. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach.

Free Tarrant County Homestead Exemption YouTube

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. View list of entities we. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. Failure to complete all applicable parts and attach.

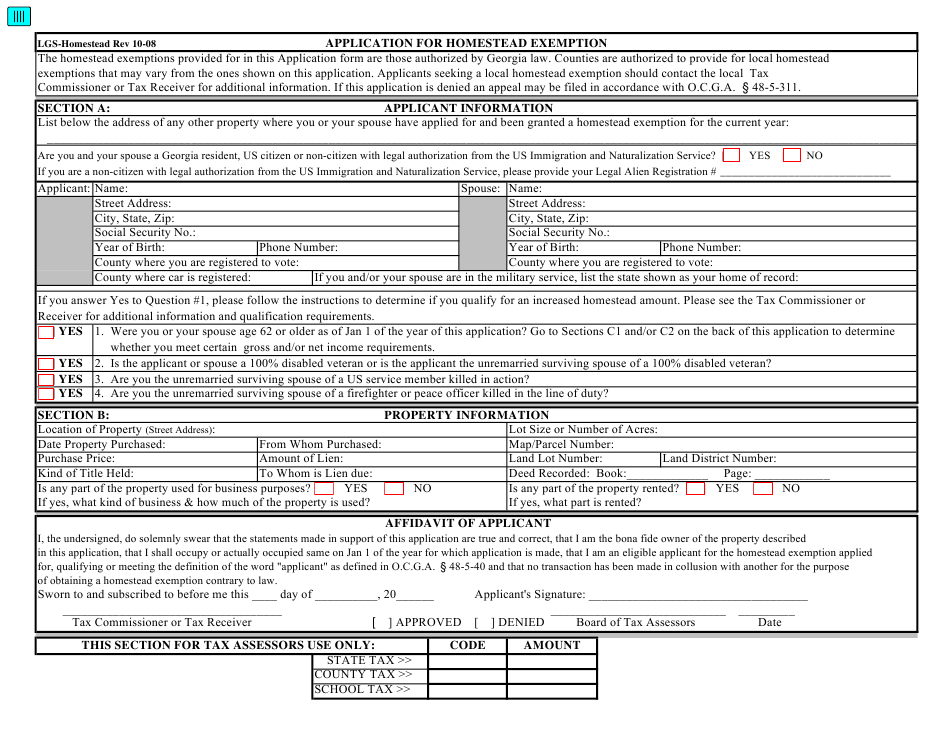

Chatham County Ga Homestead Exemption Form

View list of entities we. Failure to complete all applicable parts and attach all required documentation may result in denial of. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value.

Collin County Homestead Exemption 2024 Helga Kristin

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value.

Homestead Exemption Disappearing For Some Tarrant County Taxpayers

Failure to complete all applicable parts and attach all required documentation may result in denial of. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as.

Failure To Complete All Applicable Parts And Attach All Required Documentation May Result In Denial Of.

View list of entities we. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131.