Home Owners Exemption Form

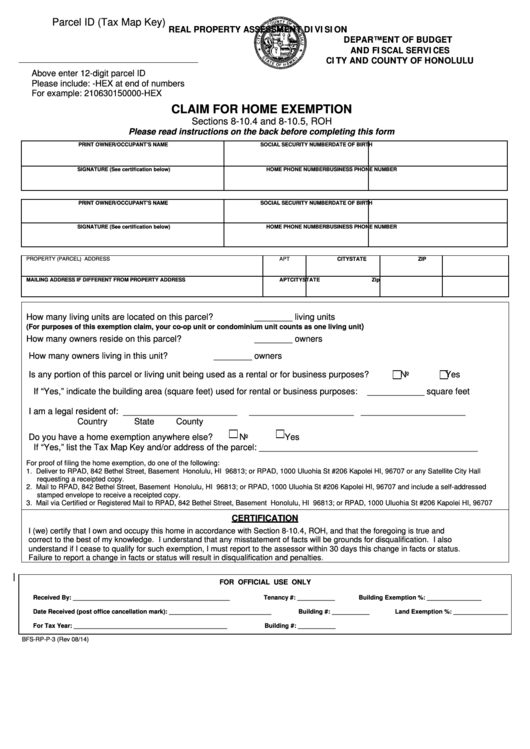

Home Owners Exemption Form - If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. If you own a home and occupy it as your principal place of residence on january 1, you may apply for an exemption of $7,000 from the. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. Please carefully read the information and.

If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. If you own a home and occupy it as your principal place of residence on january 1, you may apply for an exemption of $7,000 from the. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. Please carefully read the information and.

If you own a home and occupy it as your principal place of residence on january 1, you may apply for an exemption of $7,000 from the. Please carefully read the information and. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s.

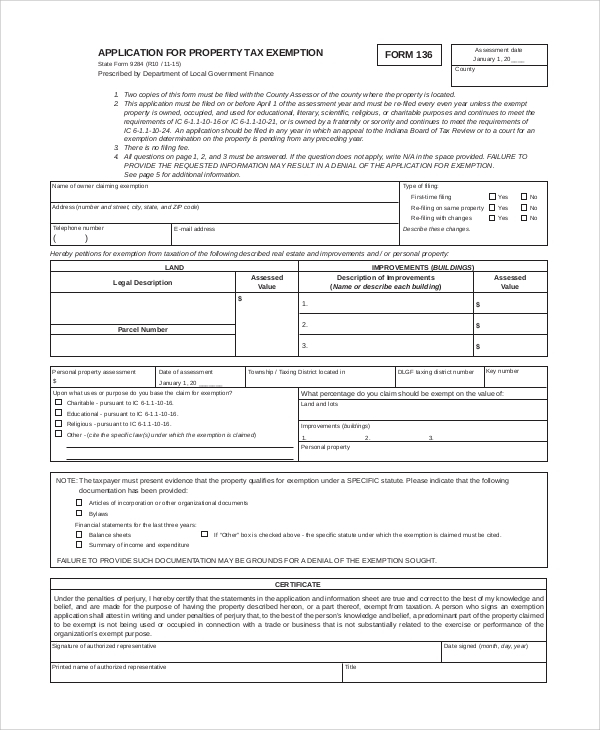

Fillable Claim For Exemption Form Printable Pdf Download

A new owner must file a claim even if the property is already receiving the homeowners’ exemption. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. If you own a home and occupy it as your principal place of residence on january.

Harris County Homestead Exemption Form

Please carefully read the information and. If you own a home and occupy it as your principal place of residence on january 1, you may apply for an exemption of $7,000 from the. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s..

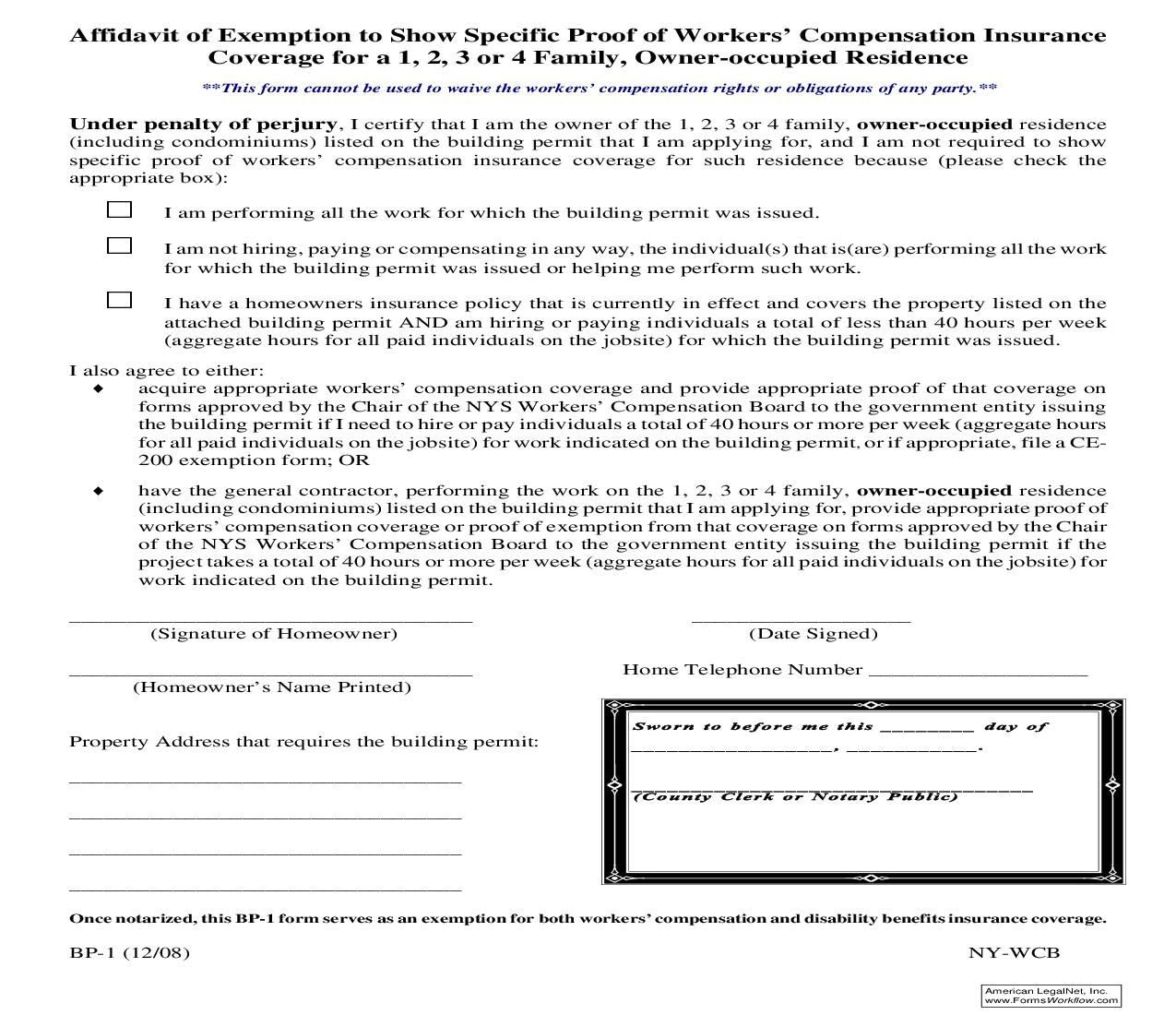

Fillable Online Home owners workers comp exemption form. Fax Email

Please carefully read the information and. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. If you own a home and occupy it as your.

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. Please carefully read the information and. If you own a home and occupy it as your.

What Is A Tax Exemption Form

A new owner must file a claim even if the property is already receiving the homeowners’ exemption. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. Please carefully read the information and. If you own a home and occupy it as your.

The homeowners exemption program needs to be updated

If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. Please carefully read the information and. If you own a home and occupy it as your.

New Florida Homeowner? File for Your Homestead Exemption by March 1, 2023

If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. Please carefully read the information and. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. If you own a home and occupy it as your.

Homeowners Exemption Cook County Form 2023

A new owner must file a claim even if the property is already receiving the homeowners’ exemption. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. If you own a home and occupy it as your principal place of residence on january.

Homeowners Exemption Form Riverside County

If you own a home and occupy it as your principal place of residence on january 1, you may apply for an exemption of $7,000 from the. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. A new owner must file a.

TAKE ACTION Oppose DHHS’s power grab on religious exemption forms

If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s. Please carefully read the information and. A new owner must file a claim even if the property is already receiving the homeowners’ exemption. If you own a home and occupy it as your.

A New Owner Must File A Claim Even If The Property Is Already Receiving The Homeowners’ Exemption.

If you own a home and occupy it as your principal place of residence on january 1, you may apply for an exemption of $7,000 from the. Please carefully read the information and. If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the property’s.