Home Office Deduction Form

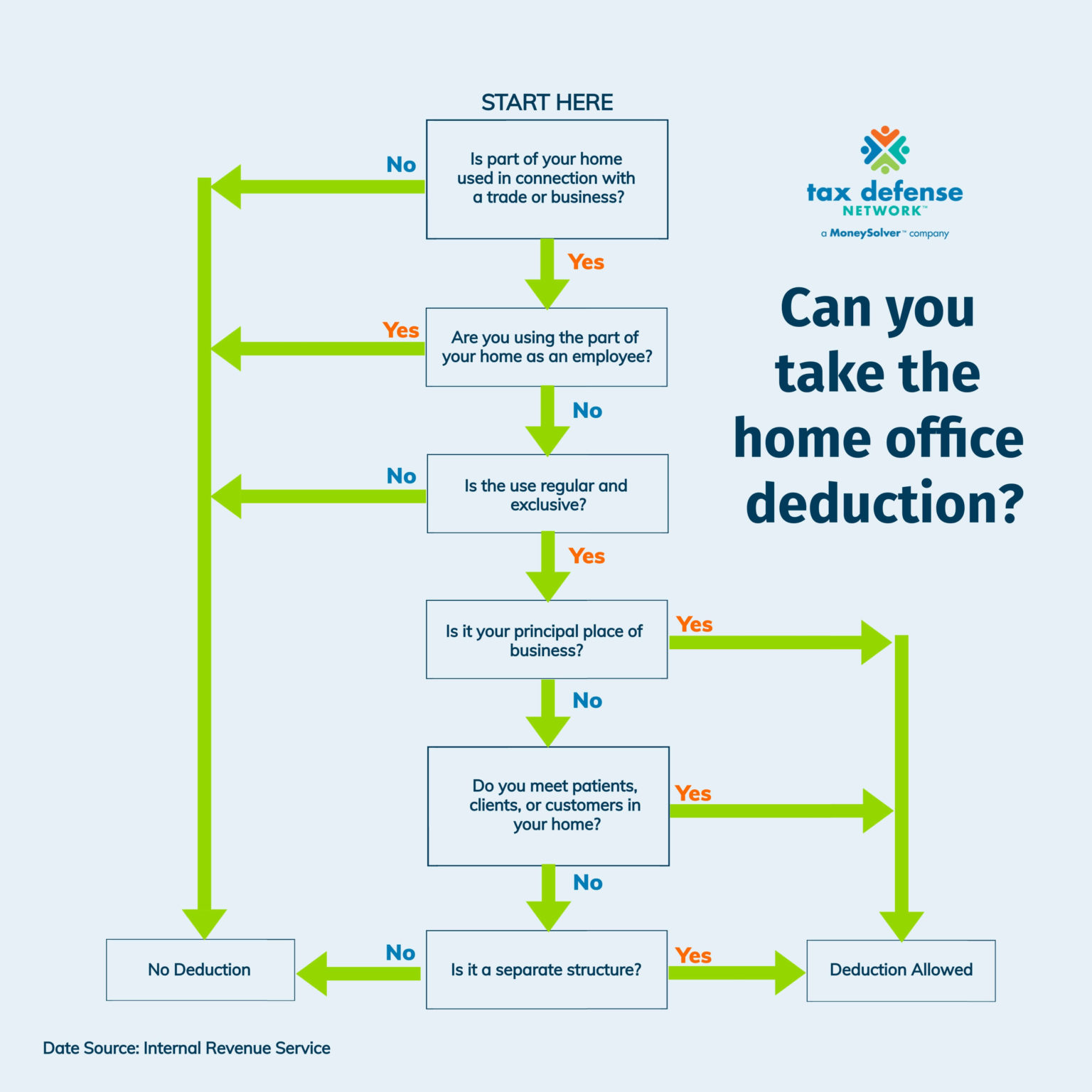

Home Office Deduction Form - [3] does my home office still qualify if my mother uses it once a year when. Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Use a separate form 8829 for each home you used for business during the year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. Mortgage interest, real estate taxes). [2] what does exclusive use mean? Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). The home office deduction, calculated on form 8829, is available to both homeowners and renters. There are certain expenses taxpayers can deduct.

The home office deduction, calculated on form 8829, is available to both homeowners and renters. [2] what does exclusive use mean? Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Use a separate form 8829 for each home you used for business during the year. [3] does my home office still qualify if my mother uses it once a year when. These may include mortgage interest, insurance, utilities,. Mortgage interest, real estate taxes). Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? Standard deduction of $5 per square foot of home used for business (maximum 300 square feet).

Mortgage interest, real estate taxes). Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Use a separate form 8829 for each home you used for business during the year. The home office deduction, calculated on form 8829, is available to both homeowners and renters. These may include mortgage interest, insurance, utilities,. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). [3] does my home office still qualify if my mother uses it once a year when. [2] what does exclusive use mean? There are certain expenses taxpayers can deduct. Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home?

Home Office Deduction 1099 Expert

There are certain expenses taxpayers can deduct. The home office deduction, calculated on form 8829, is available to both homeowners and renters. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. Office in the home frequently asked questions.

What is the Home Office Deduction?

The home office deduction, calculated on form 8829, is available to both homeowners and renters. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any.

Your 2023 Home Office Deduction Guide Orchard

These may include mortgage interest, insurance, utilities,. Use a separate form 8829 for each home you used for business during the year. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). [2] what does exclusive use mean? There are certain expenses taxpayers can deduct.

How to Calculate the Home Office Deduction 1099 Expert

Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). These may include mortgage interest, insurance, utilities,. [3] does my home office still qualify if my mother uses it once.

Home Office Deduction Breakdown LawInc

Mortgage interest, real estate taxes). Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). There are certain expenses taxpayers can deduct. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Use a separate form 8829 for each home.

An Easy Guide to The Home Office Deduction

[2] what does exclusive use mean? [3] does my home office still qualify if my mother uses it once a year when. Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? The home office deduction, calculated on form 8829, is available to both homeowners and renters. Form.

Freelancer Taxes How to deduct your home office From Rags to Reasonable

There are certain expenses taxpayers can deduct. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). The home office deduction, calculated on form 8829, is available to both homeowners and renters. [3] does my home office still qualify if my mother uses it once a.

Free Business Expense Spreadsheet and Self Employed Business Tax

Use a separate form 8829 for each home you used for business during the year. The home office deduction, calculated on form 8829, is available to both homeowners and renters. [2] what does exclusive use mean? Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? Standard deduction.

Irs Home Office Deduction 2024 Hanny Muffin

Use a separate form 8829 for each home you used for business during the year. [2] what does exclusive use mean? Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service.

Fillable Online FAQs Simplified Method for Home Office Deduction Fax

The home office deduction, calculated on form 8829, is available to both homeowners and renters. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. Use a separate form 8829 for each home you used for business during the.

[2] What Does Exclusive Use Mean?

There are certain expenses taxpayers can deduct. These may include mortgage interest, insurance, utilities,. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Mortgage interest, real estate taxes).

Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To Next Year Of Amounts Not Deductible This Year.

[3] does my home office still qualify if my mother uses it once a year when. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? The home office deduction, calculated on form 8829, is available to both homeowners and renters.