Form 990 Late Filing Penalty

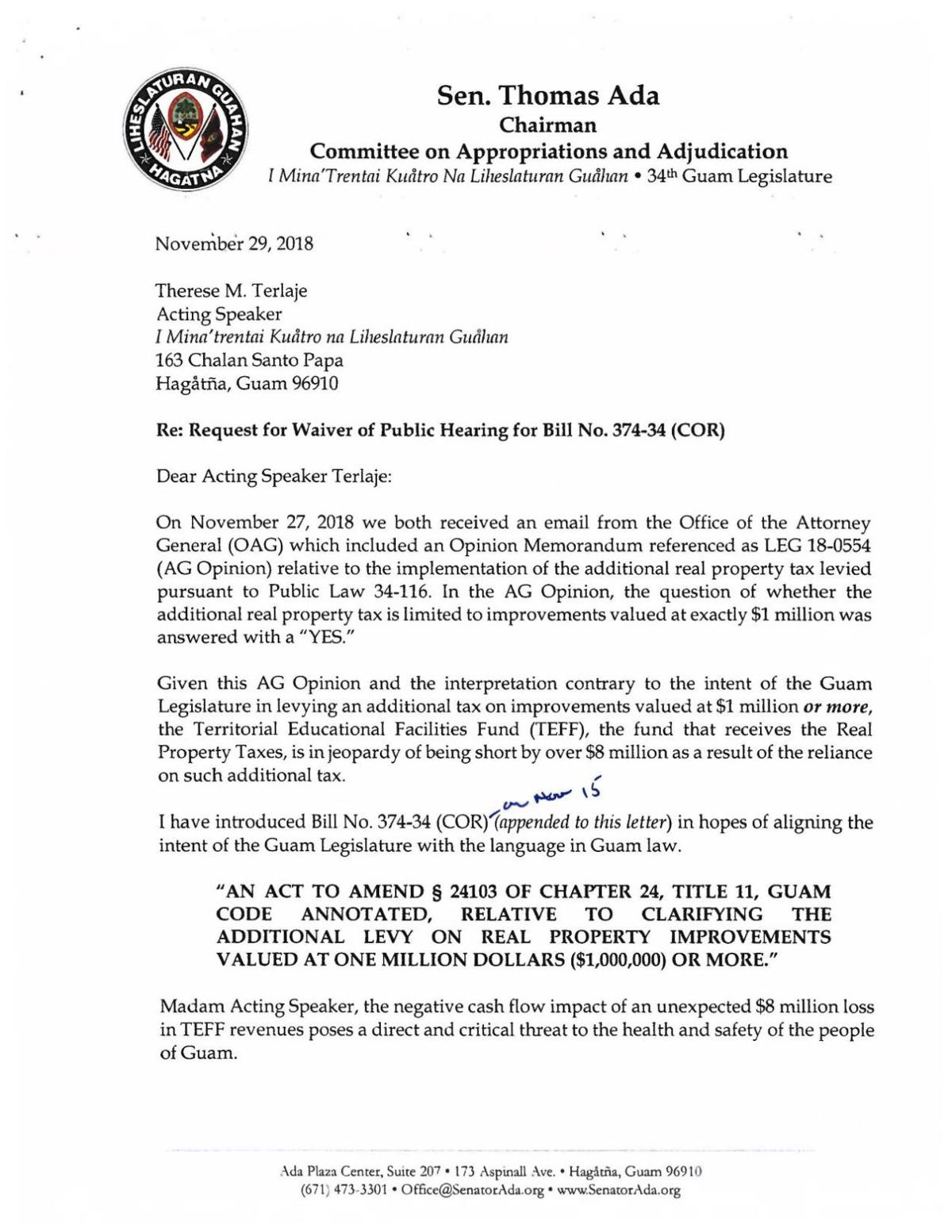

Form 990 Late Filing Penalty - Can penalties for filing form 990 late be abated? If so, you may have heard. Did your nonprofit organization file a form 990 after the due date? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Are you faced with paying a penalty to the irs? If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty.

Are you faced with paying a penalty to the irs? If so, you may have heard. If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Can penalties for filing form 990 late be abated? Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Did your nonprofit organization file a form 990 after the due date? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under.

Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Did your nonprofit organization file a form 990 after the due date? Can penalties for filing form 990 late be abated? If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Are you faced with paying a penalty to the irs? If so, you may have heard. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under.

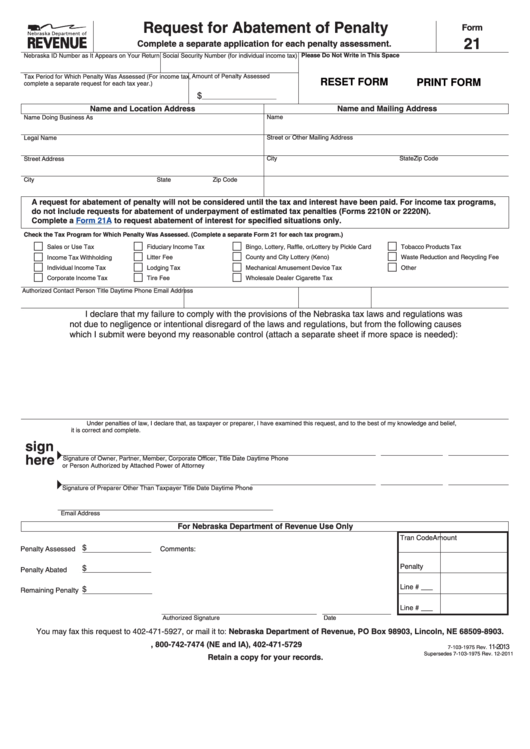

Form 990 Penalty Abatement Letter

Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. If so, you may have heard. Can penalties for filing form 990 late be abated? If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each.

990 late filing penalty Form 990 penalties for nonprofits

Can penalties for filing form 990 late be abated? Are you faced with paying a penalty to the irs? Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Did your nonprofit organization file a form 990 after the due date? If an organization fails to file a required return by the due date.

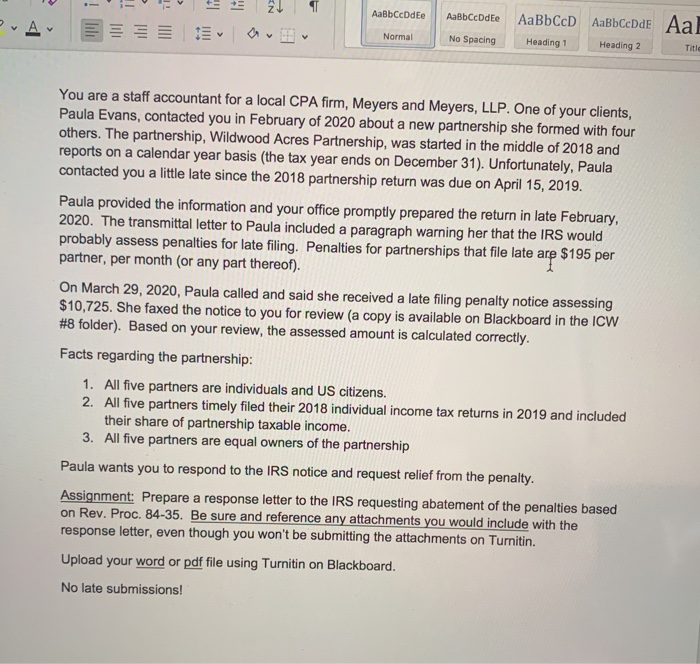

S Corp Late Filing Penalty Abatement Letter Sample

If so, you may have heard. If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under..

Irs Penalty Abatement Templates prntbl.concejomunicipaldechinu.gov.co

Can penalties for filing form 990 late be abated? If so, you may have heard. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Did your nonprofit organization file.

Abatement Of Irs Penalties Sample Letter

If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Did your nonprofit organization file a.

Penalty Abatement Letter Sample

Did your nonprofit organization file a form 990 after the due date? If so, you may have heard. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Can penalties for filing form 990 late be abated? Are you faced with paying a penalty to the.

Sample Irs Letter To Request First Time Penalty Abatement

Can penalties for filing form 990 late be abated? Are you faced with paying a penalty to the irs? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. If so, you may have heard. Failure to timely file the information return, absent reasonable cause, can.

Form 990 LateFiling Penalty Abatement Manual, Example Letters and

Are you faced with paying a penalty to the irs? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a.

Penalty Relief Due To Reasonable Cause Sample Letter

Are you faced with paying a penalty to the irs? Can penalties for filing form 990 late be abated? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. If an organization fails to file a required return by the due date (including any extensions of.

How to Write a Form 990 Late Filing Penalty Abatement Letter

Can penalties for filing form 990 late be abated? If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. If so, you may have.

Did Your Nonprofit Organization File A Form 990 After The Due Date?

Can penalties for filing form 990 late be abated? Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Are you faced with paying a penalty to the irs? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under.

If So, You May Have Heard.

If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day.

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)