Form 965 A

Form 965 A - This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the. This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid.

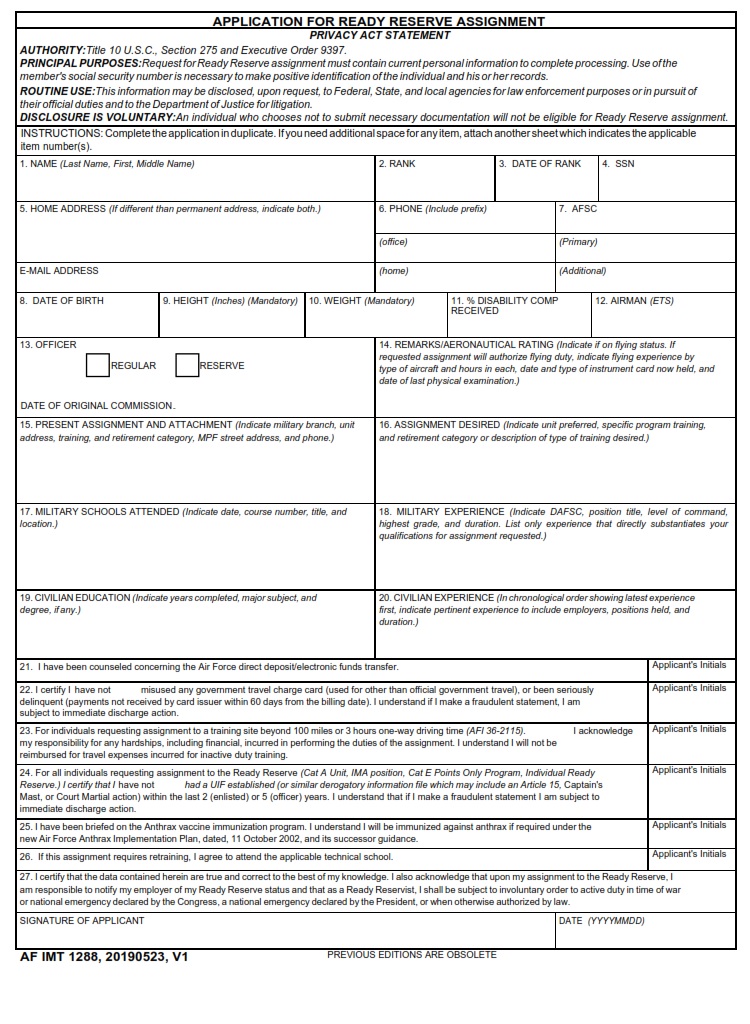

AF Form 1288 Application For Ready Reserve Assignment AF Forms

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

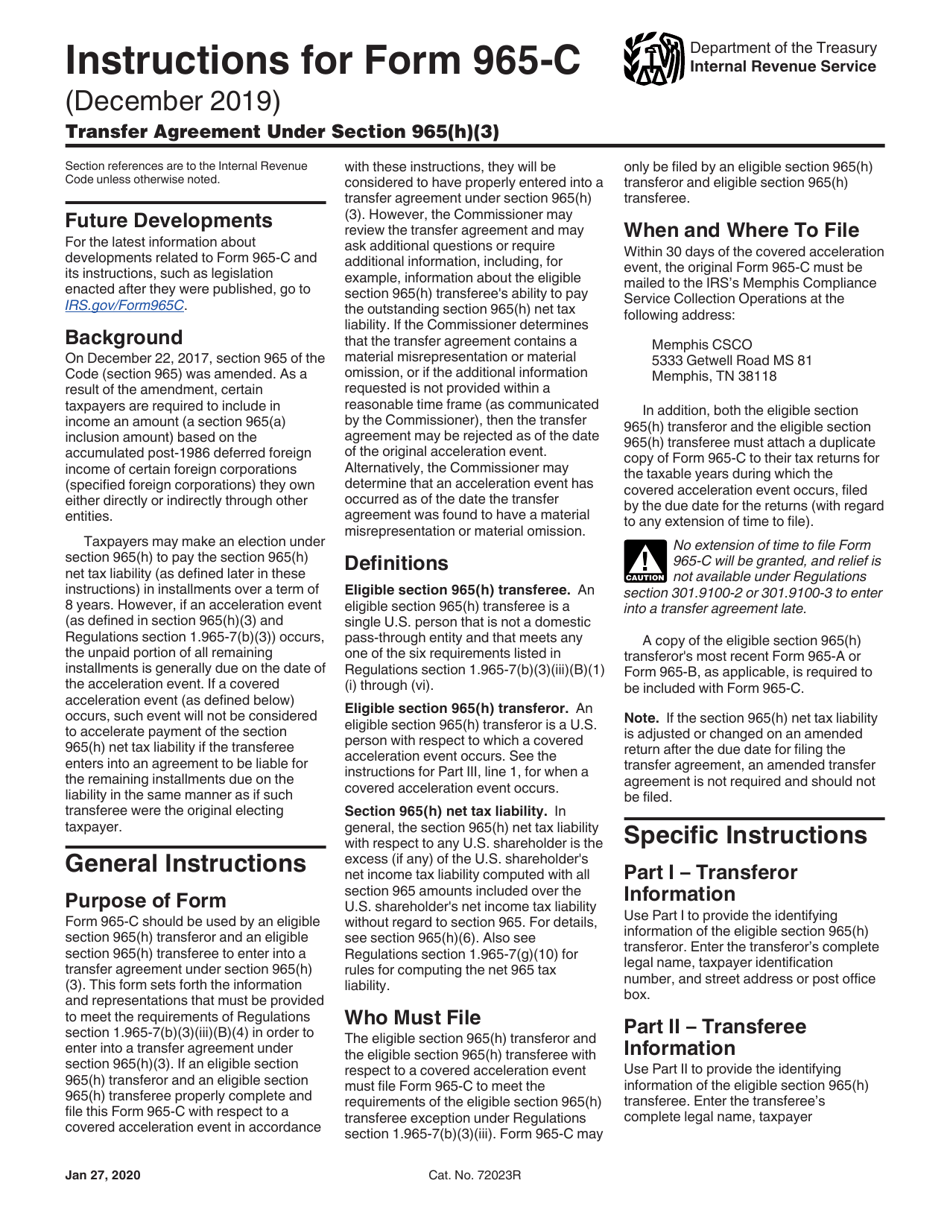

Download Instructions for IRS Form 965C Transfer Agreement Under

Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the. This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid.

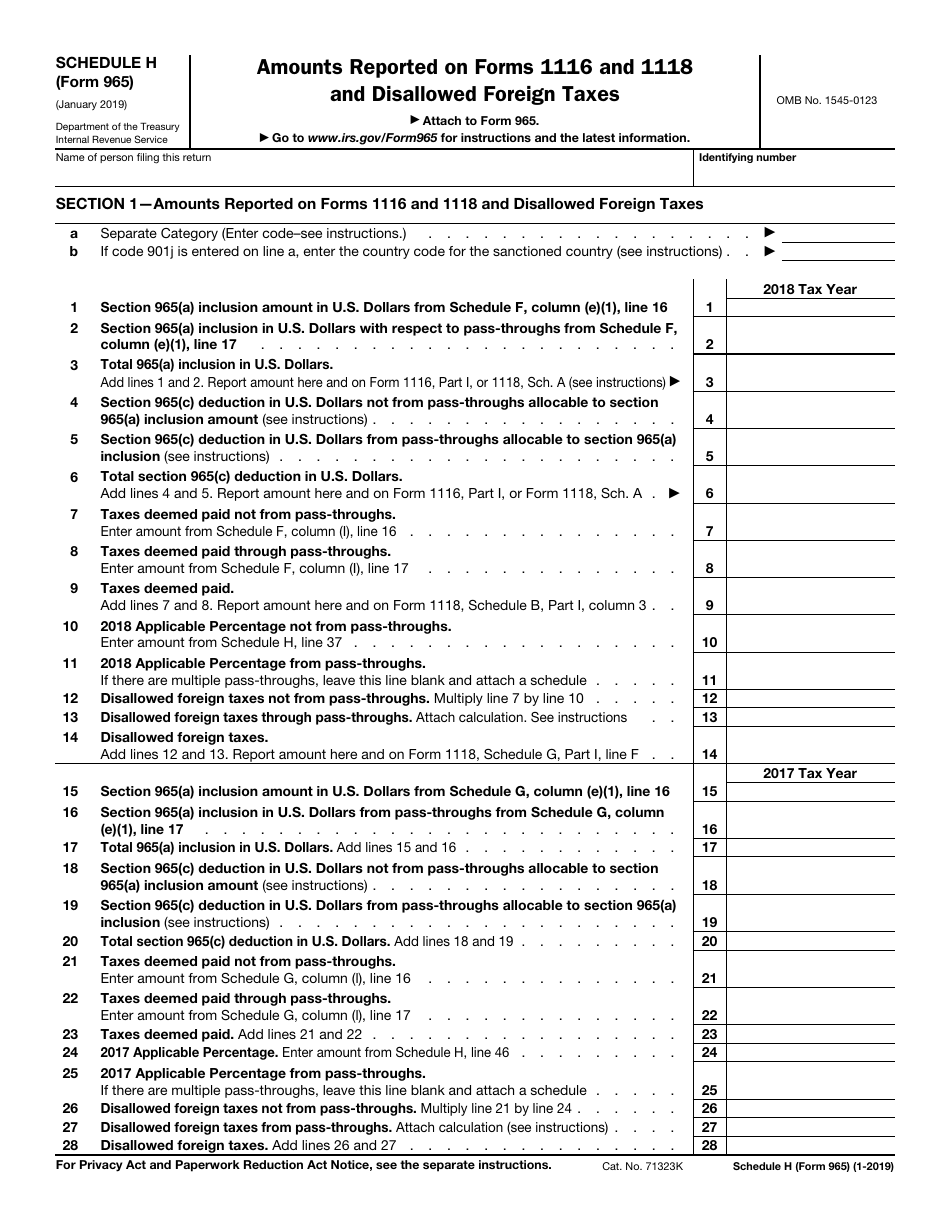

IRS Form 965 Schedule H Fill Out, Sign Online and Download Fillable

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

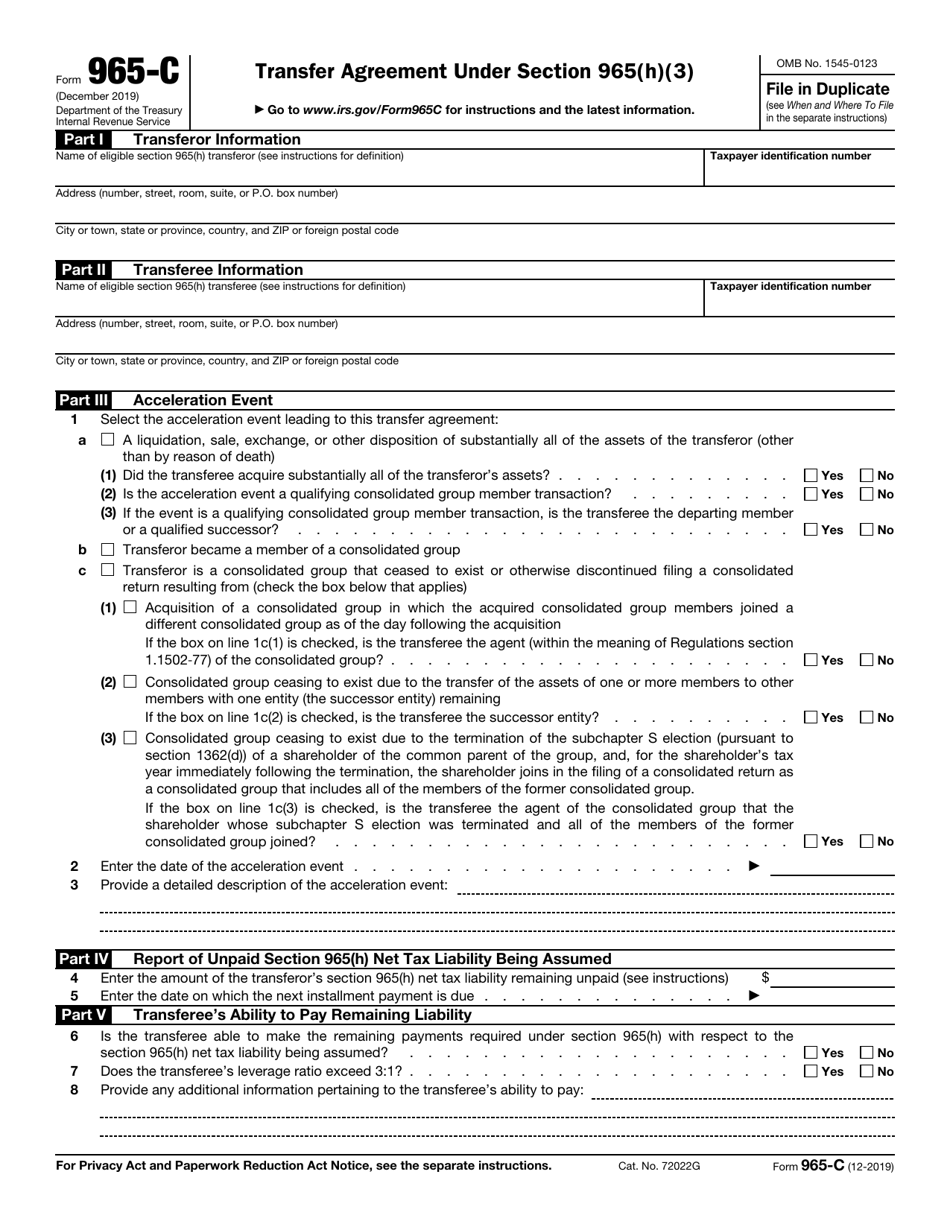

IRS Form 965C Fill Out, Sign Online and Download Fillable PDF

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

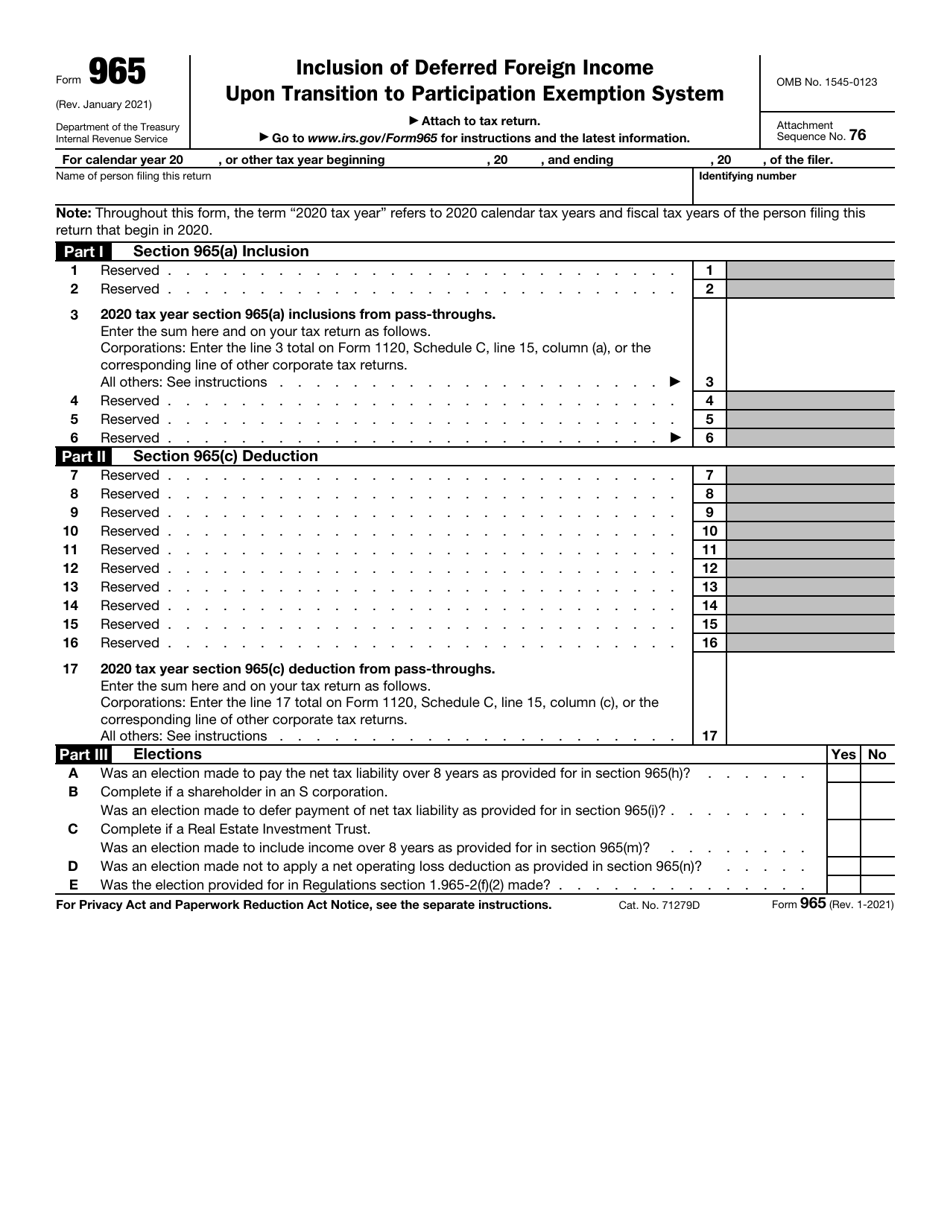

IRS Form 965 Download Fillable PDF or Fill Online Inclusion of Deferred

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

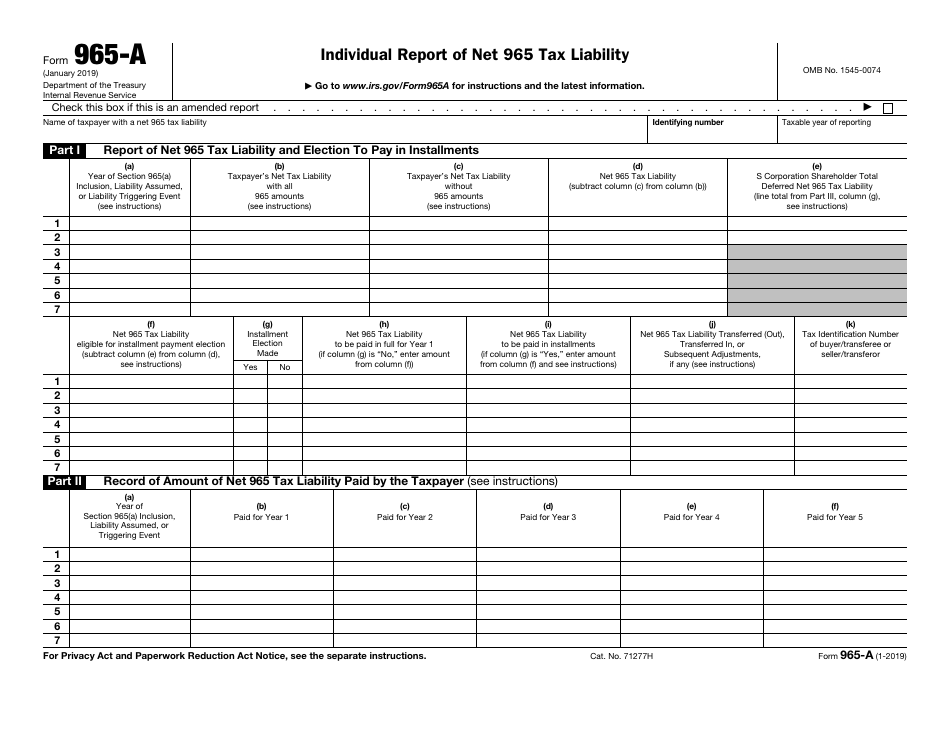

IRS Form 965A Fill Out, Sign Online and Download Fillable PDF

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

Form 965A Individual Report of Net 965 Tax Liability

Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the. This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid.

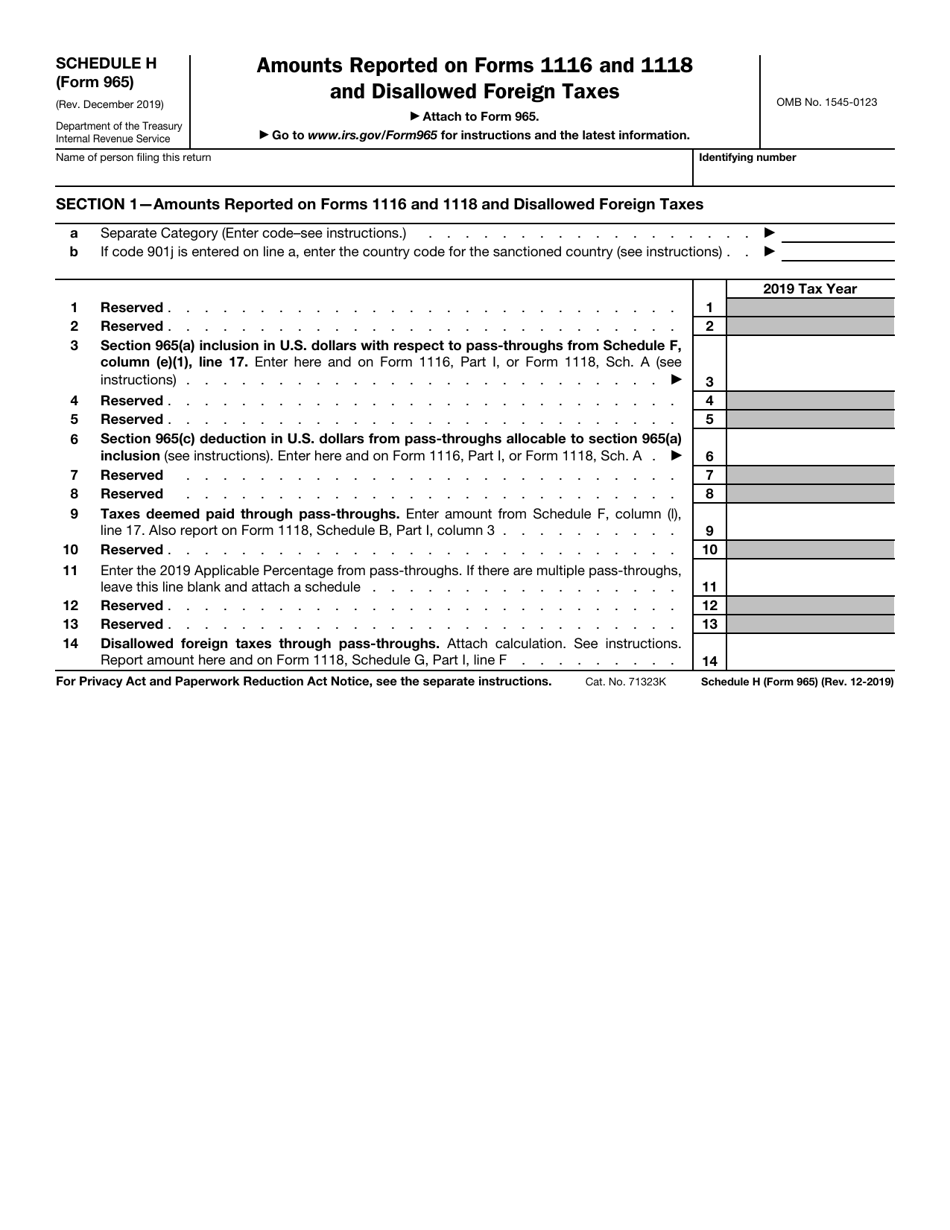

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

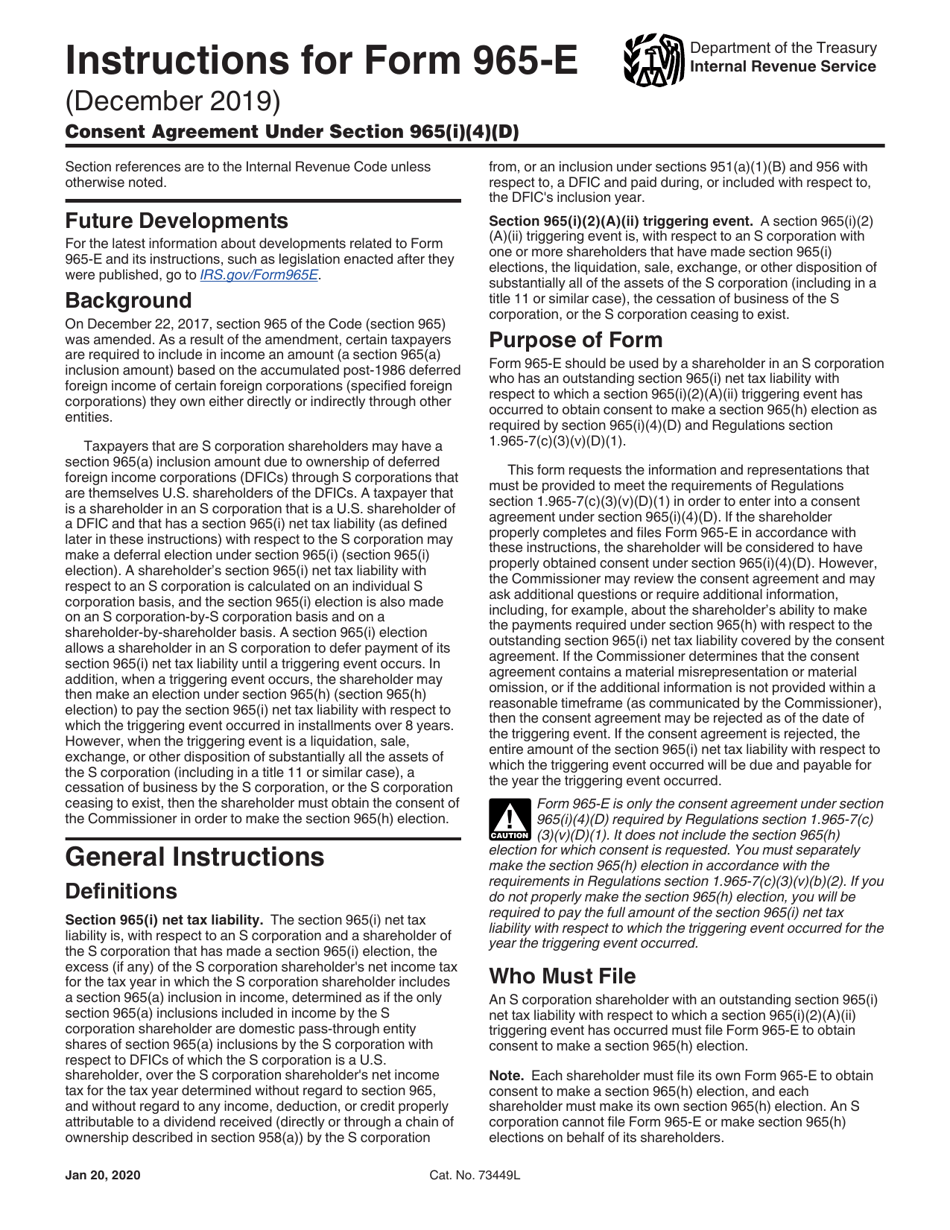

Download Instructions for IRS Form 965E Consent Agreement Under

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid. Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the.

Form 965 Instrument Flight Rules Pilot (Aeronautics)

Attach form 965 to your income tax return (or other applicable form, such as a partnership or exempt organization return) and file both by the. This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid.

Attach Form 965 To Your Income Tax Return (Or Other Applicable Form, Such As A Partnership Or Exempt Organization Return) And File Both By The.

This form must be completed by a taxpayer for every tax year for which the taxpayer has any net 965 tax liability outstanding and not fully paid.