Form 941 Late Filing Penalty No Tax Due

Form 941 Late Filing Penalty No Tax Due - The penalties for not filing form 941 on time are as. You will be subject to penalties if you fail to file your form 941 within the filing deadline. Taxpayers who don’t meet their tax obligations may owe a penalty. The irs charges a penalty for various reasons, including if you.

Taxpayers who don’t meet their tax obligations may owe a penalty. You will be subject to penalties if you fail to file your form 941 within the filing deadline. The penalties for not filing form 941 on time are as. The irs charges a penalty for various reasons, including if you.

You will be subject to penalties if you fail to file your form 941 within the filing deadline. Taxpayers who don’t meet their tax obligations may owe a penalty. The penalties for not filing form 941 on time are as. The irs charges a penalty for various reasons, including if you.

Tips for Avoiding Penalties for your Form 941 Q3 Blog TaxBandits

The irs charges a penalty for various reasons, including if you. You will be subject to penalties if you fail to file your form 941 within the filing deadline. The penalties for not filing form 941 on time are as. Taxpayers who don’t meet their tax obligations may owe a penalty.

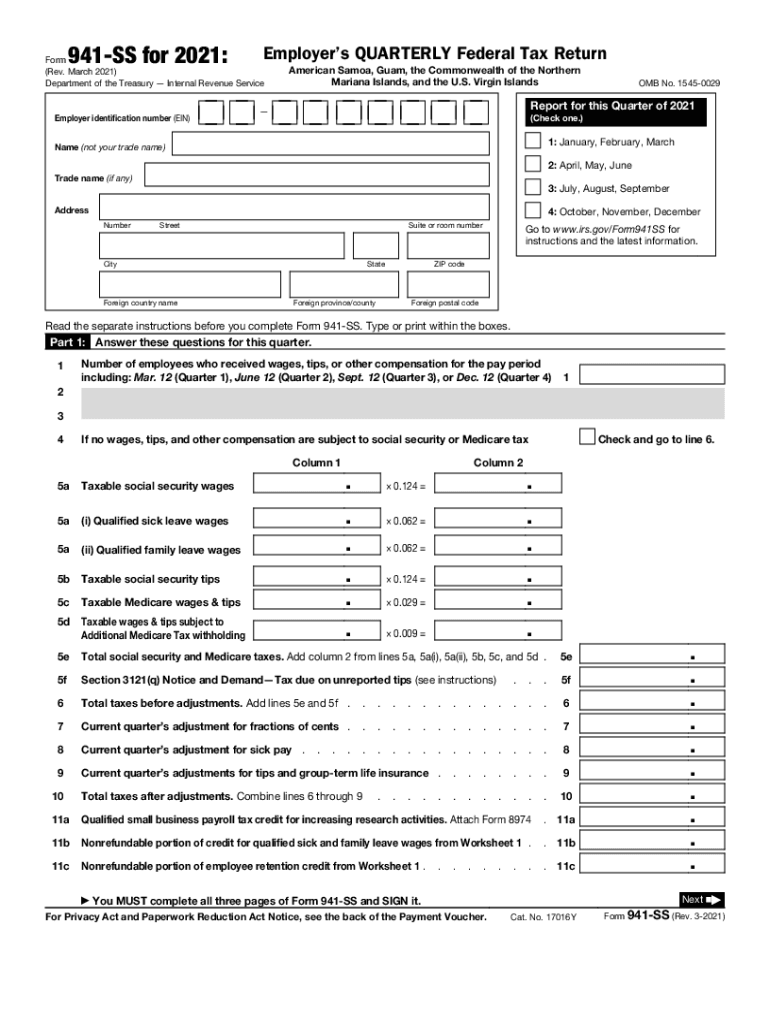

Irs Free File Fillable 941 Form Printable Forms Free Online

Taxpayers who don’t meet their tax obligations may owe a penalty. You will be subject to penalties if you fail to file your form 941 within the filing deadline. The penalties for not filing form 941 on time are as. The irs charges a penalty for various reasons, including if you.

Late Filing Penalty for Tax Returns with NO Tax Due tax taxtips YouTube

The penalties for not filing form 941 on time are as. The irs charges a penalty for various reasons, including if you. Taxpayers who don’t meet their tax obligations may owe a penalty. You will be subject to penalties if you fail to file your form 941 within the filing deadline.

Last Day For Late Filing Of Tax Return Is December 31; Learn How

Taxpayers who don’t meet their tax obligations may owe a penalty. The penalties for not filing form 941 on time are as. The irs charges a penalty for various reasons, including if you. You will be subject to penalties if you fail to file your form 941 within the filing deadline.

941 Late Payment Penalty Failure to Deposit Penalty

Taxpayers who don’t meet their tax obligations may owe a penalty. The irs charges a penalty for various reasons, including if you. The penalties for not filing form 941 on time are as. You will be subject to penalties if you fail to file your form 941 within the filing deadline.

When Is Form 941 Due 2024 Ibby Theadora

Taxpayers who don’t meet their tax obligations may owe a penalty. The irs charges a penalty for various reasons, including if you. The penalties for not filing form 941 on time are as. You will be subject to penalties if you fail to file your form 941 within the filing deadline.

941 Late Payment Penalty Failure to Deposit Penalty

The penalties for not filing form 941 on time are as. The irs charges a penalty for various reasons, including if you. Taxpayers who don’t meet their tax obligations may owe a penalty. You will be subject to penalties if you fail to file your form 941 within the filing deadline.

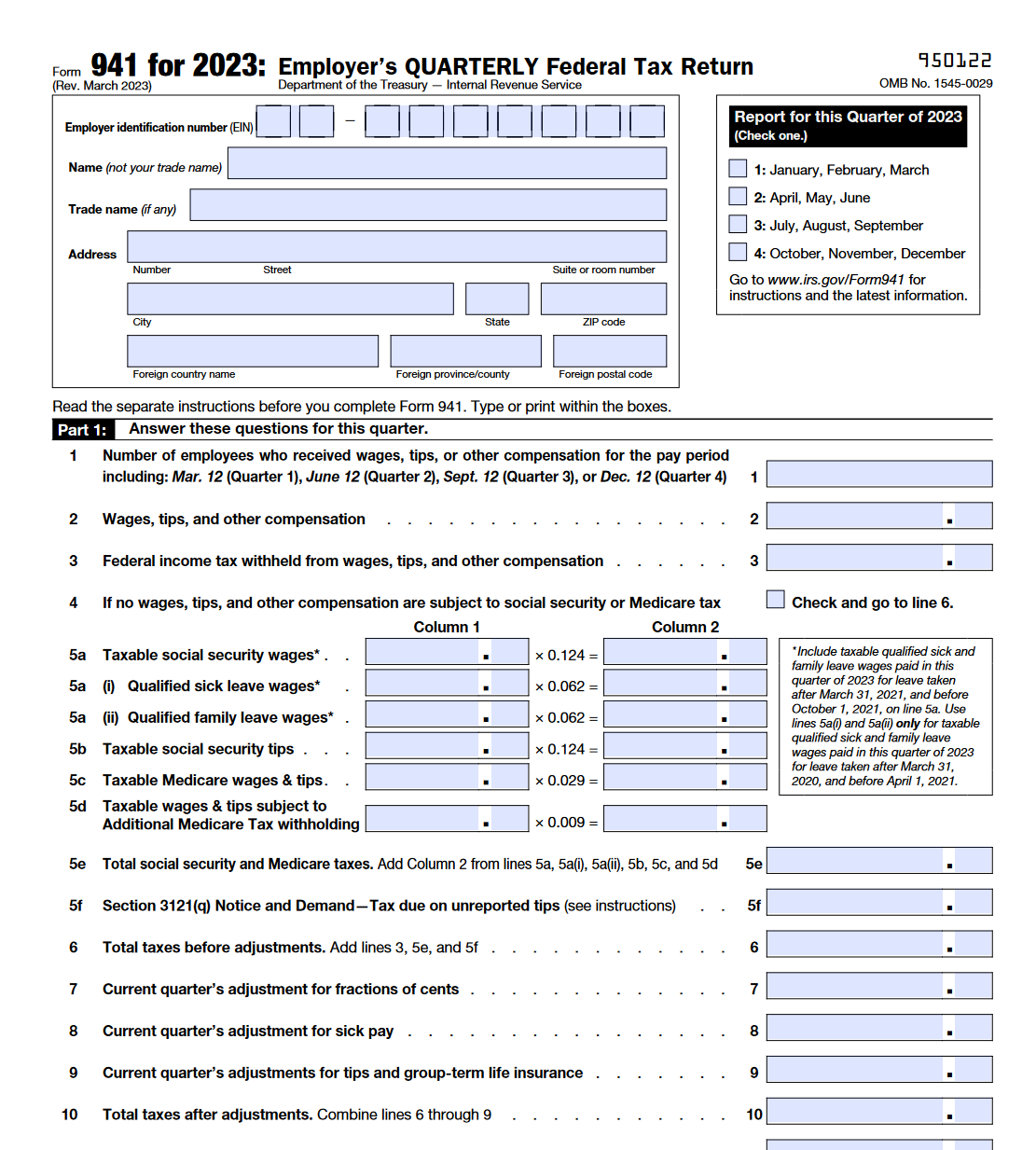

941 Forms 2024 Judy Sabine

You will be subject to penalties if you fail to file your form 941 within the filing deadline. Taxpayers who don’t meet their tax obligations may owe a penalty. The irs charges a penalty for various reasons, including if you. The penalties for not filing form 941 on time are as.

Modernizing IRS Form 941X Tackling Backlogs & EFiling

The penalties for not filing form 941 on time are as. You will be subject to penalties if you fail to file your form 941 within the filing deadline. The irs charges a penalty for various reasons, including if you. Taxpayers who don’t meet their tax obligations may owe a penalty.

Failure To Deposit IRS 941 Late Payment Penalties Tax Relief Center

You will be subject to penalties if you fail to file your form 941 within the filing deadline. Taxpayers who don’t meet their tax obligations may owe a penalty. The penalties for not filing form 941 on time are as. The irs charges a penalty for various reasons, including if you.

The Penalties For Not Filing Form 941 On Time Are As.

You will be subject to penalties if you fail to file your form 941 within the filing deadline. The irs charges a penalty for various reasons, including if you. Taxpayers who don’t meet their tax obligations may owe a penalty.

-1920w.png)