Form 8955 Ssa Late Filing Penalty

Form 8955 Ssa Late Filing Penalty - We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955. The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer.

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

Fillable Online Letter Regarding IRS Form 8955SSA Participant Notice

We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955. The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer.

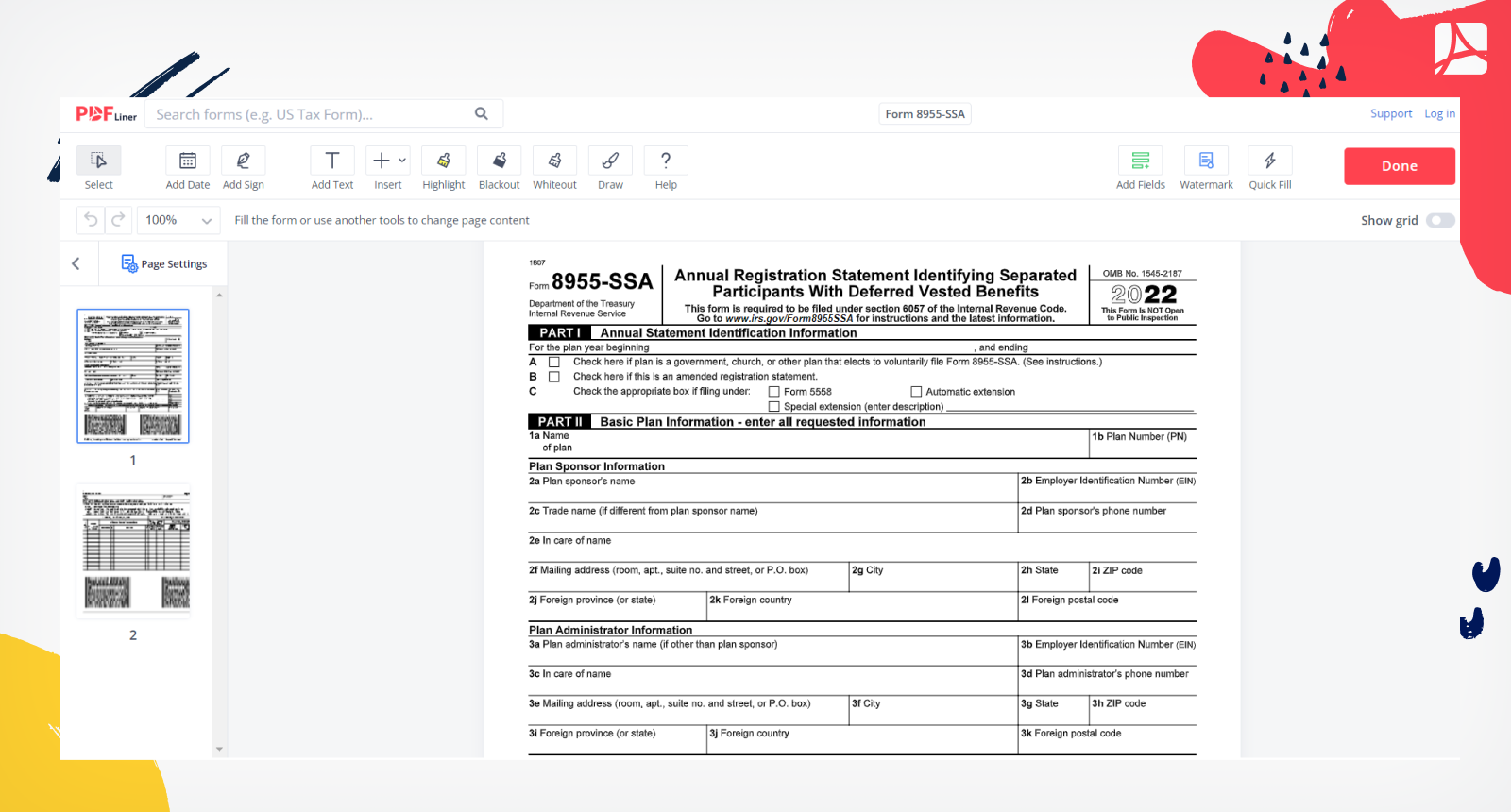

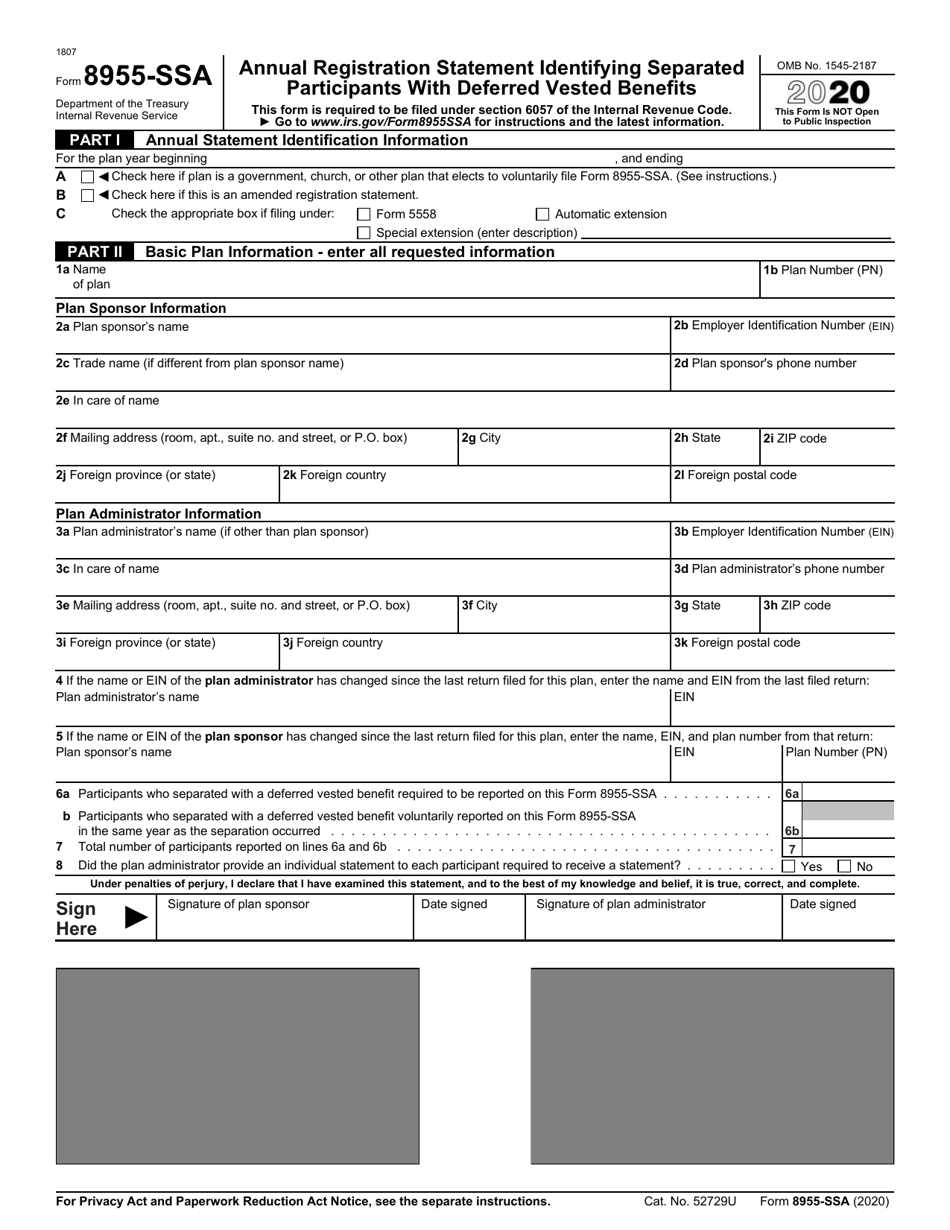

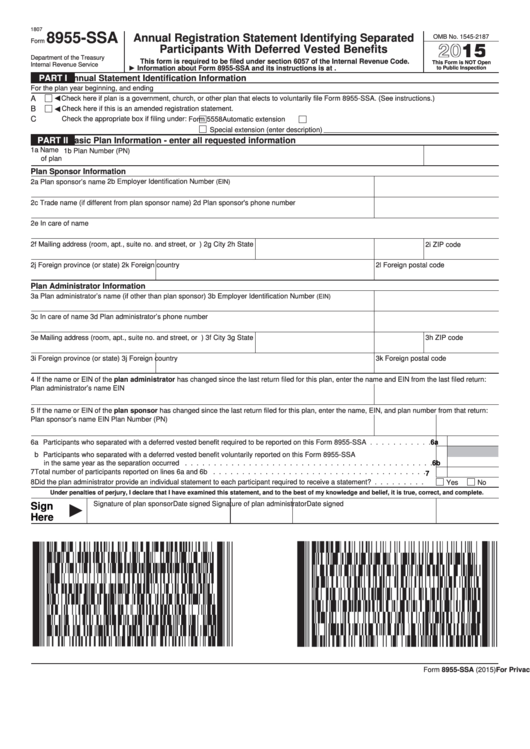

Form 8955SSA, fill out and sign the form online PDFliner

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

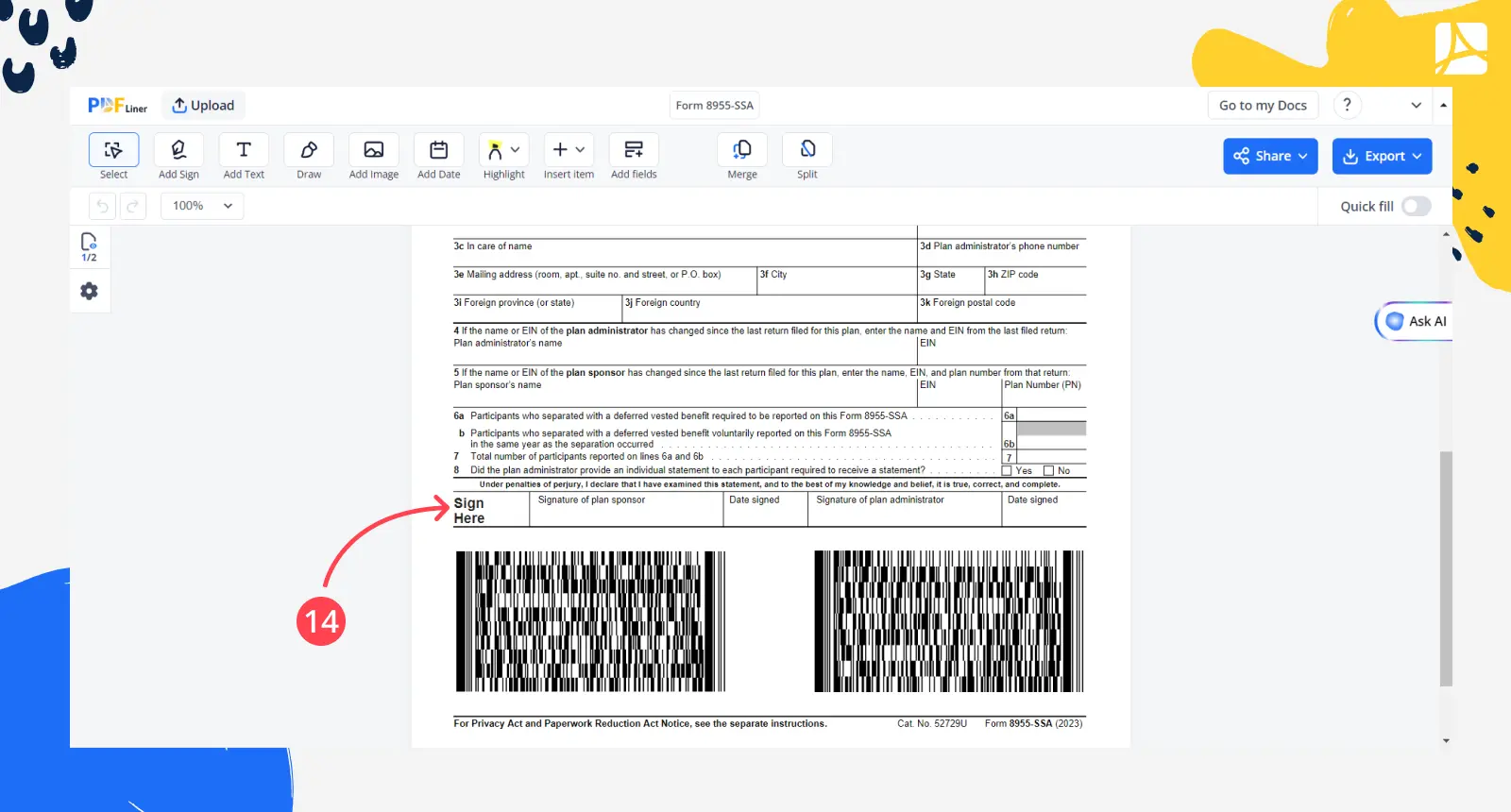

Form 8955SSA, fill out and sign the form online PDFliner

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

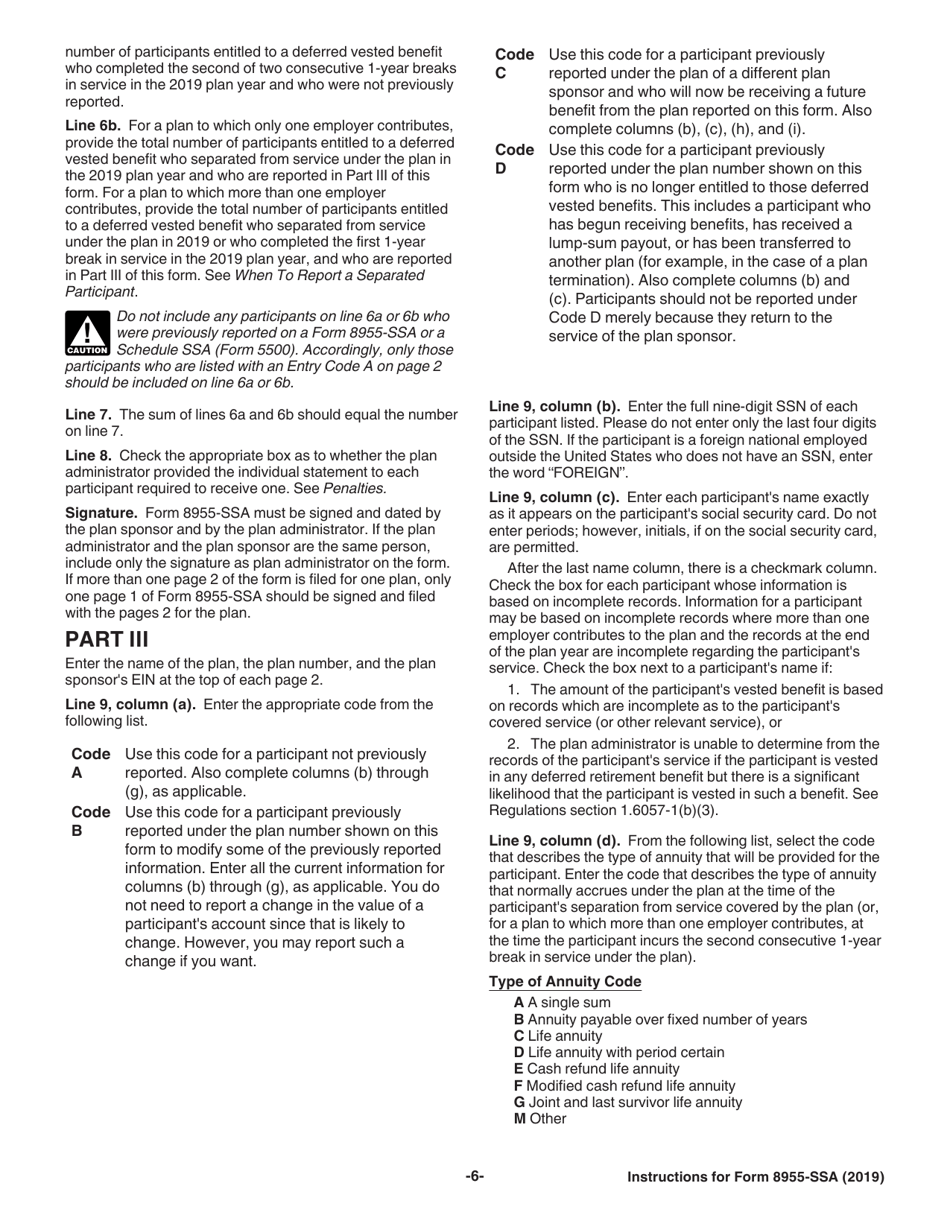

Download Instructions for IRS Form 8955SSA Annual Registration

We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955. The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer.

IRS Form 8955SSA Download Printable PDF or Fill Online Annual

We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955. The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer.

What Is Form 8955SSA? DWC

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

Top 5 Form 8955ssa Templates free to download in PDF format

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

Fillable Online Instructions for Form 8955SSA (2022) IRS Fax Email

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

Form 8955SSA What you need to know

We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955. The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer.

Fillable Online Mandatory Electronic Filing for Certain Form 8955SSA

The irs will generally waive late filing penalties for form 5500 series filers who satisfy the department of labor’s (dol) delinquent filer. We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.

The Irs Will Generally Waive Late Filing Penalties For Form 5500 Series Filers Who Satisfy The Department Of Labor’s (Dol) Delinquent Filer.

We recently contacted the irs due to several customers receiving erroneous penalty notices for filing late or incomplete form 8955.