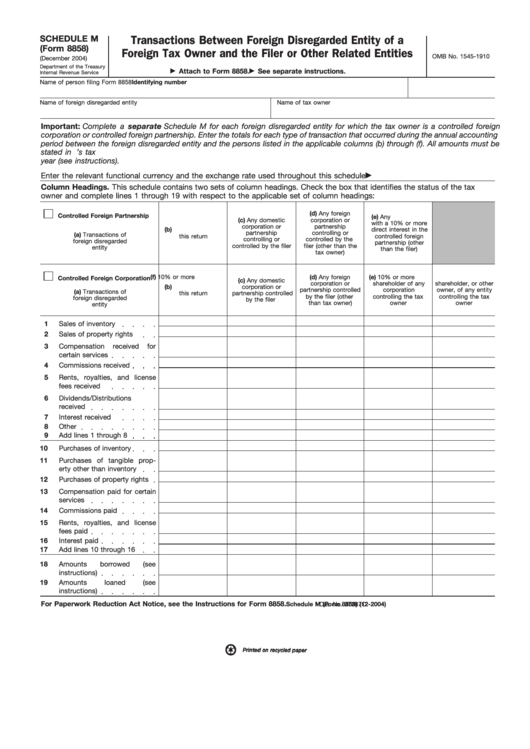

Form 8858 Schedule M

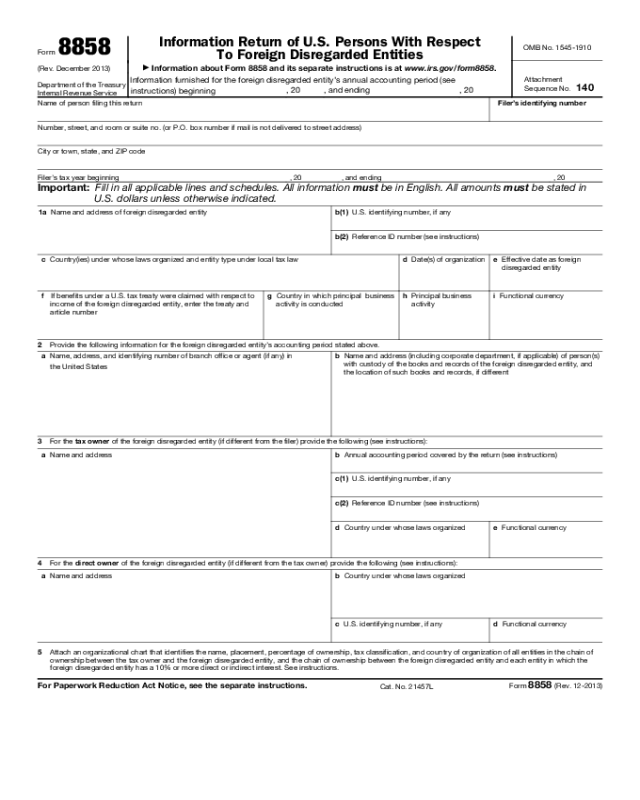

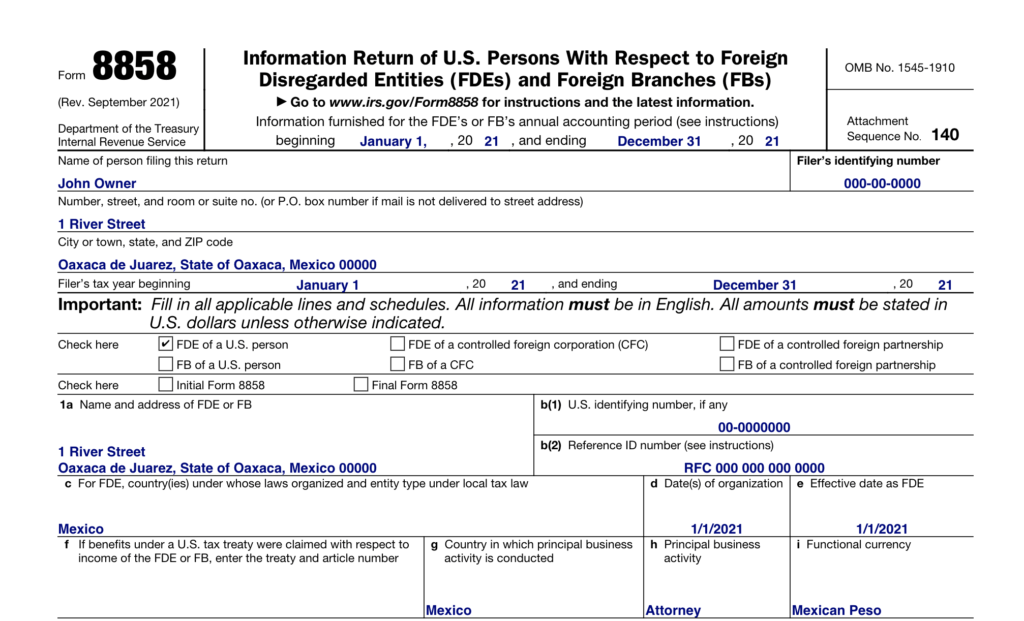

Form 8858 Schedule M - If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of the fde or operate an.

Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of the fde or operate an. If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule.

If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of the fde or operate an.

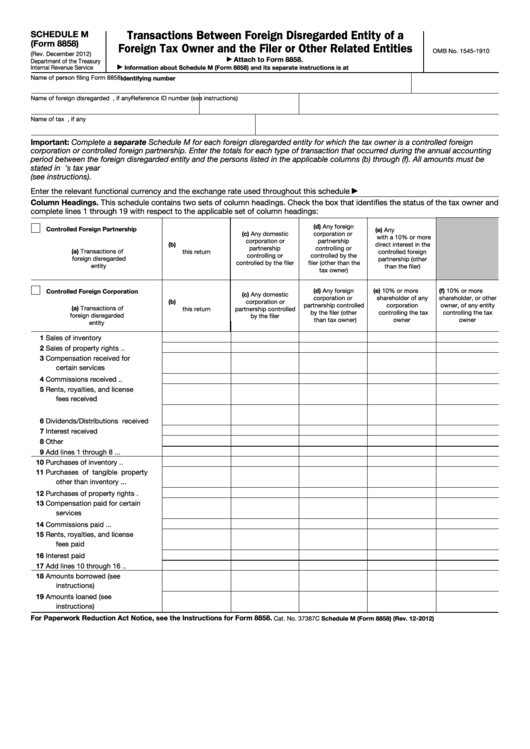

Fillable Schedule M (Form 8858) Transactions Between Foreign

If you are the tax owner of the fde or operate an. Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule.

Tax Form 8858 and Foreign Disregarded Entities for US Expats Bright

If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of the fde or operate an.

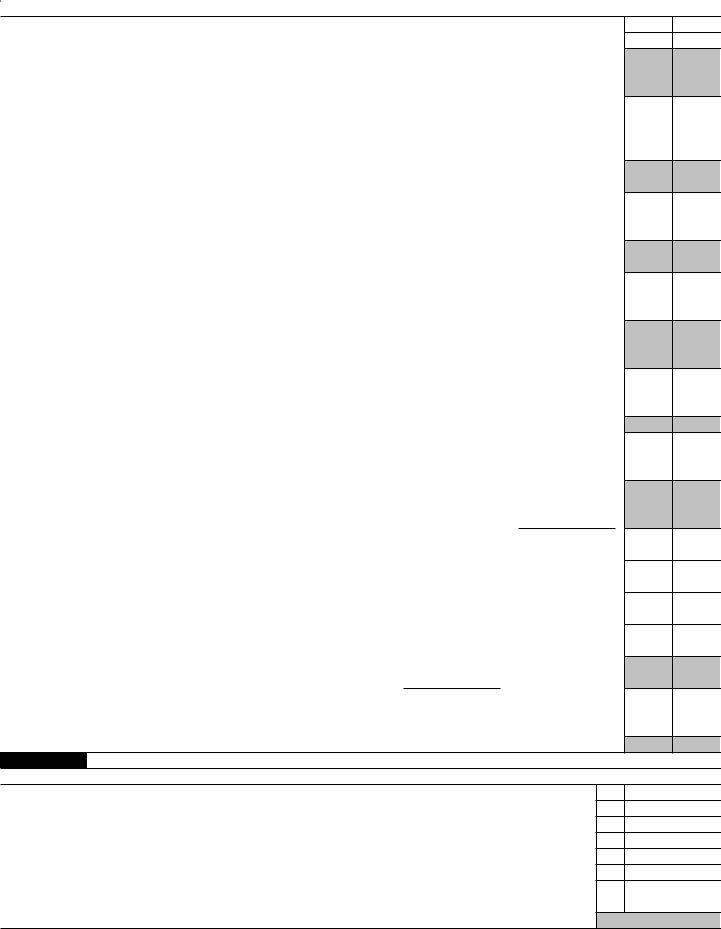

Form 8858 Fillable Printable Forms Free Online

If you are the tax owner of the fde or operate an. Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule.

Form 8858, for U.S. Expats with Foreign Rental (Guide)

Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. If you are the tax owner of the fde or operate an.

IRS Form 8858 walkthrough (Information Return of U.S. Persons with

If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. If you are the tax owner of the fde or operate an. Form 8858 is due when your income tax return or information return is due, including extensions.

Form 8858 ≡ Fill Out Printable PDF Forms Online

If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. If you are the tax owner of the fde or operate an. Form 8858 is due when your income tax return or information return is due, including extensions.

Fillable Form 8858 Schedule M Transactions Between Foreign

Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. If you are the tax owner of the fde or operate an.

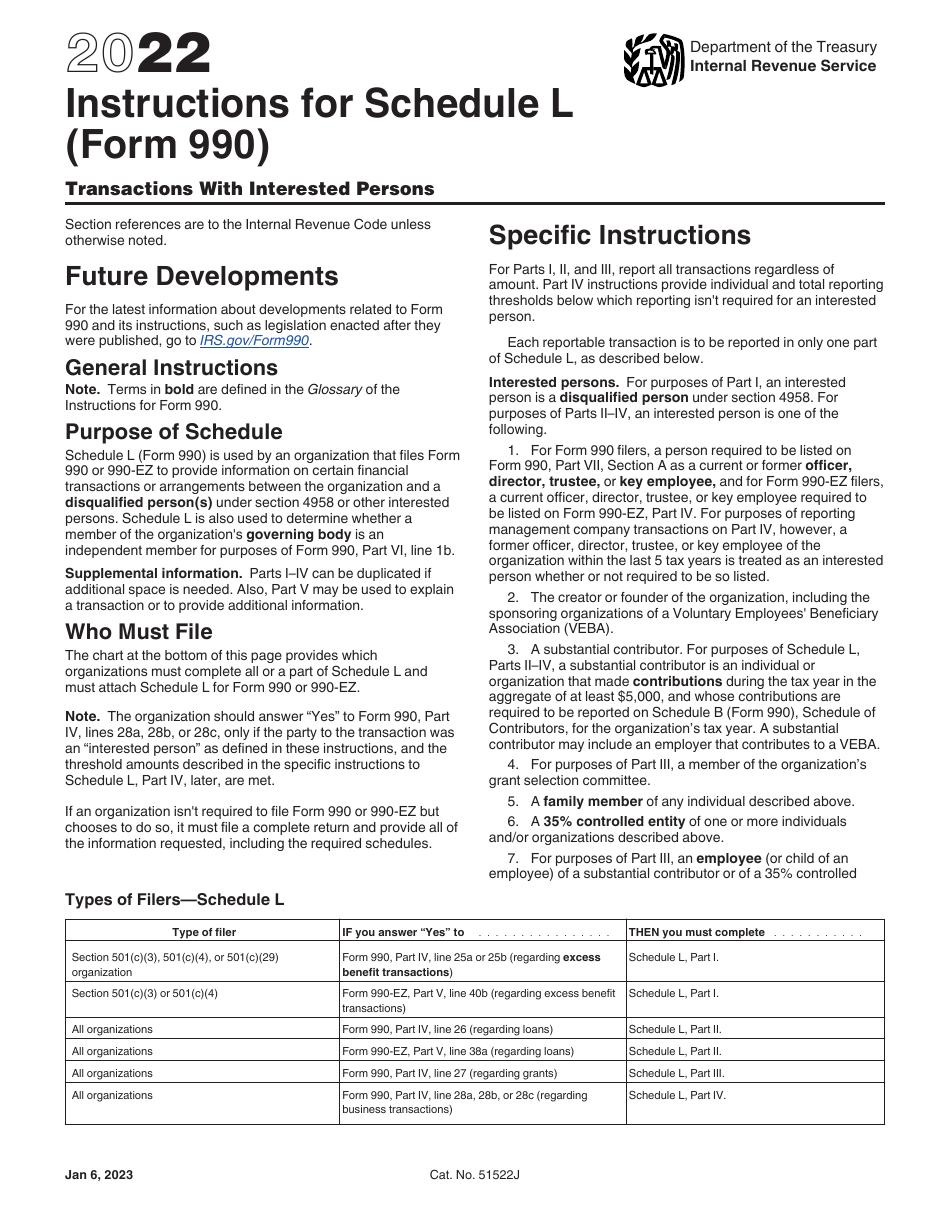

Download Instructions for IRS Form 990 Schedule L Transactions With

If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. Form 8858 is due when your income tax return or information return is due, including extensions. If you are the tax owner of the fde or operate an.

Form 8858 Fillable Printable Forms Free Online

If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. If you are the tax owner of the fde or operate an. Form 8858 is due when your income tax return or information return is due, including extensions.

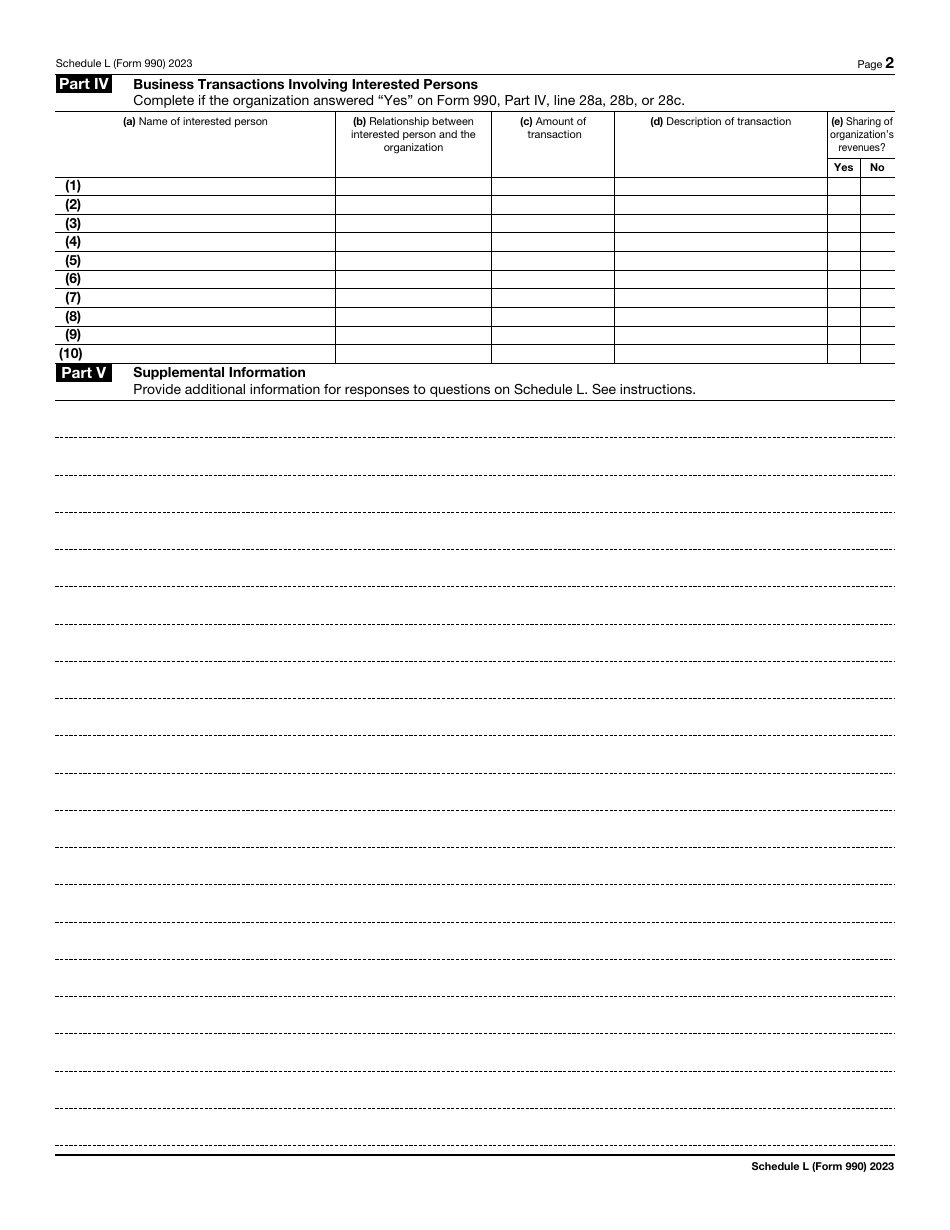

IRS Form 990 Schedule L Download Fillable PDF or Fill Online

If you are the tax owner of the fde or operate an. If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. Form 8858 is due when your income tax return or information return is due, including extensions.

If You Are The Tax Owner Of The Fde Or Operate An.

If you are the tax owner of a foreign disregarded entity or operate a fb, you need to submit form 8858 and, if applicable, the separate schedule. Form 8858 is due when your income tax return or information return is due, including extensions.