Form 8832 Due Date

Form 8832 Due Date - Form 8832 must be filed between one year prior and 75 days after its effective date. Most llcs want their form 8832 to be effective. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Llcs can file form 8832, entity classification election to elect their business entity classification.

Llcs can file form 8832, entity classification election to elect their business entity classification. Most llcs want their form 8832 to be effective. Form 8832 must be filed between one year prior and 75 days after its effective date. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file.

Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Llcs can file form 8832, entity classification election to elect their business entity classification. Most llcs want their form 8832 to be effective. Form 8832 must be filed between one year prior and 75 days after its effective date.

Form 8832 Fillable Pdf Printable Forms Free Online

Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Most llcs want their form 8832 to be effective. Form 8832 must be filed between one year prior and 75 days after its effective date. Llcs can file form 8832, entity classification election to elect their business entity classification.

Does IRS Form 8832 Make Your Tax Return Simple?

Llcs can file form 8832, entity classification election to elect their business entity classification. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Form 8832 must be filed between one year prior and 75 days after its effective date. Most llcs want their form 8832 to be effective.

IRS Form 8832 Instructions Entity Classification Election

Most llcs want their form 8832 to be effective. Llcs can file form 8832, entity classification election to elect their business entity classification. Form 8832 must be filed between one year prior and 75 days after its effective date. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file.

Form 8832 Instruction 2024 2025

Form 8832 must be filed between one year prior and 75 days after its effective date. Most llcs want their form 8832 to be effective. Llcs can file form 8832, entity classification election to elect their business entity classification. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file.

Irs Form 8832 Fillable Form Printable Forms Free Online

Most llcs want their form 8832 to be effective. Form 8832 must be filed between one year prior and 75 days after its effective date. Llcs can file form 8832, entity classification election to elect their business entity classification. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file.

What is Form 8832? An Essential Guide for Small Business Owners The

Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Llcs can file form 8832, entity classification election to elect their business entity classification. Form 8832 must be filed between one year prior and 75 days after its effective date. Most llcs want their form 8832 to be effective.

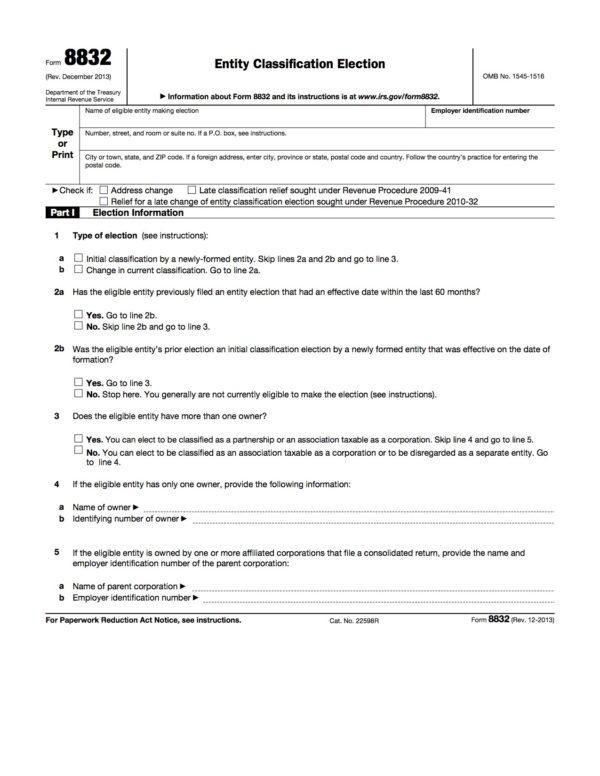

Form 8832 Entity Classification Election

Llcs can file form 8832, entity classification election to elect their business entity classification. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Form 8832 must be filed between one year prior and 75 days after its effective date. Most llcs want their form 8832 to be effective.

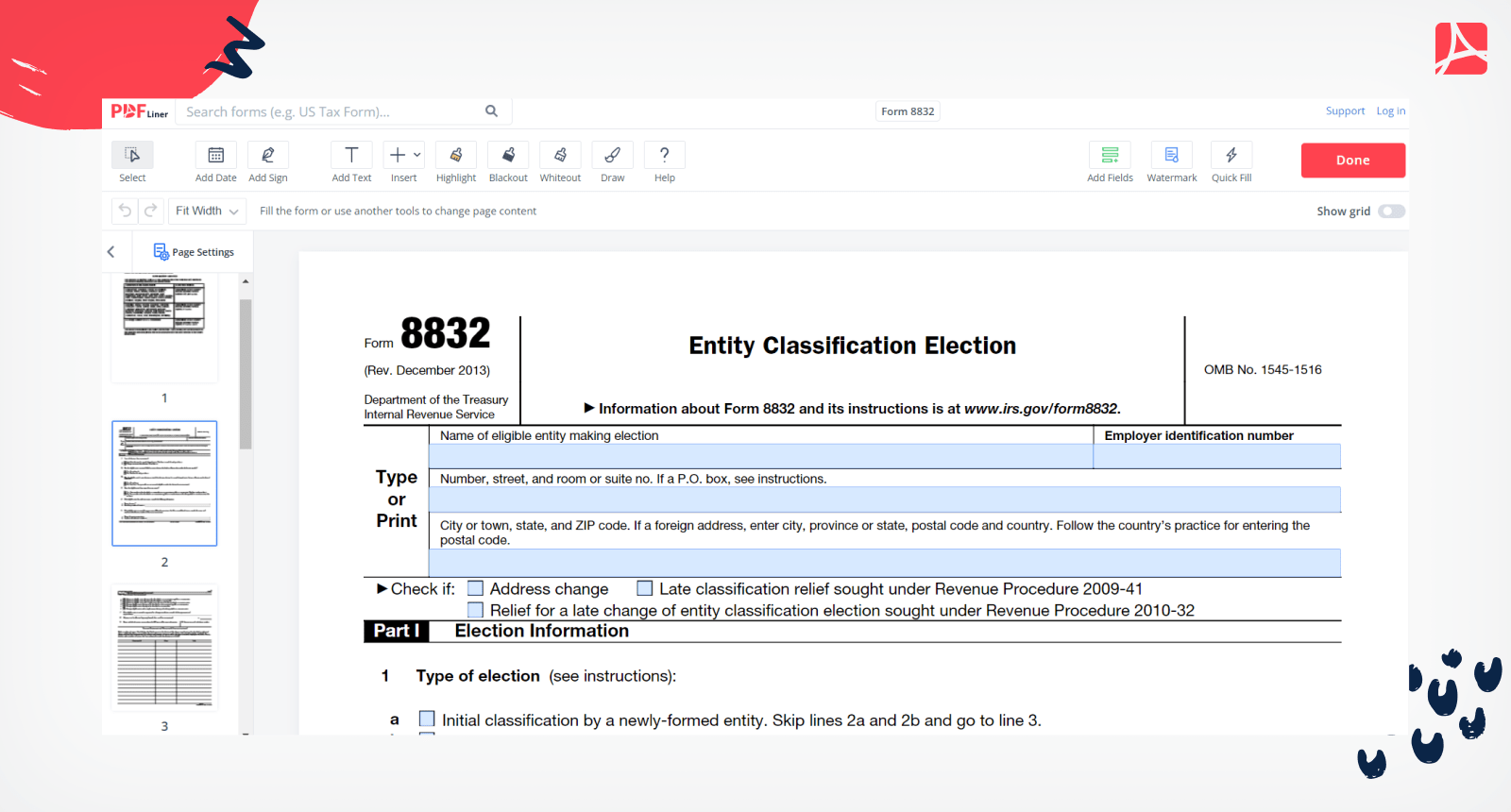

Form 8832 Fillable and Printable blank PDFline

Llcs can file form 8832, entity classification election to elect their business entity classification. Form 8832 must be filed between one year prior and 75 days after its effective date. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Most llcs want their form 8832 to be effective.

Form 8832 Fillable Pdf Printable Forms Free Online

Most llcs want their form 8832 to be effective. Form 8832 must be filed between one year prior and 75 days after its effective date. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Llcs can file form 8832, entity classification election to elect their business entity classification.

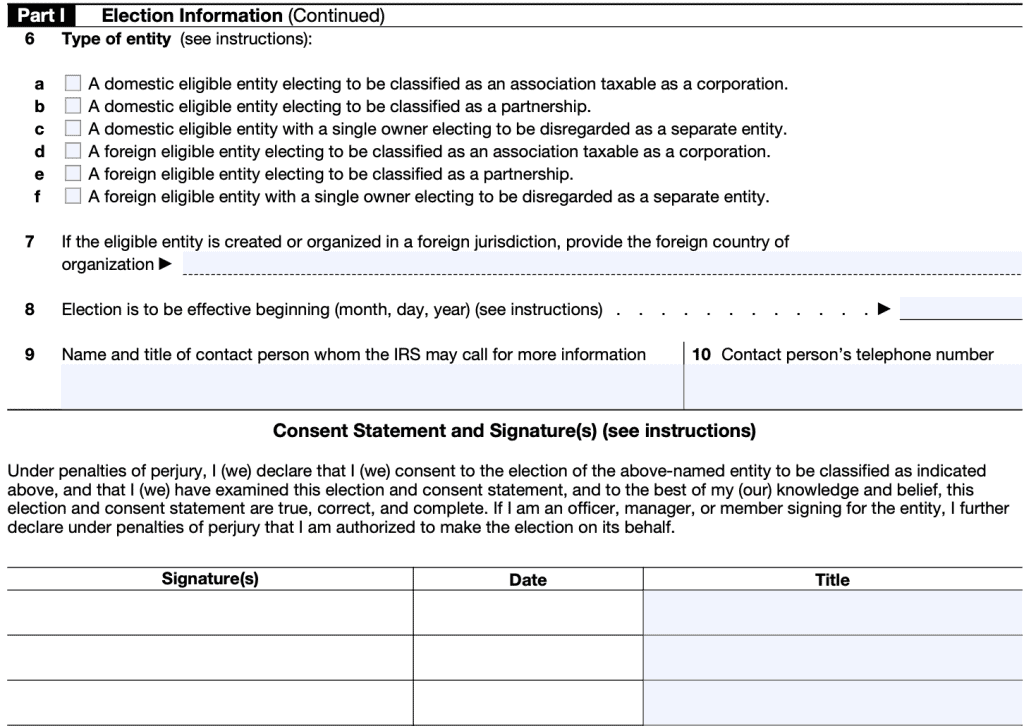

What is Form 8832?

Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Form 8832 must be filed between one year prior and 75 days after its effective date. Llcs can file form 8832, entity classification election to elect their business entity classification. Most llcs want their form 8832 to be effective.

Form 8832 Must Be Filed Between One Year Prior And 75 Days After Its Effective Date.

Most llcs want their form 8832 to be effective. Information about form 8832, entity classification election, including recent updates, related forms, and instructions on how to file. Llcs can file form 8832, entity classification election to elect their business entity classification.