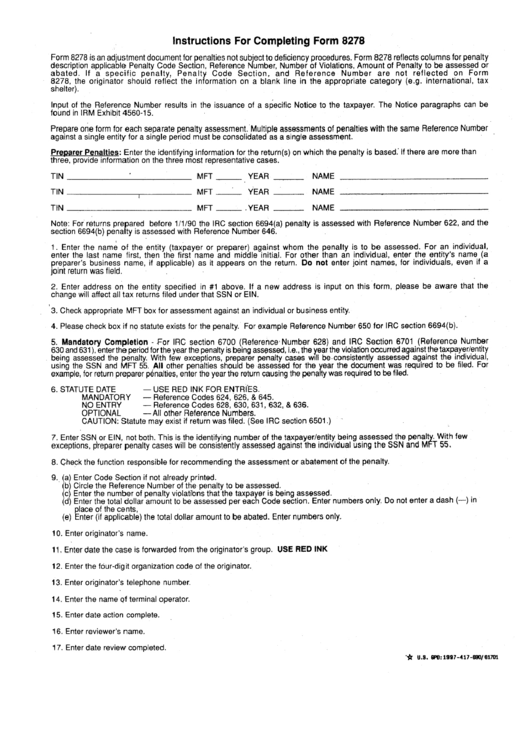

Form 8278 Irs

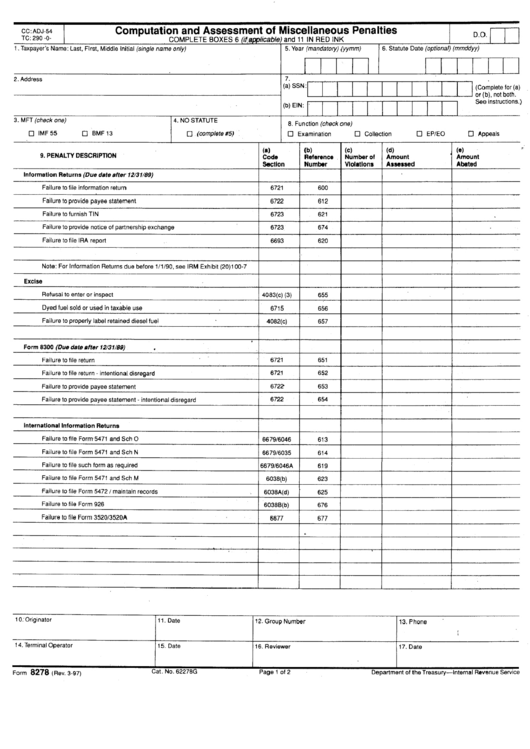

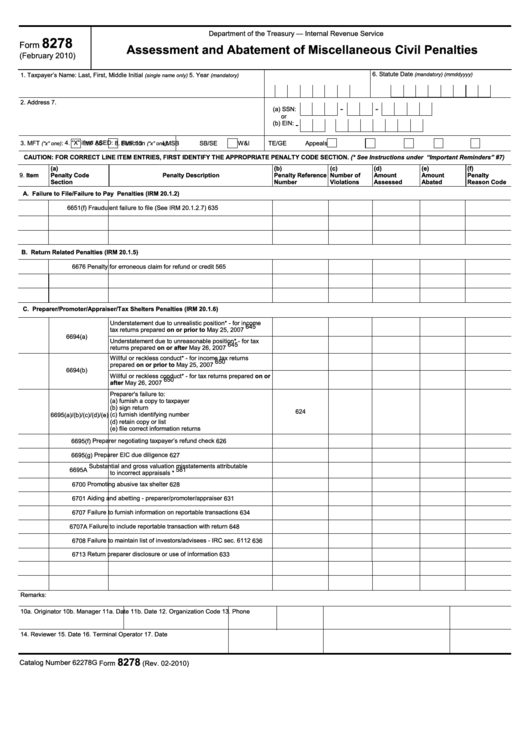

Form 8278 Irs - Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties.

The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and.

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of.

Tax Season 2023 File Your Taxes for Free With This IRS Program

Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278, assessment and abatement of.

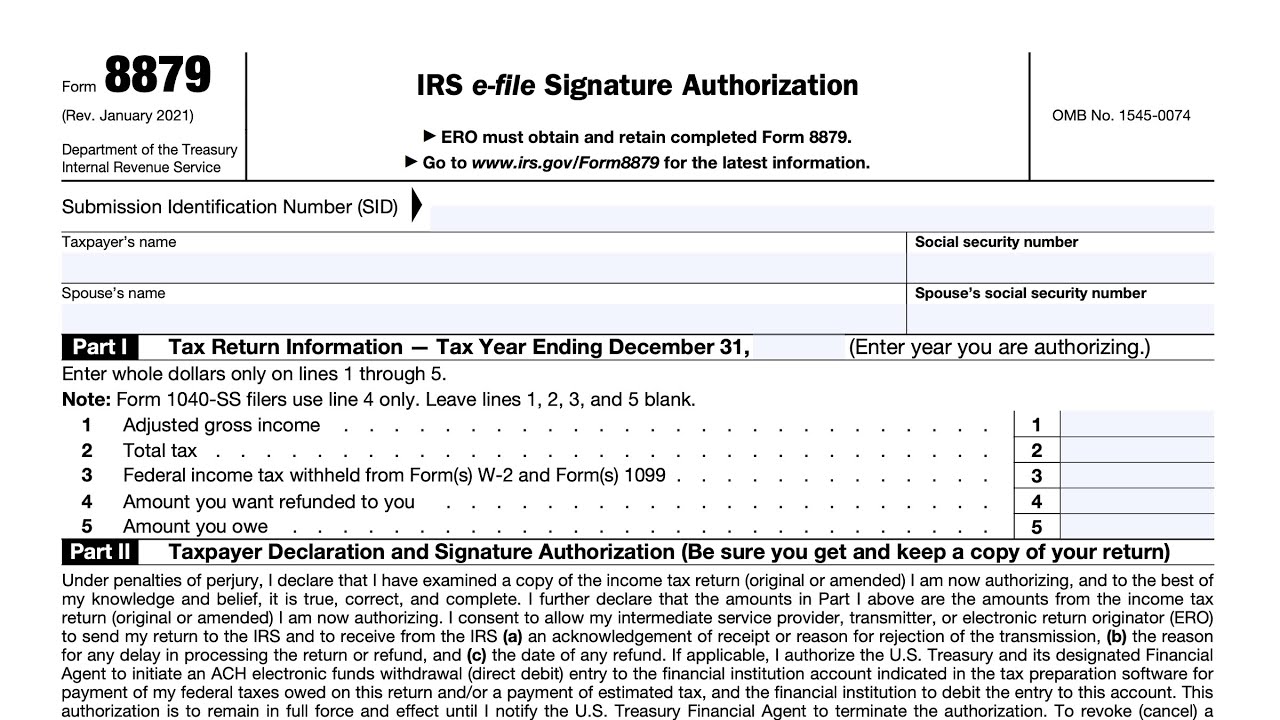

IRS Form 8879 walkthrough (IRS efile Signature Authorization) YouTube

When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties..

Form 8278 Computation And Assessment Of Miscellaneous Penalties

Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278, assessment and.

Fillable Online irs irs Fax Email Print pdfFiller

When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties..

IRS FORM 5498 Automated Systems, Inc.

The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. When you receive an.

Fillable Form 8278 Assessment And Abatement Of Miscellaneous Civil

The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties. When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Multiple assessments.

A Frivolous Return Penalty Fraud

When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties..

IRS Form 8275 Walkthrough (Disclosure Statement) YouTube

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. Multiple assessments of identical penalties for the same taxpayer in the same tax period may.

Form 8278 Assessment And Abatement Of Miscellaneous Civil Penalties

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. The examiner.

2018 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. The examiner will prepare an assessment document, form 8278, computation and assessment.

Form 8278, Assessment And Abatement Of Miscellaneous Civil Penalties, Requires That Both The Originator And Supervisor Sign And Date.

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Multiple assessments of identical penalties for the same taxpayer in the same tax period may be consolidated on form 8278, assessment and. The examiner will prepare an assessment document, form 8278, computation and assessment of miscellaneous penalties. When you receive an irs penalty for failure to pay or file taxes, interest accrues on the penalty amount as well as on the amount of.