Form 8275 Example

Form 8275 Example - Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. Name of foreign entity employer identification. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose.

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Name of foreign entity employer identification. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose.

For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. Name of foreign entity employer identification. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter:

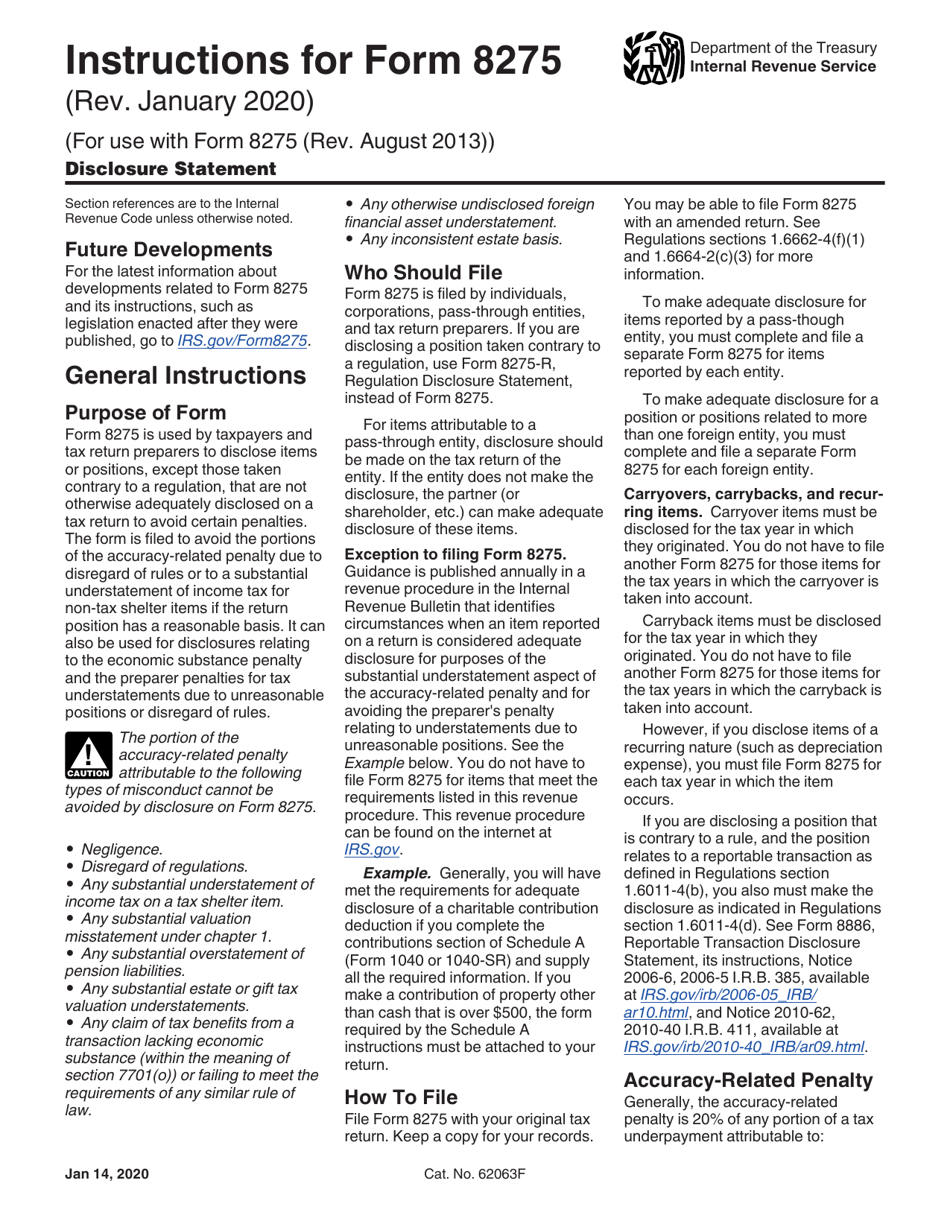

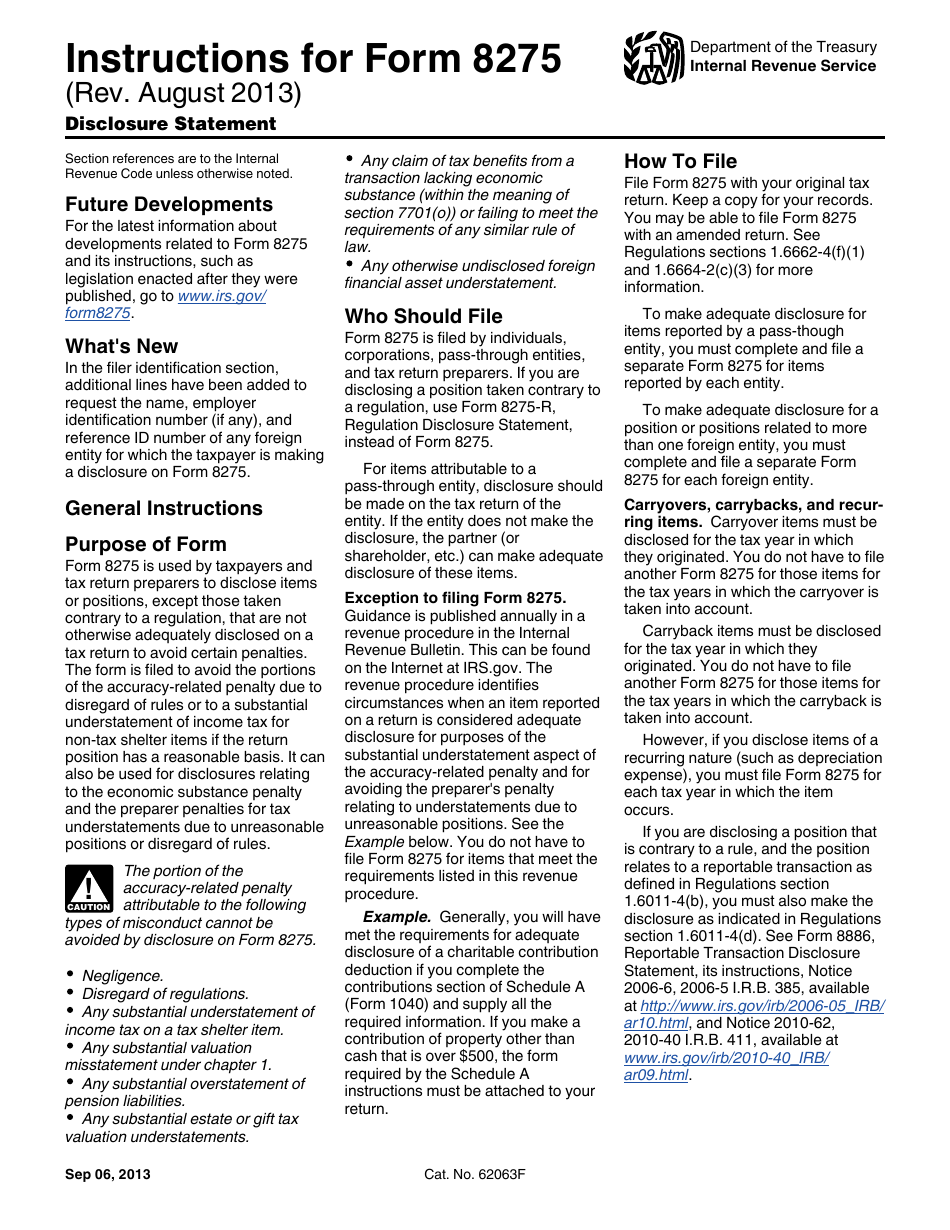

Download Instructions for IRS Form 8275 Disclosure Statement PDF

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to.

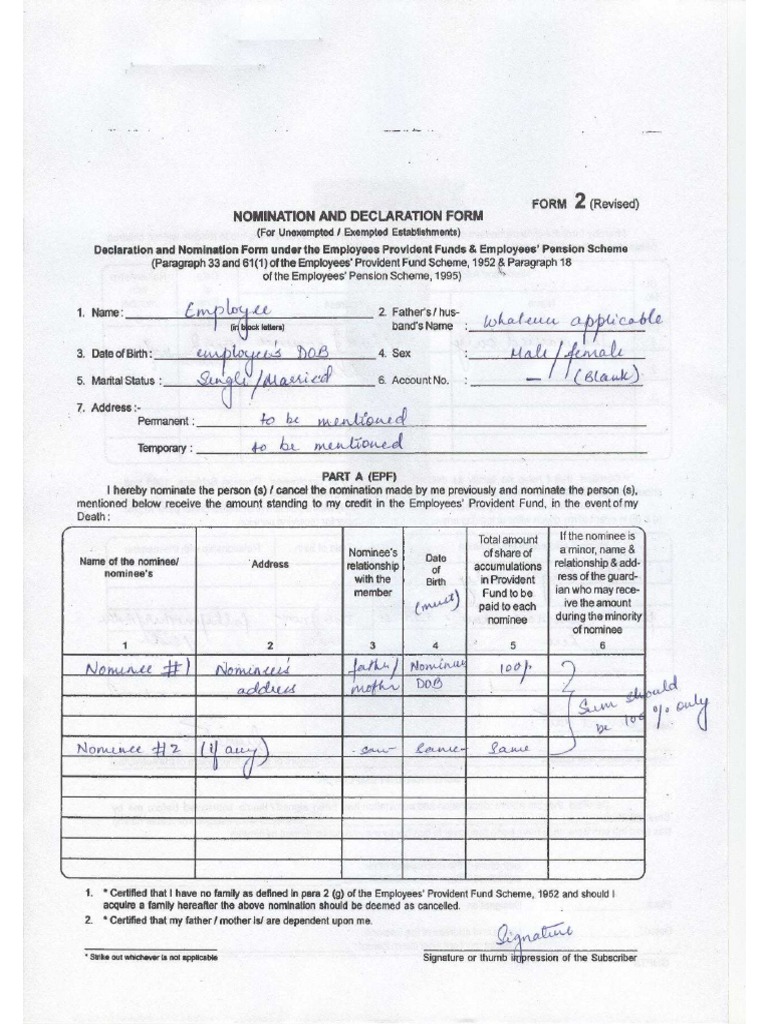

Sample Form 2 PDF

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Name of foreign entity employer identification. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except.

Proof Of Form From Employer Free Printable Documents

Name of foreign entity employer identification. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. For those of you not familiar with disclosure statement, form 8275 is used by.

What Crypto Tax Forms Should I File?

Name of foreign entity employer identification. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. If form 8275 relates to an information return for a.

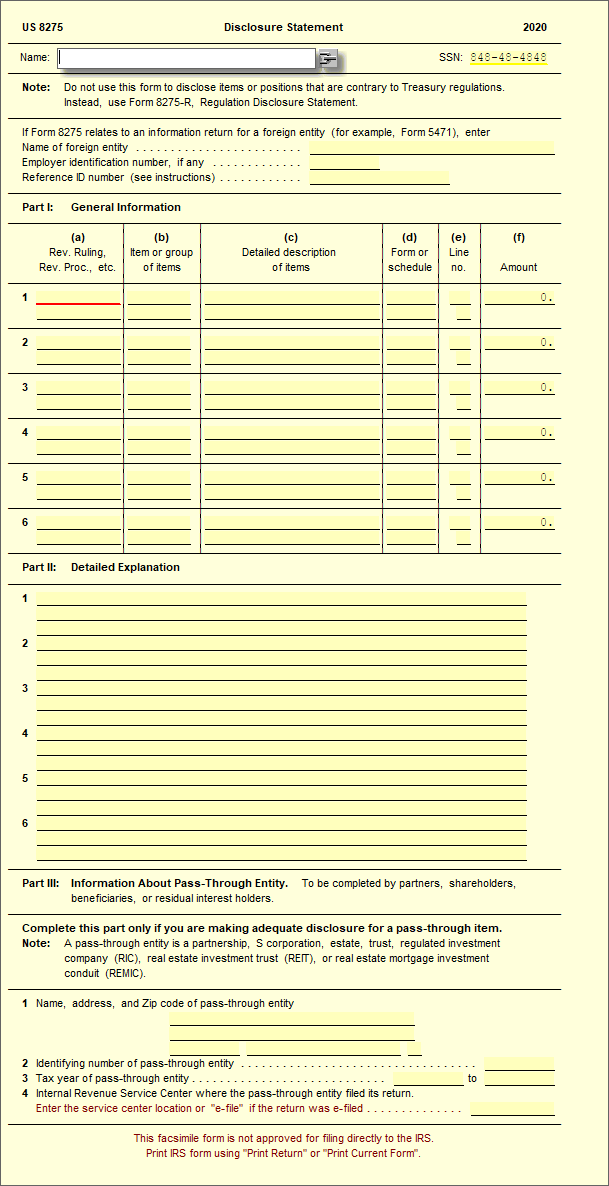

8275 Disclosure Statement UltimateTax Solution Center

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Name of foreign entity employer identification. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except.

Download Instructions for IRS Form 8275 Disclosure Statement PDF

For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Name of foreign entity employer identification. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. If form 8275 relates to an information return for a.

Form 8275 Disclosure Statement (2013) Free Download

For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Name of foreign entity employer identification. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. If form 8275 relates to an information return for a.

IRS Form 8275 Walkthrough (Disclosure Statement) YouTube

Name of foreign entity employer identification. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. For those of you not familiar with disclosure statement, form 8275 is used by.

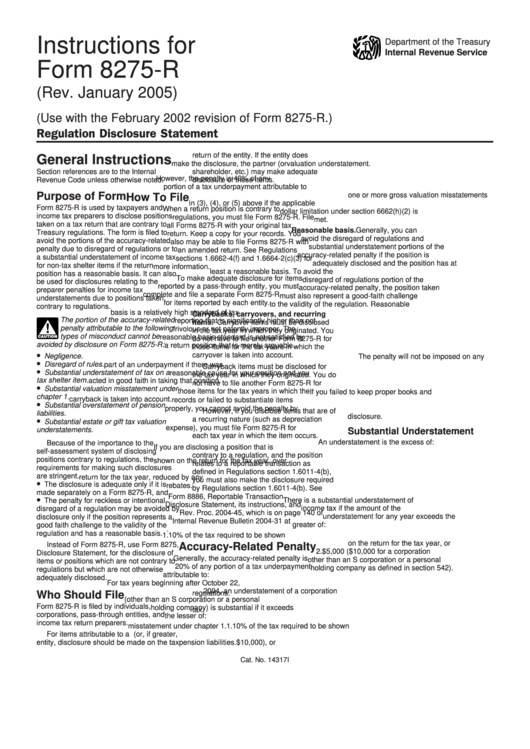

Instructions For Form 8275R Regulation Disclosure Statement

Name of foreign entity employer identification. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: For those of you not familiar with disclosure statement, form 8275 is used by.

Form 8275 Disclosure Statement (2013) Free Download

Name of foreign entity employer identification. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. If form 8275 relates to an information return for a.

Name Of Foreign Entity Employer Identification.

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that.