Form 760C Line 3

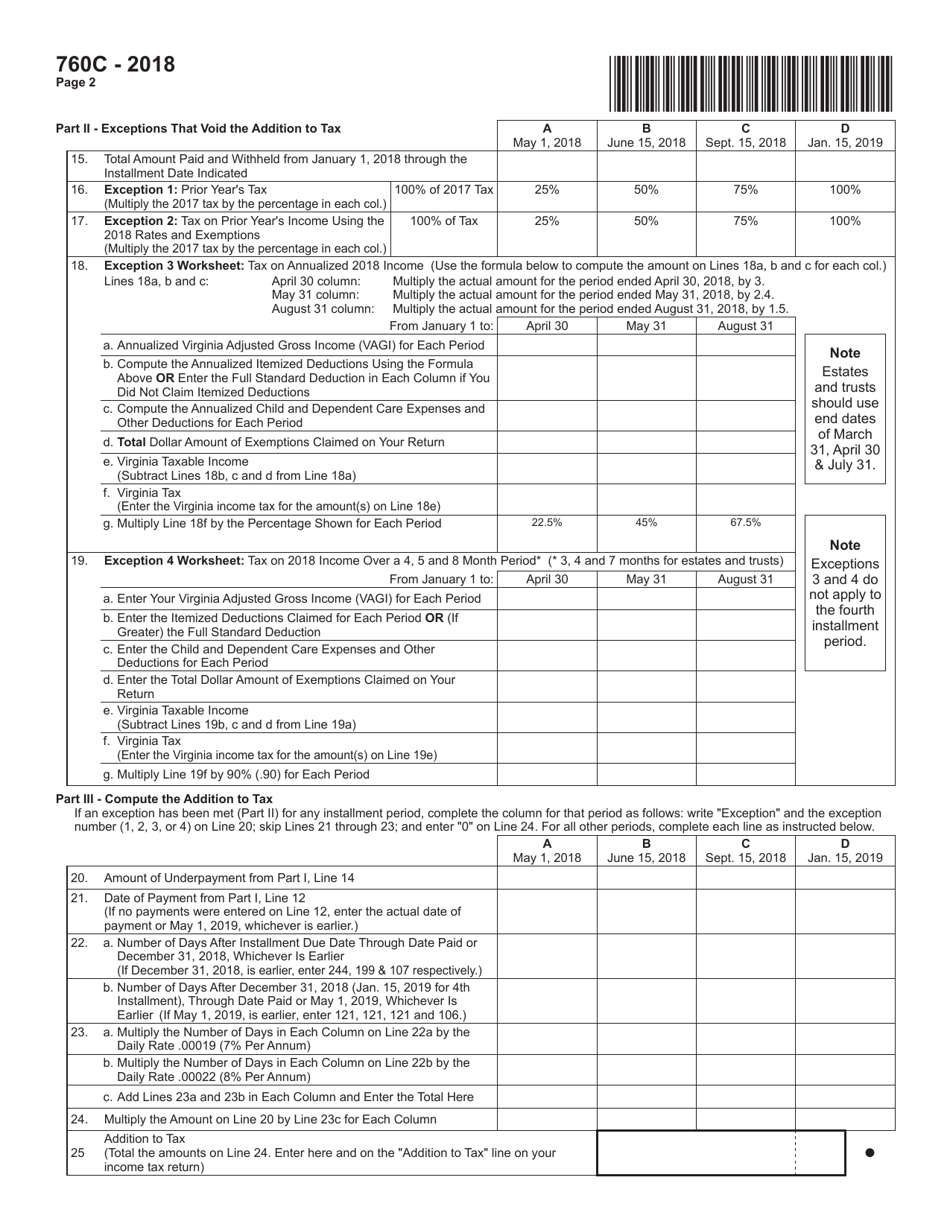

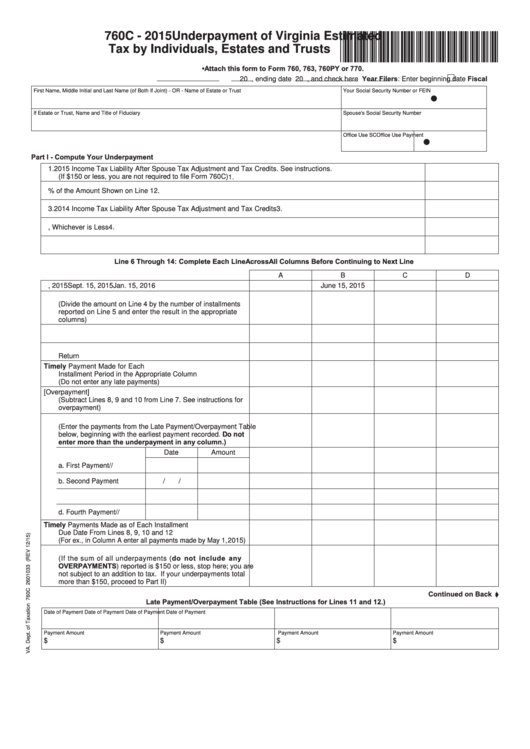

Form 760C Line 3 - Skip lines 21 through 23; • attach this form to form 760, 763, 760py or 770. You are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less,. And enter 0 on line 24. This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts. 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. For all other periods, complete each line as instructed below. Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe an addition to tax. Number (1, 2, 3, or 4) on line 20;

Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe an addition to tax. This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts. • attach this form to form 760, 763, 760py or 770. Skip lines 21 through 23; And enter 0 on line 24. You are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less,. Number (1, 2, 3, or 4) on line 20; 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. For all other periods, complete each line as instructed below.

Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe an addition to tax. You are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less,. And enter 0 on line 24. For all other periods, complete each line as instructed below. 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts. • attach this form to form 760, 763, 760py or 770. Skip lines 21 through 23; Number (1, 2, 3, or 4) on line 20;

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

• attach this form to form 760, 763, 760py or 770. 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. Skip lines 21 through 23; For all other periods, complete each line as instructed below. Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe.

Casio Film Card SL760c Calculator Slim Pocket Vintage In Original

Number (1, 2, 3, or 4) on line 20; This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts. And enter 0 on line 24. Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe an addition to tax. For all other.

Va Tax Form 2023

Number (1, 2, 3, or 4) on line 20; • attach this form to form 760, 763, 760py or 770. Skip lines 21 through 23; And enter 0 on line 24. 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,.

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Skip lines 21 through 23; And enter 0 on line 24. This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts. • attach this form to form 760, 763, 760py or 770. You are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment.

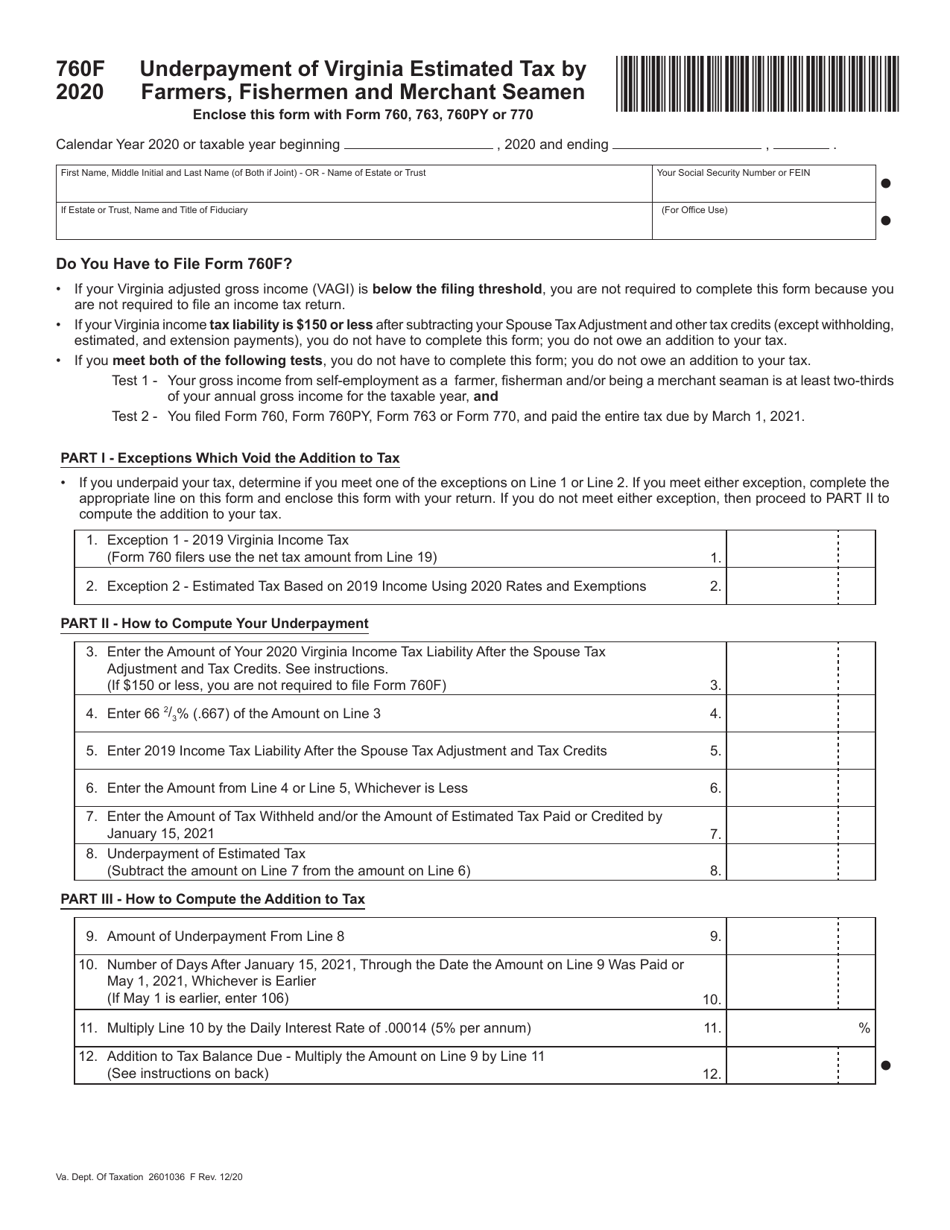

Form 760F 2020 Fill Out, Sign Online and Download Fillable PDF

For all other periods, complete each line as instructed below. Number (1, 2, 3, or 4) on line 20; You are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less,. 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,..

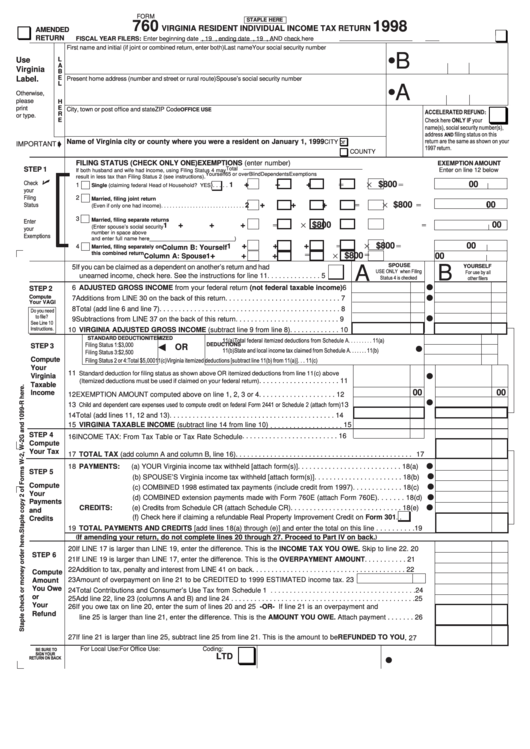

Virginia Form 760 Fillable Pdf Printable Forms Free Online

For all other periods, complete each line as instructed below. 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. Skip lines 21 through 23; And enter 0 on line 24. This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts.

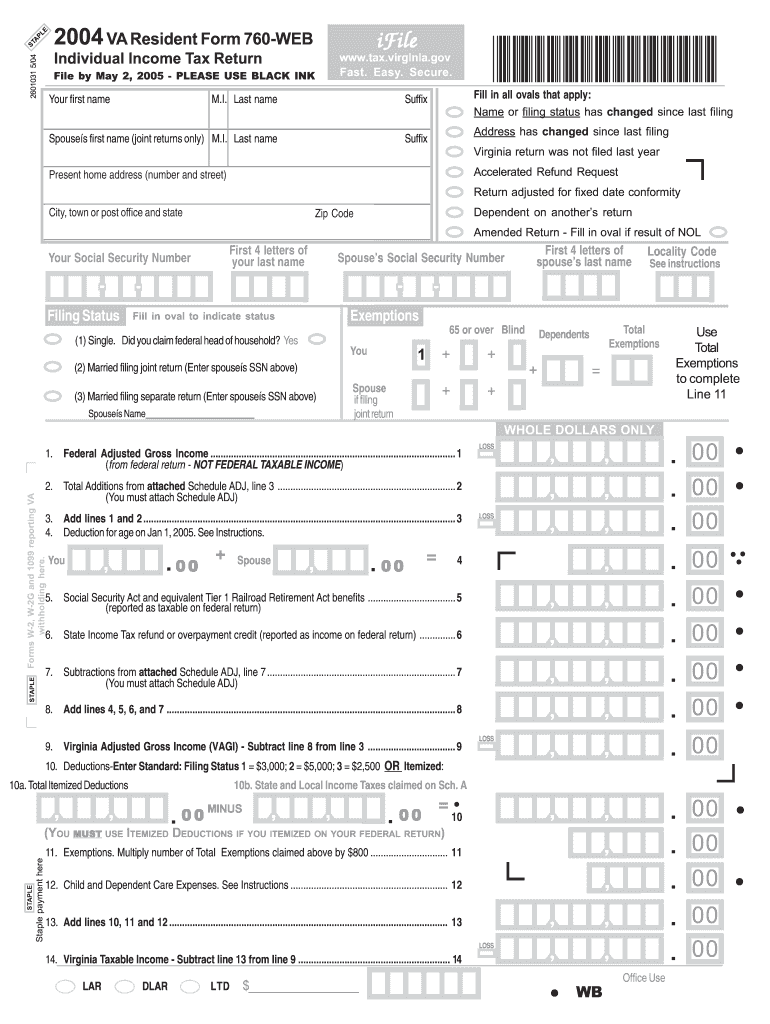

VA DoT 760 2004 Fill out Tax Template Online US Legal Forms

This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts. And enter 0 on line 24. For all other periods, complete each line as instructed below. Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe an addition to tax. Skip lines.

Form 760c line 3 Fill out & sign online DocHub

2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. You are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less,. Skip lines 21 through 23; For all other periods, complete each line as instructed below. And enter 0 on.

Virginia Tax Payments 2023 Online

Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe an addition to tax. Number (1, 2, 3, or 4) on line 20; Skip lines 21 through 23; 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. For all other periods, complete each line as.

Form 760 Es ≡ Fill Out Printable PDF Forms Online

This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts. • attach this form to form 760, 763, 760py or 770. Number (1, 2, 3, or 4) on line 20; Learn how to use form 760c to determine if you underpaid your virginia estimated tax and whether you owe an addition.

Learn How To Use Form 760C To Determine If You Underpaid Your Virginia Estimated Tax And Whether You Owe An Addition To Tax.

• attach this form to form 760, 763, 760py or 770. 2024 income tax liability after spouse tax adjustment and tax credits (if $150 or less,. And enter 0 on line 24. This form is used to compute and pay the underpayment of virginia income tax by individuals, estates and trusts.

Skip Lines 21 Through 23;

Number (1, 2, 3, or 4) on line 20; You are not required to file form 760c if your income tax liability (after subtracting the spouse tax adjustment and tax credits) is $150 or less,. For all other periods, complete each line as instructed below.