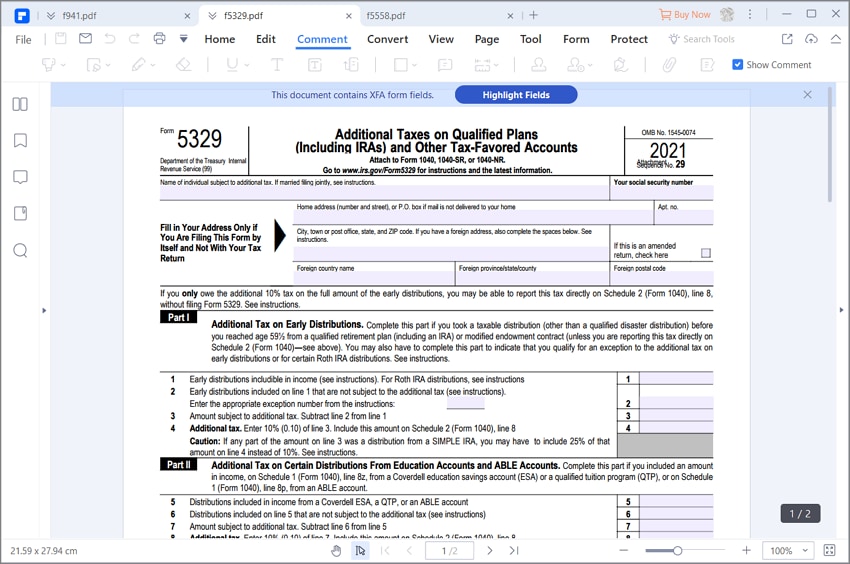

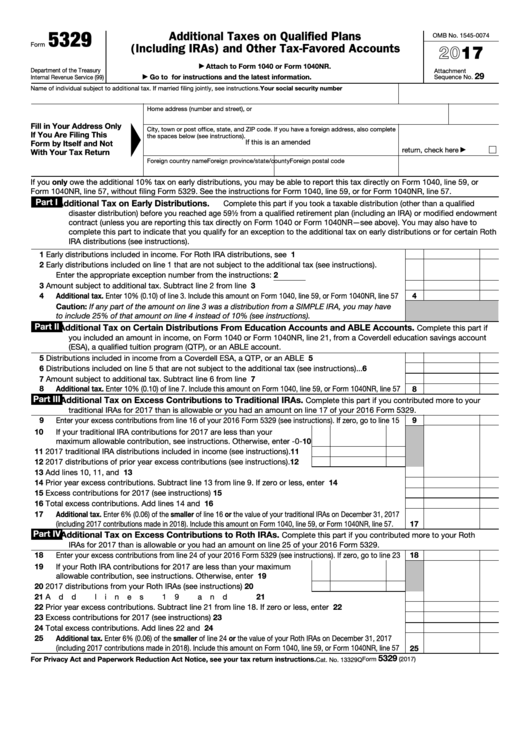

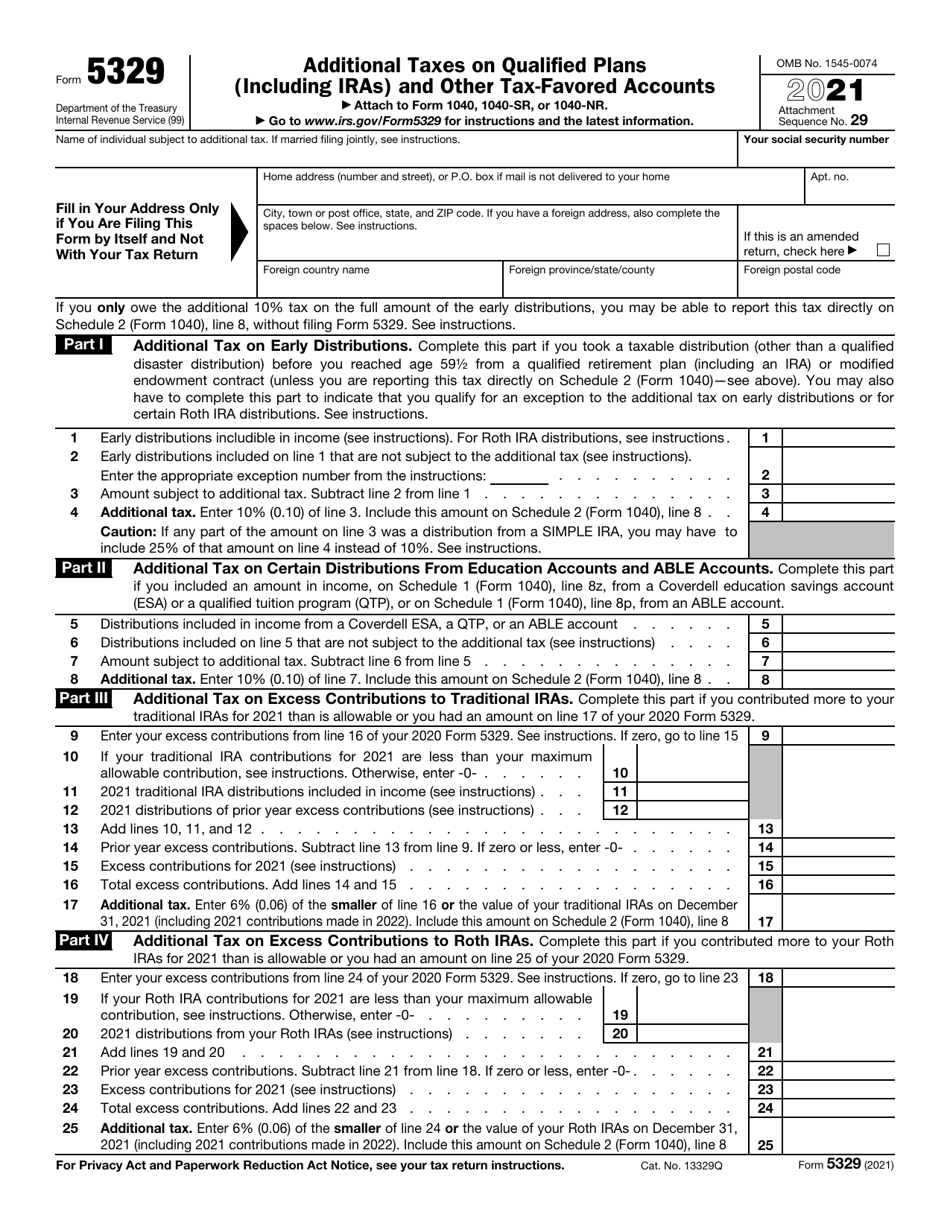

Form 5329 Turbotax

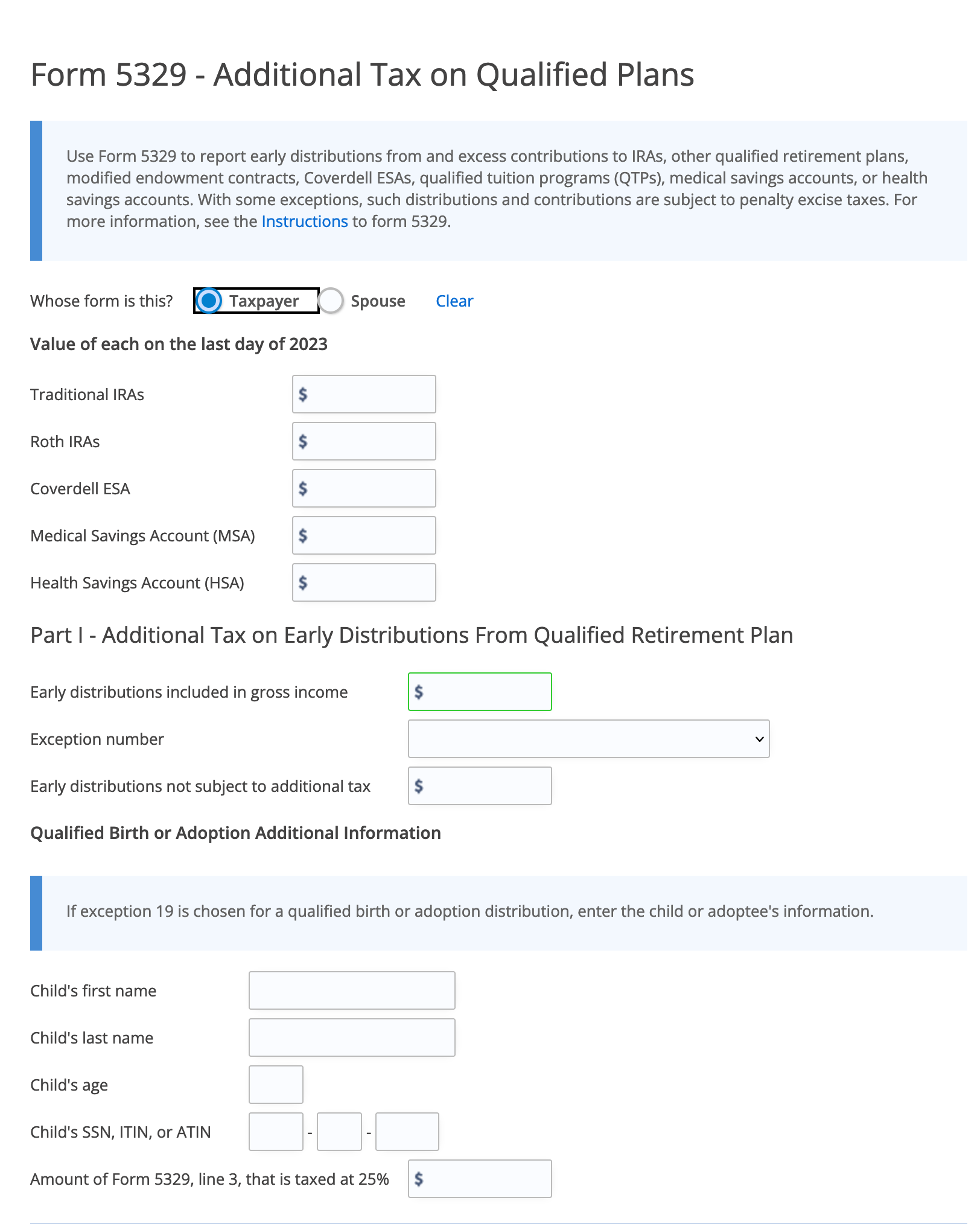

Form 5329 Turbotax - You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return.

You will get a 2022. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return.

How to Fill in IRS Form 5329

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022.

Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022.

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on

You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return.

IRS Tax Form 5329 Explained Lively

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

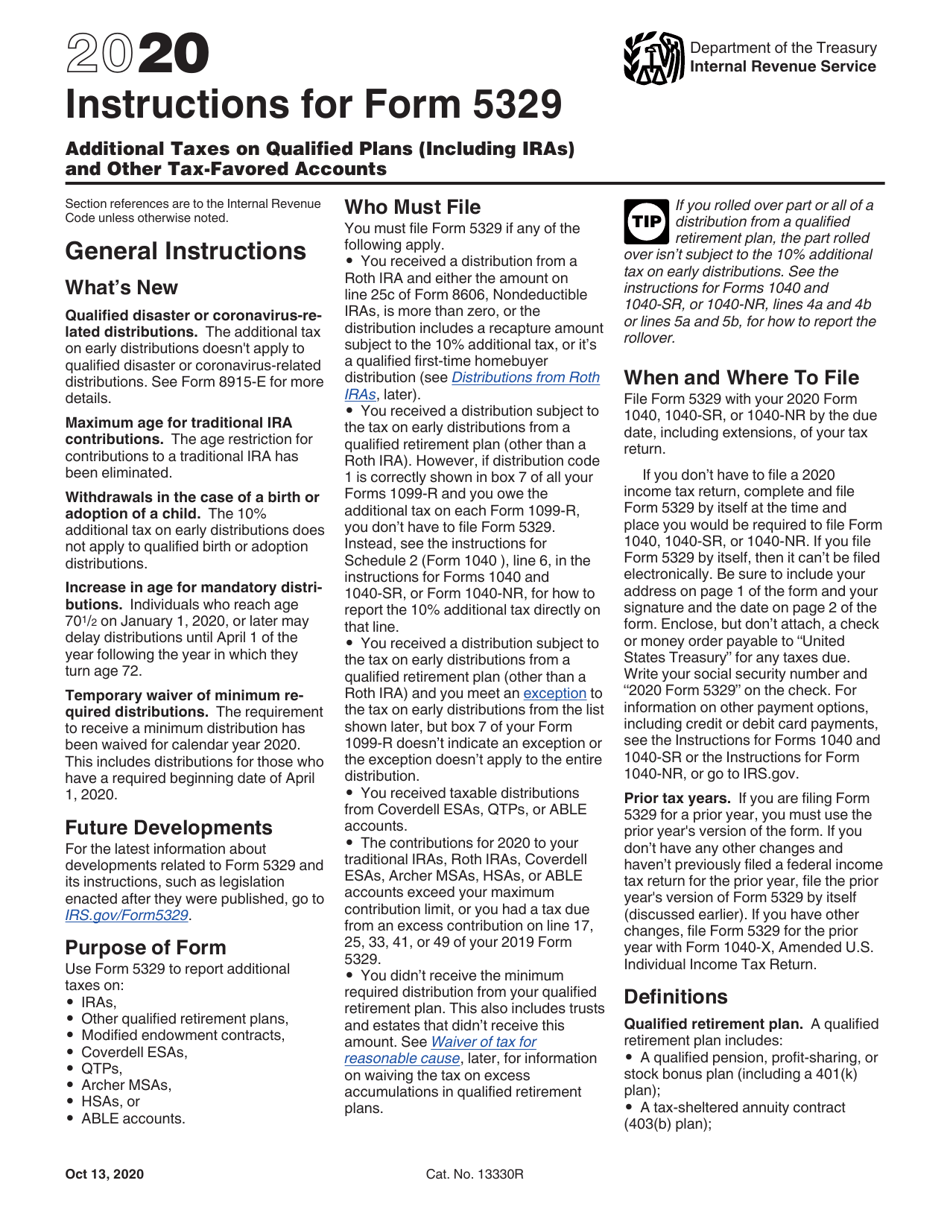

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return.

W9 Form 2024 Irs.Gov Dorie Geralda

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

When to file form 5329. Taxes on Qualified Plans

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022.

IRS Form 5329 walkthrough (Additional Taxes on Qualified Plans and

You will get a 2022. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

Irs Form 5329 Can Be Reported For Both The Taxpayer And The Spouse In A Married Filing Jointly Tax Return.

You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.