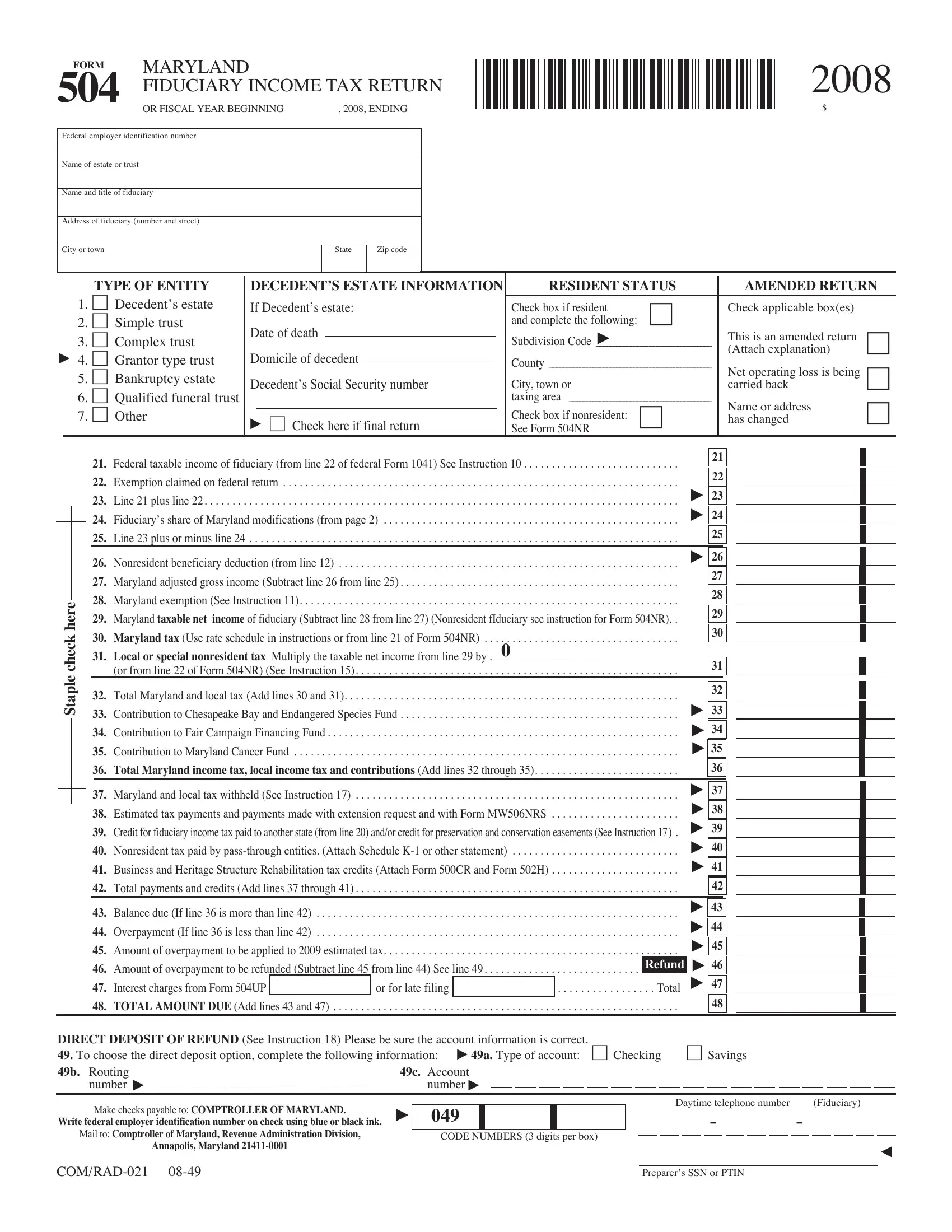

Form 504 Maryland

Form 504 Maryland - If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. Form 504 that you submit to the comptroller of maryland. Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the.

Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. Form 504 that you submit to the comptroller of maryland. Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504.

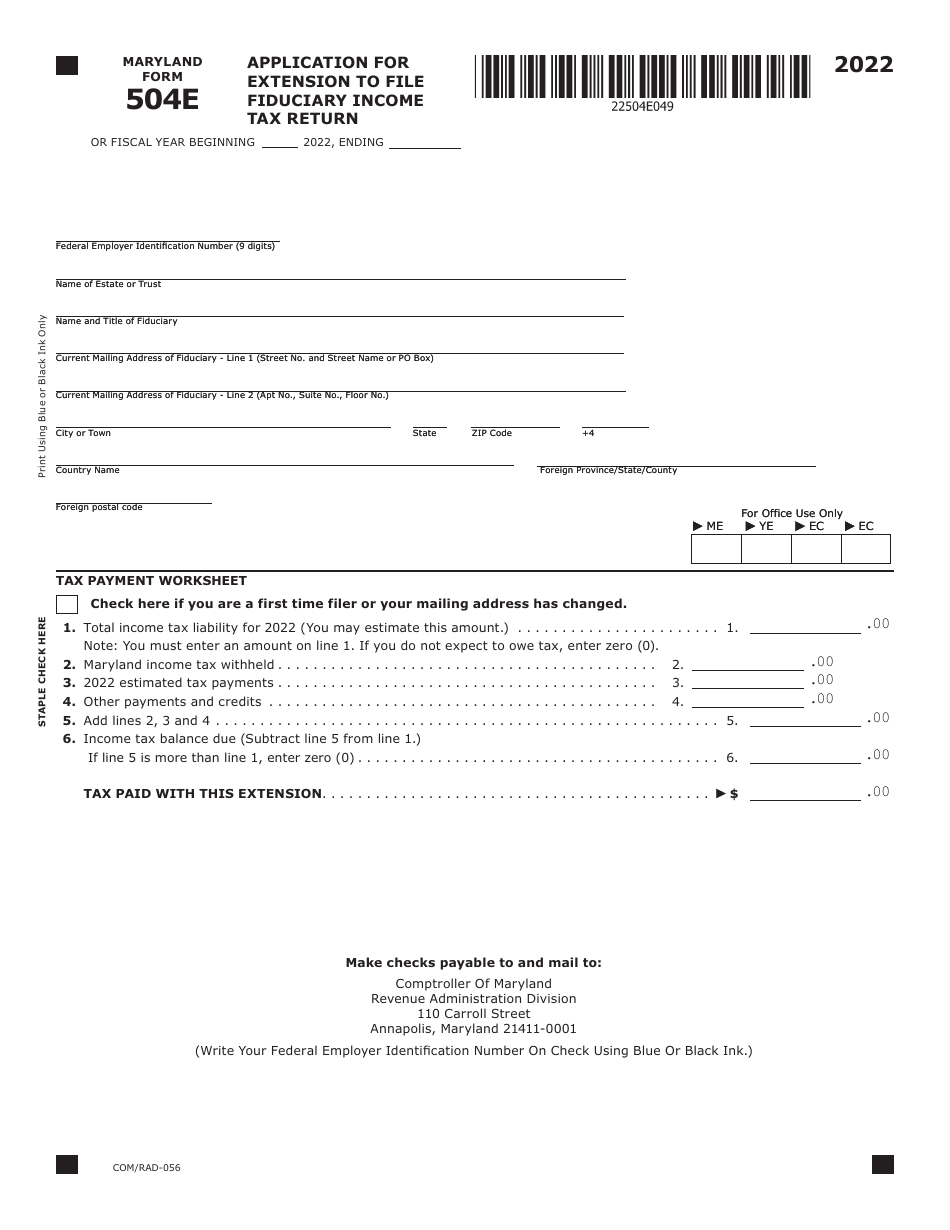

Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. Form 504 that you submit to the comptroller of maryland. Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504.

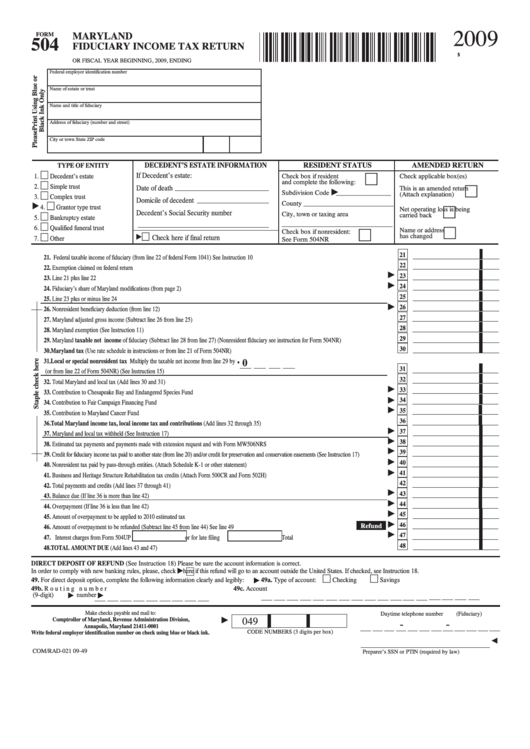

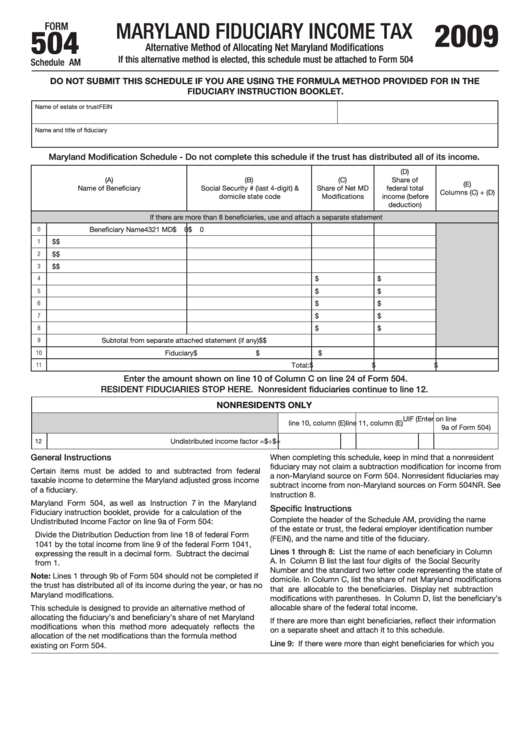

Fillable Form 504 Maryland Fiduciary Tax Return 2009

Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. Form 504 that you submit to the comptroller of maryland. Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the.

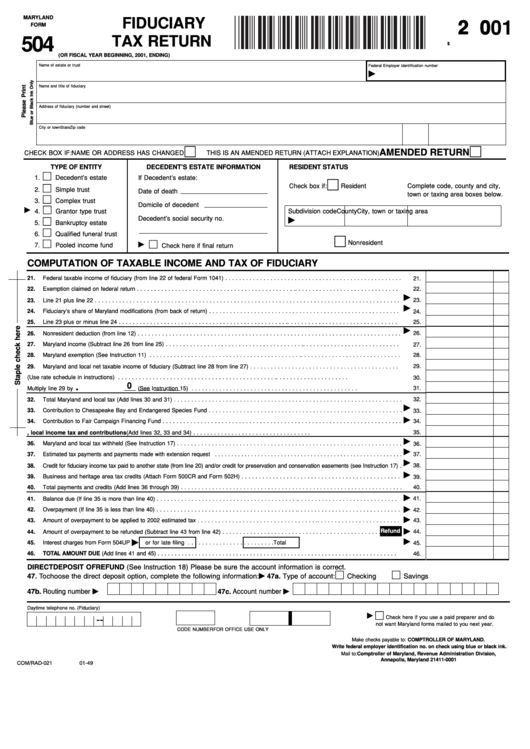

Fillable Maryland Form 504 Fiduciary Tax Return 2001 printable pdf

Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Form 504 that you submit to the comptroller of maryland. Form and instructions for requesting an extension of time of up to.

Maryland Form 504 ≡ Fill Out Printable PDF Forms Online

Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Form 504 that you submit to the comptroller of maryland. Form and instructions for requesting an extension of time of up to.

Fillable Online 504 Fax Email Print pdfFiller

Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Form 504 that you submit to the comptroller of maryland. Maryland form 504.

Maryland Form 504 ≡ Fill Out Printable PDF Forms Online

Form 504 that you submit to the comptroller of maryland. Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Form for fiduciaries.

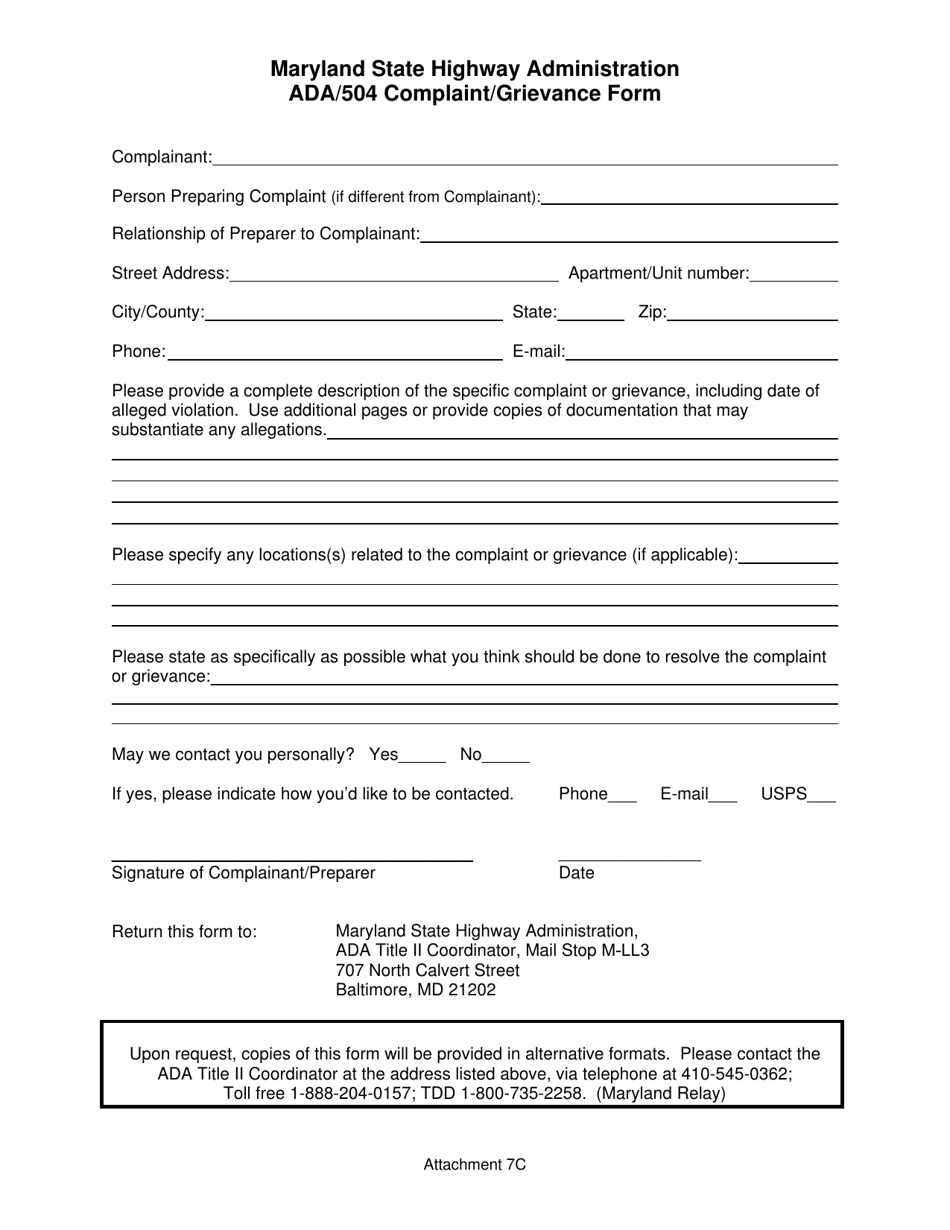

Maryland Ada/504 Complaint/Grievance Form Fill Out, Sign Online and

Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. If you have nonresident beneficiaries claiming this deduction, use.

Maryland Form 504E 2022 Fill Out, Sign Online and

If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. Form.

Fillable 504 Forms Printable Forms Free Online

Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Form 504 that you submit to the comptroller of maryland. Form and instructions for requesting an extension of time of up to.

Fillable Schedule Am (Form 504) Maryland Fiduciary Tax 2009

Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. Maryland form 504 fiduciary income tax return name fein.

Maryland Form 504 ≡ Fill Out Printable PDF Forms Online

Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. If you have nonresident beneficiaries claiming this deduction, use this summary sheet and attach to form 504. Form and instructions for requesting an extension of time of up to six months from the due date (or up to one.

If You Have Nonresident Beneficiaries Claiming This Deduction, Use This Summary Sheet And Attach To Form 504.

Maryland form 504 fiduciary income tax return name fein 2022 page 3 _____ direct deposit of refund (see instruction 18) verify. Form for fiduciaries to complete and attach to their maryland form 504 to report information on each beneficiary, including the following:. Form and instructions for requesting an extension of time of up to six months from the due date (or up to one year if the person required to file the. Form 504 that you submit to the comptroller of maryland.