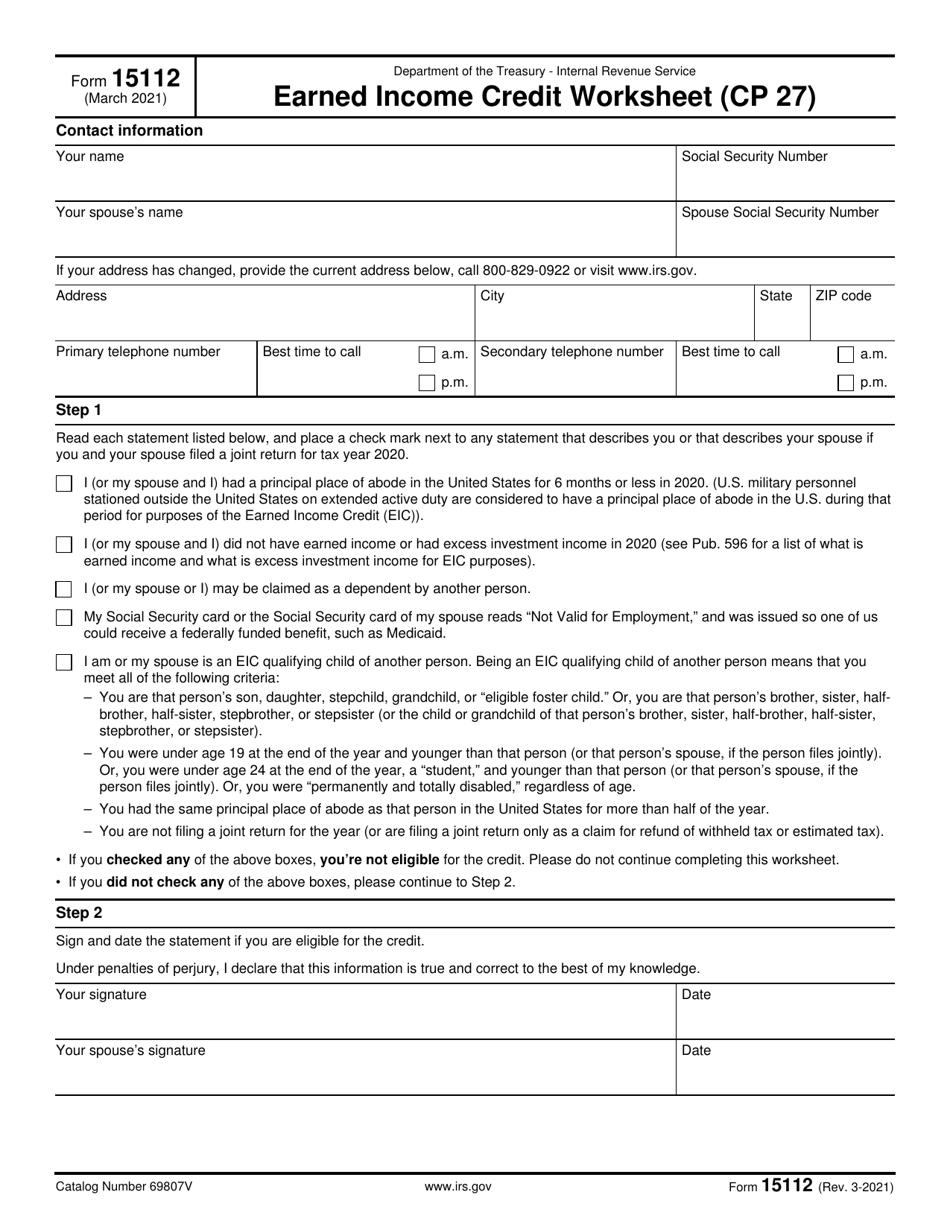

Form 15112 Instructions

Form 15112 Instructions - Sign and date form 15112; If you are not eligible for. In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet (cp 27), to verify your eligibility for. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. You must file form 1040, u.s. Mail the signed form 15112 in the envelope provided.

Mail the signed form 15112 in the envelope provided. If you are not eligible for. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. Sign and date form 15112; The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet (cp 27), to verify your eligibility for. You must file form 1040, u.s.

You must file form 1040, u.s. If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. If you are not eligible for. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. Sign and date form 15112; In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet (cp 27), to verify your eligibility for. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. Mail the signed form 15112 in the envelope provided.

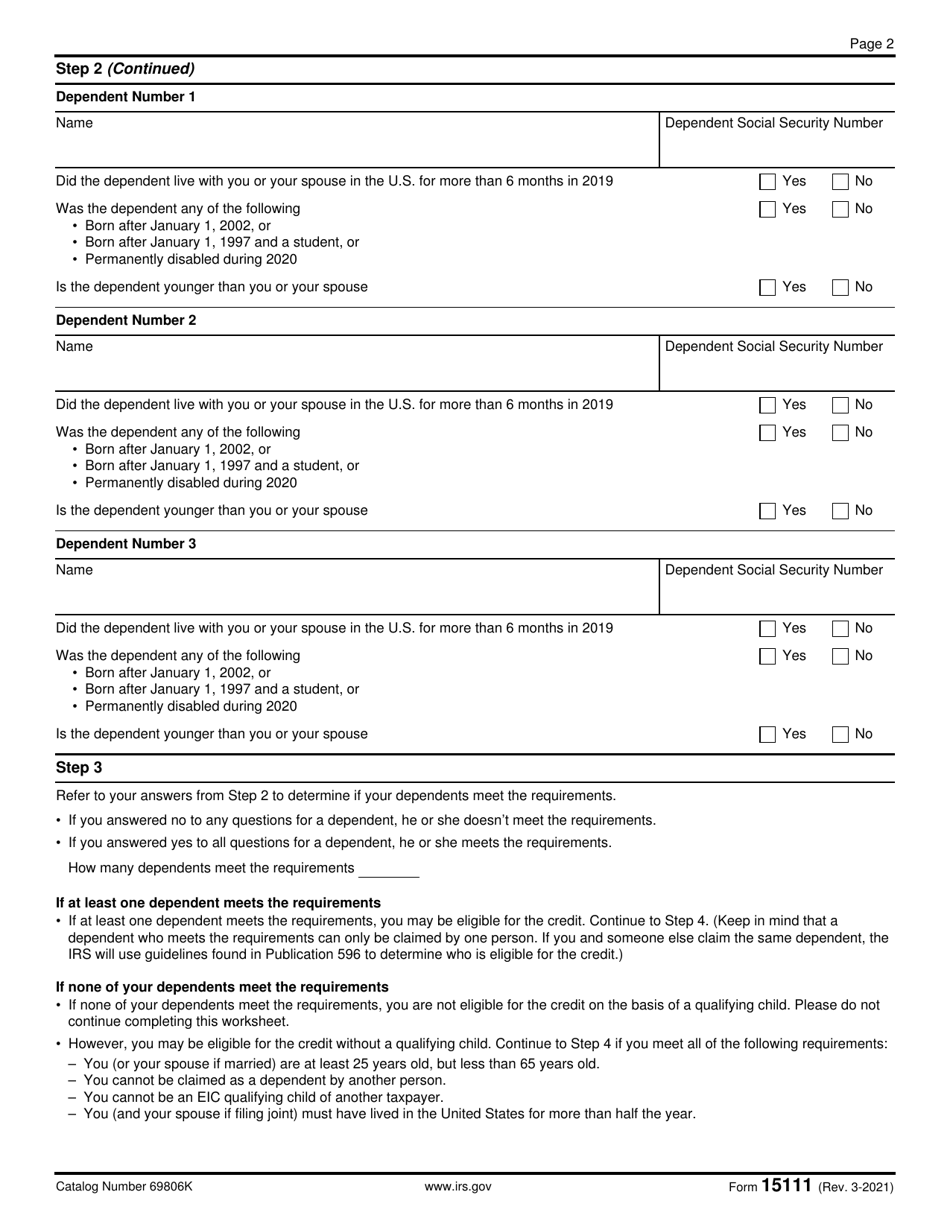

Earned Tax Credit Worksheets

If you are not eligible for. If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. The irs cp27 notice informs taxpayers they may.

IRS Form 15111 Fill Out, Sign Online and Download Fillable PDF

To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. Mail the signed form 15112 in the envelope provided. In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet (cp 27), to verify your eligibility for. If you are not eligible for. You.

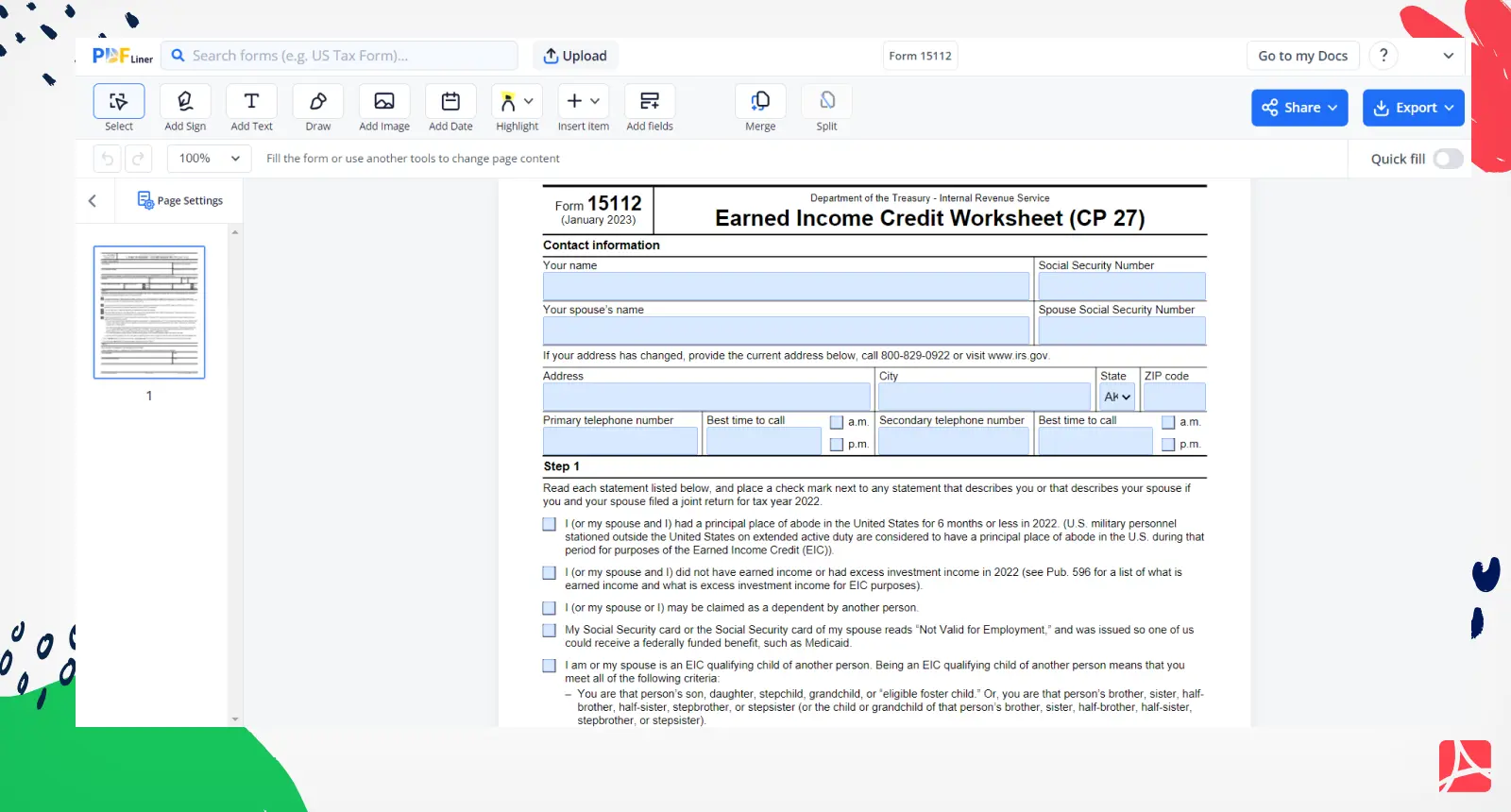

Fillable Form 15112, sign form online — PDFliner

If you are not eligible for. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. Mail the signed form 15112 in the envelope provided. You must file form 1040, u.s. In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet (cp 27),.

IRS Form 15112 Instructions EIC Worksheet (CP27)

If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. Sign and date form 15112; To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. The irs cp27 notice informs taxpayers they may be eligible for the.

Printable Schedule Eic Form Printable Forms Free Online

If you are not eligible for. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. Sign and date form 15112; If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. To claim the.

Fillable Online Form 15112 instructions Fax Email Print pdfFiller

To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet (cp 27), to verify your eligibility for. If you are not eligible for. The irs cp27 notice informs taxpayers they may be eligible.

IRS Form 15112 Instructions EIC Worksheet (CP27)

You must file form 1040, u.s. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. To claim the earned income tax credit (eitc),.

Fillable Online Form 15112 tax year 2021 Fax Email Print pdfFiller

Sign and date form 15112; If you are not eligible for. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. Mail the signed form 15112 in the envelope provided. In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet.

Form 15112 instructions Fill out & sign online DocHub

Sign and date form 15112; To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. If it appears that you’re eligible for eic for tax year 2021,.

IRS Form 15112 Instructions EIC Worksheet (CP27)

If it appears that you’re eligible for eic for tax year 2021, according to the earned income credit worksheet (cp 27), you should. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. If you are not eligible for. Sign and date form 15112; To claim the.

To Claim The Earned Income Tax Credit (Eitc), You Must Qualify For The Credit And File A Federal Tax Return.

You must file form 1040, u.s. Before you file your next tax return, use the eitc assistant toolkit on our website at irs.gov/eitcassistant to see if you may qualify. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. Sign and date form 15112;

If It Appears That You’re Eligible For Eic For Tax Year 2021, According To The Earned Income Credit Worksheet (Cp 27), You Should.

Mail the signed form 15112 in the envelope provided. If you are not eligible for. In this case, the irs will ask you to complete irs form 15112, earned income credit worksheet (cp 27), to verify your eligibility for.