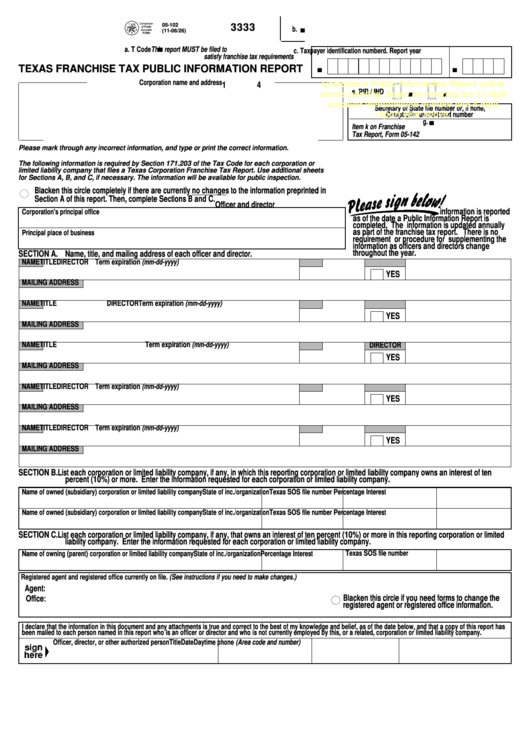

Form 05 102 For 2022

Form 05 102 For 2022 - Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas?

Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas? Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment.

Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas? Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and.

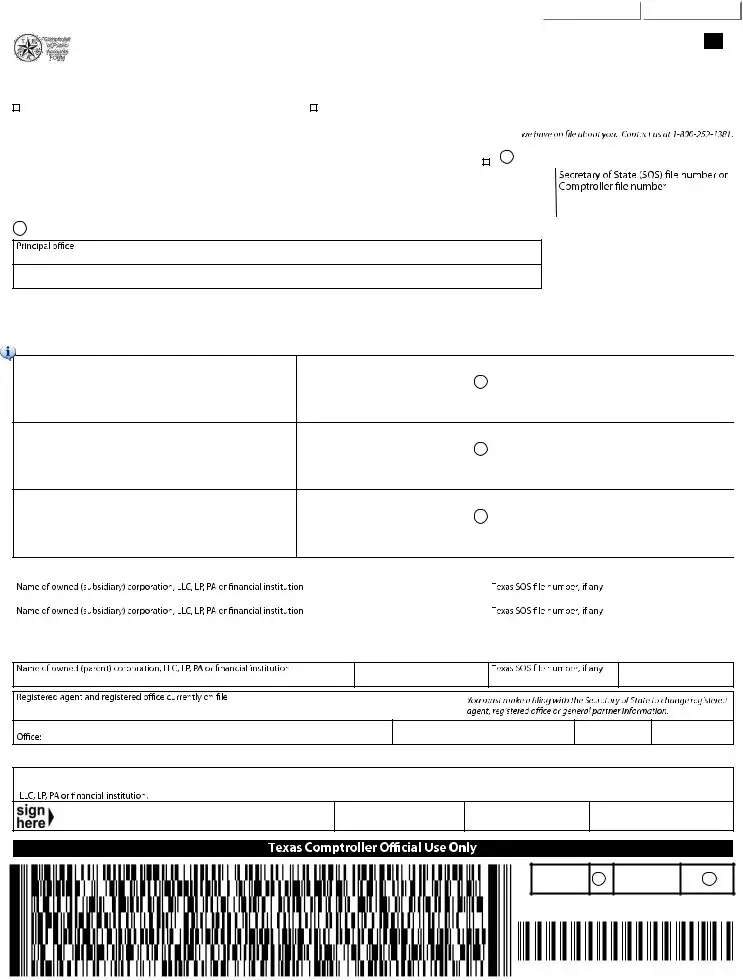

TX Comptroller 05163 2022 Fill and Sign Printable Template Online

Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas? Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to.

Texas Franchise Tax Form Instructions 2024 Erda Odelle

Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical.

05102 Form 2024 Coreen Corinna

Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical.

Texas Form 05102 ≡ Fill Out Printable PDF Forms Online

Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical.

Fillable Online What is form 05102. What is form 05102

Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical.

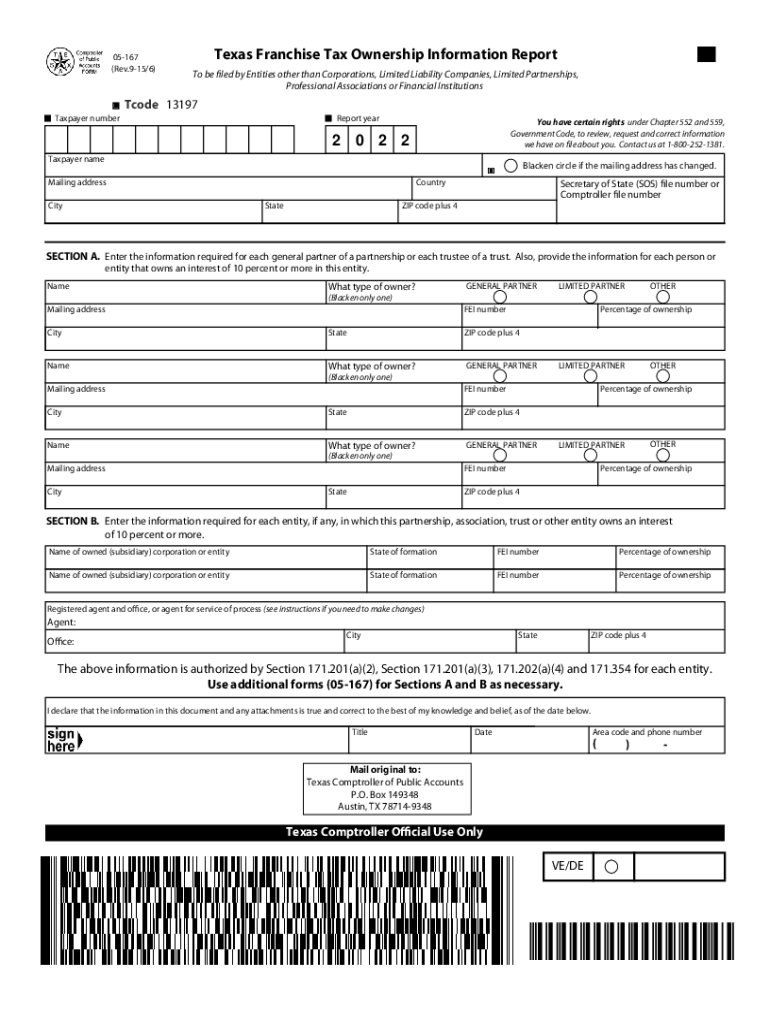

20222024 Form TX Comptroller 05167 Fill Online, Printable, Fillable

Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas? Each taxable entity formed as a corporation, limited liability company (llc), limited partnership,.

Fillable Online What is form 05102. What is form 05102. Form 05102

Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas? Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to.

05102 Form 2024 Coreen Corinna

Each taxable entity formed as a corporation, limited liability company (llc), limited partnership, professional association and. Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical.

102 2022 0 b Education FCP1501/102/0/ Tutorial Letter 102/0

Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas? Each taxable entity formed as a corporation, limited liability company (llc), limited partnership,.

Texas Form 05 141 Fill Online, Printable, Fillable, Blank pdfFiller

‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas? Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. Each taxable entity formed as a corporation, limited liability company (llc), limited partnership,.

Each Taxable Entity Formed As A Corporation, Limited Liability Company (Llc), Limited Partnership, Professional Association And.

Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment. ‣ how do you indicate an affiliate of a combined return was not organized in texas and does not have physical presence in texas?