Esbt Election Form

Esbt Election Form - A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the.

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the.

While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the.

Nails Punched For The Election, Election, Election Logo, Vote PNG and

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the. Form 2553 is.

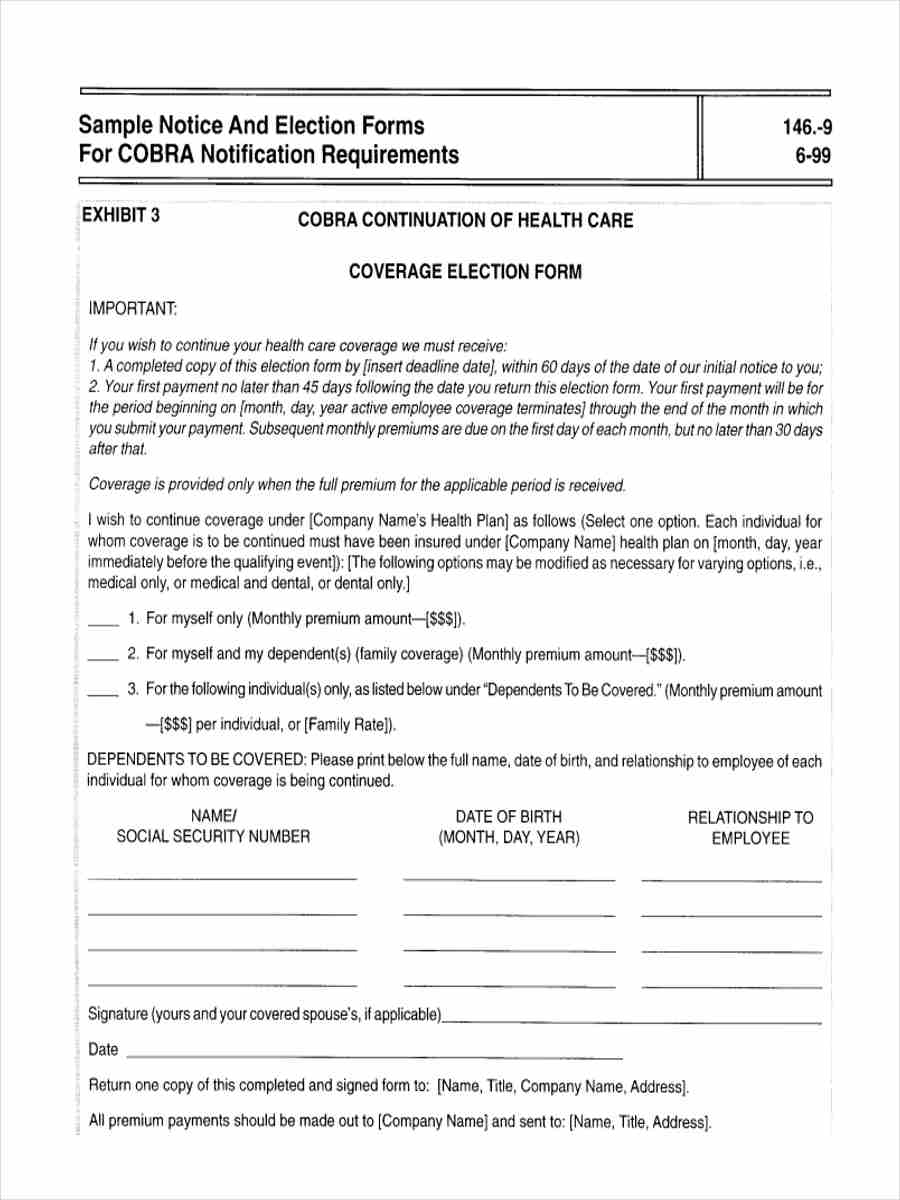

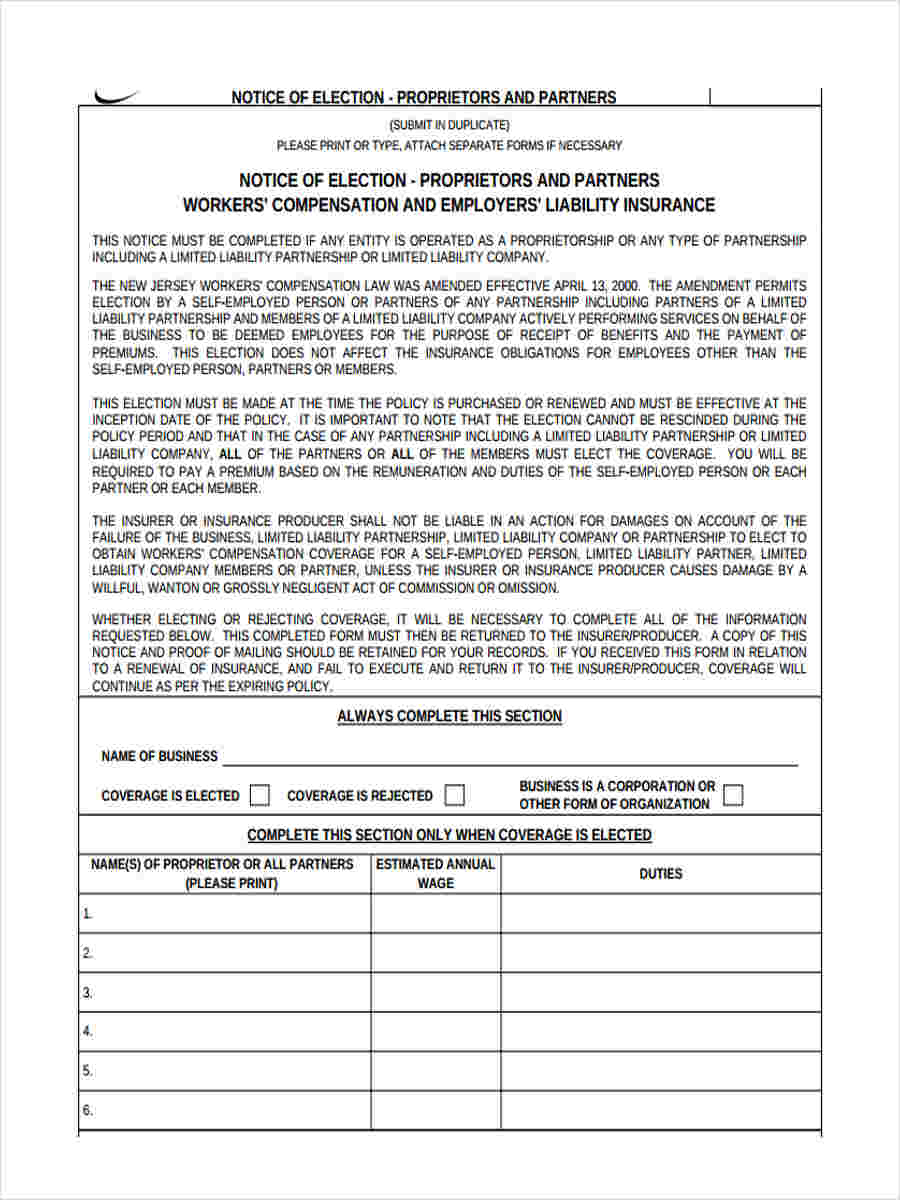

FREE 6+ Sample Notice of Election Forms in MS Word PDF Excel

While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the. A corporation or other entity eligible to elect to.

FREE 6+ Sample Notice of Election Forms in MS Word PDF Excel

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. Form 2553 is.

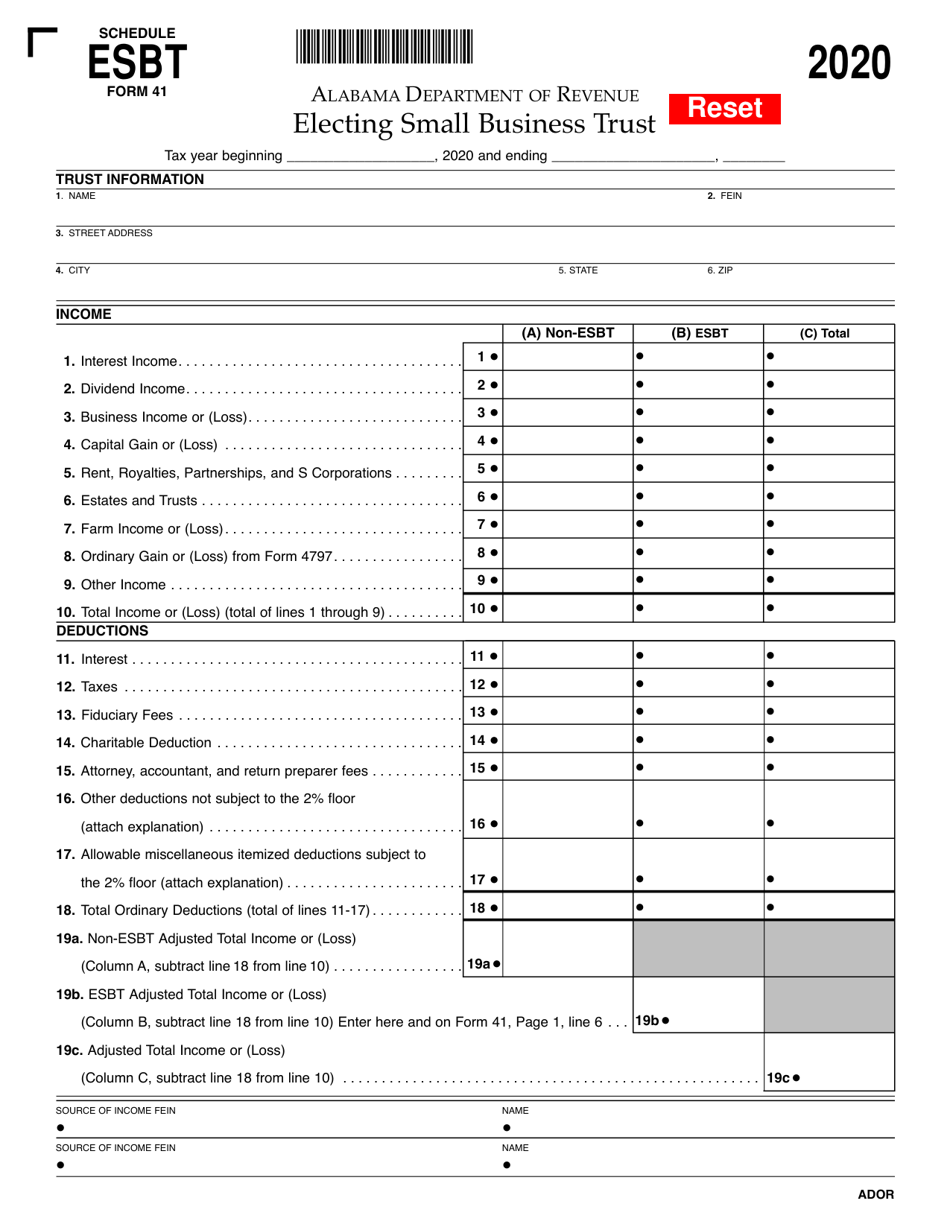

Form 41 Schedule ESBT 2020 Fill Out, Sign Online and Download

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. To obtain relief, the trustee of an esbt.

IRS Form 8832 walkthrough (Entity Classification Election) YouTube

While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. To obtain relief, the trustee of an esbt.

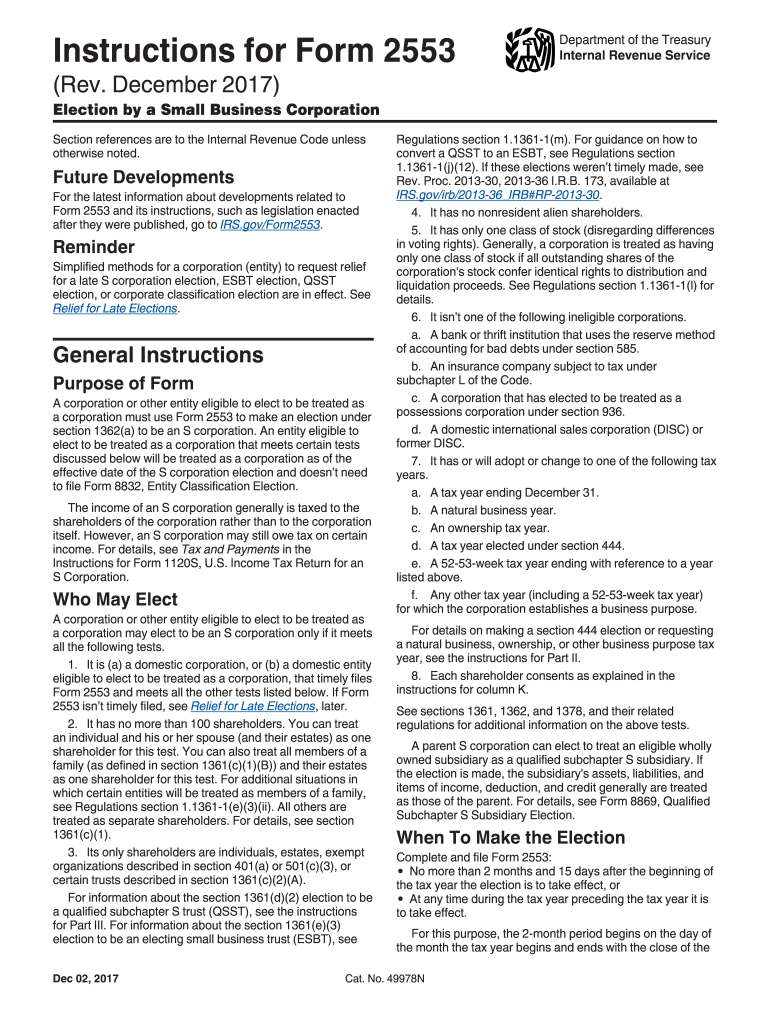

IRS Instruction 2553 2017 Fill and Sign Printable Template Online

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. Form 2553 is used by qualifying small business.

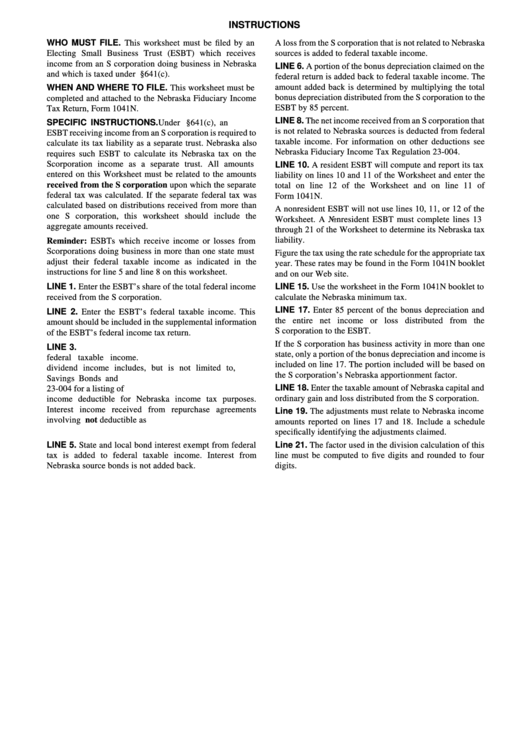

Instructions For Form 1041n Electing Small Business Trust (Esbt) Tax

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the. While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. A corporation or other entity eligible to elect to.

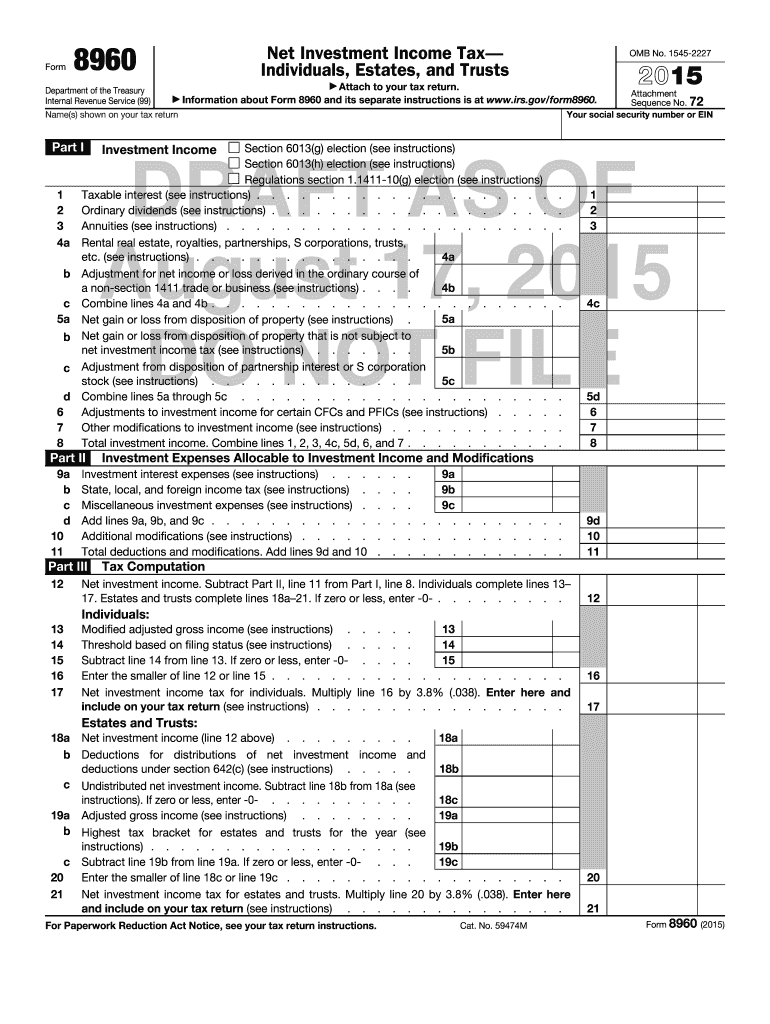

10g Election Complete with ease airSlate SignNow

To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. Form 2553 is.

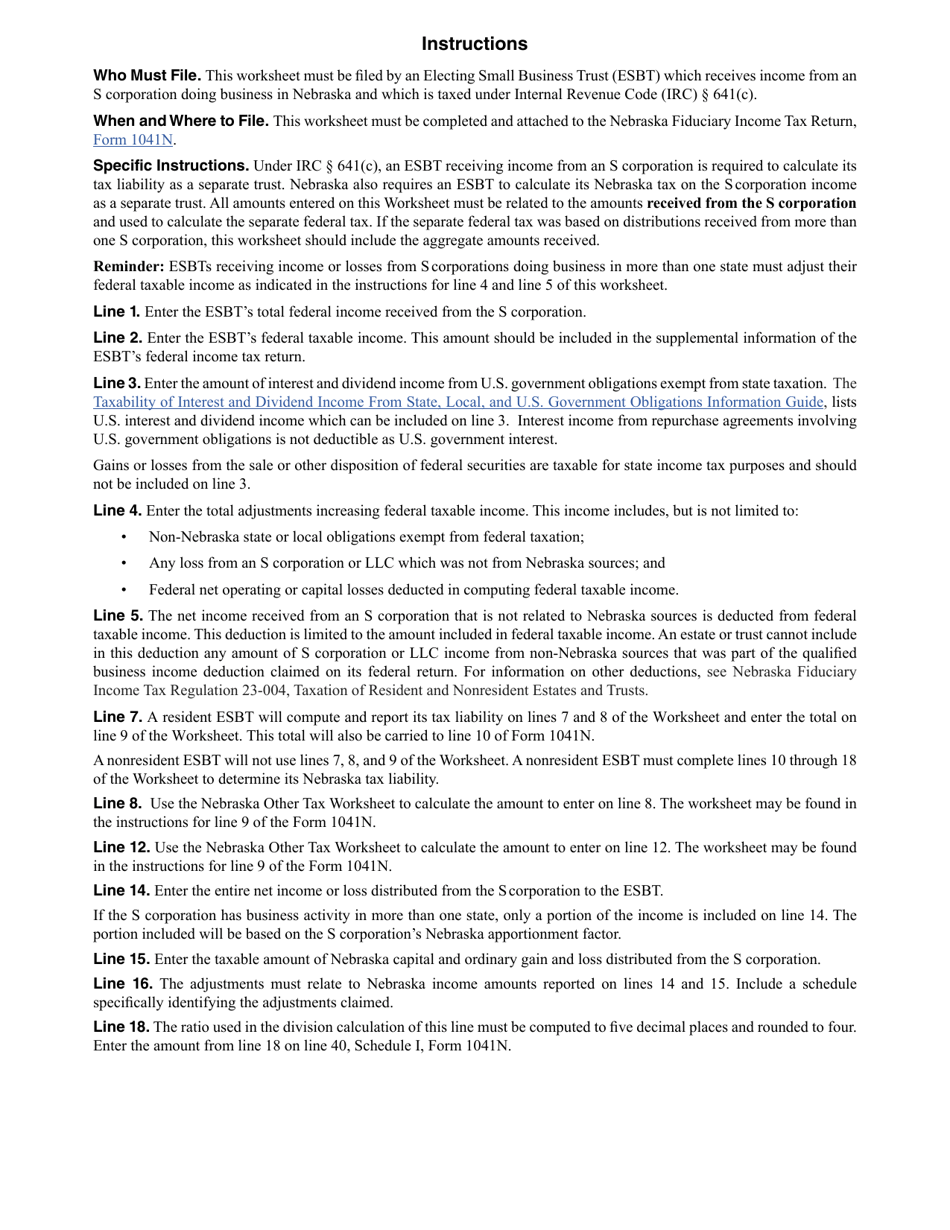

Form 1041N Worksheet ESBT 2020 Fill Out, Sign Online and Download

A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. Form 2553 is used by qualifying small business.

Fillable Online IEI Election Form Fax Email Print pdfFiller

While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s. Form 2553 is used by qualifying small business.

Form 2553 Is Used By Qualifying Small Business Corporations And Limited Liability Companies To Make The Election Prescribed By Sec.

While an esbt is probably more flexible in responding to the future needs of trust beneficiaries, there are several rules that must be. To obtain relief, the trustee of an esbt or the current income beneficiary of a qsst must sign and file the appropriate election form, which must include the. A corporation or other entity eligible to elect to be treated as a corporation must use form 2553 to make an election under section 1362(a) to be an s.