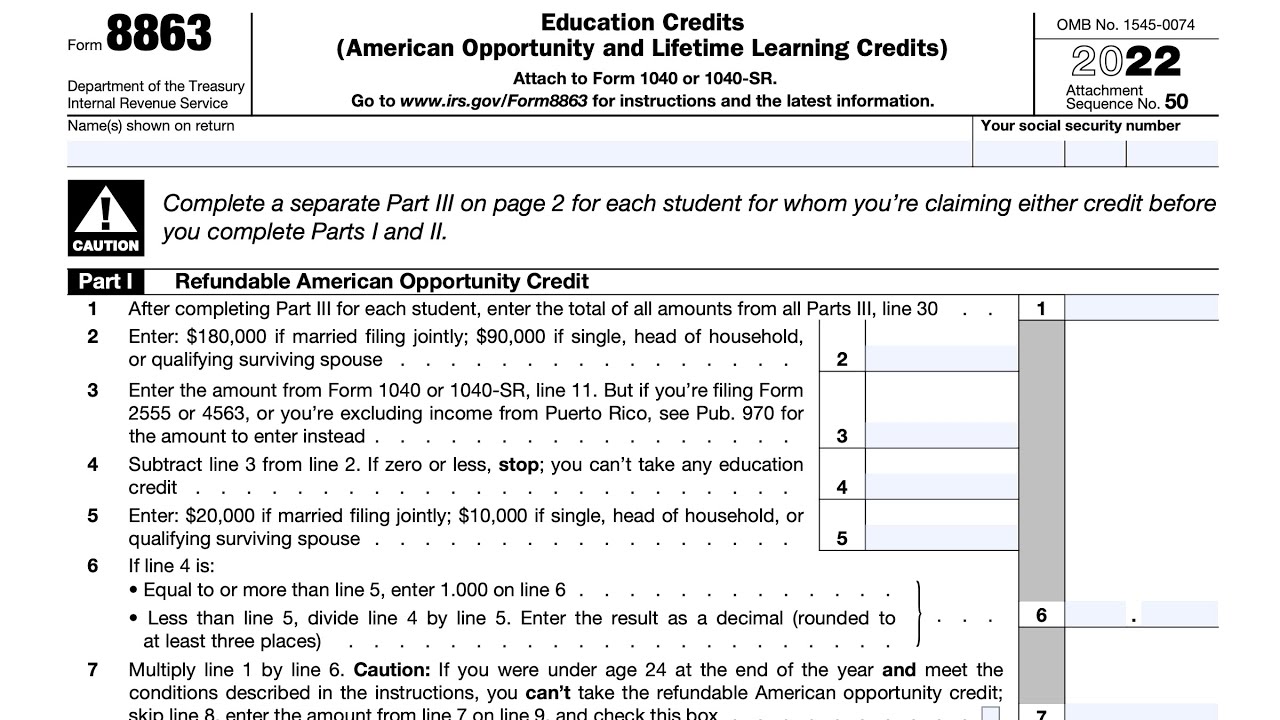

Education Credits From Form 8863

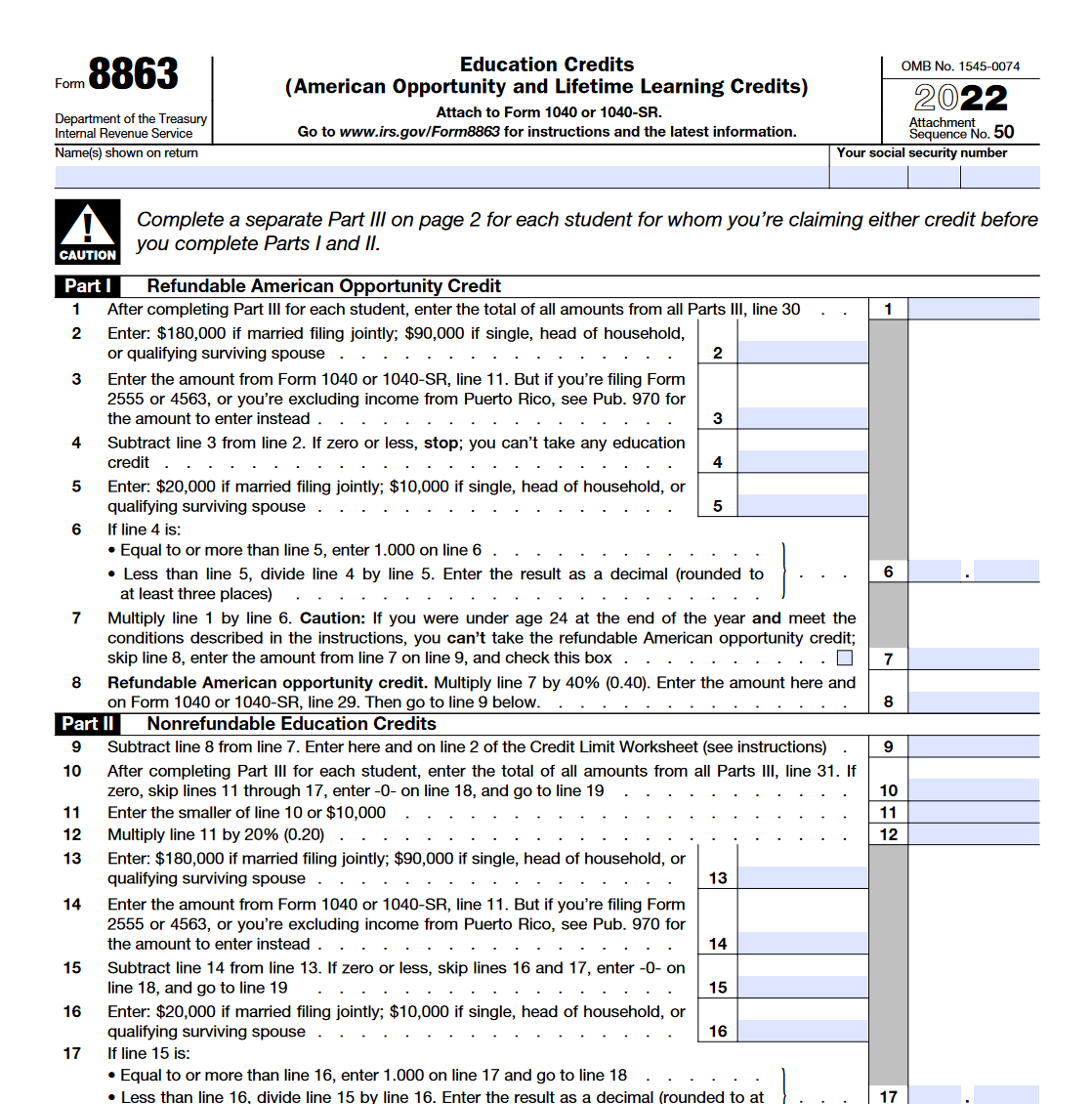

Education Credits From Form 8863 - Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Form 8863, education credits, is used to determine eligibility and figure each credit. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Irs form 8863 allows taxpayers to claim two primary education tax credits: The american opportunity credit and the lifetime. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible.

Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Irs form 8863 allows taxpayers to claim two primary education tax credits: Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Form 8863, education credits, is used to determine eligibility and figure each credit. The american opportunity credit and the lifetime.

Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Irs form 8863 allows taxpayers to claim two primary education tax credits: Form 8863, education credits, is used to determine eligibility and figure each credit. The american opportunity credit and the lifetime. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning.

Understanding Form 8863 Complete Guide on Unlocking Education Credits

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Irs form 8863 allows taxpayers to claim two primary education tax credits: The american opportunity.

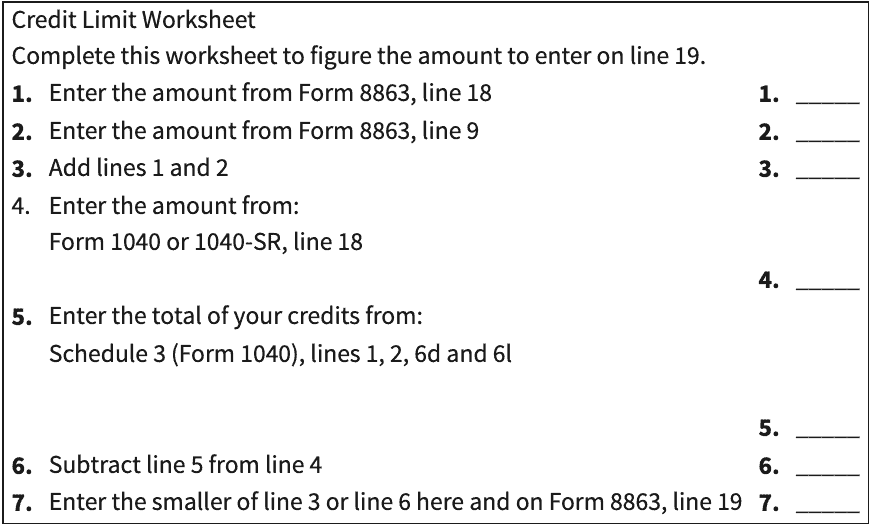

Form 8863 Credit Limit Worksheet 2023

Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education.

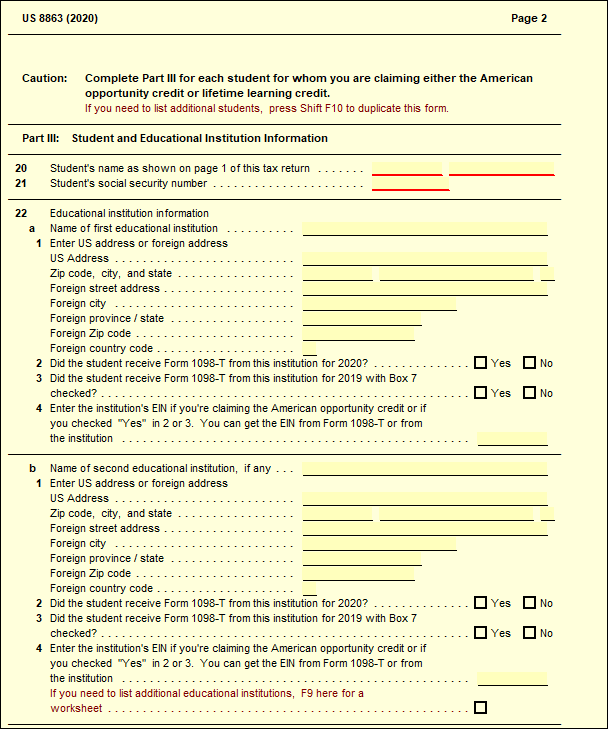

IRS Form 8863 Instructions

Irs form 8863 allows taxpayers to claim two primary education tax credits: Form 8863, education credits, is used to determine eligibility and figure each credit. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim.

Appendix A (Continued)Form 8863 Education Credits (Hope and Lifetime

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. The american opportunity credit and the lifetime. Enter the amount from line 7 of the.

Blank Form 8863 Fill Out and Print PDFs

The american opportunity credit and the lifetime. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Irs form 8863 allows taxpayers to claim two primary education tax credits: Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc).

8863 Education Credits UltimateTax Solution Center

Irs form 8863 allows taxpayers to claim two primary education tax credits: Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Form 8863, education credits, is used.

IRS Form 8863. Education Credits Forms Docs 2023

The american opportunity credit and the lifetime. Form 8863, education credits, is used to determine eligibility and figure each credit. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and.

IRS Form 8863 walkthrough (Education Credits) YouTube

The american opportunity credit and the lifetime. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Use form 8863 to figure and claim your education credits,.

Printable Form 8863

The american opportunity credit and the lifetime. Irs form 8863 allows taxpayers to claim two primary education tax credits: Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses.

Form 8863 Education Credits (American Opportunity and Lifetime

Irs form 8863 allows taxpayers to claim two primary education tax credits: The american opportunity credit and the lifetime. Form 8863, education credits, is used to determine eligibility and figure each credit. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Irs form 8863, titled “education credits,” is a.

The American Opportunity Credit And The Lifetime.

Irs form 8863 allows taxpayers to claim two primary education tax credits: Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible.

Irs Form 8863, Titled “Education Credits,” Is A Vital Document For Taxpayers Seeking To Claim The American Opportunity Tax Credit (Aotc) And The.

Form 8863, education credits, is used to determine eligibility and figure each credit.