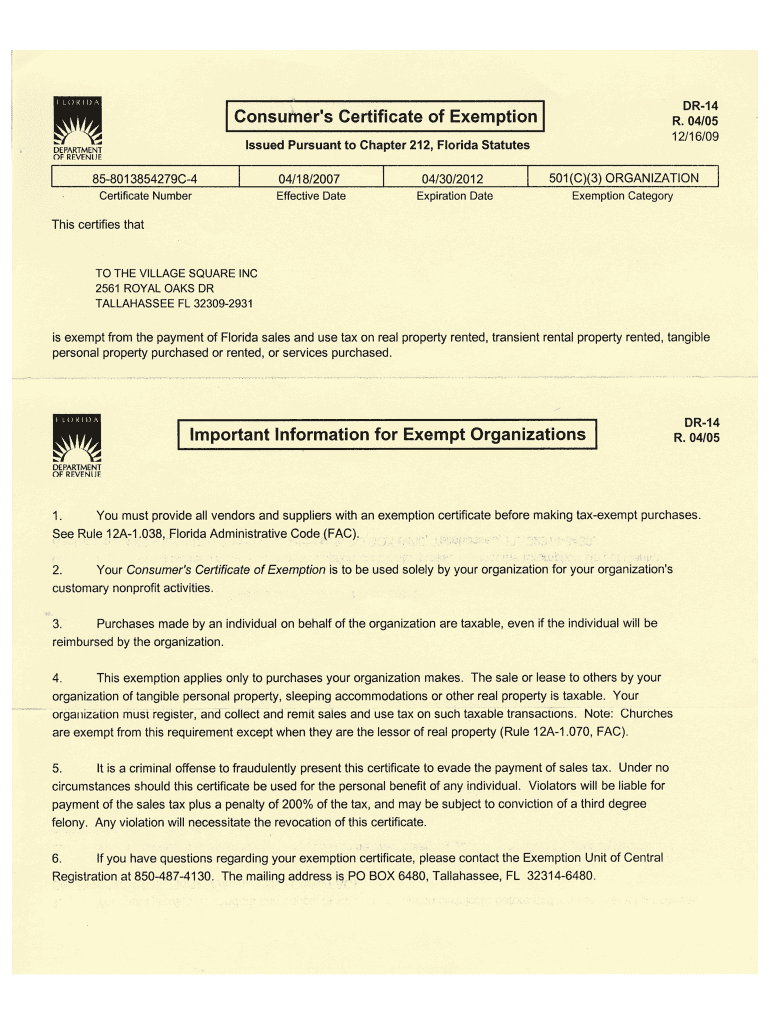

Dr 14 Tax Exemption Form

Dr 14 Tax Exemption Form - This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased.

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. This exemption applies only to purchases your organization makes. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased.

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

Dr 14 2009 form Fill out & sign online DocHub

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. This exemption applies only to purchases your organization makes. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased.

Dr 14 form pdf Fill out & sign online DocHub

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

Tax Free Week 2024 Florida Lina Shelby

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

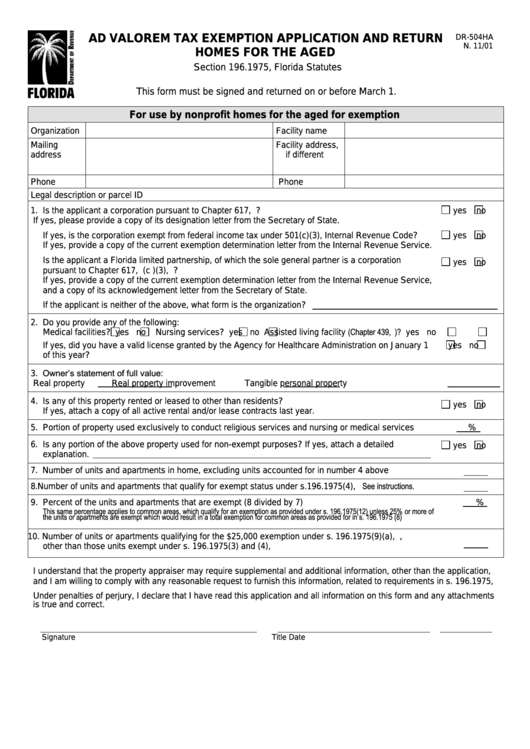

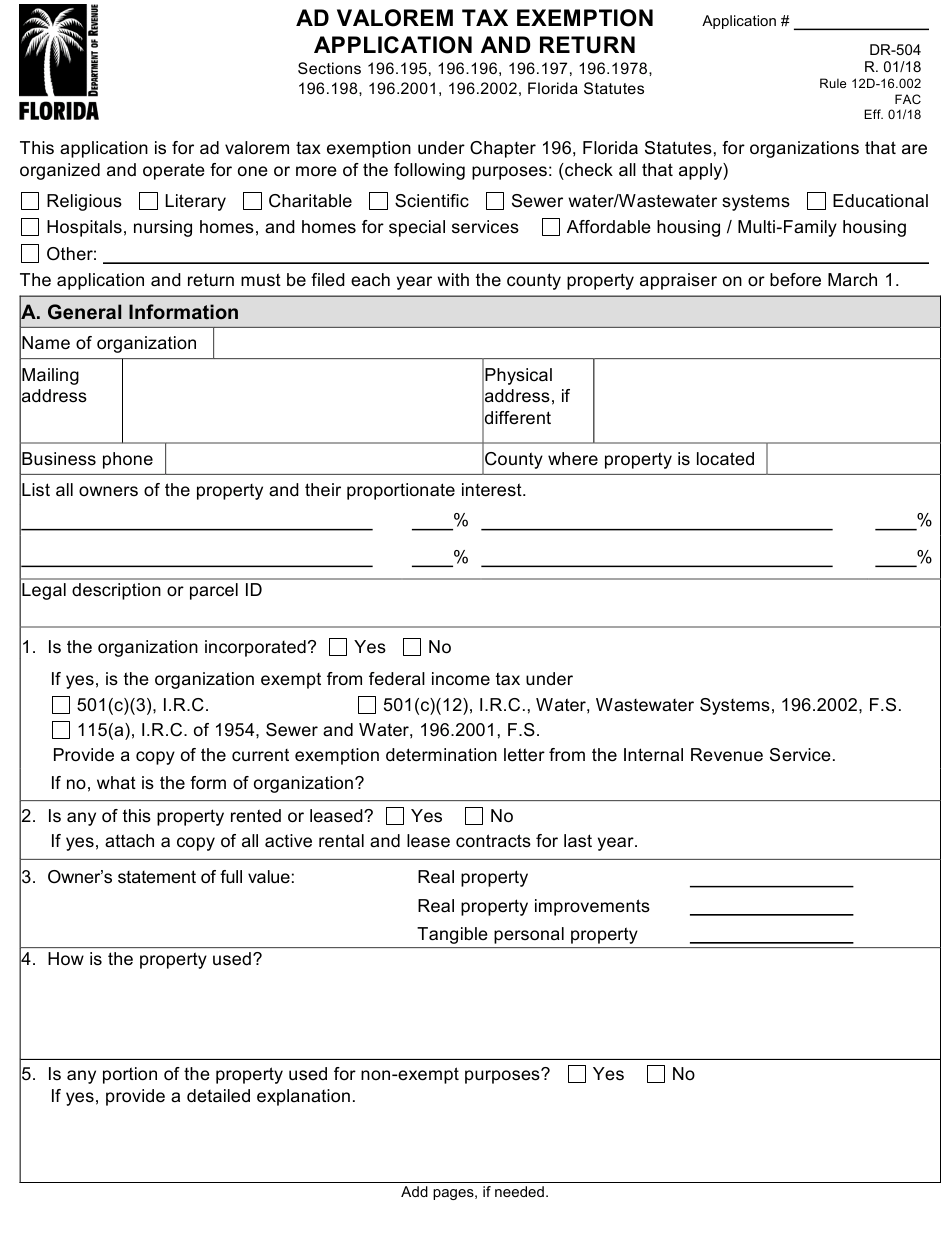

Form Dr504ha Ad Valorem Tax Exemption Application And Return Homes

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is.

Fillable Form R 1310 Certificate Of Sales Tax Exemption Exclusion For

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

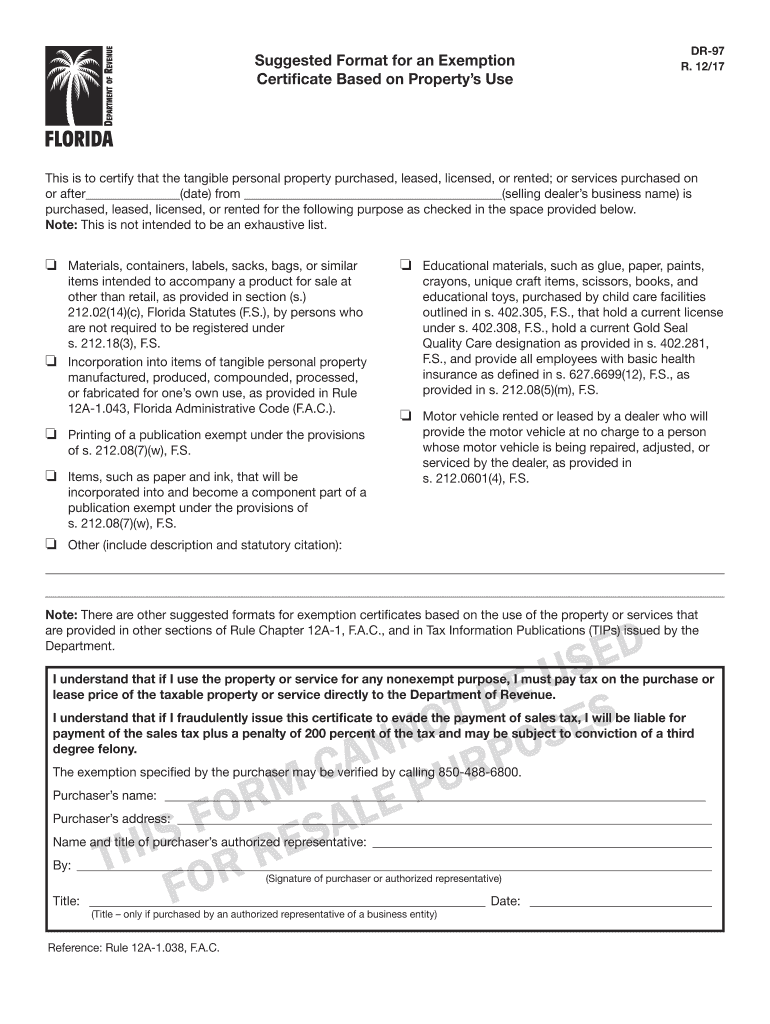

Exemption State of Florida 20172024 Form Fill Out and Sign Printable

This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased.

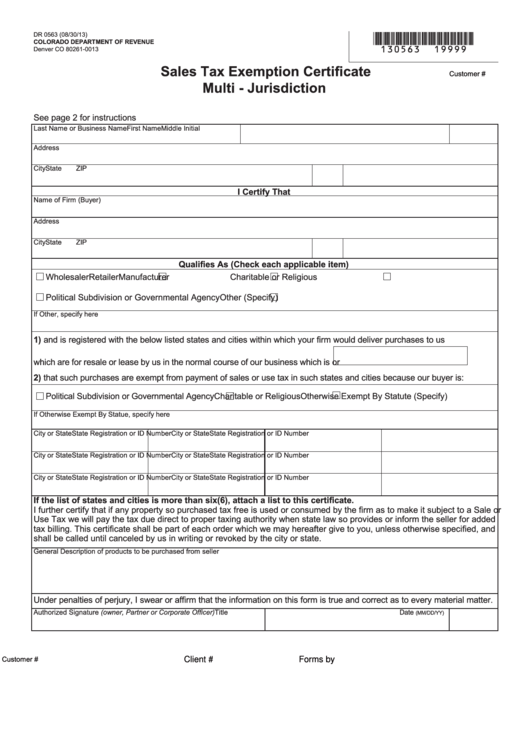

Sales Tax Exemption Certificate Multi Jurisdiction Form

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

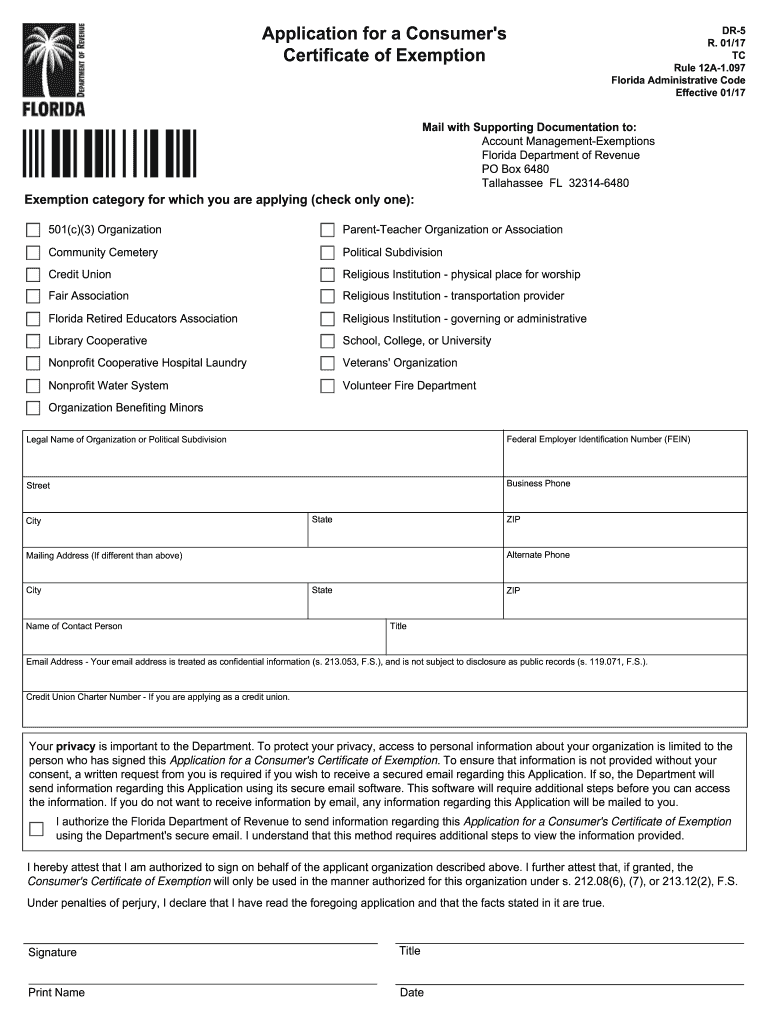

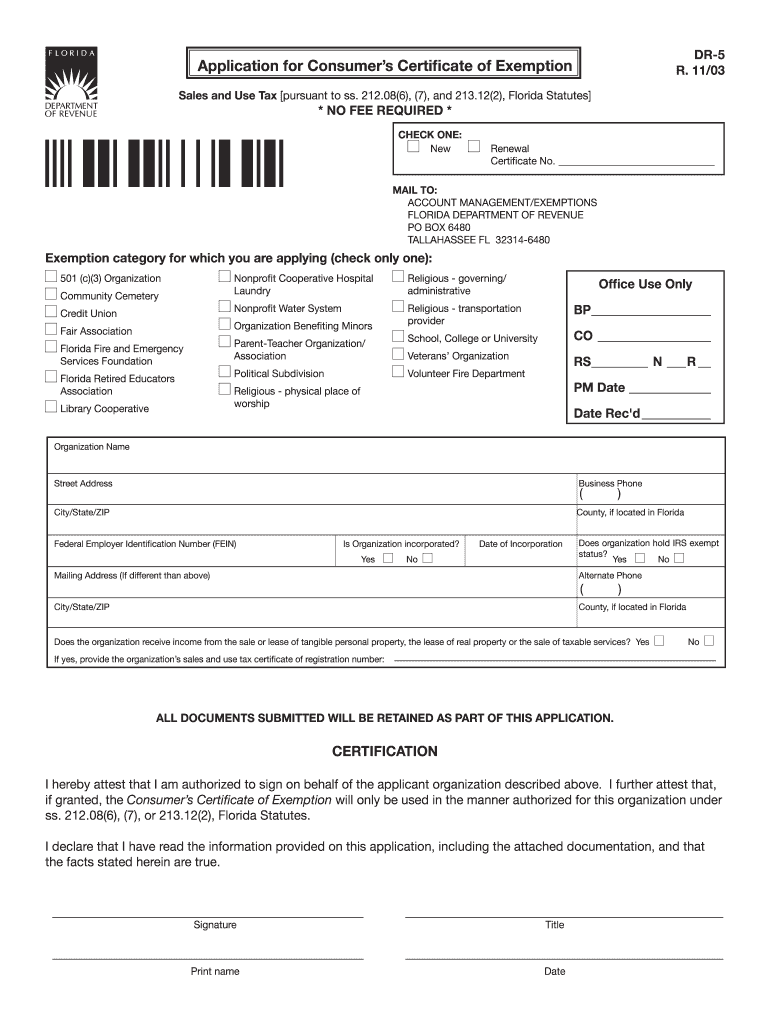

Florida Sales Tax Exemption Application Form

This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased.

Agriculture Tax Exempt Form Florida

The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.

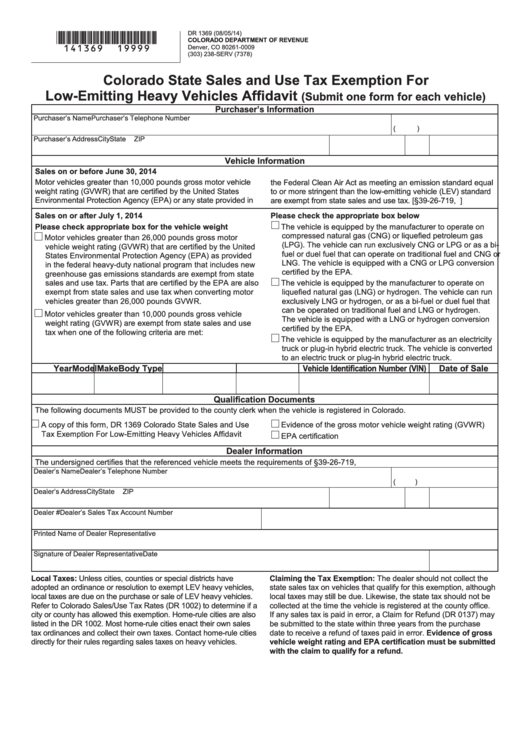

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

This exemption applies only to purchases your organization makes. The sale or lease to others of tangible personal property, sleeping accommodations, or other real property is. Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased.

The Sale Or Lease To Others Of Tangible Personal Property, Sleeping Accommodations, Or Other Real Property Is.

Is exempt from the payment of florida sales and use tax on real property rented, transient rental property rented, tangible personal property purchased or rented, or services purchased. This exemption applies only to purchases your organization makes.