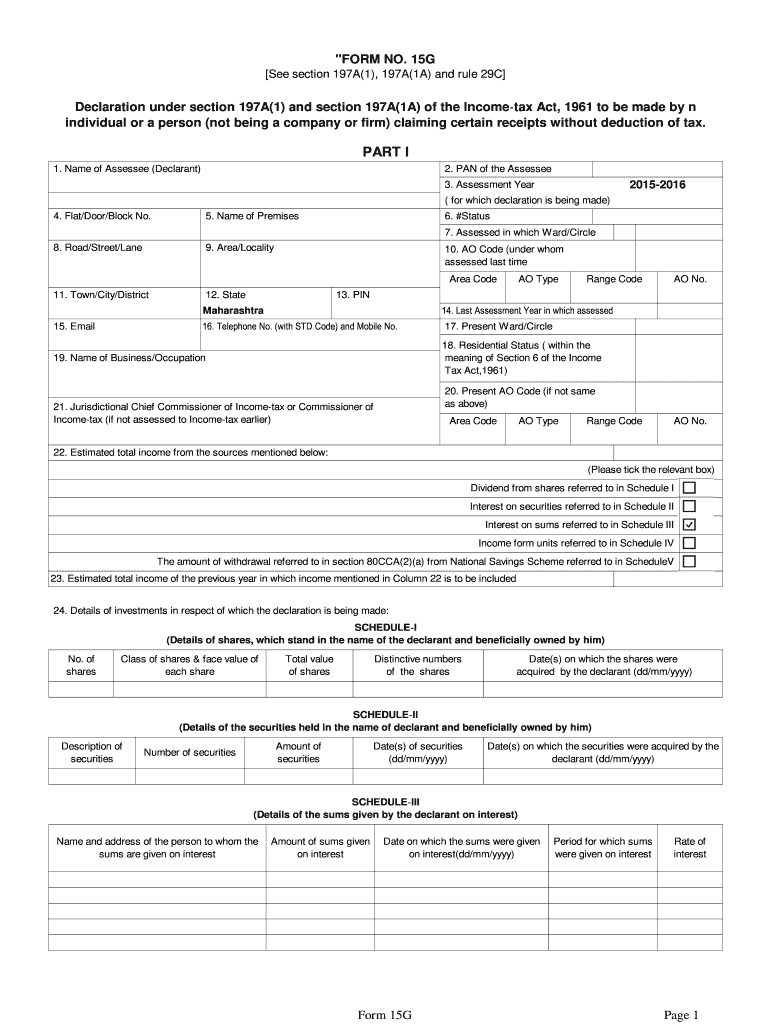

Download Form 15G For Pf Withdrawal

Download Form 15G For Pf Withdrawal - 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal.

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions.

Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal.

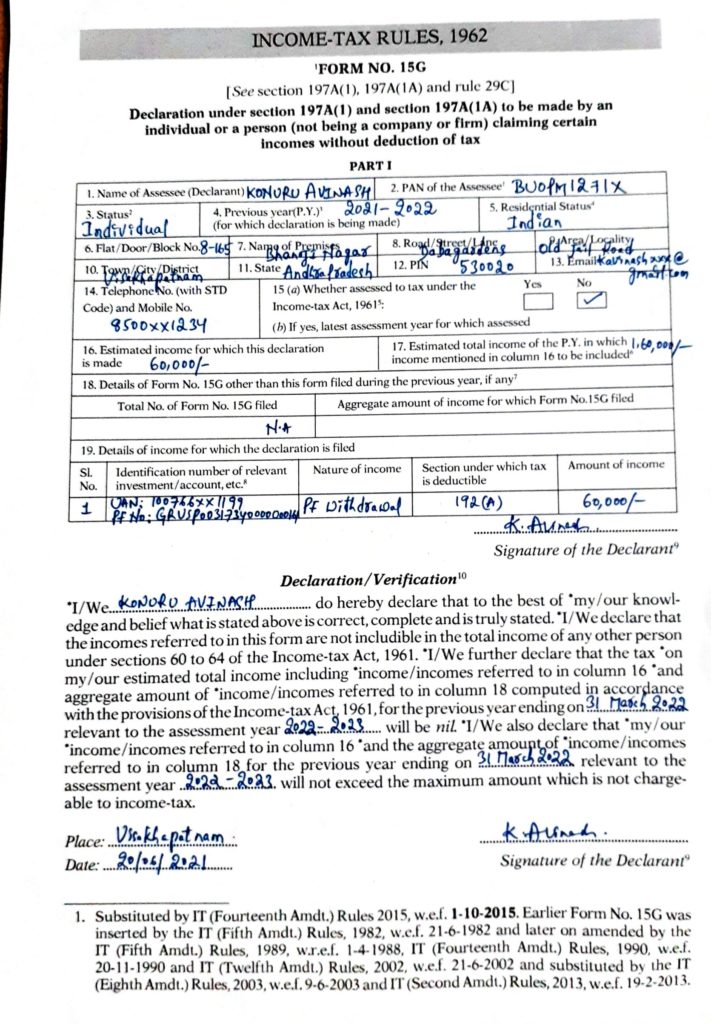

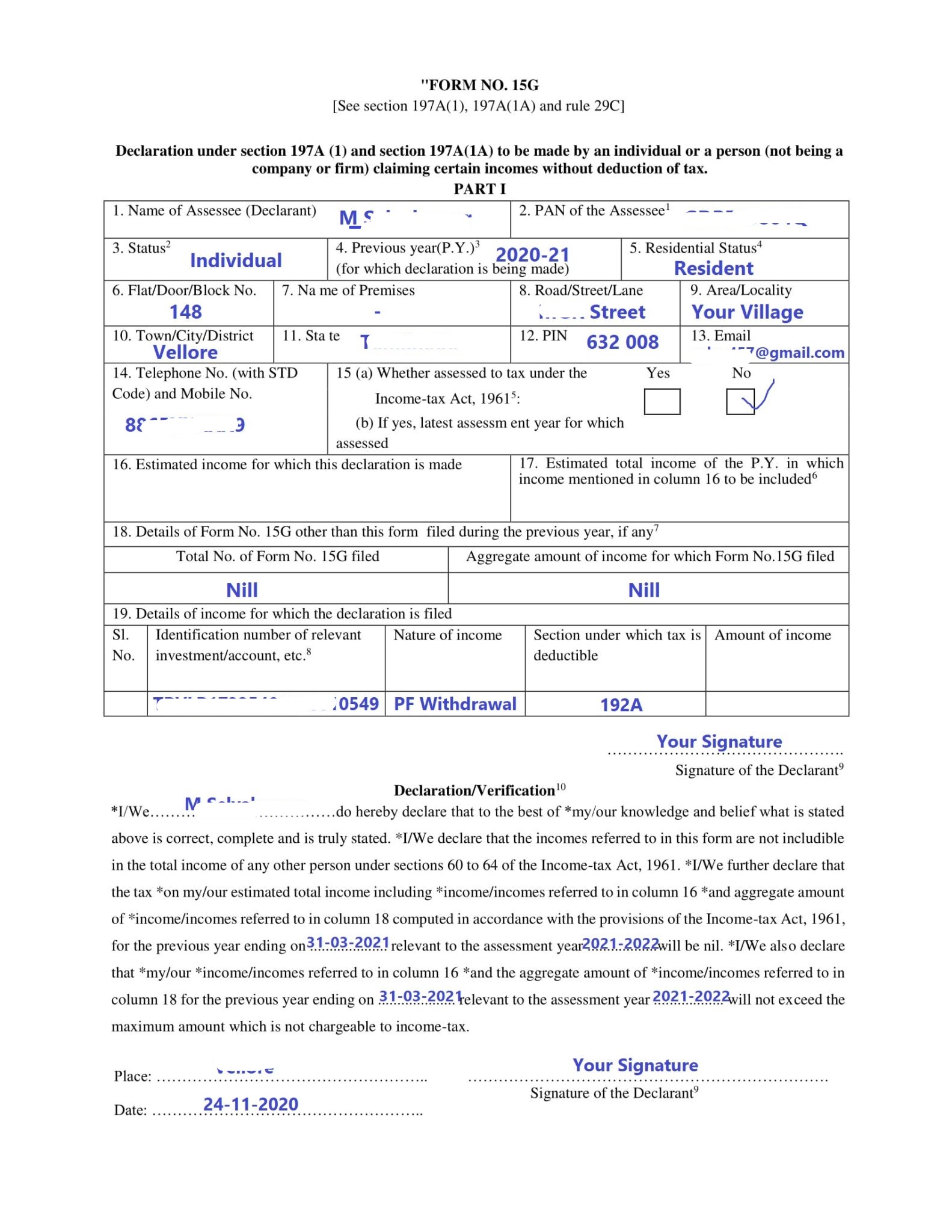

Sample Filled Form 15G for PF Withdrawal

Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

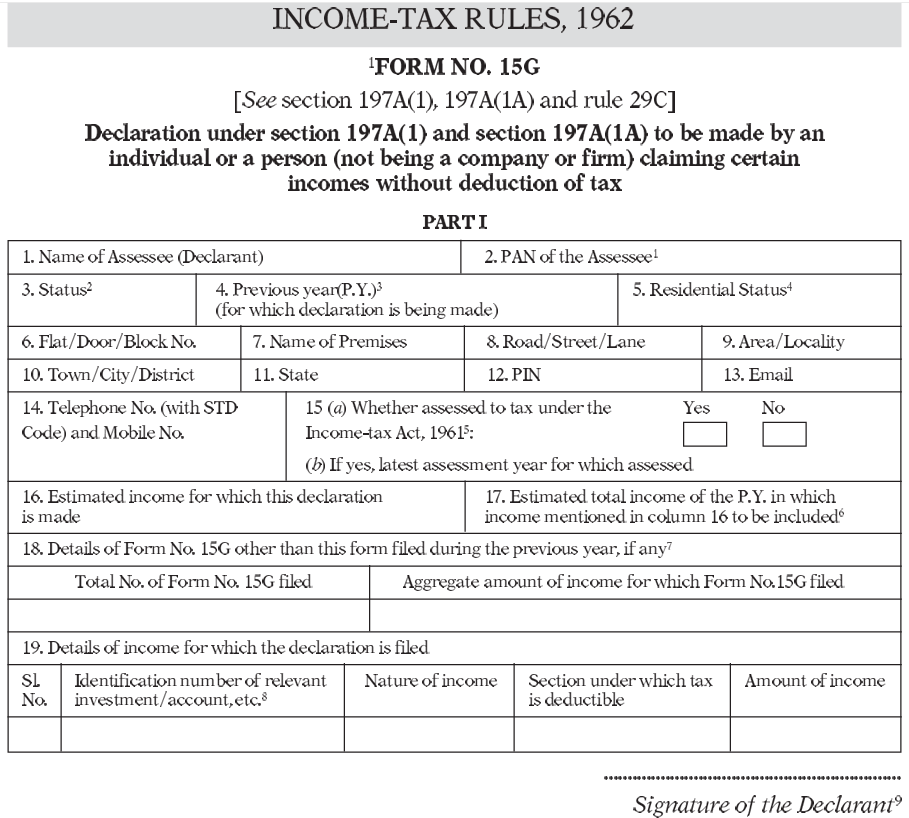

Form 15g Download In Word Format 20202021 Fill and Sign Printable

Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Declaration under.

Download Form 15g For Pf Withdrawal 2023 Printable Templates Free

By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of.

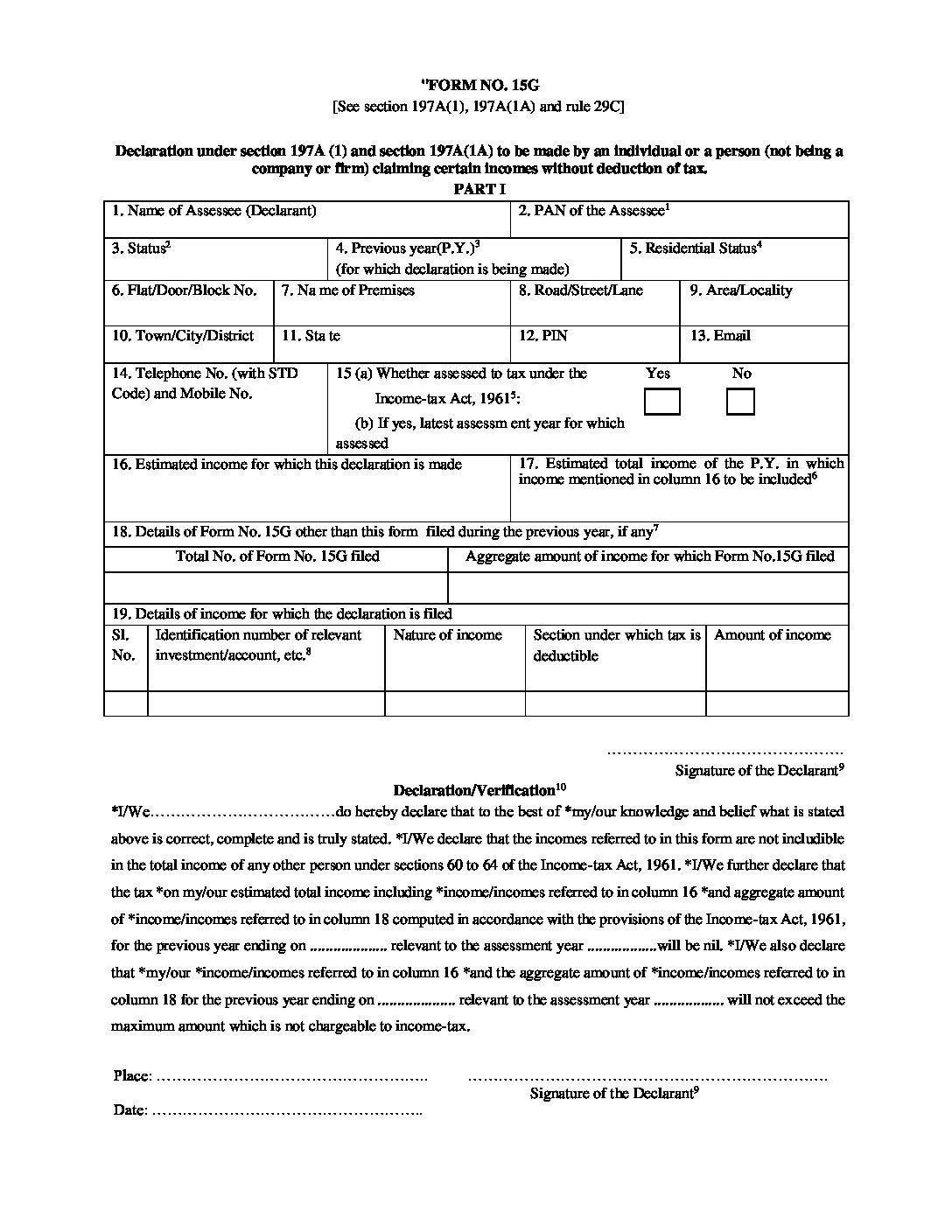

Form 15g For Pf Withdrawal 2023 Printable Forms Free Online

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. Declaration under.

Sample Filled Form 15G for PF Withdrawal in 2022 (2022)

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being.

Fill Form 15G for PF Withdrawal Complete Guides

By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. 15g.

Download Form 15G for PF Withdrawal 2022

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. By submitting form 15g for pf download, you're telling the authorities you don't need tds.

Form 15G Download PDF For PF Withdrawal Sample Filled

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961.

Form 15G How to Download and Fill Form 15G For PF Withdrawal?

By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to. Learn how to download, fill, and submit form 15g for pf withdrawal to avoid tds deductions. Declaration under.

Learn How To Download, Fill, And Submit Form 15G For Pf Withdrawal To Avoid Tds Deductions.

By submitting form 15g for pf download, you're telling the authorities you don't need tds cut from your pf withdrawal. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm) claiming. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income‐tax act, 1961 to.