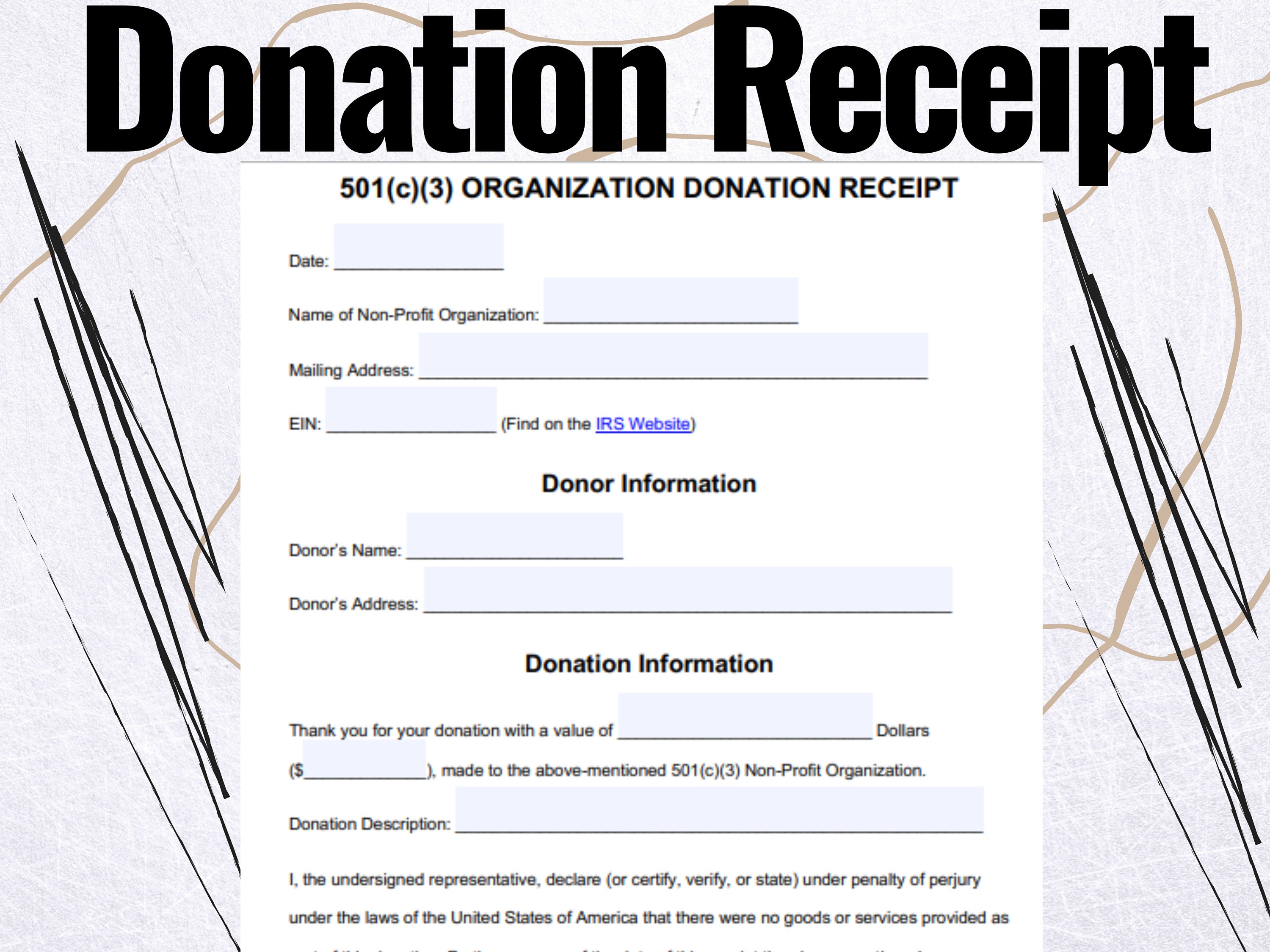

Donation Receipt Form

Donation Receipt Form - The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

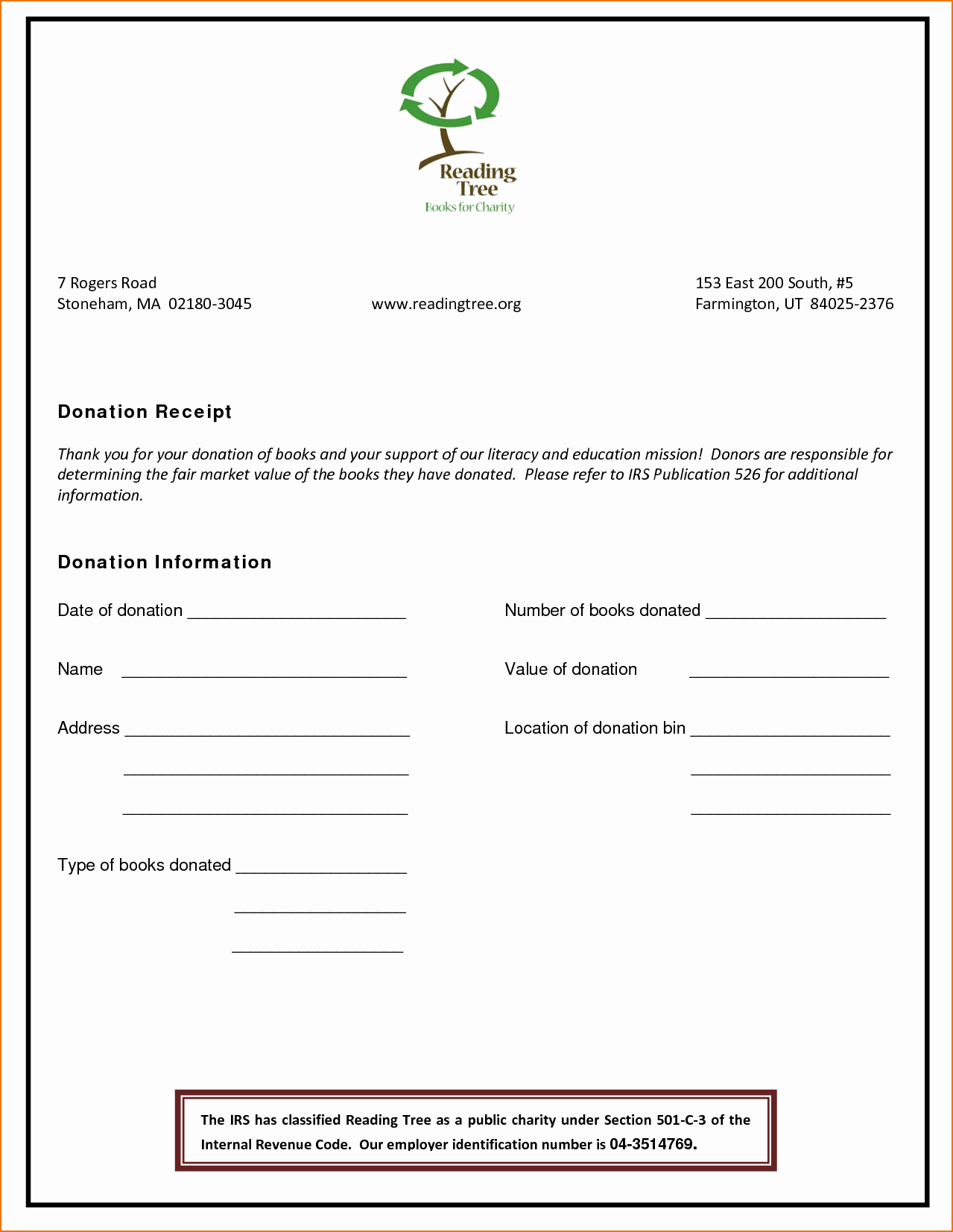

Free Sample Printable Donation Receipt Template Form

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

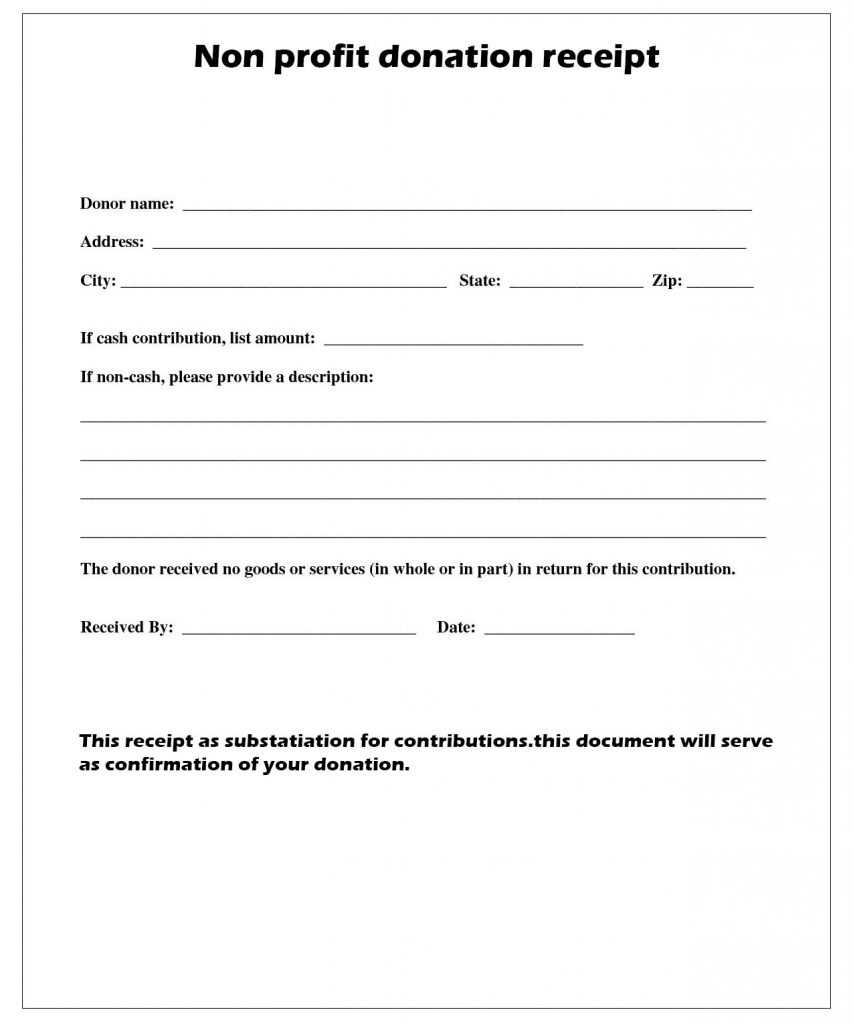

Non Profit Donation Receipt Template Excel Templates

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

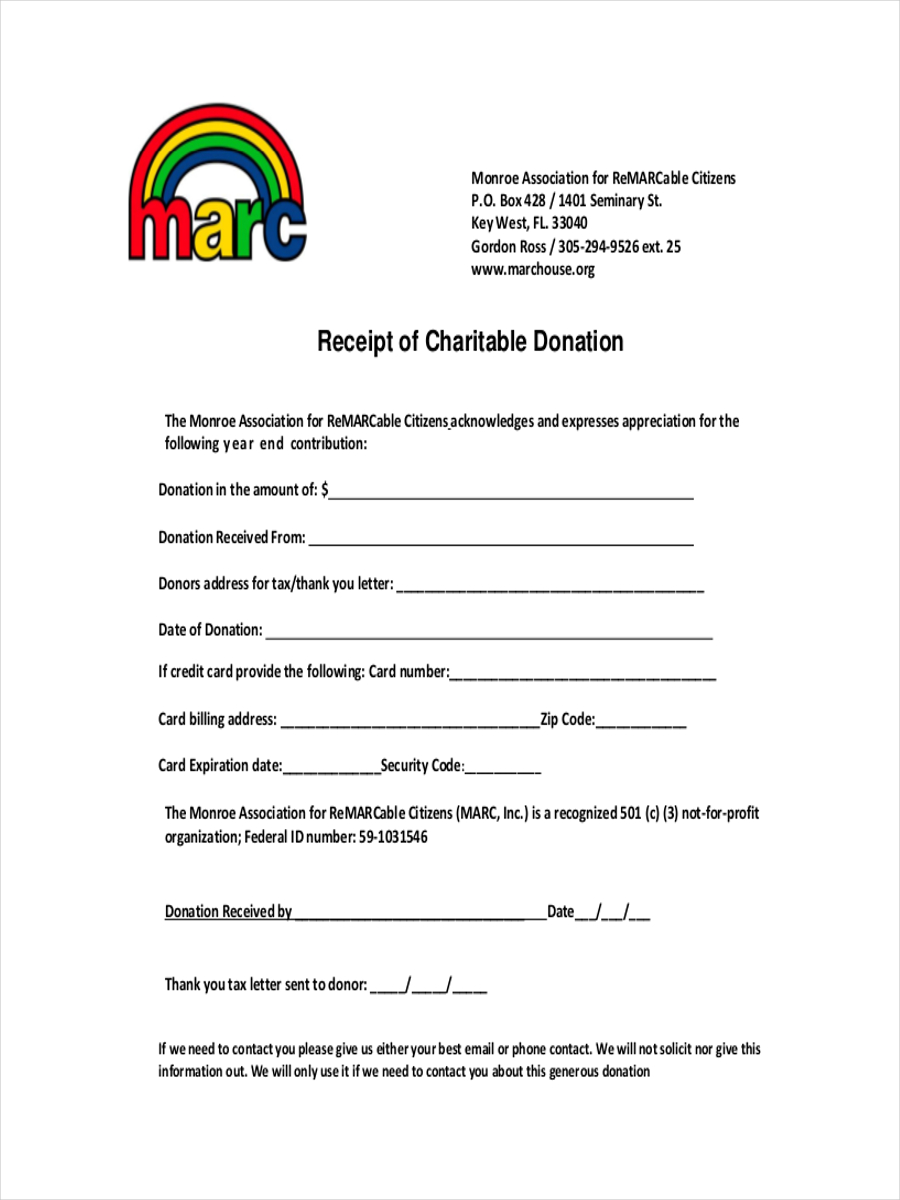

Explore Our Free Furniture Donation Receipt Template Receipt template

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

Donation Receipt Format ikigairazaodeser

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

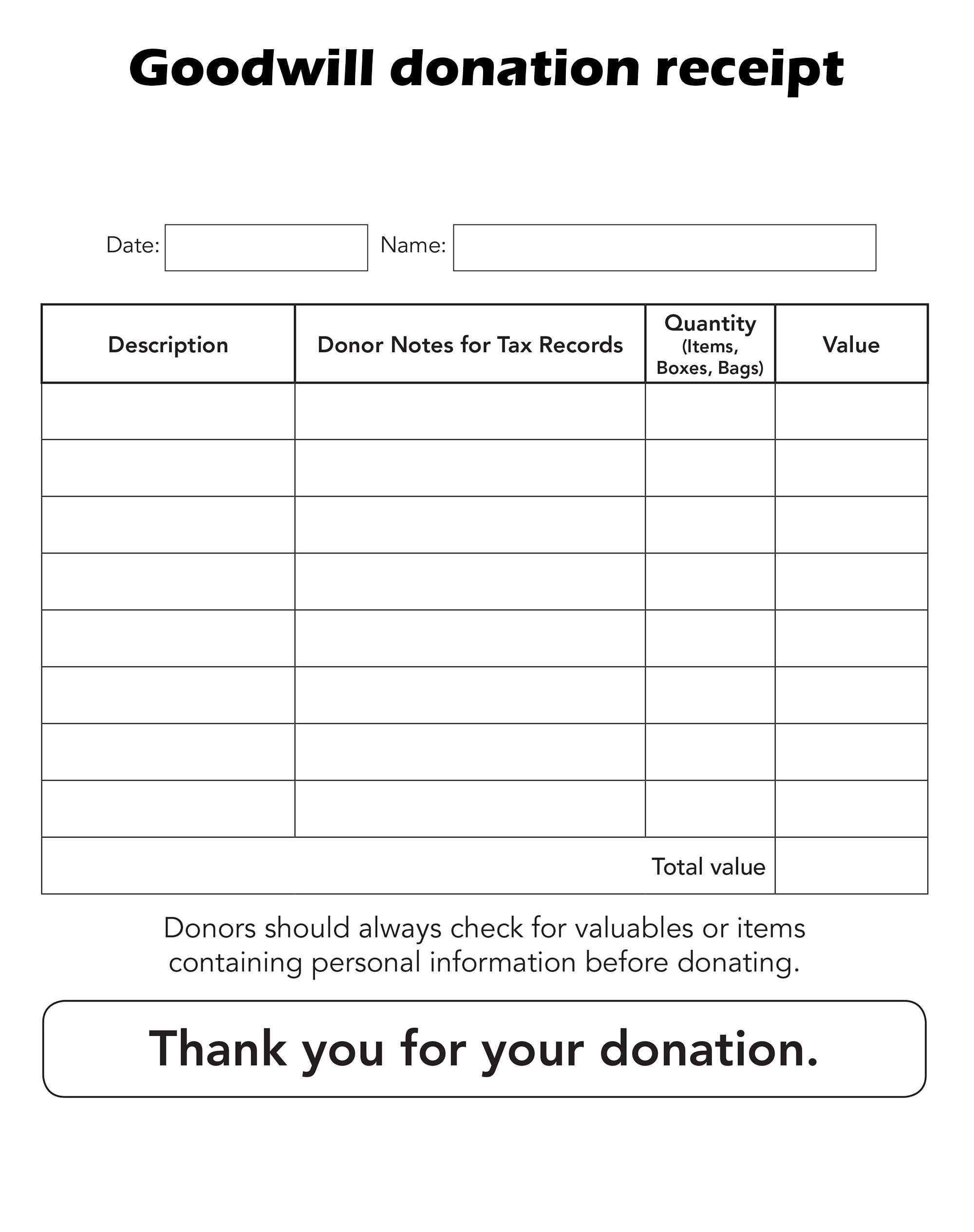

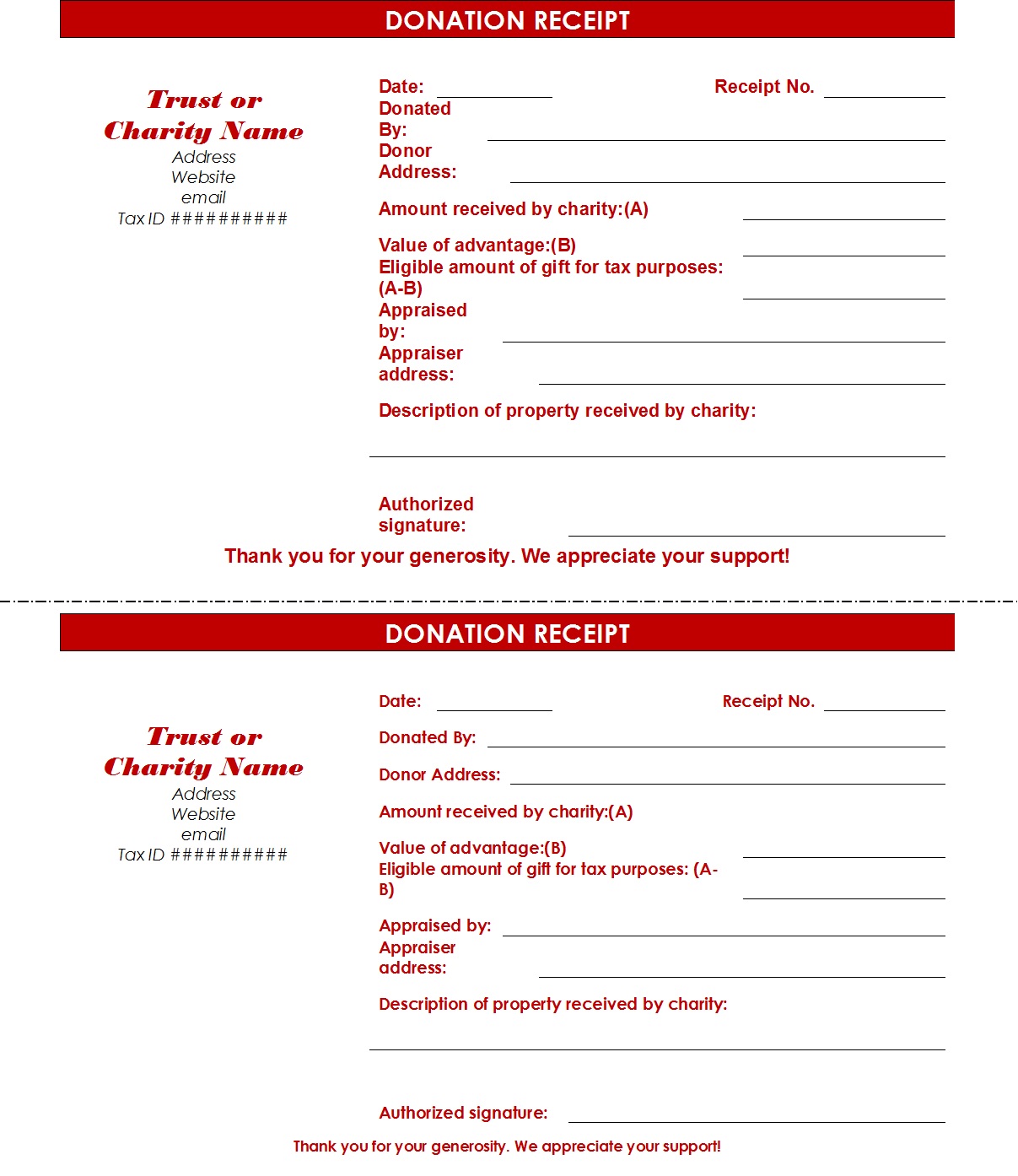

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

Donation Receipt Donation Receipt Forms , Donation Receipt Template Etsy

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

Donation Printable Form Printable Forms Free Online

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

Inspiring Tax Receipt for Donation Template

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

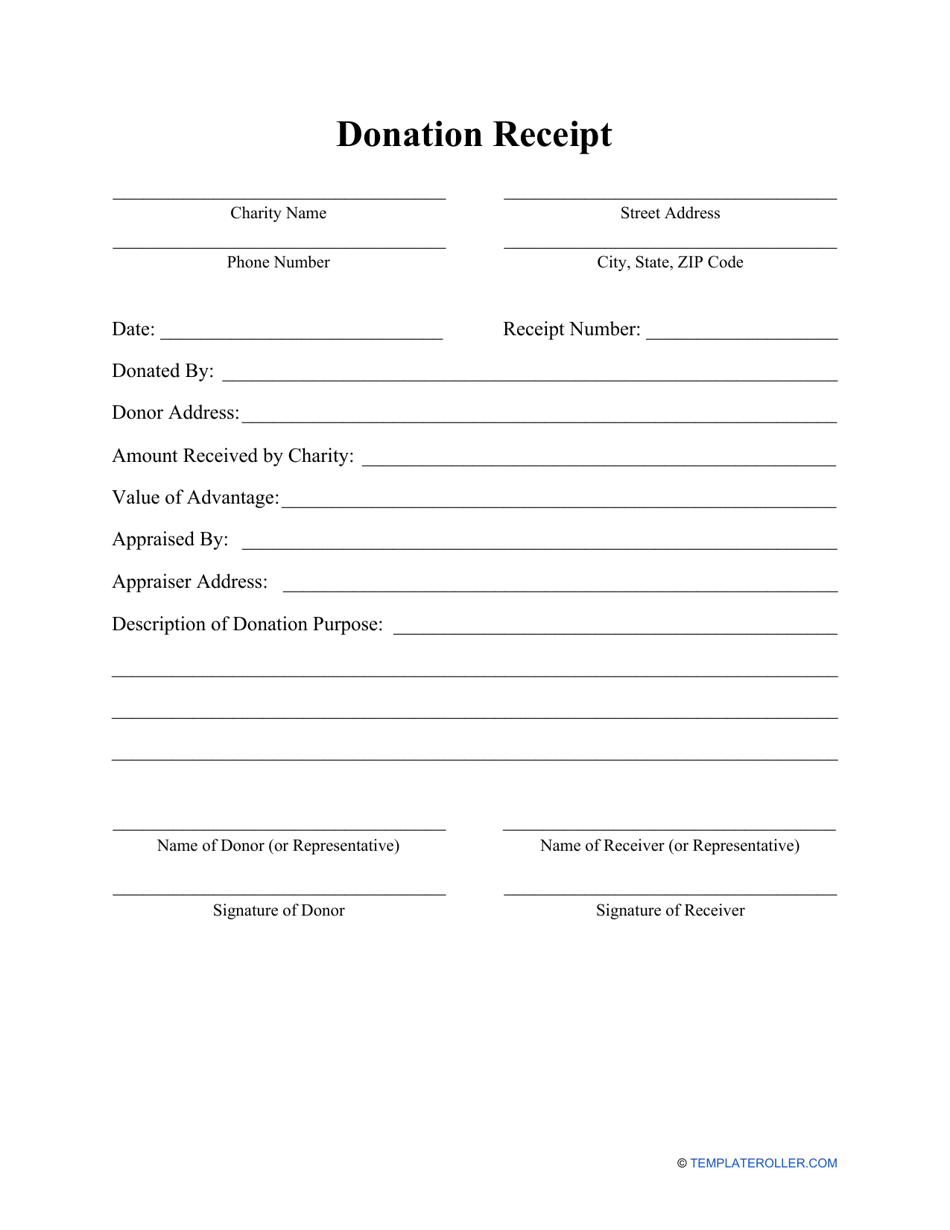

Ultimate Guide to the Donation Receipt 7 MustHaves & 6 Templates

The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card.

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)