Does The Custodial Parent Have To Sign Form 8332

Does The Custodial Parent Have To Sign Form 8332 - The custodial parent is generally the parent with whom the child lived for the greater number of nights. If you are the custodial parent, you can use form 8332 to do the following. The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of. Release a claim to exemption for your child so that the. The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. Custodial parent and noncustodial parent.

Custodial parent and noncustodial parent. If you are the custodial parent, you can use form 8332 to do the following. The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. The custodial parent is generally the parent with whom the child lived for the greater number of nights. Release a claim to exemption for your child so that the. The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of.

The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of. The custodial parent is generally the parent with whom the child lived for the greater number of nights. Custodial parent and noncustodial parent. If you are the custodial parent, you can use form 8332 to do the following. Release a claim to exemption for your child so that the. The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs.

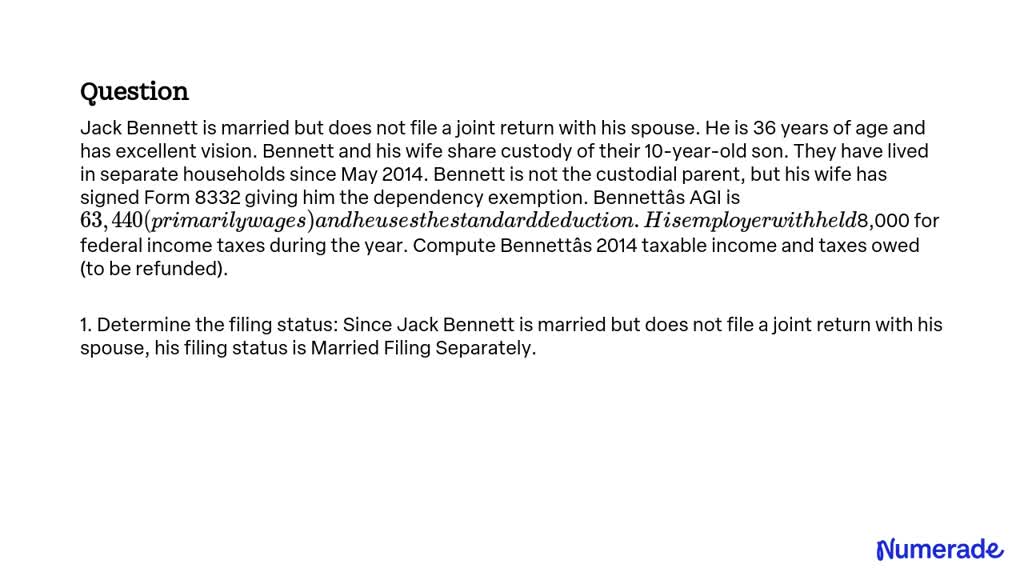

SOLVED Jack is married but does not file a joint return with

The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. Custodial parent and noncustodial parent. The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of. Release a claim to exemption for your child so that the. The custodial parent.

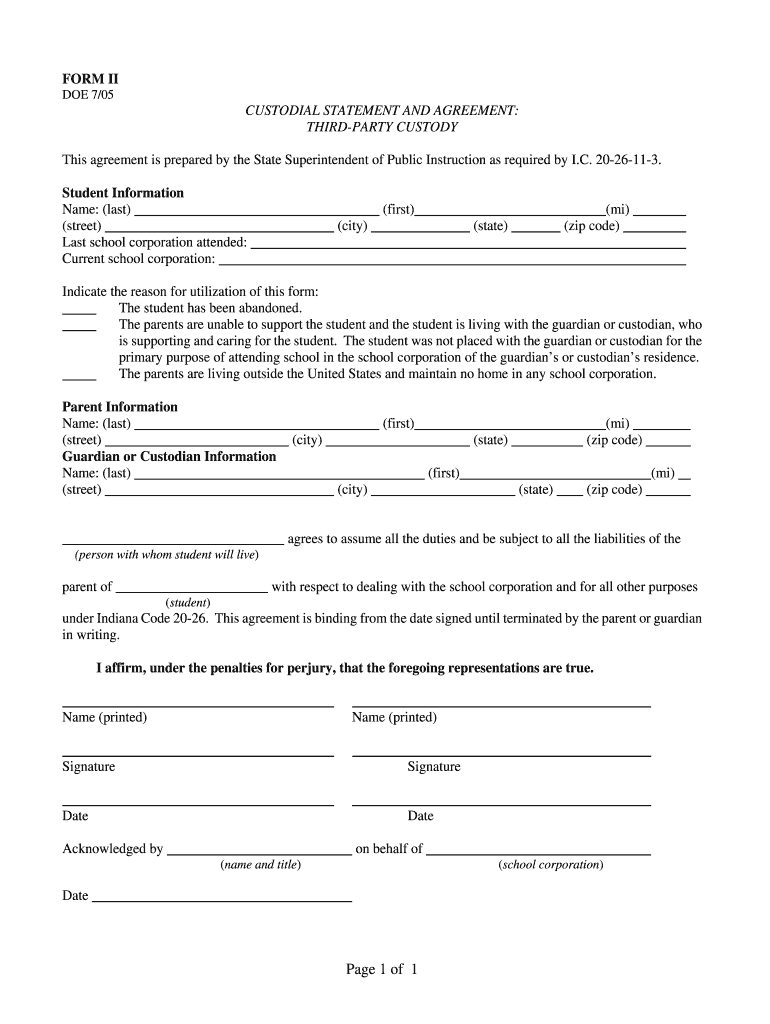

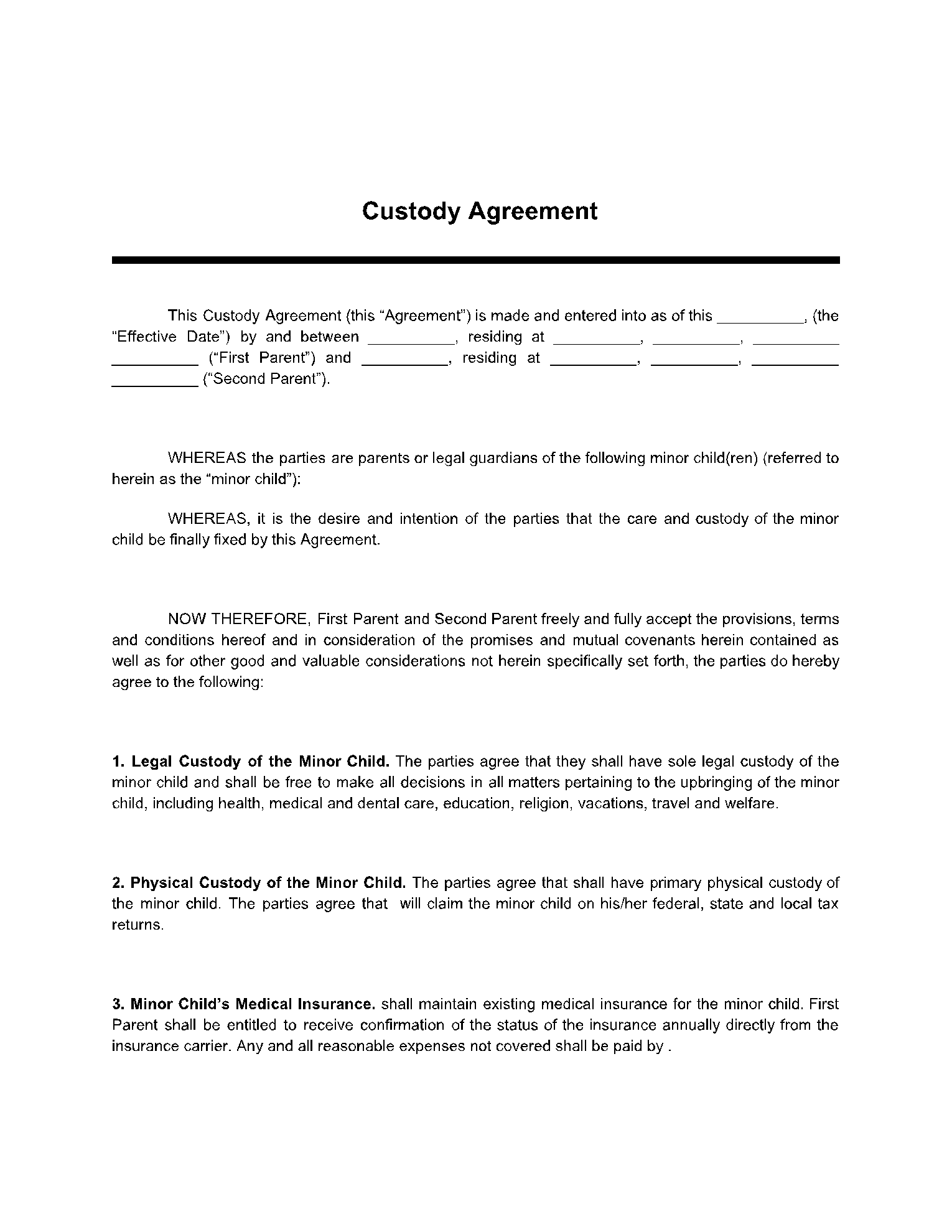

Custodial Statement and Agreement Third Party Custody Form Fill Out

The custodial parent is generally the parent with whom the child lived for the greater number of nights. Custodial parent and noncustodial parent. Release a claim to exemption for your child so that the. If you are the custodial parent, you can use form 8332 to do the following. The parties should use form 8332 to be sure nothing is.

Voluntary termination of parental rights form arkansas Fill out & sign

The custodial parent is generally the parent with whom the child lived for the greater number of nights. Release a claim to exemption for your child so that the. Custodial parent and noncustodial parent. If you are the custodial parent, you can use form 8332 to do the following. The custodial parent can release the dependency exemption and sign a.

Congratulations Roy’s Lily! Hancock Prospecting PTY LTD

The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of. If you are the custodial parent, you can use form 8332 to do the following. Custodial parent and noncustodial.

Release a claim to exemption for your child so that the. The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of. Custodial parent and noncustodial parent. The custodial parent is generally the parent with whom the child lived for the greater number of nights. If you are the custodial parent, you can.

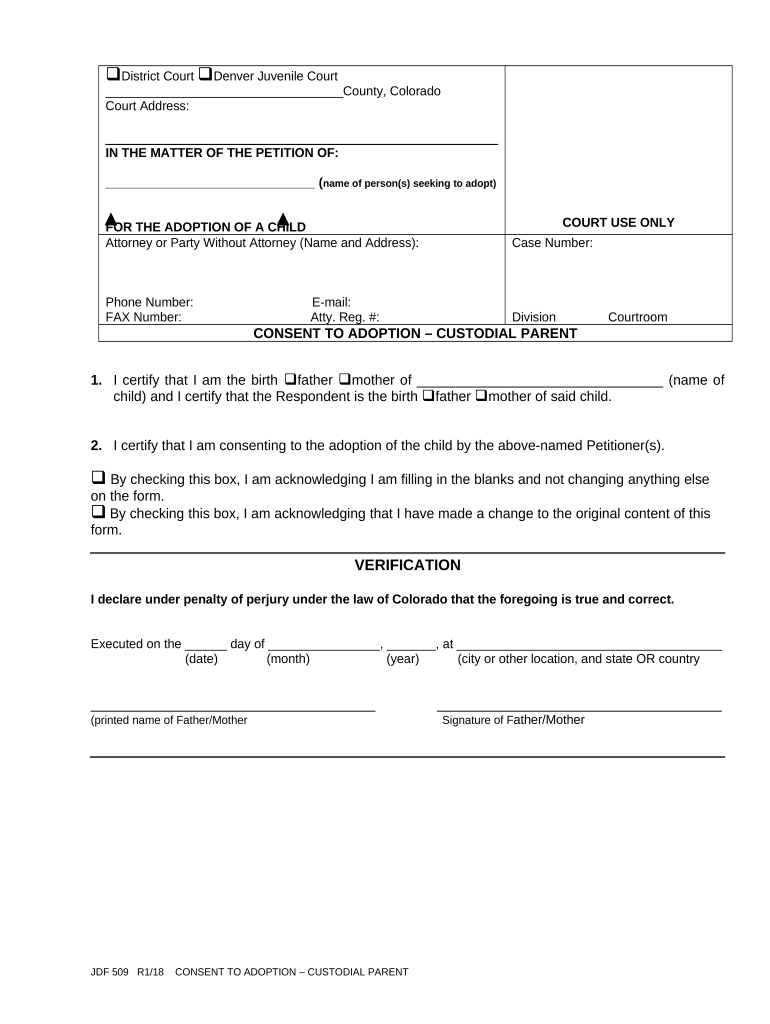

Consent Custodial Parent Colorado Form Fill Out and Sign Printable

The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of. If you are the custodial parent, you can use form 8332 to do the following. Custodial parent and noncustodial parent. The custodial parent is generally the parent with whom the child lived for the greater number of nights. The parties should use.

IRS Form 8332 Instructions Release of Child Exemption

If you are the custodial parent, you can use form 8332 to do the following. The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. Custodial parent and noncustodial parent. The custodial parent is generally the parent with whom the child lived for the greater number of.

Can You Write Your Own Child Custody Agreement at webannaliseblog Blog

Custodial parent and noncustodial parent. The custodial parent is generally the parent with whom the child lived for the greater number of nights. The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. If you are the custodial parent, you can use form 8332 to do the.

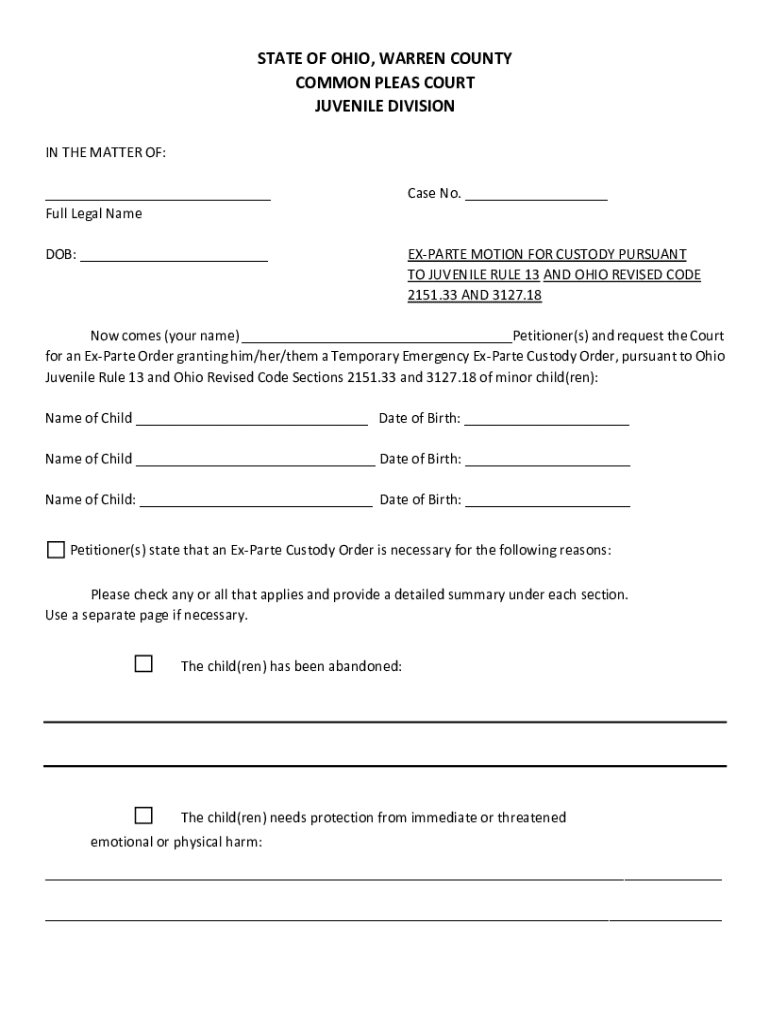

Child custody forms pdf ohio Fill out & sign online DocHub

The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. Custodial parent and noncustodial parent. If you are the custodial parent, you can use form 8332 to do the following. Release a claim to exemption for your child so that the. The custodial parent can release the.

What Rights Does the NonCustodial Parent Have When Parenting?

Release a claim to exemption for your child so that the. Custodial parent and noncustodial parent. If you are the custodial parent, you can use form 8332 to do the following. The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs. The custodial parent can release the.

Release A Claim To Exemption For Your Child So That The.

If you are the custodial parent, you can use form 8332 to do the following. Custodial parent and noncustodial parent. The custodial parent can release the dependency exemption and sign a written declaration or form 8332, release/revocation of. The parties should use form 8332 to be sure nothing is overlooked and to ensure that it is properly recognized by the irs.