Do I Get A Tax Form For My 401K

Do I Get A Tax Form For My 401K - There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. This includes when you’ve taken. Tips on how to find, fix and avoid common errors in 401 (k) plans.

Helps you keep your 401 (k) plan in compliance with important tax rules. There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k) plans. This includes when you’ve taken.

Tips on how to find, fix and avoid common errors in 401 (k) plans. Helps you keep your 401 (k) plan in compliance with important tax rules. There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. This includes when you’ve taken.

401k Highly Compensated Employee 2024 Siana Dorothea

Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. This includes when you’ve taken. Tips on.

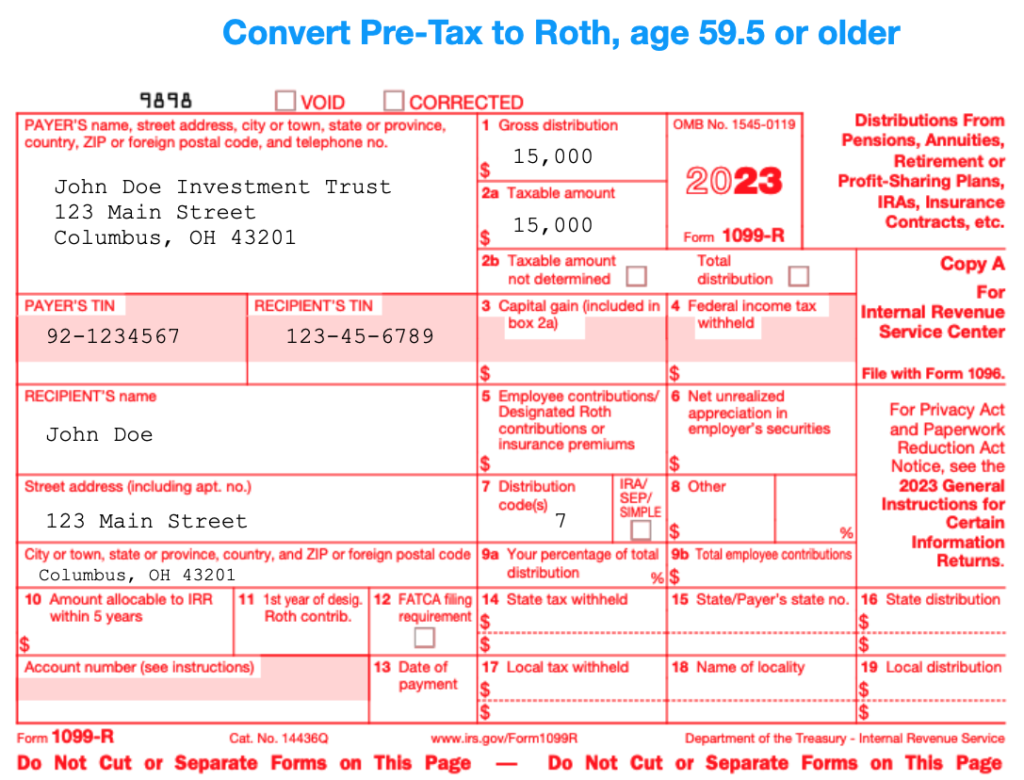

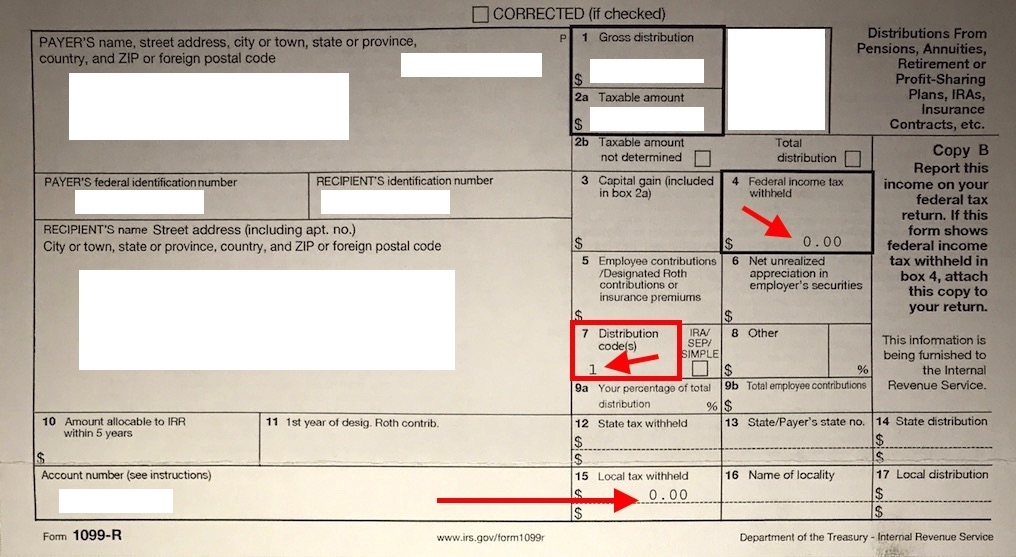

401k Withdrawal 1099 Form Form example download

There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and.

Do I Get A Tax Statement For 401k Tax Walls

Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k) plans. This includes when you’ve taken. There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Helps.

What Tax Document Do I Need For 401K LiveWell

Helps you keep your 401 (k) plan in compliance with important tax rules. This includes when you’ve taken. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k) plans. There are various situations in which.

solo 401k contribution limits and types

Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k) plans. There are various situations in which taxpayers must report their 401.

Qu'estce qu'un 401(k) et comment ça marche ? (2024)

There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. This includes when you’ve taken. Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on.

How To Take Money out of a 401(k) Plan

There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k) plans. This includes when you’ve taken. Helps.

1099 Pension

This includes when you’ve taken. Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k) plans. There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Luckily, you typically don’t need to report your 401(k) contributions,.

What to do if you have to take an early withdrawal from your Solo 401k

Helps you keep your 401 (k) plan in compliance with important tax rules. There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and.

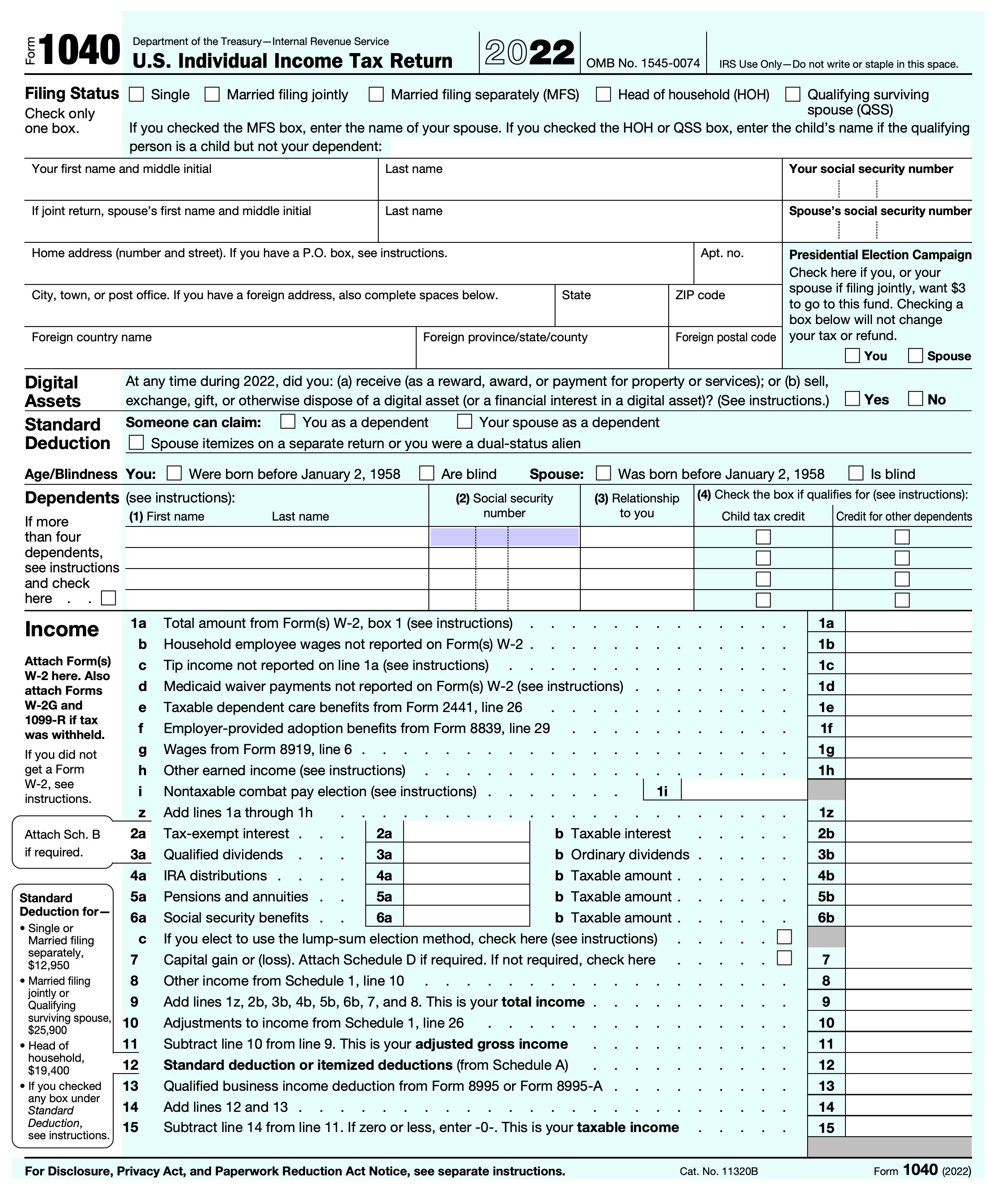

2023 Form 1040 Ez Printable Forms Free Online

Helps you keep your 401 (k) plan in compliance with important tax rules. This includes when you’ve taken. Tips on how to find, fix and avoid common errors in 401 (k) plans. There are various situations in which taxpayers must report their 401 (k) activity on their tax return forms. Luckily, you typically don’t need to report your 401(k) contributions,.

There Are Various Situations In Which Taxpayers Must Report Their 401 (K) Activity On Their Tax Return Forms.

Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k) plans. This includes when you’ve taken. Luckily, you typically don’t need to report your 401(k) contributions, 401(k) or ira balances, or even investment returns to the internal revenue.

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

:max_bytes(150000):strip_icc()/howtotakemoneyoutofa401kplan-79531c969f74433db11c032e3cfd3636.png)