Discharge Of Indebtedness

Discharge Of Indebtedness - Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. 9, 1986, in taxable years. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. Amendment by section 405(b) of pub. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts.

9, 1986, in taxable years. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. Amendment by section 405(b) of pub.

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. 9, 1986, in taxable years. Amendment by section 405(b) of pub.

IRS Form 982 Instructions Discharge of Indebtedness

This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. Amendment by section 405(b) of pub. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take.

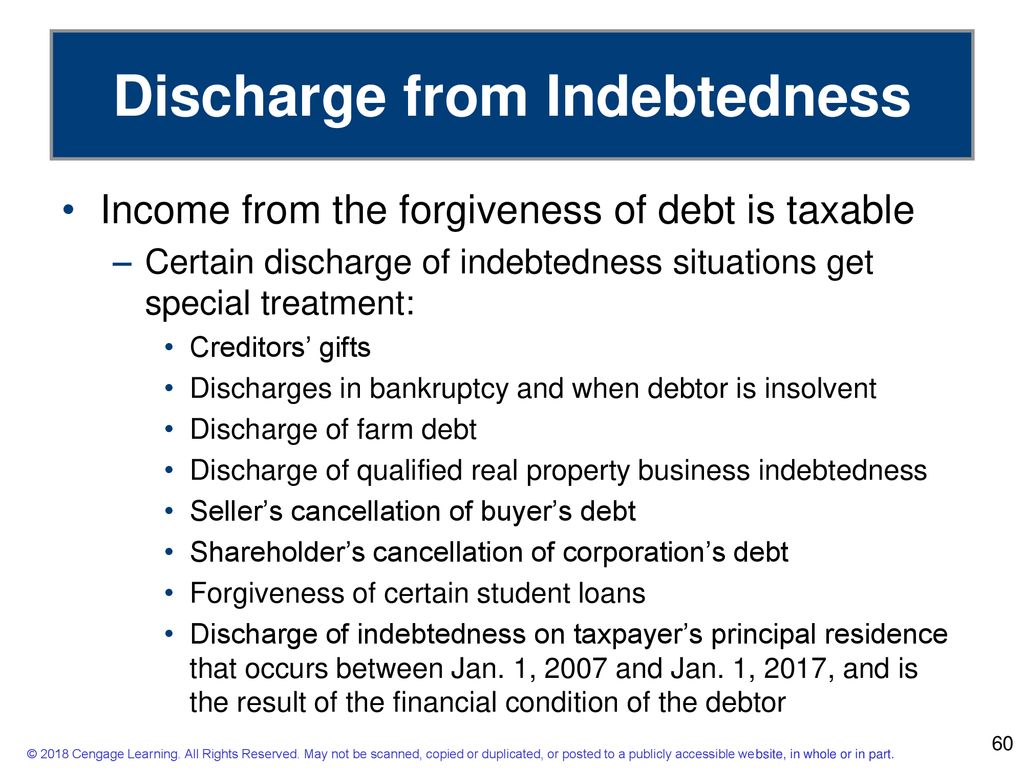

Gross Exclusions ppt download

Amendment by section 405(b) of pub. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. Qualified principal residence indebtedness can be excluded from income.

Discharge of Indebtedness on Principal Residences and Business Real

Amendment by section 405(b) of pub. 9, 1986, in taxable years. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross.

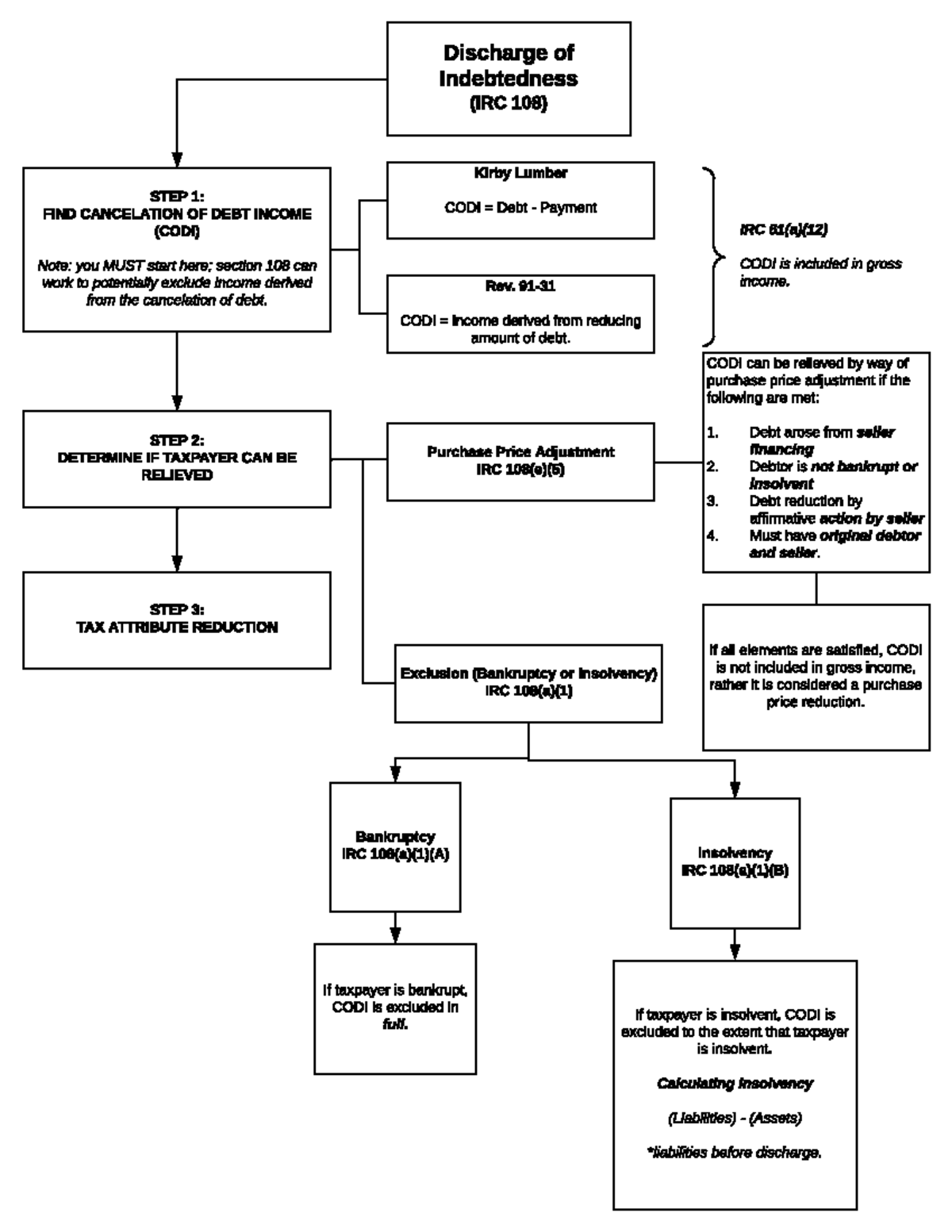

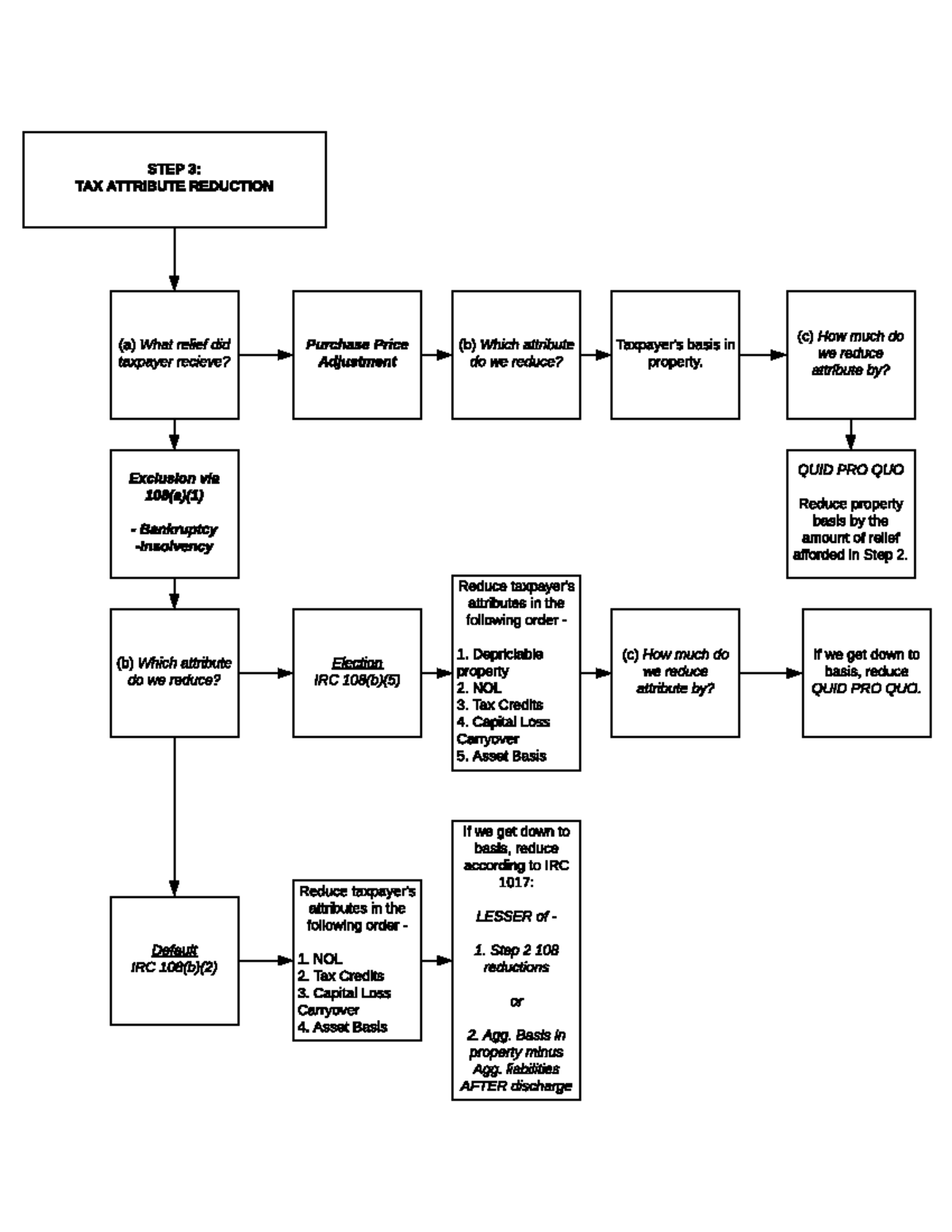

Discharge of Indebtedness Chart 1 Discharge of Indebtedness (IRC

Amendment by section 405(b) of pub. 9, 1986, in taxable years. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Qualified principal residence indebtedness.

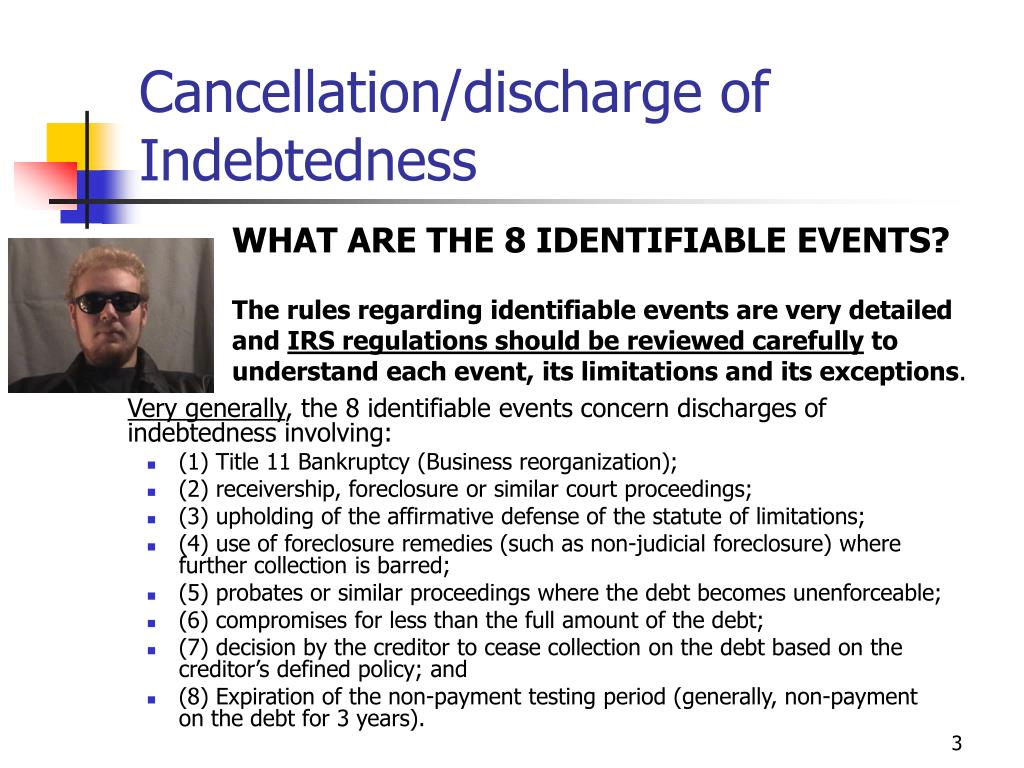

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026..

PPT Chapter 9 PowerPoint Presentation, free download ID3597638

Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. 9, 1986, in taxable years. This section explains how to exclude or reduce gross income and tax attributes due to.

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

(a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. Amendment by section 405(b) of pub. 9, 1986, in taxable years. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Qualified principal residence indebtedness.

PPT Cancellation/discharge of Indebtedness PowerPoint Presentation

Amendment by section 405(b) of pub. 9, 1986, in taxable years. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. (a) before discharging a delinquent debt (also referred to as a close out of.

Discharge of Indebtedness Chart 2 STEP 3 TAX ATTRIBUTE REDUCTION

This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. 9, 1986, in taxable years. (a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all.

IRS Form 982 Instructions Discharge Of Indebtedness, 55 OFF

(a) before discharging a delinquent debt (also referred to as a close out of the debt), agencies shall take all appropriate steps to collect the. 9, 1986, in taxable years. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. Amendment by section 405(b) of pub. This section explains how to exclude or reduce gross.

(A) Before Discharging A Delinquent Debt (Also Referred To As A Close Out Of The Debt), Agencies Shall Take All Appropriate Steps To Collect The.

9, 1986, in taxable years. Amendment by section 405(b) of pub. Qualified principal residence indebtedness can be excluded from income for discharges before january 1, 2026. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts.