Depreciation Quickbooks

Depreciation Quickbooks - In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. The depreciation records the reduction in its.

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. The depreciation records the reduction in its. In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation.

The depreciation records the reduction in its. In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. In quickbooks online, after you set up your assets , you can record their depreciation.

What account do you credit for depreciation? Leia aqui What is journal

In quickbooks online, after you set up your assets , you can record their depreciation. In this article learn how to setup, record & calculate depreciation in quickbooks. The depreciation records the reduction in its. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records.

A Beginner's Guide to Accumulated Depreciation

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. The depreciation records the reduction in its. In quickbooks online, after you set up your assets , you can record their depreciation. In this article learn how to setup, record & calculate depreciation in quickbooks.

Fixed Assets and Depreciation Basics for QuickBooks Users YouTube

The depreciation records the reduction in its. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation.

Accumulated Depreciation in QuickBooks Desktop YouTube

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation. The depreciation records the reduction in its.

Depreciation Expense in QuickBooks YouTube

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. The depreciation records the reduction in its. In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation.

How do you handle depreciation on QB

In quickbooks online, after you set up your assets , you can record their depreciation. The depreciation records the reduction in its. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. In this article learn how to setup, record & calculate depreciation in quickbooks.

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube

In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. In quickbooks online, after you set up your assets , you can record their depreciation. The depreciation records the reduction in its.

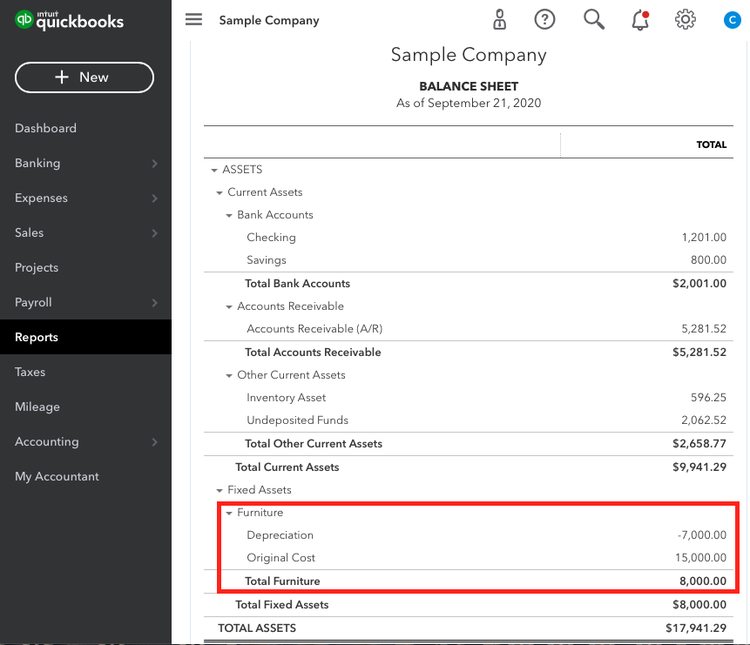

How to record Depreciation and Accumulated Depreciation in QuickBooks

In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. The depreciation records the reduction in its.

How to Use QuickBooks to Calculate Depreciation dummies

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. The depreciation records the reduction in its. In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation.

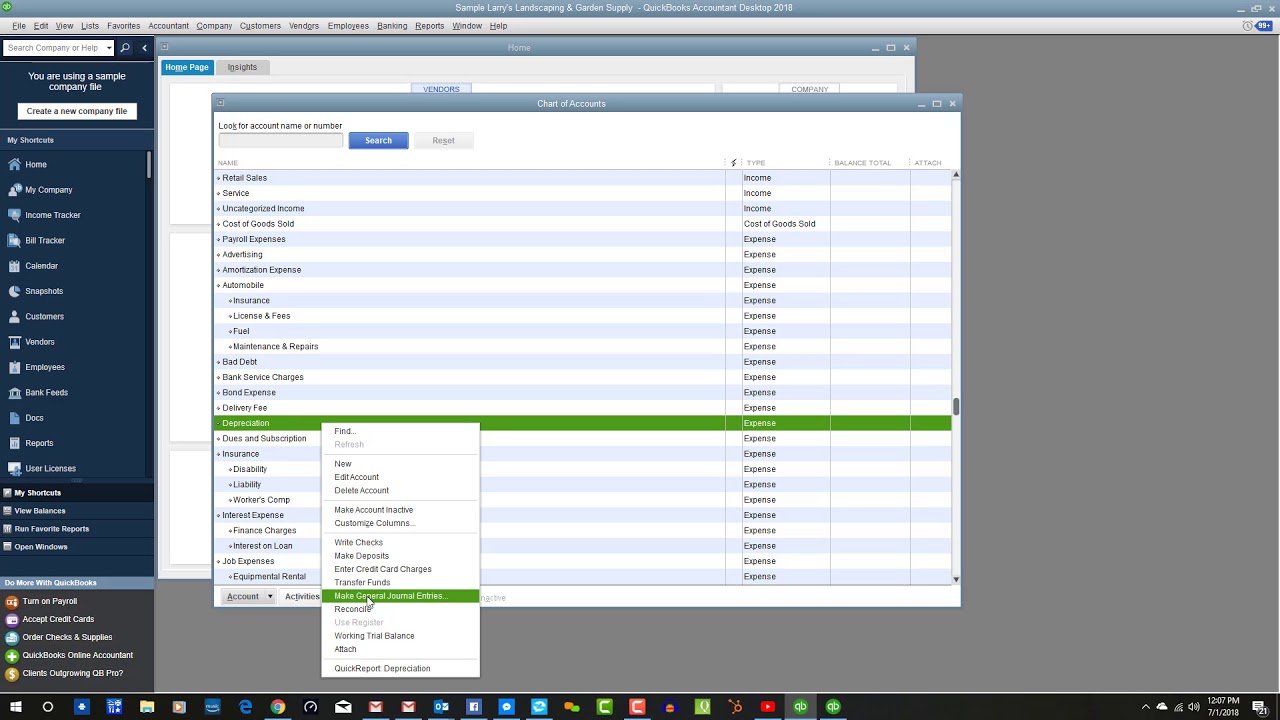

Depreciation Inside QuickBooks Desktop Candus Kampfer

In quickbooks online, after you set up your assets , you can record their depreciation. In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. The depreciation records the reduction in its. In this article learn how to setup, record & calculate depreciation in quickbooks.

The Depreciation Records The Reduction In Its.

In quickbooks, an efficient and accurate method of recording depreciation is essential for maintaining precise financial records. In this article learn how to setup, record & calculate depreciation in quickbooks. In quickbooks online, after you set up your assets , you can record their depreciation.